No one needs to tell you that you need to save for your future—hopefully, you're already doing it. After all, no matter your age and how far away retirement is, you want to be able to enjoy retirement

"It's important to focus on 3 main things during your working years: the amount you save, the accounts you save in, and your asset mix," says Rita Assaf, a vice president in Fidelity's retirement and college savings group. "Of the 3, of course, the first is the most important, as no account or asset mix can make up for not saving enough."

1. Amount: How much and how long

We suggest starting as early as possible and consider saving at least 15% of pre-tax income each year toward retirement to help ensure enough in savings to maintain your current lifestyle in retirement.

The good news: That 15% savings rate includes any matching or profit sharing contributions from your employer to your 401(k) or other workplace savings account, like a 403(b) or governmental 457(b) plan. An employer match can make saving 15% easier. For example, Elaine earns $50,000 a year and her employer match is 100%, up to 6% of pay, which means her employer will match her contributions dollar for dollar, up to 6% of her salary. To save 15% of her salary for the year, or $7,500, she would need to contribute only 9%, or $4,500. Her employer would be contributing $3,000, or 6%, for her.

Even if you can't contribute 15% of your income right now, try to contribute enough to get the entire employer match in a workplace account, which is effectively "free" money, and then try to step up your savings as soon as you can.

Read Viewpoints on Fidelity.com: Just 1% more can make a big difference

2. Account: Where you save

Be sure to make the most of retirement savings accounts like 401(k)s, 403(b)s, and IRAs. Depending on the type of account, your contributions can grow tax-deferred or tax-free.

With a traditional 401(k) or IRA, your contributions are pre-tax, which means that they generally reduce your taxable income and, in turn, lower your tax bill in the year you make them. Your contributions won't avoid taxes entirely; you'll pay income taxes on any money you withdraw from your traditional 401(k) or IRA in retirement.

A Roth 401(k) or IRA works the opposite way. Contributions are made after-tax, with money that has already been taxed, and you generally don't have to pay taxes when you withdraw from your Roth 401(k) or Roth IRA.1

In 2026, you can contribute up to $24,500 pre-tax or Roth to your 401(k). Some plans may allow after-tax contributions up to the combined employee and employer limit of $72,000. If you're at least age 50 at the end of the calendar year, you can add a pre-tax or Roth catch-up contribution of $8,000 (or $11,250 if age 60–63).

According to the SECURE 2.0 Act’s higher earner rule, in 2026, catch-up contributions for earners whose FICA wages (typically Box 3 of Form W-2) exceed $150,000 in the previous tax year, must be designated as Roth or after-tax contributions.

If your employer's plan does not offer a Roth contribution feature and you fall under the high-earner rule, you won’t be able to make catch-up contributions to that plan.

The annual contribution limit for IRAs, including Roth and traditional IRAs, is $7,000 for 2025 and $7,500 for 2026. If you're age 50 or older, you can contribute an additional $1,000 for 2025 and $1,100 for 2026.

So how does a person determine which type of 401(k) or IRA to contribute to: a traditional or a Roth account? There are several things to consider, but for many, the answer comes down to a simple question: Am I better off paying taxes now or later? For those who expect their tax rate in retirement to be higher than their current rate, tax-free withdrawals from a Roth 401(k) or Roth IRA might be a better choice. On the other hand, for those who expect their tax rate to go down in retirement, a traditional 401(k) or traditional IRA may make more sense.

For those who can, it may make sense to contribute to both a traditional and a Roth account. That can provide the flexibility of taxable and tax-free options when it comes time to take withdrawals in retirement, which can help manage taxes. Those who aren't sure of their future tax picture could choose to make both types of contributions.

Read Viewpoints on Fidelity.com: Traditional or Roth account? 2 tips to choose

It's important to note that the SECURE 2.0 Act allows employers to also match contributions to Roth accounts, as opposed to just a traditional 401(k), so make sure to check your plan rules before choosing where to contribute.

Alternative saving options to consider

1. If you're self-employed or a small-business owner, then small-business retirement plans like a self-employed 401(k) or SIMPLE or SEP IRA allow you to set aside a certain percentage of your income. See which small-business retirement plan could be right for you.

2. You may be able to contribute to an IRA even if you aren't working. As long as one spouse works, the non-working spouse can have a spousal IRA and contribute to their own traditional IRA or Roth IRA. You must file a joint federal income tax return. Spousal IRAs are also eligible for catch-up contributions.

3. If you have an eligible high deductible health plan (HDHP), consider taking advantage of an HSA, which can offer one of the most effective means of saving for qualified medical expenses now and in retirement. Money contributed to an HSA is tax-deductible,2 and withdrawals for qualified medical expenses—now or in the future—are tax-free (that includes the money contributed as well as any earnings).

On average, according to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover health care expenses in retirement.

The cost of health care in retirement will likely continue to increase, so it can be a good idea to prepare specifically for those expenses. Saving in an HSA can reduce the amount you need because contributions, earnings, and withdrawals are tax-free when used to pay for qualified medical expenses.

For 2025, the IRS contribution limits for HSAs are $4,300 for individual coverage and $8,550 for family coverage. The HSA contribution limits for 2026 are $4,400 for self-only coverage and $8,750 for family coverage. Any employer contributions will count toward these limits.

