Your comprehensive wealth plan

Your dedicated Fidelity advisor1 can help you build a wealth plan around the people who matter to you. We'll work to match your priorities with our extensive planning capabilities, from retirement to legacy planning.

Already working 1–on–1 with us?

Schedule an appointmentLog In Required

A comfortable retirement starts with a plan

Providing proactive insights

Our guidance can help you understand how to enhance your savings strategy and invest for the future you envision.

Planning for your income in retirement

Your plan works to balance growth potential, sources of guaranteed income,2 and, for accounts we're managing, tax-smart withdrawals.3

Accounting for health care

Your plan can be built to factor in the rising costs of health care, helping you retire with confidence.

An investment strategy to help bring your plan to life

We can recommend an investment strategy for you and, if you choose, can actively manage your portfolio, making adjustments as your life changes.

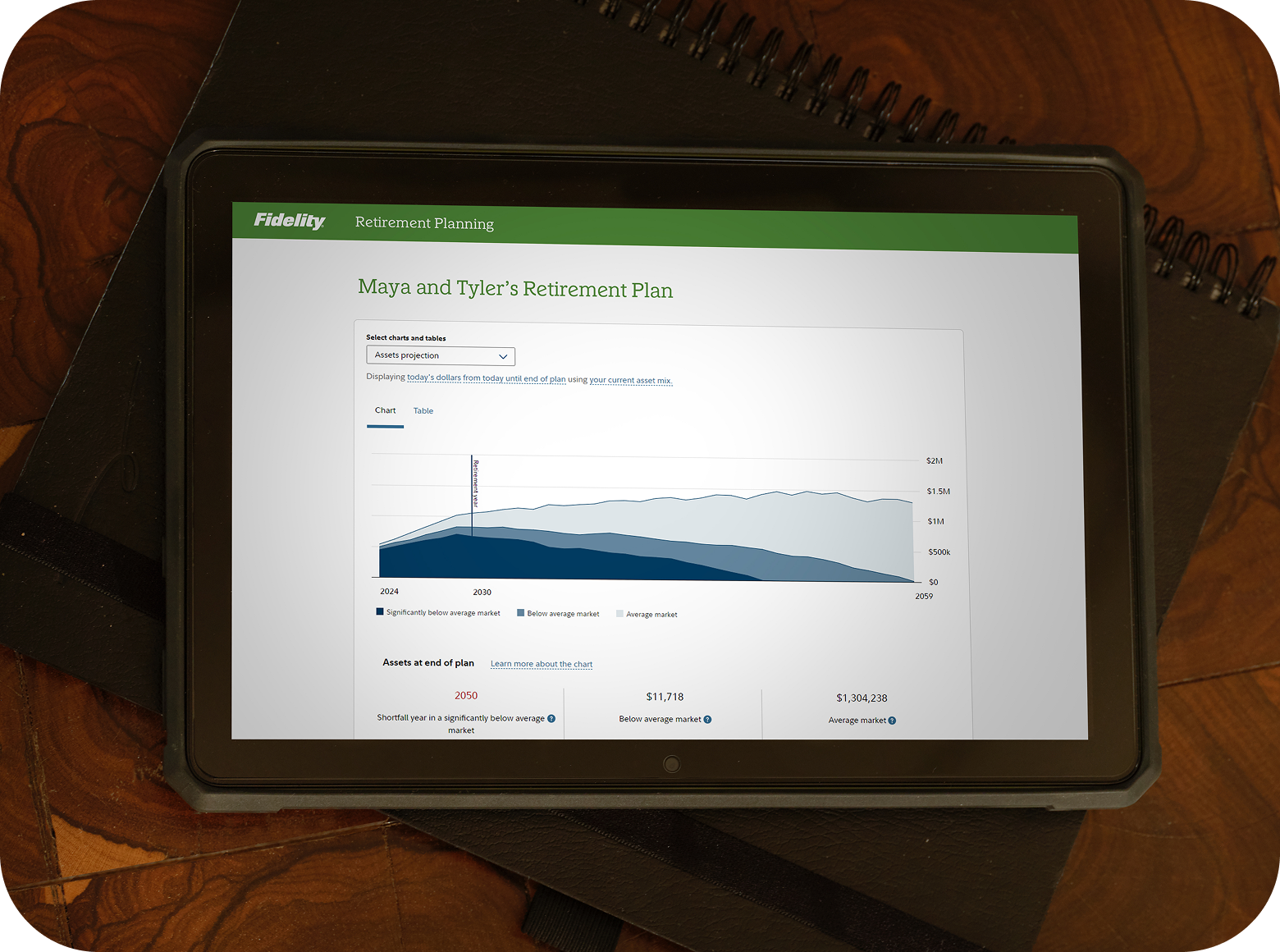

Screenshots are for illustrative purposes only.

Designing a portfolio around you

Your strategy is personalized around your goals, financial situation, comfort with risk, time horizon, and preferences.

Putting our experience to work

Our investment team has deep experience in asset allocation, manager analysis and selection, risk management, and personalized trading.

Managing around the big picture

Your portfolio can be built around all your household’s accounts, even those not held at Fidelity.

Taking a tax-smart approach

Depending on the type of account we’re managing for you, we may employ up to 8 tax-smart strategies designed to help you keep more of what you earn.3

Plan for the costs of health care

We can work with you to build a plan to help ensure that the cost of health care—even unexpected expenses—doesn't compromise your retirement.

Offering a clear assessment

We start by providing a breakdown of the health care expenses you may encounter during your retirement.

Accounting for long-term care

We can offer guidance on the right combination of coverage to manage the costs of long-term care.

Integrating health savings accounts

We can work with you to build the triple tax benefits4 of HSAs into your plan to help cover health care costs.

Getting more from Medicare

Our licensed insurance agents, specializing in Medicare can provide a complimentary evaluation, as well as annual reviews, to help you choose the right coverage for your situation.

Tax strategies designed to help you keep more of what you earn

We take a comprehensive approach when working to help reduce what you pay in taxes. In the accounts we manage for you we may apply certain strategies as early as when we start building your portfolio.

Taking a personalized approach

