Customer Service FAQs: Exporting Account Information

-

Managing Your

Profile -

Account

Services -

Exporting Account

Information -

Technical

Support -

Account

Security

Microsoft Excel®*

-

How do I download my account information from Fidelity.com to Microsoft Excel®?

By selecting the Download button on the History page, you can export data from your Account History on Fidelity.com directly into Microsoft Excel® in CSV (comma-separated values) format. This will export your account transaction details. If you have a Fidelity® Cash Management Account, you can filter for specific types of transactions.

Quicken®* and QuickBooks®

-

How do I suppress Redemption and Purchase from Core transactions seen in Quicken®?

To better support our customers, we’ve updated the FDIC core cash position in Quicken®. Now, an FDIC core cash position will be treated as Cash instead of as a security. This will suppress additional end of day net activity (Purchase and Redemption of FDIC Core) which displays daily for accounts that have an FDIC core cash holding. Follow the steps below and this will then provide a more accurate cash available balance in Quicken and suppress any Redemption and Purchase Core activity from displaying. You will only need to make this change once.

Step 1) Remove your Consolidated FDIC Holding. This can be accomplished by the following steps:

- In Quicken's main menu go to Edit > Transactions > New

- Enter Transaction as Remove – Shares Removed in the dropdown

- Select Consolidated FDIC in the Security name dropdown

- Select Specify Lots button to remove for each lot for the account that it is held

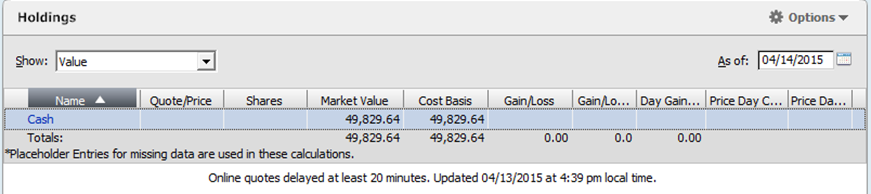

Step 2) Select the Cash link (shown below) to update you current cash value in Quicken.

Once completed, these steps will not be required again for future downloads. This will also suppress unnecessary Core Purchase and Redemption Transactions from displaying.

Note: If you have not already been deleting extra core transactions from their existing transaction view, it may be required to delete extra activity seen as Core FDIC Insured Buy/Sell transactions in the existing Quicken registry.

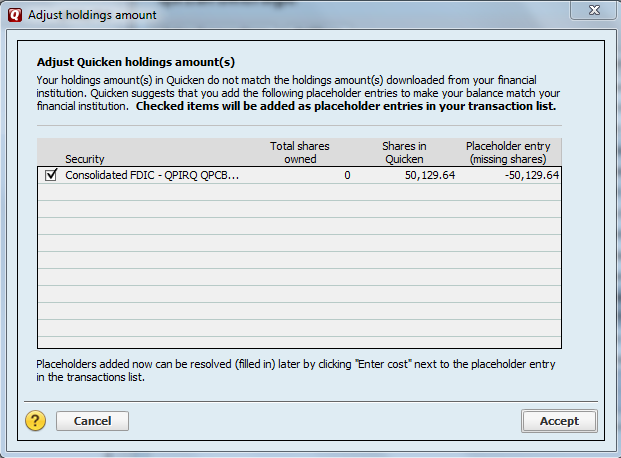

If the following message is being presented, it can also be addressed by following the steps below.

Step 1) Keep the box checked and select for Consolidated FDIC position and then select the Accept button. This will also remove the Consolidated FDIC position.

Note: Quicken will delete the Consolidated FDIC position after this step; however if you have multiple lots created, you may need to follow Step 1 mentioned above.

Step 2) Follow Step 2 mentioned above to now update current cash value.

Did you know you could avoid the steps above by creating a new Quicken File?

This can be accomplished by going to File > New Quicken File. This will automatically make all the necessary adjustments.

Note: By choosing this method, your history for up to the last two years will be refreshed for the new file being created, for all your accounts. As a result, consider saving a copy of your previous file before creating a new one by going to File > Save a copy as… seen in Quicken.

