1. Tax-smart (i.e., tax-sensitive) investment management techniques (including tax-loss harvesting) are applied in managing certain taxable accounts on a limited basis, at the discretion of the portfolio manager primarily with respect to determining when assets in a client's account should be bought or sold. As the discretionary portfolio manager, Strategic Advisers LLC ("Strategic Advisers") may elect to sell assets in an account at any time. A client may have a gain or loss when assets are sold. There are no guarantees as to the effectiveness of the tax-sensitive investment techniques applied in serving to reduce or minimize a client's overall tax liabilities, or as to the tax results that may be generated by a given transaction. Strategic Advisers does not currently invest in tax-deferred products, such as variable insurance products, or in tax-managed funds, but may do so in the future if it deems such to be appropriate for a client. Strategic Advisers does not actively manage for alternative minimum taxes; state or local taxes; foreign taxes on non-U.S. investments; federal tax rules applicable to entities; or estate, gift, or generation-skipping transfer taxes. Strategic Advisers relies on information provided by clients in an effort to provide tax-sensitive investment management, and does not offer tax advice. Except where Fidelity Personal Trust Company (FPTC) is serving as trustee, clients are responsible for all tax liabilities arising from transactions in their accounts, for the adequacy and accuracy of any positions taken on tax returns, for the actual filing of tax returns, and for the remittance of tax payments to taxing authorities.

2. Tax savings will vary from client to client and past performance is no guarantee of future results; there is no guarantee that tax savings will cover the net advisory fee now or in the future. Factors that could impact the value of our tax-smart investing strategies include market conditions, the purchase date, and cost basis of any securities used to fund an account, client-imposed investment restrictions, client tax rate, and any changes in tax regulation. This analysis is based on performance of all investment strategies offered in Fidelity Managed FidFolios® and substantially similar strategies offered through Fidelity® Strategic Disciplines from 08/01/2015 through 12/31/2024. The analysis includes identifying the total amount of capital gains tax savings for each individual client account, and the total amount of net advisory fees paid for each individual client account (accounts that did not pay a fee were excluded from the analysis). We estimate potential capital gains tax savings by multiplying each harvested tax loss by the relevant short- or lon-term capital gains tax rate for each client account at the end of each year. Our analysis assumes that any losses realized are able to be offset against gains realized inside or outside of the client account during the year realized. However, all capital losses harvested in a single tax year may not result in a tax benefit for that year. Remaining unused capital losses may be carried forward to offset up to $3,000 of ordinary income per year.

3. We use a proprietary calculation to help measure the value of the tax-smart investing techniques that we apply in an effort to improve after-tax returns of tax-smart accounts. Our calculation uses asset-weighted composite pre-tax and after-tax performance information for Equity Strategy accounts held in taxable registrations (please see endnotes for more information on the methodology and assumptions (and their related risks and limitations) used in calculating composite and benchmark returns).

The Value of after-tax management is calculated by subtracting Pre-tax Excess Return from After-tax Excess Return. After-tax Excess Return is the amount by which the annualized after-tax investment return for the composite portfolio is either above or below the annualized after-tax benchmark return. Pre-tax Excess Return is the amount by which the annualized pre-tax investment return for the composite portfolio is either above or below the annualized pre-tax return of the benchmark.

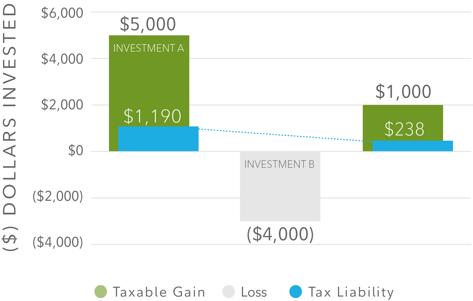

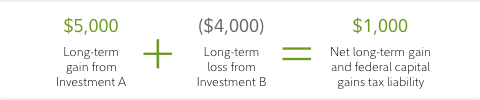

4. This hypothetical illustration assumes the investor met the holding requirement for long-term capital gains tax rates (longer than one year), the gains were taxed at the current maximum federal rate of 23.8%, and the loss was not disallowed for tax purposes due to a wash sale, related party sale, or other reason. It does not take into account state or local taxes, fees, or expenses, or the net gain's potential impact on adjusted gross income, which could impact exemption and deduction phaseouts and eligibility for other tax benefits.

5. For a list of eligible investments, see our Form ADV, Part 2A Brochure or contact a Fidelity representative. Clients may elect to transfer noneligible securities into their accounts. Should they do so, Strategic Advisers or its designee will liquidate those securities as soon as reasonably practicable, and clients acknowledge that transferring such securities into their accounts acts as a direction to Strategic Advisers to sell any such securities. Clients may realize a taxable gain or loss when these shares are sold, which may affect the after-tax performance/return within their accounts, and Strategic Advisers does not consider the potential tax consequences of these sales when following a client's deemed direction to see such securities. Strategic Advisers reserves the right not to accept otherwise eligible securities, at its sole discretion.

