You already know about the benefits of saving in your workplace savings plan, like a 401(k). But you may be able to save more than you think—for many people, the annual contribution limit isn't the end of their tax-advantaged saving opportunities.

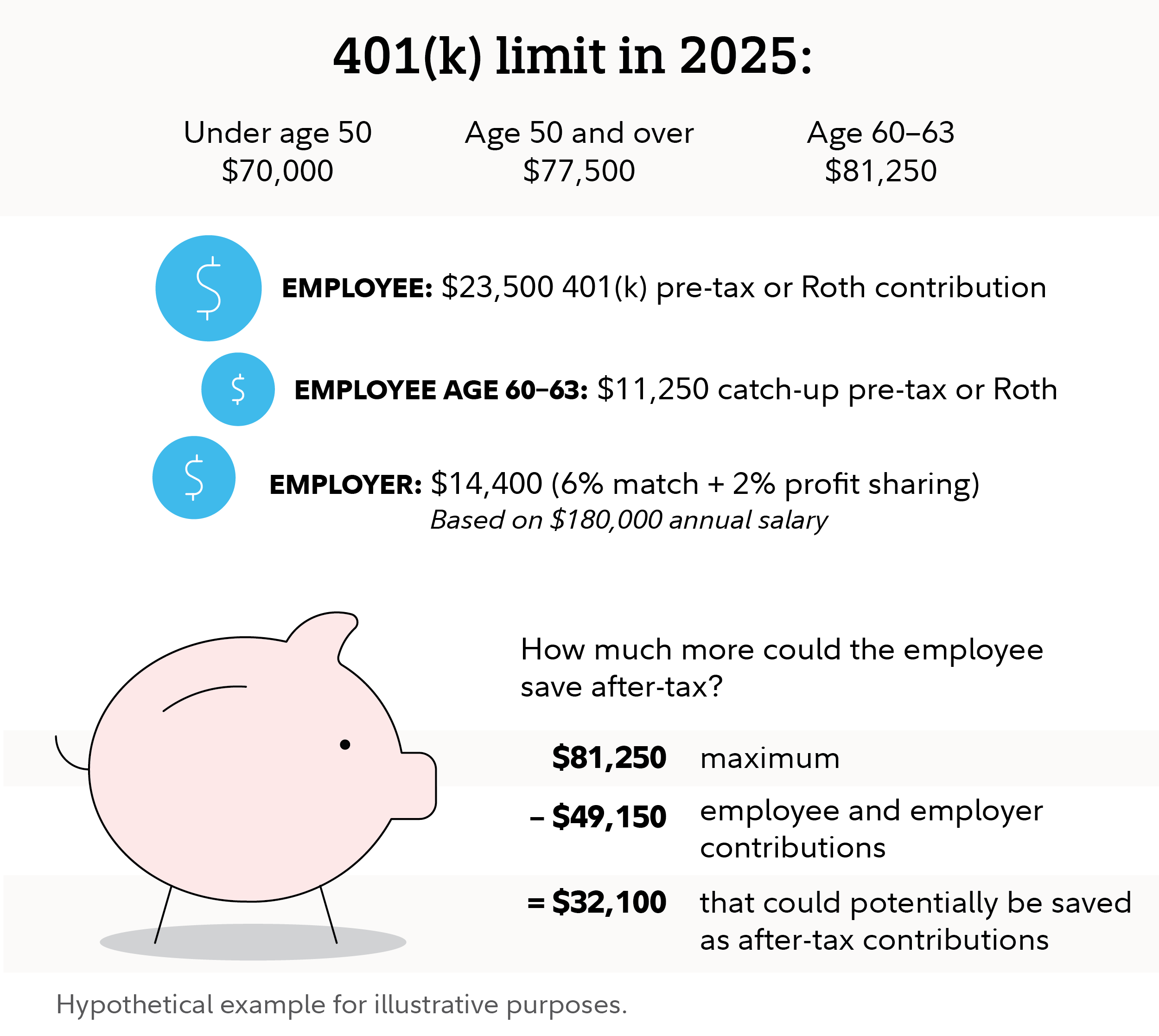

In 2025, you can contribute up to $23,500 to your 401(k). Your contributions can be entirely pre-tax or Roth (if your plan allows for Roth contributions), or some combination of the two. If you're at least age 50 by the end of the calendar year, you can add a catch-up contribution of $7,500 pre-tax. And if you're between ages 60 and 63, you will be eligible to contribute up to $11,250 as a catch-up contribution, if your plan allows.

Unlike Roth IRAs, there are no income caps on Roth contributions in a workplace savings account like a 401(k). Once you see that you will max out your contributions, you may want to consider making after-tax contributions if your plan allows. These are a third type of contribution to your workplace savings plan, in addition to pre-tax and Roth.

One quick note about after-tax contributions—you may not have to wait until you’ve hit the annual contribution limit during the year to make them. After-tax contributions can be made at the same time as your regular contributions—just be sure that your after-tax contributions aren't set so high that they will prevent you from fully making pre-tax and Roth contributions first. Check with your plan administrator if the rules seem unclear.