-

What versions of Quicken® and QuickBooks® support the account download service?

To use the Quicken® and QuickBooks® download services, the version being used cannot be more than three versions old. Current versions of Quicken and QuickBooks can accept downloaded information from your Fidelity account. Fidelity cannot support or help troubleshoot problems that may occur with older versions of these products.

-

What are the system requirements for using the account download service?

To use the Fidelity.com account download service, your computer must meet the hardware, memory, operating system, browser, and access requirements provided by Quicken® and QuickBooks®. Usually this information is available on the product packaging or in the software's Read Me file.

-

What is required to use the account download service?

To download your account data, you must have the following:

- Any one of the three most recent versions of Quicken® and QuickBooks®—available from stores or direct from Intuit at 800-4-INTUIT or www.intuit.com.

- A Fidelity password to download your account data. This is the same password you use to log in to Fidelity.com. You will be prompted for your Social Security number or customer ID and password every time you request your account to be updated. If you do not have a password, you can Register Now to establish a password online.

-

Must I enroll for the account download service?

You do not need to enroll to use the account download service. All you need to download your data is an online password to access your account. This is the same password that you use to access your account through Fidelity.com.

-

How much does the account download service cost?

Downloading your Fidelity account information into Quicken® and QuickBooks® is free.

-

What types of accounts can I download information from, and what kind of account information can I download?

For Quicken®, you can download the following account information from your Fidelity accounts:

- Account balances

- Investment holdings

- Up to 24 months of transaction history with 90 days as the default

If your plan permits, you can download information from your Fidelity NetBenefits® 401(k), 403(b), and 457 accounts.

For QuickBooks®, you can download the following account information from your Fidelity accounts:

- All Brokerage account activity (excluding annuity accounts)

- Transaction history with the latest 90 calendar day view

- Transaction balances, which reflect all transaction activity within the last 90 days.

You cannot download NetBenefits 401(k), 403(b), 457 accounts or Fidelity annuity accounts. QuickBooks does not support these account types. We recommend utilizing Quicken for these account types.

-

How much transaction history can be downloaded? How often is account information updated?

The last 90 days of transaction history is downloaded the first time an account is downloaded into Quicken® and QuickBooks®. Customers using Quicken 2010 and 2011 can download up to 24 months of transaction history. Customers using QuickBooks can download up to 90 days of transaction history. Please call a Fidelity representative at 800-544-7595 for assistance. On subsequent downloads, Fidelity will transmit up to 90 days of new transaction history since the previous download. Therefore, we suggest customers download account information at least every 90 days. Please note that account information is updated on Fidelity's systems nightly, so downloads will contain transaction history up to the close of the previous business day.

-

Where is my account information stored when I download it into Quicken® and QuickBooks®?

When you download your account data into Quicken® and QuickBooks®, your financial data is stored on your computer's hard drive. Take all precautions to protect this information, especially if you share your computer with others or use an Internet provider with persistent Internet access (e.g., broadband or DSL).

Make sure to read all legal disclosures within any product to understand the details behind usage of products and data storage.

-

Can I perform trades in my account using Quicken®?

No, although Quicken® and/or QuickBooks® has in-product links to Fidelity's online trading capability, you must access your account on Fidelity.com to trade in your account.

-

Can I perform transactions like bill payments and money transfers in my account using Quicken® and/or QuickBooks®?

No, although Quicken® and QuickBooks® has in-product links to Fidelity's online capability; you must access your account on Fidelity.com to transact in your account. We suggest you enroll in the free Fidelity BillPay® to pay your bills through Fidelity.com. Your processed bill payment transactions will be automatically downloaded into Quicken and QuickBooks when you use the account download service.

-

How secure is the account download service?

To allow customers to download account information with confidence and security, Fidelity has implemented powerful electronic security measures using industry-standard encryption technology and additional proprietary measures. These include requiring users to enter a password and user ID (Social Security number or customer ID) incorporating 128-bit, two-way data encryption technologies,† and 24-hour monitoring of access to Fidelity data and information.