6. US Treasury bond interest payments are tax-exempt from state taxes but are typically subject to taxes at the federal level. This differs from Municipal Bonds where income paid by these bonds is generally exempt from federal taxes, and in some cases, state taxes.

7. This hypothetical example shows annual income from a $100,000 investment in a taxable account and the impact to that income from the four highest Federal tax rates. The municipal bond investment has a 3.06% assumed yield and the taxable US Treasury yield is assumed to be a 4.56% yield (Thomson Reuters and Fidelity Investments, respectively, as of 12/31/2024). This hypothetical example is used for illustrative purposes only; actual investment results may vary. It does not reflect the impact of state taxes, federal and/or state alternative minimum taxes, tax credits, exemptions, fees, or expenses. If it did, after-tax income might be lower. Please consult a tax advisor for further details. *All or a portion of the income may be subject to the federal alternative minimum tax. Income attributable to capital gains are usually subject to both state and federal income taxes. † Tax rates 38.8% and 40.8% include a Medicare surtax of 3.8% imposed by the Patient Protection and Affordable Care Act of 2010.

Information about the calculation of account and composite returns. Returns for periods of one year or less in duration are reported cumulative. Returns for periods greater than one year may be reported on either a cumulative or average annual basis. Calendar year returns reflect the cumulative rates of return for the 12-month period from January 1 to December 31, inclusively, of the year indicated.

Reported rates of return utilize a time-weighted calculation, which vastly reduces the impact of cash flows. Returns shown assume reinvestment of interest, dividends, and capital gains distributions. Assets valued in U.S. dollars. Performance includes accrued interest for certain securities when provided by a third-party vendor; otherwise, performance returns are computed on a cash basis. Performance will be understated for periods when accrued interest information is not available. For accounts with individual bonds, amortization and accretion for bonds are not included in performance calculations. Performance reporting generally begins after the portfolio manager reviews the account and deems it ready for investment in the chosen strategy.

Net rates of return are calculated to include the deduction of the actual (net of any applicable fee credits) investment advisory fees paid for each account including any applicable separately managed account sleeve fees (“sleeve fees”), and any underlying fund's own management fees and operating expenses. If applicable, gross rates of return are presented with net rates of return to help you understand the overall effect of investment advisory fees on performance. Gross rates of return are calculated without the deduction of investment advisory fees paid for each account (including sleeve fees) but are net of any underlying fund’s own management fees and operating expenses. Strategic Advisers LLC (“Strategic Advisers”) includes performance from the time period when the program was offered by Fidelity Personal and Workplace Advisors LLC and subadvised by Strategic Advisers (other than the bond strategies offered through FSD) from July 2018 through March 2025 and for legacy programs offered by Strategic Advisers prior to July 2018. Fee schedules for these legacy programs differ from current fee schedules, and fees for accounts enrolled in those legacy programs may have been higher or lower than Strategic Advisers' current fees. Fee structures and services offered have changed over time. Please consult a Fidelity financial advisor or the Fidelity Internal Information applicable to Fidelity Strategic Disciplines current Form ADV, Part 2A Brochure for current fee information. Additional information about our methodology for calculating pre- and after-tax performance return information is available at Fidelity.com/information in a document titled “About Managed Account Performance.”

Assumptions used in calculating after-tax returns. After-tax rate of return measures the performance of an account, taking into consideration the impact of a client’s U.S. federal income taxes, based on the activity in the account. Strategic Advisers does not actively manage for alternative minimum taxes; state or local taxes; foreign taxes on non-U.S. investments; federal tax rules applicable to entities; or estate, gift, or generation-skipping transfer taxes. Strategic Advisers relies on information provided by clients in an effort to provide tax-sensitive investment management and does not offer tax advice. Any realized short-term or long-term capital gain or loss retains its short- or long-term characteristics in the after-tax calculation. The gain/loss for any account is applied in the month incurred and there is no carryforward. We assume that taxes are paid from outside the account. Taxes are recognized in the month in which they are incurred. This may inflate the value of some short-term losses if they are offset by long-term gains in subsequent months. After-Tax Returns do not take into account the tax consequences associated with income accrual, deductions with respect to debt obligations held in client accounts, or federal income tax limitations on capital losses. Withdrawals from client accounts during the performance period result in adjustments to take into account unrealized capital gains across all securities in such account, as well as the actual capital gains realized on the securities. Adjustments for reclassification of dividends from non-qualified to qualified status that occur in January of the subsequent year, are reflected in the prior December monthly returns. We assume that a client reclaims in full any excess foreign tax withheld and is able to take a U.S. foreign tax credit in an amount equal to any foreign taxes paid, which increases an account’s after-tax performance; the amount of the increase will depend on the total mix of foreign securities held and their applicable foreign tax rates, as well as the amount of distributions from those securities.

