Fidelity® Limited Duration Bond StrategyA separately managed account providing investment-grade bond exposure through a diversified mix of individual bonds and a Fidelity mutual fund, which seeks to deliver interest income while balancing risk and return. This actively managed strategy looks to maintain an average target duration1 of 2 to 3 years. |

Investment objective: Seeks to deliver interest income, while limiting risk to principal over a full market cycle

Types of investments: Primarily A- or higher investment-grade2 taxable bonds at time of purchase and a completion fund3

Investment minimum: $350,0004

Eligible Registration Types: Taxable & Retirement

Gross annual advisory fee: 0.35% – 0.40%5 (varies based on total assets invested)

- A diversified mix of individual investment-grade bonds—including government-issued securities, corporate bonds, taxable municipal bonds, and short-term debt instruments—complemented by a Fidelity mutual fund that provides exposure to securitized bonds.

- Managed by an investment team leveraging Fidelity's extensive fixed income resources and research capabilities.

- Seeks to provide a balance between income potential and risk.

- Considers both income and price appreciation as potential sources of return and seeks bonds with a favorable risk/reward trade-off.

Seeks income from high-quality bonds

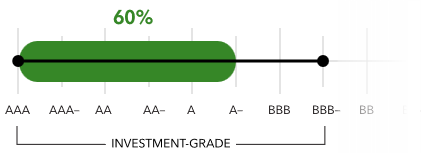

- Target average rating6: Primarily A- or higher

- Minimum credit quality: Bonds rated BBB- or better at purchase.

- Average target duration: 2 to 3 years

- Maturities: Bonds generally maturing within 10 years

Expected range of credit quality of the bonds in your SMA

Diversified exposure

The Strategy invests in a diverse mix of investment-grade bonds across a range of sectors and varying maturities.

A decline in one sector could hopefully be offset by a gain in another, which may help smooth out portfolio volatility.

Active positioning in a specialized sector of the bond market

To gain exposure to the securitized segment of the bond market—an area traditionally dominated by institutional investors—the Strategy utilizes the Fidelity® Limited Term Securitized Completion Fund (FLTGX). This zero-fee mutual fund offers access to a professionally managed portfolio of shorter-duration securitized fixed income instruments, such as asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), and mortgage-backed securities (MBS).

The Strategy will typically maintain approximately 10%7 of the portfolio in FLTGX, though allocations may vary over time based on market conditions and portfolio positioning. The mutual fund structure offers daily liquidity and operational efficiency, making it a flexible and effective way to access this specialized sector.

Benefits of using FLTGX within the Strategy

- Broader income potential: Securitized bonds may offer higher yields than government bonds.

- Greater access for individual investors: Many securitized bonds are typically available only to large institutions or require high minimum investments. FLTGX offers a way for individual investors to access this segment of the market without those traditional barriers.

- Expanded diversification: Securitized bonds are backed by assets consumer loans, commercial real estate, and home mortgages—areas not typically represented in government or corporate bonds. Including them in a portfolio through FLTGX can help diversify sources of return and risk while maintaining the strategy’s short maturity profile.

Strives to balance income and price appreciation vs. risk

Fidelity Limited Duration Bond Strategy considers both income and price appreciation as potential sources of return and seeks bonds with a favorable risk/reward trade-off. Using a research-based approach, the investment management team strives to avoid bonds that will not compensate bond holders for their investment risk.

To also help manage risk, the strategy will seek to maintain an average duration similar to that of the Bloomberg US 1-5 Year Credit/Government Bond Blend Index.8

In general, portfolios with shorter durations are less sensitive to changes in interest rates than portfolios with longer durations.

- Fully independent and proprietary research

- Leverage research across fixed income, high yield, and equity

- Analyze opportunities and risks using proprietary models and tools

- Invest in a broad range of investment-grade bonds at time of purchase

- Invest in a completion fund providing liquidity and diversified exposure to securitized bonds

- Exposure to BBB rated bonds limited to 40% or less at time of purchase

- Seek to provide an experience consistent with client expectations

- Employ a total return approach—consider both yield and risk

- Emphasize opportunities that offer income generation, capital preservation and liquidity

- Strive to avoid bonds whose yields may not offset their risks

Tapping Fidelity's Fixed Income expertise

Strategic Advisers LLC (Strategic Advisers), has engaged Fidelity Management & Research Company LLC (FMR), a registered investment adviser and a Fidelity Investments company, to provide the day-to-day discretionary portfolio management of Fidelity Limited Duration Bond Strategy accounts, including investment selection and trade execution, subject to Strategic Advisers’ oversight.

FMR brings investors a rich history of managing fixed income investments for over 50 years.