Be aware also that there is an annual maximum limit on contributions from all sources—including your employer. As you’re calculating the amount you can contribute, include any matching or profit sharing/non-elective contributions from your employer so that “free money” contribution doesn’t get crowded out.

The IRS allows a total of up to $70,000 of employer and employee contributions to be saved in a 401(k) for 2025, plus any age-dependent employee catch-up contributions. Here's what's included:

What you save

- Elective deferrals (either tax-deferred, Roth, or a combination)

- Optional after-tax contributions to your workplace savings plan beyond the annual elective deferral limit (if allowed by your employer)

What your employer can contribute on your behalf

- Employer matching contributions

- Employer nonelective contributions, typically profit sharing

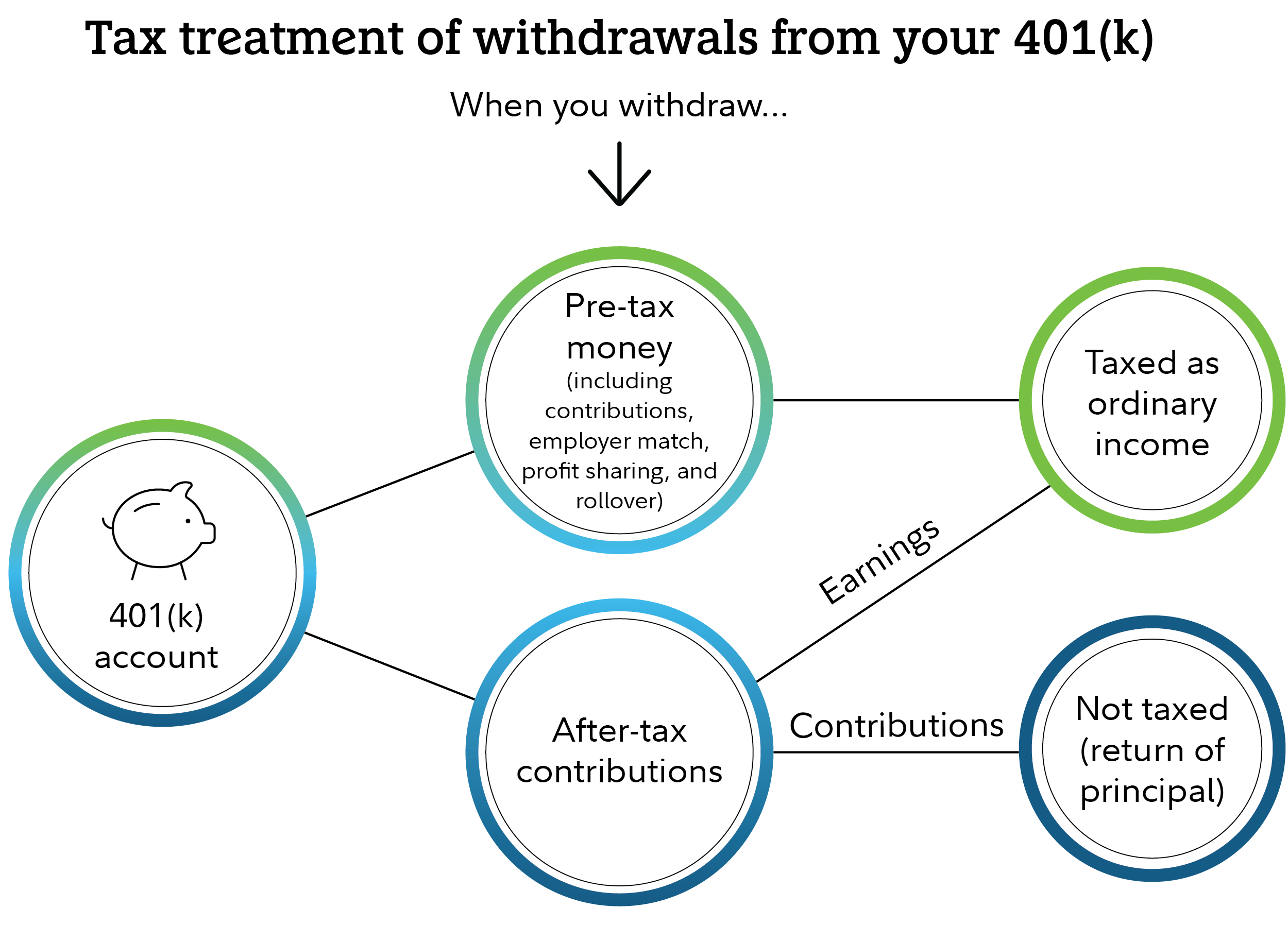

After-tax contributions to your workplace plan can be withdrawn without taxes or penalties. Any earnings on those after-tax contributions are considered pre-tax balances—so taxes would have to be paid on withdrawals of the earnings and there may be a 10% penalty if you're under age 59½.

