Fidelity® Environmental Focus StrategyA separately managed account that looks to reduce exposure to companies that have less favorable environmental ratings while seeking to approximate the pre-tax return and risk profile of the Fidelity U.S. Large Cap Index. The strategy uses tax-smart strategies in an effort to enhance after-tax returns in taxable accounts.3 |

Investment objective: Build a portfolio with reduced exposure to companies that have less favorable environmental ratings while approximating pre-tax returns and risk characteristics of the Fidelity U.S. Large Cap IndexSM.

Types of investments: Primarily US large-cap stocks

Investment minimum: $100,0001

Eligible Registration Types: Taxable & Retirement

Gross annual advisory fee: 0.20%–0.40% 2 (varies based on total assets invested)

Your account will be managed in an effort to reflect the performance of large-cap stocks with a reduced exposure to companies with less favorable environmental ratings than the broader market.

Strategic Advisers LLC (Strategic Advisers) constructs portfolios using a rigorous, systematic process that analyzes companies based on a customized data set of key environmental considerations while seeking to approximate pre-tax returns and risk characteristics of the Fidelity U.S. Large Cap IndexSM. This offers the potential to invest in companies with higher environmental ratings within their sectors. We look at all the companies in the index, removing those that don't fit our filtering criteria, such as companies that engage in certain industries or product lines or that own oil & gas or coal reserves.

Securities in the starting investment universe are filtered and rated based on key environmental issues.

Climate Change

Companies that are leaders in helping manage environmental risks such as carbon emissions or climate change vulnerability

Environmental Opportunities

Companies that are innovating in areas that help offset environmental impacts, such asopportunities in renewable energy or clean technology

Natural Resources

Companies that are efficient in using natural resources, including biodiversity and land use,and spur innovations that support a sustainable resilient economy and society

Pollution and Waste

Companies that have a demonstrated commitment to, reducing pollution and waste, addressing waste management problems or designing out waste and pollution