All customer data is transferred over the Internet using industry-standard encryption technology designed to be secure. Fidelity recommends that users take the following measures to maintain the highest level of security:

- Make your passwords as obscure or abstract as possible; avoid obvious numbers and words, such as maiden name, birth date, or an anniversary, which may be easy to guess

- Don't tell anyone your password

- Ideally, your password will be easy for you to remember so you won't have to write it down, but difficult for others to guess

Please call a Fidelity representative at 800-544-7931 if you have any further questions on security with the account download service.

† In an effort to provide a higher degree of confidentiality and security for your personal financial information, Fidelity strongly recommends the use of 128-bit encryption browser. Encryption is the process for scrambling your trading and account information as it passes between Fidelity and your computer. The encryption process is built into most Internet browsers. The larger the number of bits for encryption (e.g., 128) the more difficult it is for an unauthorized person to unscramble the transmission.

A browser that supports 128-bit encryption is the most secure way to access your Fidelity information. Fidelity may only be liable for losses resulting from unauthorized transactions if it does not follow reasonable security procedures for verifying the identity of a user. Fidelity recommends that you verify the accuracy of your confirmation statements immediately after you receive them.

-

Do I use my Fidelity.com password to download my account data, or do I need a new password?

The password you use to download your account data is the same password you use for Fidelity online trading and FAST® phone access. If you have forgotten your password, you can establish a new password online, which takes just a few minutes.

-

Can I download my Fidelity NetBenefits® accounts?

If your plan allows, you may be able to download your Fidelity 401(k), 403(b), or 457 accounts into Quicken®. If you need assistance importing your Fidelity NetBenefits® account information, call 800-581-5800.

-

Can I download my employer-sponsored account information?

If your plan allows, you may be able to download your Fidelity 401(k), 403(b), or 457 accounts into Quicken®. If you need assistance importing this type of account information, call 800-581-5800.

-

Are there any instances in which Fidelity data varies from the manner in which it is displayed by Fidelity?

Yes, some transaction types do not appear in the information displayed once you download your account. You can always refer to your account on Fidelity.com or your regular account statements for an accurate representation of your account history.

-

How do I change a Fidelity account in Quicken® to recognize cash transactions like a checking account?

Quicken® recognizes cash transactions in a Fidelity account, as it would in a checking account, when you follow these steps:

- After a successful download of your History data into Quicken, choose Tools, then Accounts List from the Main Menu.

- Select the investment account to which you'd like to add a linked checking account, then choose the Edit button. On the General Information tab on the Account Details window, choose Yes to "Show cash in a checking account." Quicken will prompt you to back up your data file.

- Once the backup is complete, the linked checking account is created in Quicken with the same name as your investment account, plus the suffix Cash. Select the OK button to save your changes.

- Quicken converts all transactions in the investment account to their transfer equivalents. For example, Buy transactions are converted to Buy X transactions, and Sell transactions are converted to Sell X transactions.

-

Can I export all of my account information?

In Quicken®, you can export your investment holdings and account balances, along with 90 days of transaction history for your personal accounts. In addition, you can get transaction history up to 24 months. If you need assistance please contact Fidelity at 800-544-7931. If your plan allows, you may be able to download your Fidelity 401(k), 403(b), or 457 accounts.

Note: Some transaction types do not appear in the information displayed once you download your account. You can always review your account online or on your regular account statements for an accurate representation of your account history.

In QuickBooks®, you can export your transaction history for the last 90 days of transaction history for your personal brokerage accounts. On subsequent downloads, Fidelity will transmit incremental days of new transaction history since the previous download. Therefore, we suggest customers download account information regularly within 90 days period.

If you need assistance please contact Fidelity at 800-544-7931. If your plan allows, you may be able to download your Fidelity 401(k), 403(b), or 457 accounts in Quicken.

Note: Some transaction types do not appear in the information displayed once you download your account. You can always review your account online or on your regular account statements for an accurate representation of your account history.

-

How can I receive further assistance with the account download service?

If you need further assistance downloading your Fidelity account information into Quicken® or QuickBooks®, please call Fidelity at 800-544-7931 and a specialist will be able to assist you.

Additional FAQs

Find answers to questions about these products and services.