Everyone's road to retirement is personal, with twists and turns that are unique to their situation. Yet most of us grapple with the same, sometimes elusive, questions, usually starting with "How much money do I need to retire?"

Of course, no one knows the precise answers to these questions because you don't know what life—or the markets—will bring. Still, you need to know where you stand to make decisions along the way that will help you have choices as retirement nears.

That's why we did the analysis and determined guidelines based on 4 key metrics: a yearly savings rate, a savings factor (savings milestones), an income replacement rate, and a potentially sustainable withdrawal rate to start you on the path to creating your retirement roadmap.

They are all interconnected, so it is important to keep each in mind, and to understand how they work together as you save for retirement and monitor your progress. We will focus on each metric—and associated guidelines—in separate articles, and we've included tools and interactive widgets to help you explore the impact of changing assumptions on these individual guidelines.

Here are 4 common retirement questions—and general rules for each (assuming a retirement age of 67, which is the full Social Security benefits age for those born in 1960 or later). Of course, your particular needs may be different, which is why you should consider working with a professional to build a personalized plan. But the following guidelines offer a starting point.

Retirement guidelines

- What will my savings cover in retirement? For most people, Social Security will provide an income base in retirement with the rest coming from savings. But how much should you assume will come from savings? Fidelity's estimate is to save enough to replace at least 45% of your preretirement income,1 after accounting for Social Security. Read Viewpoints on Fidelity.com: What will my savings cover in retirement?

- How much do I need to save for retirement? Every journey should begin with a goal. Until you know the goal, it is hard to figure out whether you are on the right path. One simple way of estimating and monitoring your retirement savings goal is with our age-based savings factors. These are savings milestones expressed as multiples of your current income. Based on our analysis, we suggest aiming to save 1× your current income by 30, 3× by 40, 6× by 50, 8x by 60, and 10x by 67.2 Read Viewpoints on Fidelity.com: How much do I need to save for retirement?

- How much should I save each year for retirement? For a high level of confidence that you can maintain your lifestyle in retirement, we suggest aiming to save at least 15% of your pre-tax income3 (including any employer match) a year over the course of your working life. This may seem like a lot, but it includes all retirement savings across different accounts plus any employer contributions. Of course, you may not be able to do this every year, but there are always ways to catch up along the way. Read Viewpoints on Fidelity.com: How much should I save for retirement?

- How can I make my retirement savings last? One of the most challenging questions many retirees face is how much to withdraw from their savings in retirement. Withdraw too much and you risk running out of money. Withdraw too little and you may not live the life you want to in retirement. Our guideline is to limit withdrawals to 4% to 5% of your initial retirement savings,4 then keep increasing this withdrawal based on inflation. Read Viewpoints on Fidelity.com: How can I make my savings last?

Retirement age and Social Security benefits are key

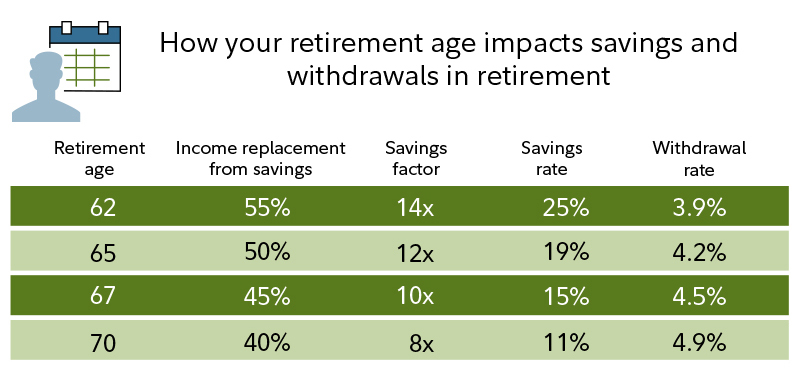

All these guidelines depend on a number of factors, especially the age at which you retire. The average retirement age in America is about 65 for men and 63 for women.5 At 62, you can start claiming Social Security benefits. But postponing claiming can increase your monthly benefit by 8% every year you delay between age 62 and 70. Delaying can also extend the period over which your retirement savings can grow, and reduce the number of years to be funded by those savings.

So the age at which you choose to stop working can have a big impact on how much income you need from your own savings. This, in turn affects the values for other retirement guidelines—savings rate, savings factors, and sustainable withdrawal rates (see table). Remember, these guidelines are all linked together.

While you may not be able to pinpoint exactly how much income you may need in retirement, you probably have an idea about when you want to retire. If you're planning to retire early, you may want to use the guidelines for age 62. If you are planning to work longer, the rules for age 70 might be more appropriate for you.

Things to keep in mind

Our guidelines assume no pension income, and we make a number of other assumptions, including continuous employment, uniform wage growth, and contribution amounts increasing with the wage growth. We acknowledge that individual circumstances are different and may vary through time. That is why we have applied a “strong plan” framework to our analysis, stress testing these guidelines to be successful in 9 out of 10 market conditions across a broad range of investment mixes (see footnotes for methodology and other key assumptions).6

To get a sense of where you stand, visit Fidelity's Planning and Guidance Center Retirement Analysis tool. For planning strategies, particularly as you get closer to retirement, it's always a good idea to work with a financial advisor to create a retirement income plan.