What you should know is that you won't be able to withdraw your after-tax contributions without also withdrawing any earnings associated with them. Taking out just the after-tax balance would not be allowed (unless they are rolled over to an IRA).

Let's say you made $10,000 in after-tax contributions and that money earned $2,000 in returns. In order to withdraw the $10,000, the $2,000 in earnings would need to be withdrawn as well. And that applies if you are converting the after-tax balance as well (if you are converting in-plan).

Potential strategies for after-tax 401(k) contributions

Making after-tax contributions allows you to invest more money with the potential for tax-deferred growth. That's a powerful benefit on its own—but that's not the end of the story. You could then go a step further and convert your after-tax contributions to a Roth account. There are a couple of different ways to accomplish that (if your employer permits), including rolling over your balances to an IRA or doing an in-plan conversion if it's offered by your employer along with a Roth option.

When you convert after-tax balances to Roth, no taxes would be due on the conversion of your contributions. However, when you convert, you have to include associated earnings, which would be subject to tax. So, if the option is available to you, you may want to roll those earnings to a traditional IRA instead. That strategy is covered more in subsequent sections.

Earnings in a Roth account grow and may potentially be distributed tax-free as long as certain conditions are met. So no taxes would be due on withdrawals—as long as they take place after age 59½ and the 5-year aging requirement has been met.

Satisfying the 5-year aging requirement for the tax-free withdrawal of earnings means that there are at least 5 years between either the year of your first Roth contribution or the year the conversion took place and any withdrawals. The 5-year clock starts on January 1 of the tax year in which the conversion occurred or the contribution was made, no matter when during the year it actually happened. So if you converted in December, the aging requirement might, in practice, be only a bit more than 4 years.

Not all employers offer a Roth option in their retirement plan—or they may not offer the option to do an in-plan conversion. If your employer does not offer a Roth option or the in-plan Roth conversion feature, you can still roll over your after-tax contributions to a Roth IRA. Here are the 3 strategies. The options available to you will depend on your situation.

1. In-plan Roth conversion

Many employers do offer a Roth option in their retirement plan. And some plans allow you to do an in-plan conversion.

An in-plan Roth conversion allows you to take after-tax contributions and convert them to Roth. Some employers even offer an auto-convert feature inside their plan. You can set it up so that any after-tax contributions are automatically converted to a Roth at regular intervals. Though after-tax contributions have already been taxed, any earnings associated with them have not—so converting earnings will trigger a tax bill in the year of the conversion.

2. Rolling out to IRAs after an in-plan conversion

After completing a Roth conversion within your workplace retirement plan, rolling out to IRAs should be relatively straightforward if you choose to do that. If you’re planning to roll the money out to a Roth IRA at some point and don’t already contribute to a Roth IRA, it may make sense to open an account and make at least one contribution now, if possible, so the 5-year clock starts ticking on this account. Roth 401(k)s have a 5-year aging requirement as well that is tracked separately from Roth IRAs. These rules don't need to be subsequently met again in the future, unlike Roth conversions, which have a new 5-year clock for each converted amount (however, the earnings follow the rule for either the plan or the Roth IRA).

If you earn too much to contribute to a Roth IRA, you do have options. Read Viewpoints on Fidelity.com: Do you earn too much for a Roth IRA?

3. IRA rollover without an in-plan conversion

You can roll over after-tax contributions to a Roth IRA, and it is possible to do that before age 59½. There is a big catch, though: Not all plans allow withdrawals while you’re still with the company, and your retirement plan may have some rules around the requirements for rolling out of the plan. In-service withdrawals come with some potentially complicated rules, so it’s important to understand the rules the IRS has and those of your retirement plan.

In general, to roll after-tax money to a Roth IRA, earnings on the after-tax balance must, in most cases, also be withdrawn. You may have a few options.

If you have both pre-tax and after-tax contributions, you may be able to take a partial distribution from your retirement plan, consisting of just one or the other, if the plan separately tracks the sources of all of your contributions. In that case, you may want to roll out only the after-tax source balances directly into a Roth IRA.

The pre-tax contributions, along with the earnings from both the pre-tax and the after-tax contributions, can be rolled to a traditional IRA, incurring no current income tax.

Alternatively, you can roll everything into a Roth IRA, but you would need to pay income taxes on the pre-tax contributions and all of the earnings.

Important note: Any partial withdrawals or in-plan conversions may affect eligibility for net unrealized appreciation treatment on appreciated employer stock held in the plan.

It's advisable to consult with a financial advisor before making any decisions.

To find out more, read Viewpoints on Fidelity.com: Rolling after-tax money in a 401(k) to a Roth IRA

Be sure to consider all your options

Making after-tax contributions and then converting to Roth may seem complicated, but the long-term benefits can make it worthwhile. But bear in mind: there can be benefits to keeping your money in the workplace savings plan. Balances in your workplace retirement account may be available for loans, if your plan allows them, while balances in an IRA are not. On the other hand, IRAs have certain advantages as well. For instance, you may be able to get a broader range of investment choices. So it's a good idea to check with your financial advisor and tax advisor before choosing a strategy.