We start with a personalized analysis to help you understand how taxes may be affecting your overall financial plan.

Evaluating impact

We consider the potential tax impact of every trade we make in your accounts that we’re managing using tax-smart strategies.3

Providing a continuous focus

While some firms only harvest tax losses at year end, we search for ways to reduce what you pay throughout the year, using up to 8 different tax-smart strategies.

A plan to help your legacy endure

From guidance around estate planning to assistance with document organization we can work with you to create an approach designed to help support future generations.

Helping to ensure your family is prepared

We can provide guidance around your estate plan, assist with document preparation and organization, and, if you choose, help your loved ones understand the responsibilities of inheriting wealth.5

Providing trust administration

Our trust administration services6 could help your estate avoid probate, while providing greater flexibility and control over how assets are managed.

Enhancing your charitable impact

We can offer guidance as you look to make your charitable giving more tax efficient.

Investing in education

We can help you build a plan to help finance the cost of education for future generations, including tax-efficient investment options.

Protecting your loved ones and what you're building

We can help you find solutions to help meet your family's needs after you've stopped working or are unable to provide for them.

Creating reliable income

We can work with you to convert some your savings into income you can rely on to cover your essential expenses in retirement.2

Preparing for long-term care

Work with us to find a policy to help cover costs like nursing homes or in-home care, potentially easing the burden on you and your loved ones.

Offering a holistic approach to coverage

We’ll estimate the amount of coverage you might need to help protect your family’s financial future from the unexpected.

Guidance to help meet current and future cash flow needs

We offer a range of solutions designed to help you get more from the cash you keep on hand while creating a spending plan designed to give you the flexibility to take advantage of opportunities that may arise.

Helping your cash work harder

Our comprehensive cash management solution can provide an alternative to a traditional bank, including competitive rates on your cash.

Developing a smart withdrawal strategy

We can provide guidance on which accounts to withdraw from in retirement, potentially helping your savings go further.

Borrowing against your portfolio

Qualifying Fidelity customers can use their assets as collateral for a line of credit, keeping their investment portfolio intact.5

Learn more about Fidelity Wealth Management