We assume that losses are used to offset gains realized outside the account in the same month, and we add the imputed tax benefit of such a net loss to that month’s return. This can inflate the value of the losses to the extent that there are no items outside the account against which they can be applied, and after-tax returns may exceed pre-tax returns as a result of an imputed tax benefit received upon realization of tax losses. Our after-tax performance calculation methodology uses the full value of harvested tax losses without regard to any future taxes that would be owed on a subsequent sale of any new investment purchased following the harvesting of a tax loss. That assumption may not be appropriate in all client situations but is appropriate where (1) the new investment is donated (and not sold) by the client as part of a charitable gift, (2) the client passes away and leaves the investment to heirs, (3) the client’s long-term capital gains rate is 0% when they start withdrawing assets and realizing gains, (4) harvested losses exceed the amount of gains for the life of the account, or (5) where the proceeds from the sale of the original investment sold to harvest the loss are not reinvested. It is important to understand that the value of tax-loss harvesting for any particular client can only be determined by fully examining a client’s investment and tax decisions for the life the account and the client, which our methodology does not attempt to do. Clients and potential clients should speak with their tax advisors for more information about how our tax-loss harvesting approach could provide value under their specific circumstances.

Information about composite returns. The rates of return featured for accounts managed to a long-term asset allocation represent a composite of accounts managed with the same long-term asset allocation, investment approach and investment universe as applicable; rates of return featured for accounts managed with a single asset class strategy represent a composite of accounts managed to the applicable strategy. Accounts included in the composite utilize a time-weighted calculation, which vastly reduces the impact of cash flows. Composites are asset-weighted. An asset-weighted methodology takes into account the differing sizes of client accounts (i.e. considers accounts proportionately). Larger accounts may, by percentage, pay lower investment advisory fees than smaller accounts, thereby decreasing the investment advisory fee applicable to the composite and increasing the composite’s net-of-fee performance. For tax-smart accounts in Fidelity Wealth Services, composite results are based on the returns of the managed portion of the accounts; assets in a liquidity sleeve are excluded from composite performance. Composites set minimum eligibility criteria for inclusion. Accounts with less than one full calendar month of returns and accounts subject to significant investment restrictions are excluded from composites (including fixed income strategies offered through Fidelity Strategic Disciplines with a state preference option). Accounts with a do-not-trade restriction are removed from the composite once the restriction has been applied to the account for thirty days. For periods prior to October 1, 2022, composite inclusion required a minimum investment level that reflected product-relative Fidelity Internal Information investment requirements. Effective October 1, 2022, product composites will reflect all accounts for which we produce a rate of return and that meet the aforementioned criteria. Non-fee paying accounts, if included in composite, will increase the net-of-fee performance. Certain products, like Fidelity Go, offer investment services where accounts under a certain asset level do not incur investment advisory fees. Employees do not incur investment advisory fees for certain products.

Information about after-tax composite benchmarks. Return information for an after-tax benchmark represents an asset-weighted composite of clients’ individual after-tax benchmark returns. Each client’s personal after-tax benchmark is composed of mutual funds (index funds where available) and ETFs in the same asset class percentages as the client’s investment strategy. The after-tax benchmark uses mutual funds and ETFs as investable alternatives to market indexes in order to provide a benchmark that takes into account the associated tax consequences of these investable alternatives. The after-tax benchmark returns implicitly take into account the net expense ratio of their component mutual funds because mutual funds report performance net of their expense. They assume reinvestment of dividends and capital gains, if applicable. The after-tax benchmark also takes into consideration the tax impact of rebalancing the benchmark portfolio, assuming the same tax rates as are applicable to each client’s account, as well as an adjustment for the level of unrealized gains in each account. The after-tax composite benchmark return is calculated assuming the use of the “average cost-basis method” for calculating the tax basis of mutual fund shares.

Additional Information. Changes in laws and regulations may have a material impact on pre- and/or after-tax investment results. Strategic Advisers LLC relies on information provided by clients in an effort to provide tax-smart investing techniques. Strategic Advisers LLC can make no guarantees as to the effectiveness of the tax-smart investing techniques applied in serving to reduce or minimize a client’s overall tax liabilities or as to the tax results that may be generated by a given transaction. Strategic Advisers does not provide tax or legal advice. Please consult your tax or legal professional for additional guidance. For more information about Strategic Advisers and its advisory offerings, including information about fees and investment risks, please visit our website at Fidelity.com.

The information contained herein includes information obtained from sources believed to be reliable, but we do not warrant or guarantee the timeliness or accuracy of the information as it has not been independently verified. It is made available on an "as is" basis without warranty.

The municipal market can be affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities. Interest income generated by municipal bonds is generally expected to be exempt from federal income taxes and, if the bonds are held by an investor resident in the state of issuance, state and local income taxes. Such interest income may be subject to federal and/or state alternative minimum taxes. Investing in municipal bonds for the purpose of generating tax-exempt income may not be appropriate for investors in all tax brackets. Generally, tax-exempt municipal securities are not appropriate holdings for tax advantaged accounts such as IRAs and 401(k)s.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

An SMA is not intended to provide a complete investment program. You are responsible for appropriate diversification of assets held outside your SMA.

Fidelity® Strategic Disciplines provides nondiscretionary financial planning and discretionary investment management for a fee. Advisory services offered by Strategic Advisers LLC (Strategic Advisers), a registered investment adviser. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. Strategic Advisers, FBS, and NFS are Fidelity Investments companies.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917