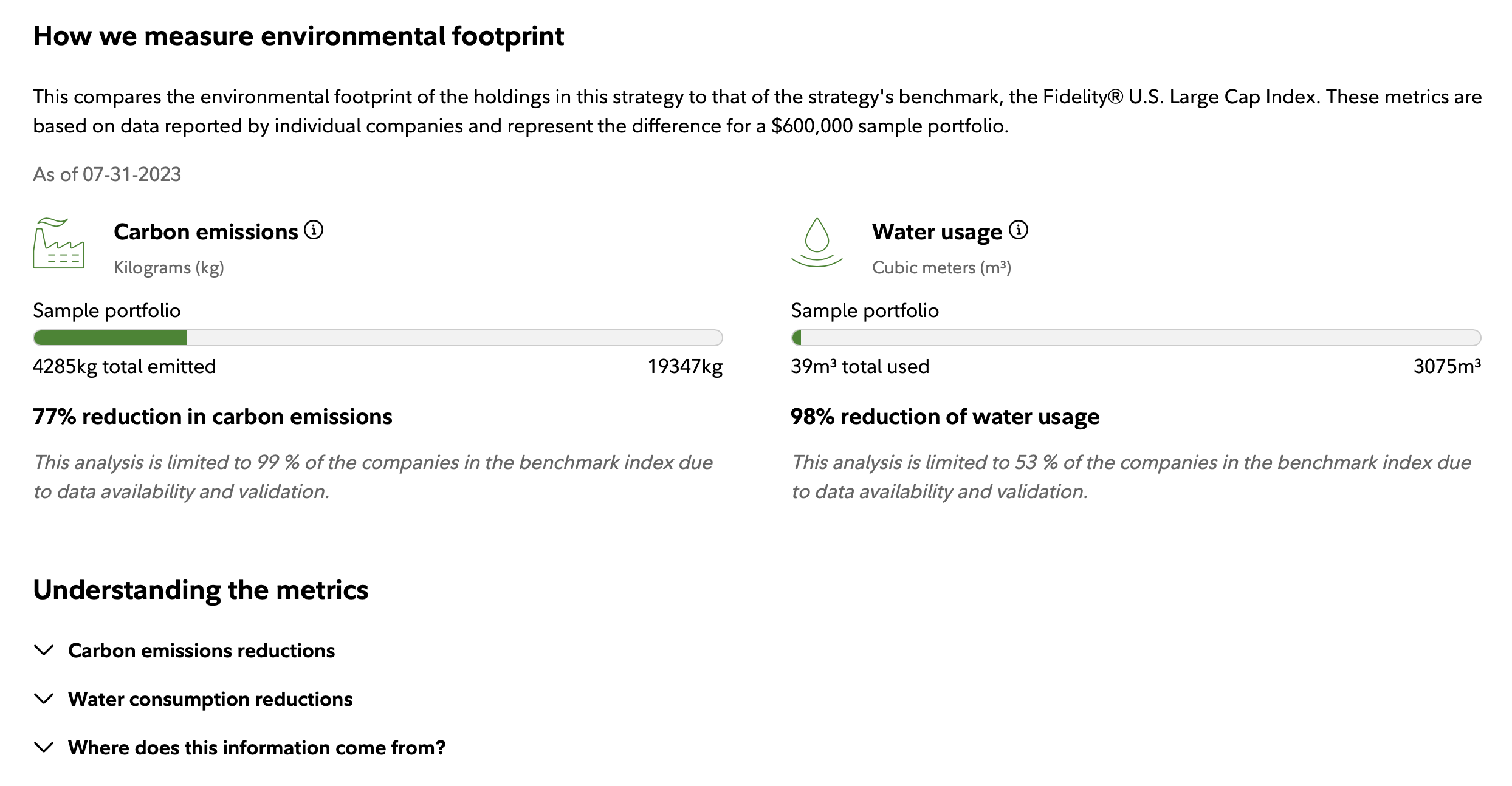

How we measure environmental footprint

With the Fidelity Environmental Focus Strategy, you will get personalized environmental footprint metrics specific to your account. The environmental footprint section of your account summary represents the results of the environmental screening process by comparing your environmental focus account's holdings to that of the strategy's benchmark, the Fidelity® US Large Cap Index. These metrics will be personalized to represent your portfolio’s reduced carbon emissions and water usage at a relative scale to the value of your account.

Carbon Emissions Reductions

The sample portfolio shown above owns less kg of carbon emissions than the benchmark because it holds fewer companies, and those that it does own generally have more favorable environmental practices than the companies in the benchmark as a whole.

For perspective, according to the US Environmental Protection Agency, a gallon of gas burned by a typical car generates nearly 9 kg of CO₂.

Water Consumption Reductions

The sample portfolio shown above consumes less water than the benchmark because it holds fewer companies, and those that it does own generally have more favorable environmental practices than the companies in the benchmark as a whole.

For perspective, according to a 2015 Los Angeles Times study, a pound of beef requires roughly 6.4 cubic meters of water to produce, which is equivalent to about 1,700 gallons.

Where Does This Information Come From?

Information about a company's carbon emissions or water consumption through its core or related business operations is provided by individual companies in the benchmark index, as well as the sample portfolio, on a quarterly basis.

Environmental Exclusions Applied to Your Environmental Focus SMA

A number of exclusions are applied to your Environmental Focus SMA in the pursuit of reducing your portfolio's exposure to companies with less favorable environmental ratings. These exclusions include, but may not be limited to:

- Companies subject to certain FMRCo sustainable portfolio exclusions

- Exclude companies with "> 0 reserves" on Coal Reserves

- Exclude companies with "> 0 reserves" on Oil & Gas Reserves

- Exclude companies with "> 0 % of power" generated from Thermal Coal

- Exclude about the bottom 50% of names that score poorly (based on FMR Systematic E Ratings) in each sector (sector-neutral)

- Exclude companies that are in both the top 30% of their sector and top 10% of the index – Carbon Emissions

- Exclude companies that are in both the top 30% of their sector and top 10% of the index – Water Usage

Your equity SMA will be managed in an effort to harness the long-term growth potential of stocks while seeking to enhance after-tax returns through the ongoing monitoring and application of tax-smart investing strategies.3 In fact, 94% of our clients investing in SMAs in taxable accounts have had their advisory fees covered by the tax savings provided.4

Strategic Advisers LLC (Strategic Advisers) constructs portfolios with reduced exposures to companies that have lower environmental ratings while seeking to approximate the risk characteristics and pre-tax returns of the Fidelity® U.S. Large Cap IndexSM. The investment team also provides day-to-day management looking for opportunities to apply tax-smart investing techniques designed to help outperform the benchmark after-taxes in taxable accounts.