David Houser's father, Robert, died suddenly in his sleep. "Dad was 77, but he hadn't been ill. He was always up by 5:30 a.m. to go on his road bike ride with his buddy," says Houser. "But when my mom went in to wake him up that morning, he had gone quietly in his sleep—the way we all dream of."

That was nearly 4 years ago, and, while Robert's passing may have been peaceful, his death was a jolt for the family. There was, however, an upside: It opened the door for a family conversation about the next chapter of Houser's mother's life.

David, a Shell Oil executive based in Naperville, Illinois, and his 2 siblings wanted to be sure that their mother, 77, who lives in Palm Desert, California, was cared for from a financial and physical standpoint in the years to come—without disrupting her lifestyle.

Houser and his siblings sat down with their mom in the days following the funeral, and began a series of sobering discussions. Of course, every family is different and has to find the right time and place to talk about what they would do if a family member had a severe health event stemming, for example, from a car accident, heart attack, stroke, or stage 4 cancer diagnosis.

Planning and managing a new life

"Dad's death forced us to get to the place where we knew we needed to have that conversation," says Houser. "Mom was good with the discussion only because we had several recent deaths in the family. That gave us the impetus and catalyst to get going and be able to put into place what Mom really wanted done, including where she would live and who would take over managing her financial caregiving," he recalls.

With their mother in good health, the siblings had some lead time to make thoughtful decisions. So, if the call came that their mother had been hospitalized and was unable to make decisions for herself, everyone knew what needed to be done.

Tip: When a health event happens to a parent, in-law, or spouse, it can have a ripple effect across the entire family. Ideally, parents, siblings, and financial advisors can work together to plot out everyone’s roles and responsibilities ahead of time, so there are no surprises when emotions are running high.

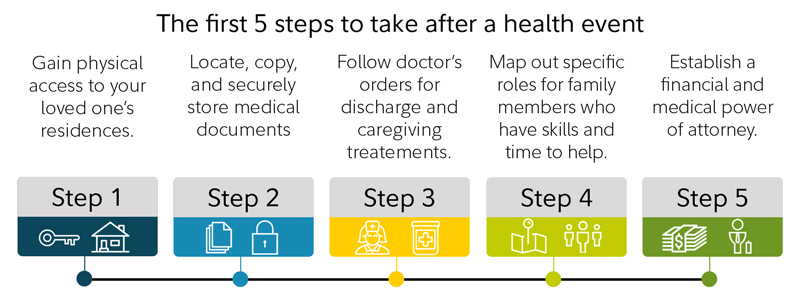

To mobilize your family after a major health event, put your team together now and ask these 5 questions:

1. Who will be the financial caregiver?

Houser was chosen by his mother and siblings to take the financial reins. Investing and finances are his passion. "I am into stocks and have the experience," admits Houser. "I was a trader in one of my jobs, and I understand the financial markets, but I don't have the time to actively manage her investment accounts."

After consulting with their estate planning professional, the first thing the family did was review and tweak the mother's will and establish a trust, so their mother could leave an inheritance for her kids and her 4 grandkids. She also wanted to put a Do Not Resuscitate (DNR) legal order in place.

Houser's mother hired a local elder care attorney to obtain and sign a power of attorney (POA) so her son could legally monitor her finances and make key investment decisions. Many financial institutions and brokerages also have documents that must be signed by the account holder before the institution will offer account authorization to anyone other than the account holder.

At the same time, she signed a health care proxy, or a living will, giving her eldest son the authority to make life-and-death medical decisions on her behalf if she isn't able to do so for herself.

Taking financial inventory Next, Houser reviewed his mother's bank and investment accounts, insurance policies, and credit cards. While his mother "was fine with bill paying at the time, she wasn't very involved with investments," he says. “Her way was to put money in the savings account and CDs and kind of let it ride. The old-school way."

When he drilled into the investment accounts, he discovered that his parents had multiple IRAs. In the meantime, his mother had recently inherited funds from her deceased sister's estate. "Honestly, she really didn't know what she had," says Houser. "We literally had to go through everything to figure out what she had because she lost track of all that."

Once that was straightened out, Houser's primary financial objective was to be certain that his mother had a smart monthly income strategy. "My Fidelity financial advisor in Naperville helped me explore the myriad of options and tradeoffs," he says. "We explored options that would generate income but weren't too risky because we needed to make sure the money my mom had in various accounts would last for her lifetime," Houser recalls.

In the end, Houser's mother ended up with a simple but well-thought-out approach that generates a target income, which automatically transfers to her bank account. And because he has POA, Houser can keep an eye on the accounts for her.

2. Who can handle the short-term, day-to-day medical needs and caregiving?

Houser's younger brother currently lives with his mother and is lined up to handle any immediate or emergency medical needs.

All families need a person living nearest to the parent or loved one, who can be on call. That individual should have a handle on what insurance will cover and what outside support he or she might need if there's a medical crisis that requires in-house care for a period of time.

The family should have a single point of contact for medical matters. In general, medical professionals don't want to deal with multiple family members. Ask: Who in the family has the most experience dealing with medical issues? Who is the best communicator? Can you tap into community resources offered by local religious and civic groups to provide services for basics like meals and transportation?

3. What are the housing options?

If the time comes when their mother can no longer live independently in her home where she now lives with her youngest son, the Housers have decided, with their mom's approval, that she will sell her home and move to northern California to live with her daughter. The house proceeds, an estimated $350,000+, will then be rolled into her trust to help cover expenses.

Mother and daughter already talk 3 times a day, so both are on board with the future arrangement. "My relationship with my mom is more transactional," says Houser. "We have a neat combination of who is playing what role for her and it works. The biggest reward for the family is that we put this in a stable place that is trusting and predictable, so there is no uncertainty about what is going on."

For those who have a different family story from the Housers or who might not have family members that can willfully take on these challenges, engage the support of a trusted friend or financial advisor to help you sort through these complex decisions.

4. How will we communicate as a family?

Family communication strategies are vital when there's a major medical event. You have to have a plan for who gets the phone call from the hospital. Who will be in charge of getting the word out in terms of what everyone needs to know? Is there a family phone tree in place for who calls whom? Is text, email, or phone the best way to communicate with a local family member and those far away?

That said, don't wait for a crisis to start talking. Get the communication lines up and running during the time when you're gradually taking over care for your aging parent, as the Housers are doing. "I communicate constantly with my siblings about what is going on from a financial perspective," says Houser. "I'm really lucky because Mom granted us permission up front to get involved, and my sister and brother have a great deal of confidence and trust in me. That is a backdrop that really matters."

Tip: Make connecting a priority. Once you have a caregiving and health event plan of action formulated, commit to follow-up conversations. Keep the momentum going and schedule as many get-togethers as you need—and revisit your plans at least annually, to make sure they still make sense.

The Houser siblings, for instance, have a quarterly meeting where they talk by phone, go online, and look at their mother's Fidelity financial and investment statements together. "I have had to work with my siblings to establish that financial trust. But we all make the effort to keep the lines of communication open," says Houser.

5. How will we navigate the eventuality of death?

This is a conversation families may be reluctant to have, but it's important to understand last wishes and what your loved ones want toward the end of their life. 'We call it 'Mom's transition' and we've pushed ourselves to talk about it—delicately, but practically," says Houser.

"The best part is that she's confident we have delivered on her goals, and we got along in the process, plus it's strengthening our relationships," he says. "And when she goes, we're going to need those relationships the most. She would like to know that we are there for each other."