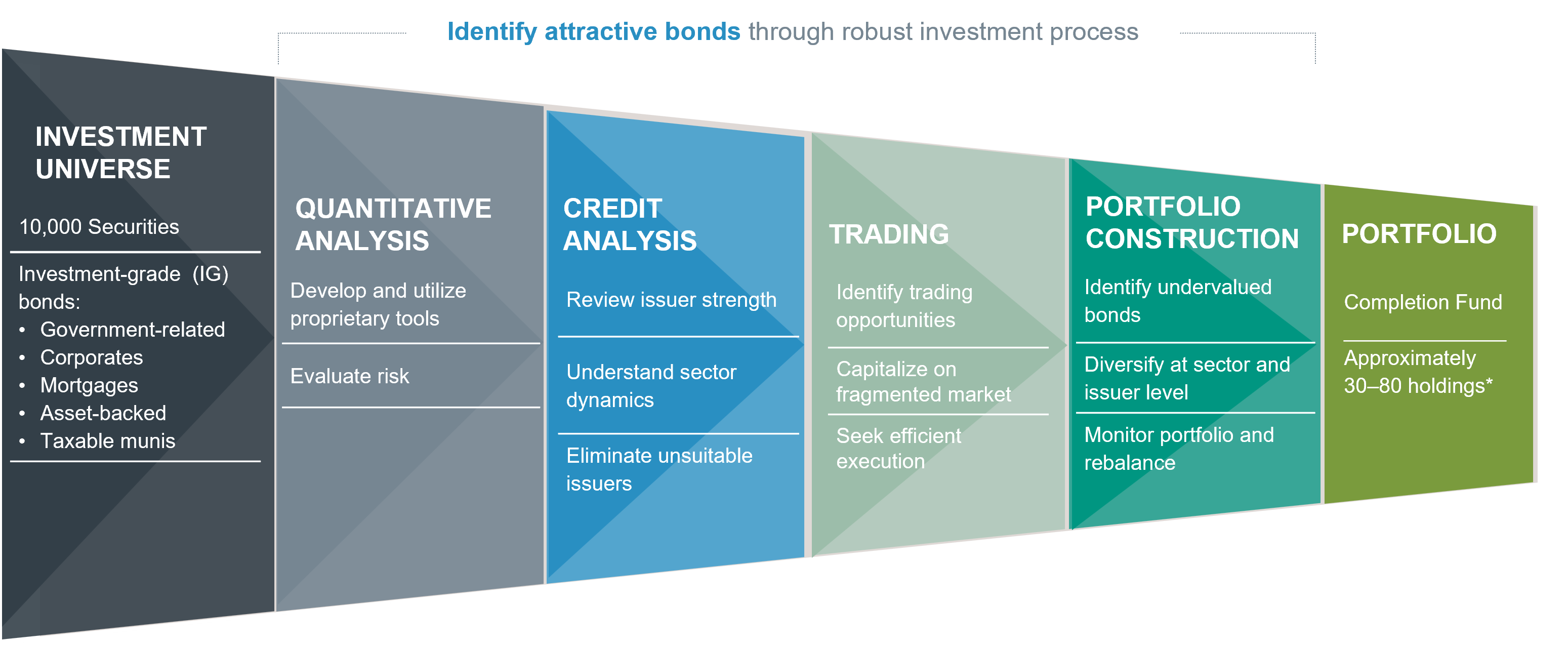

Using proprietary research, models, and tools, FMR can analyze thousands of securities across the investment-grade taxable bond universe.

This capability allows them to:

- Build a diversified taxable bond strategy

- Support income generation

- Balance risk and return potential

- Help keep your account aligned with your preferences

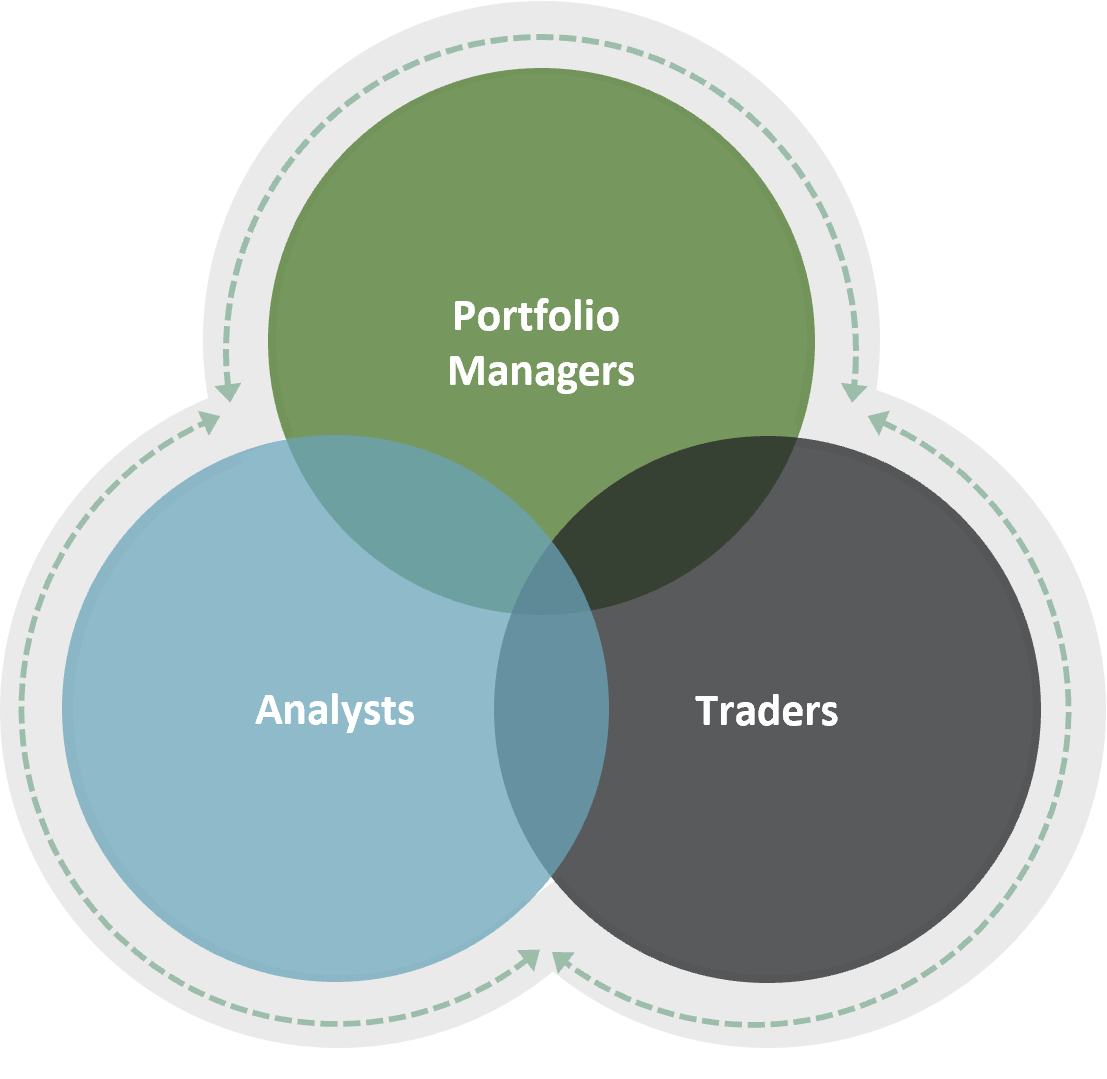

Fidelity's Fixed Income division believes investment success is a function of teamwork—involving portfolio managers, quantitative analysts, credit analysts and traders. Their investment team will actively manage your account, putting their knowledge, experience, and resources to work as they seek to uncover opportunities in all types of markets

Source: Fidelity Investments.

Why will my account hold a Fidelity mutual fund?

The Fidelity® Limited Term Securitized Completion Fund (FLTGX) offers access to a professionally managed portfolio of securitized fixed income instruments—including mortgage-backed securities (MBS), commercial mortgage-backed securities (CMBS), and asset-backed securities (ABS).

These types of securities can provide distinct risk and return characteristics compared to traditional corporate or government bonds. By incorporating FLTGX, your portfolio gains exposure to a segment of the bond market that is typically less accessible to individual investors. Additionally, the mutual fund structure provides benefits such as daily liquidity and operational efficiency.

This addition supports the ongoing effort to enhance diversification within your Limited Duration Bond SMA, helping to broaden exposure across different fixed income sectors.

How we select bonds for your account

The investment team looks at many factors when assessing risk for each proposed bond, including but not limited to, issuer specific credit risk, sector risk, interest rate risk, and liquidity risk.

The team assigns a proprietary credit rating to each bond they purchase, which is independent of the rating agencies. The team focuses on selecting investment-grade bonds that offer strong relative value in an effort to generate income while seeking to limit risk to the money invested.

Each account is diversified across a variety of sectors and maturities to help ensure it is not concentrated in any one area, can better handle changes in interest rates, and potentially helps reduce overall risk to principal over the long term.

Diversification does not ensure a profit or guarantee against loss.

Do we hold bonds to maturity?

Bonds can be sold prior to maturity when market opportunities or portfolio needs arise.

While the investment team manages the portfolio with a focus on maintaining low turnover, trades may be made to enhance return potential and manage risk. These decisions are typically driven by factors such as changes in credit quality, relative value opportunities through security selection, strategic yield curve positioning, or evolving cash flow needs.