Direct Indexing with Equity Separately Managed Accounts

|

What is direct indexing

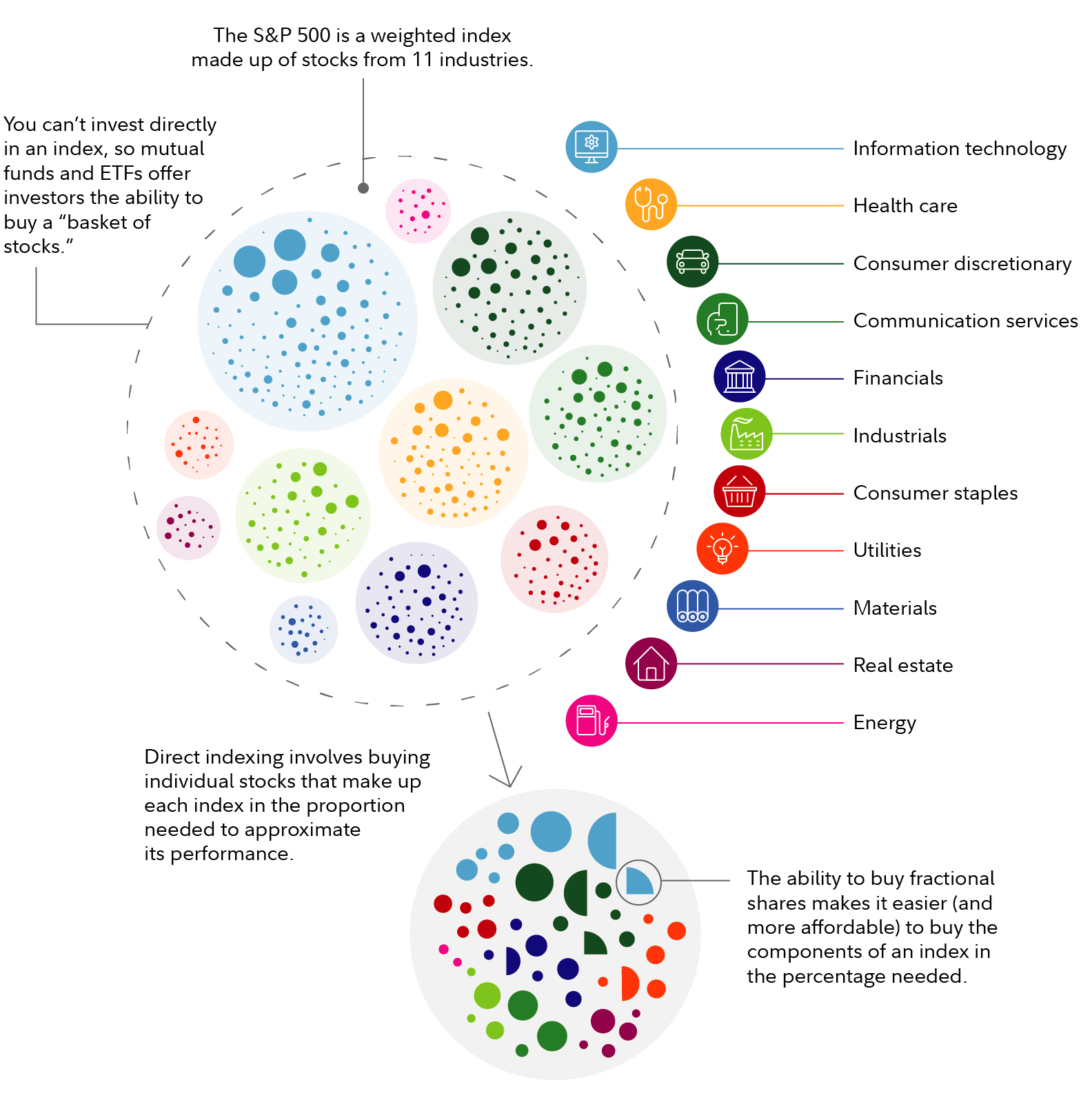

In direct indexing SMA strategies, investment managers seek to approximate the risk characteristics and pre-tax return of each strategy's benchmark index by investing in a portion of the individual stocks that make up each index, such as a U.S. Large Cap or U.S. Total Investable Market Index.

Normally, to approximate the investment results of an index such as the S&P 500, you'd have to purchase each individual stock at a relative weight equal to the index.

Over time, as different stocks change in value, as new companies enter the index, or as companies exit the index, you may have to adjust how much of each stock you own in order to maintain those relative weights and continue to see index-like returns in your portfolio.

Professional investment managers who build and maintain direct indexing SMAs use a methodology called "sampling", or buying some of the individual stocks or fractional shares of stocks that make up an index in an effort to track the benchmark's exposure risk and return characteristics. With this approach, managers are able to maintain diversification across sectors and allow for personalization through investment exclusions.

Fractional shares at Fidelity

Fidelity's equity SMAs also benefit from our unique technology and trading capabilities, like our ability to buy and sell fractional shares of stocks in your account. Using fractional shares in a direct indexing SMA may help to improve how closely the investment manager can track the benchmark's risk and return characteristics.

In taxable accounts, we'll also look for opportunities to apply personalized, tax-smart investment management to your account. Fractional shares may also enhance our ability to apply certain tax-smart investing techniques,1 such as tax-loss harvesting. Our tax-smart approach may help enhance after-tax returns, keeping more of your money invested and working for you.

What happens after you fund your account

Once your account has been funded, you'll start to see us making trades, usually within 5 business days. There are a number of factors that could impact this timeline, including the amount of your initial investment, the strategy you've chosen, and whether you're funding with securities or cash. For instance, if you fund your account with eligible stocks that don't fit the strategy and that are carrying large capital gains or represent concentrated positions within your overall portfolio, we will first determine what may need to be sold first, versus what can be sold over time to help mitigate the tax impact of building portfolios for taxable accounts.2

Once your portfolio has been built, the number of positions will vary based on the strategy you selected. This number may fluctuate over time. The use of fractional shares allows us to build portfolios using relatively small positions, with many potentially making up less than 1% of your portfolio. Fractional shares can create the opportunity for more precise exposures within portfolios.

Account transparency

With a Fidelity SMA, you'll always know which stocks, and how much of each, you own in your account. Each time you log into your account, you will see your holdings, real-time performance updates, and any activity in your account. You'll also receive rationales for the trades we make on your behalf and will have access to quarterly insights from the portfolio manager in charge of the strategy you select.

Tax-loss harvesting and wash sales

Within taxable equity accounts, we look for tax-loss harvesting opportunities throughout the year, as opposed to waiting until year-end. However, it's important to note that while we focus on tax-smart investment management throughout the year, our first priority is risk management and adherence to the strategy you choose. This is why, as you review trades we make on your behalf, you may see some wash sales. The wash-sale rule states that any tax loss will be disallowed if you buy the same security, a contract or option to buy the security, or a "substantially identical" security, within 30 days before or after the date you sold the loss-generating investment (it's a 61-day window).This is normal and reflects our commitment to prioritizing risk management over potential tax savings.