Fidelity® International Index StrategyA separately managed account that seeks to approximate the pre-tax return and risk profile of the Fidelity Developed International ex North America Index by investing in international stocks, while using tax-smart strategies in an effort to enhance after-tax returns in taxable accounts.4 |

Investment strategy: Seeks index-like performance with enhanced after-tax returns

Types of investments: Primarily American Depository Receipts (ADRs) and Exchange Traded Products (ETPs)2

Investment minimum: $100,0001

Eligible registration types: Taxable only

Gross annual advisory fee: 0.20%–0.40%3 (varies based on total assets invested)

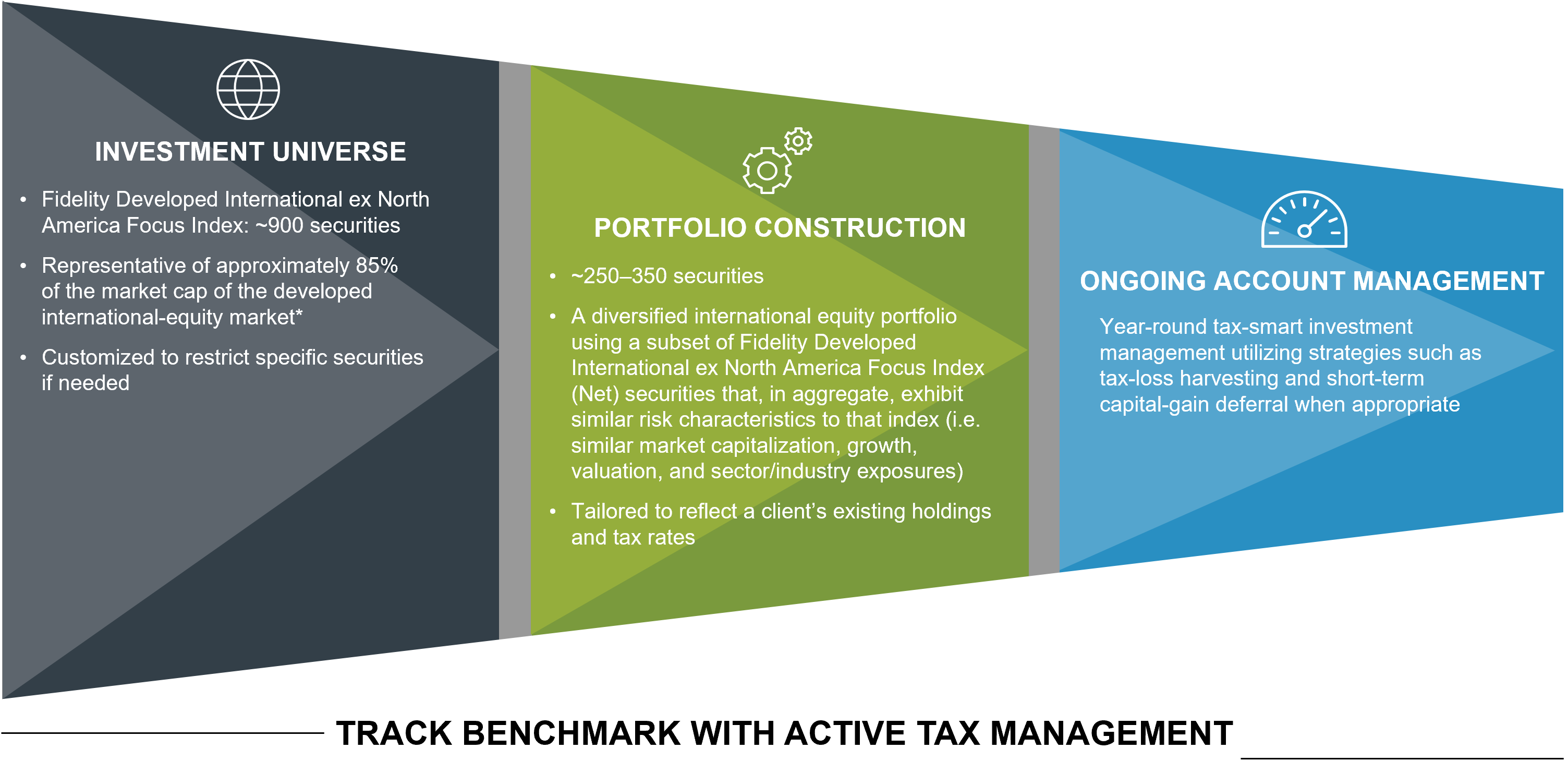

Your account will be managed in an effort to approximate the performance of international developed market stocks by pursuing the pre-tax returns and characteristics of the Fidelity Developed International ex-North America Focus Index.

Strategic Advisers LLC (Strategic Advisers) constructs portfolios by seeking to approximate pre-tax returns and risk characteristics of the Fidelity Developed International ex-North America Focus Index. The Fidelity Developed International ex-North America Focus Index is designed to provide an allocation to a broad range of non-U.S. developed-market stocks. The index is constructed from a universe of approximately 85% of the total available non-U.S. developed market equity stocks. Each account is built to seek index-like returns with a subset of securities, primarily U.S.-traded American depositary receipts (ADRs), and, as needed exchange-traded products (ETPs).

Focusing on geographic diversification

In general, we believe a well-diversified equity portfolio should include at least 30% allocation to international securities including developed and emerging markets. Returns from developed-market countries, including the U.S., can vary widely from year‐to‐year, as seen in the chart below. Given these ups and downs, investing around the world may help a portfolio by lessening the impact any one market can have. To this end, the Fidelity® International Index Strategy diversifies across many developed-market countries outside the U.S. while pursuing the risk and return characteristics of the Fidelity Developed International ex-North America Focus Index (Net).

Calendar year returns represented by individual country's MSCI IMI Country Index. The MSCI Investable Market Index (IMI) captures large, mid, and small cap representation of approximately 99% of the investable equity universe for each individual country. Eleven countries shown include the United States and the top 10 country holdings in the MSCI® EAFE Index as of 12/31/24 (represents over 88% of the index's total net assets). Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. It is not possible to invest directly in an index. All market indices are unmanaged.

Your equity separately managed accounts (SMA) will be managed in an effort to harness the long-term growth potential of stocks while seeking to enhance after-tax returns through the ongoing monitoring and application of tax-smart investing strategies4. In fact, 94% of our clients investing in SMAs in taxable accounts have had their advisory fees covered by the tax savings provided.5

How we manage your account for taxes

Your account will be managed in an effort to boost your after-tax returns throughout the year—not just at year end. Your account is evaluated each business day to determine whether it is appropriate to implement one or a combination of the following techniques to seek enhanced after-tax returns.

We take a disciplined and thoughtful approach to building and maintaining your account by applying a number of tax-sensitive techniques designed to help reduce the impact of taxes and enhance after-tax returns in an effort to help you achieve your financial goals.