If you're 55 or older during the tax year, you may be able to make a catch-up contribution, up to $1,000 per year. Your spouse, if age 55 or older, could also make a catch-up contribution, but will need to open their own HSA. See IRS Publication 969 for more on annual HSA contribution limits.

If you have an HSA, consider contributing money above and beyond the amount you think you’ll need for the current year's health care expenses. If you're able to invest some of it for the future, you may have some of your future health care expenses covered.

Learn more about HSAs in Smart Money: What is an HSA, and how does it work?

3. Asset mix: How you invest

Stocks have historically outperformed bonds and cash over the long term. So when investing for a goal like retirement that is years away, it can make sense to have more invested in stocks and stock mutual funds. But higher volatility also comes with investing in stocks, so you need to be comfortable with the risks.

We believe that an appropriate mix of investments should be based on your time horizon, financial situation, and tolerance for risk. As a general rule, investors with a longer investment horizon should have a significant, broadly diversified exposure to stocks.

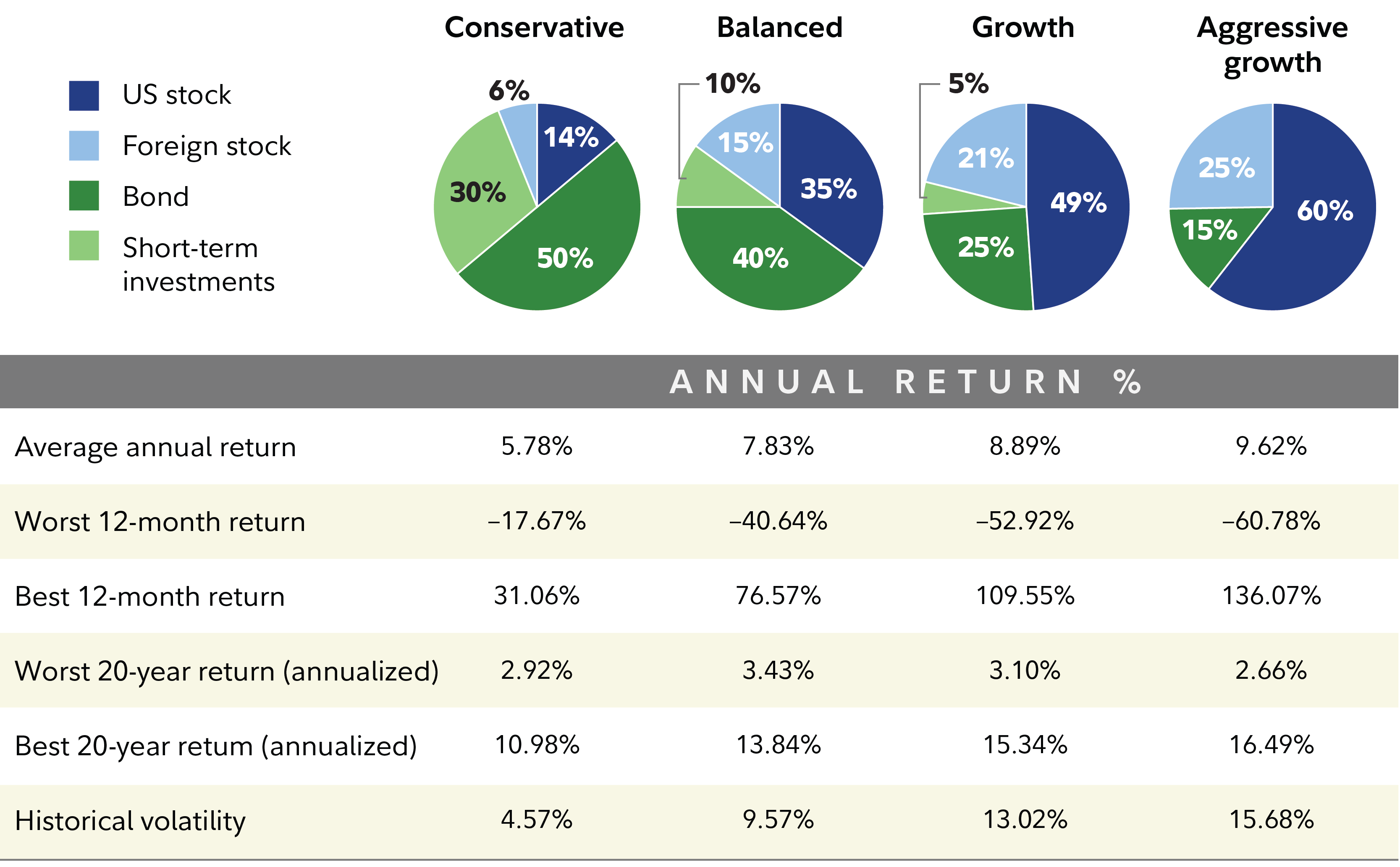

Take a look at our 4 investment mixes3 in the following chart and how they performed historically over a long period of time. As the chart illustrates, the conservative mix has historically provided much less growth than a mix with more stocks, but less volatility too. Having a significant exposure to stocks that’s appropriate for your investing time frame may help grow savings.

Choose an investment mix you are comfortable with

Think ahead

When retirement is years away and you have many other financial demands, it may be hard to focus on the future, but saving for retirement with the 3 A's in mind can help.