Giving to charitable causes that are close to your heart is rewarding. Getting a tax break for your generosity can make it even more gratifying—even more so than you may realize. What if you could give more to charity and maximize your tax savings by taking advantage of an often-overlooked tax provision?

Here's how: The federal tax code allows you to contribute long-term appreciated securities (that is, those held at least one year)—such as stocks, bonds, and mutual fund shares—directly to a charity without paying capital gains tax on the appreciated value, as you would if you sold it first and then contributed cash to the charity. And that's not all. When you add up your itemized tax deductions for the year, you can generally deduct the fair market value of the long-term security at the time of the donation, not the lower amount you paid for it originally.1

"The charitable deduction is one of the most advantageous tax strategies available to people who make charitable giving part of their overall financial plan," says Natasha O'Yang, regional vice president with Fidelity Charitable®, an independent public charity. "It allows you to give more effectively to increase your impact on the lives of others, reduce your taxable income, and align your charitable giving with your other financial strategies."

Reduce capital gains taxes

Contributing long-term appreciated assets to a qualified charity can be a highly effective tax strategy for eliminating capital gains taxes, especially for people with investments that have increased significantly in value.

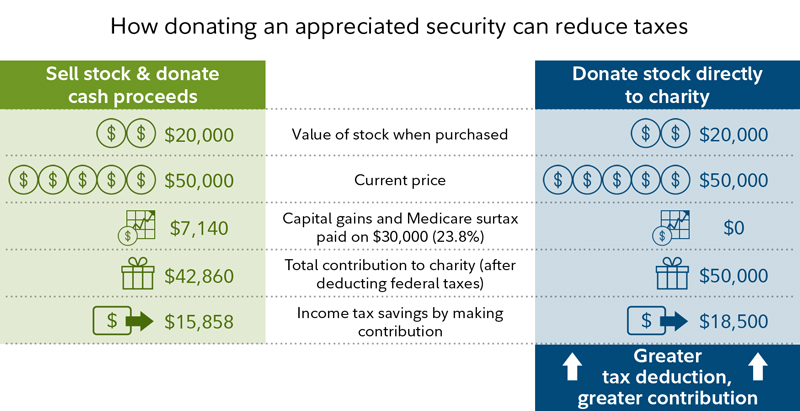

Consider a hypothetical example. Suppose you purchased $20,000 worth of stock in a company 20 years ago. Today those shares are worth $50,000, meaning a $30,000 taxable long-term capital gain. The chart compares donating the stock directly to charity versus selling the security and donating the proceeds to charity. The bottom line: By donating the stock, you eliminate a $7,140 long-term capital gain and Medicare surtax on the $30,000 increase in the stock's value.

The more your security has appreciated and the higher your long-term capital gains tax rate, the more beneficial this strategy becomes. But you could still use this strategy to eliminate a substantial amount of tax, even if your taxable income puts you at the 15% tax rate for long-term capital gains.

Estimate the potential effect of charitable giving on your taxes with Fidelity’s Retirement Strategies Tax Estimator.

Increase the amount you can contribute—and deduct

The capital gains tax elimination can be substantial, especially for those who take the standard deduction. Itemizers can also benefit from a tax deduction2 for the charitable gift. Whether you itemize or not, you not only reap the potential tax benefits but also the positive effect of contributing more to your favorite causes by donating long-term appreciated securities.

People who sell investments to make their annual charitable contribution will often set aside a portion of the proceeds from the sale to pay the capital gains tax bill. Or, if they have decided to donate a certain amount, they may need to sell extra shares of an investment to cover the tax cost in addition to the contribution.

Not only does a direct contribution of a long-term appreciated security enable you to eliminate the capital gains tax bill, it may also offer the additional benefit of increasing the size of your itemized tax deduction. You are generally allowed to calculate your charitable tax deduction based on the fair market value, not the cost basis, of the long-term appreciated security.

Using the hypothetical example above and in the chart to illustrate this point, the total income taxes you could save by contributing your long-term appreciated security in kind directly to charity would be $18,500. That's more than the $15,858 you would save if you sold the investment and contributed cash from the after-tax proceeds of the sale.

Find the right asset to give

To maximize the value of the strategy, O'Yang suggests that you look for securities to contribute that have increased the most in value and that you have held for more than a year. By gifting appreciated assets, you get two distinct tax advantages instead of one with checkbook giving. You are eligible for an income deduction, plus you may avoid the capital gains tax liability. To see the impact of contributing securities with various levels of appreciation, you can use Fidelity Charitable's Appreciated Assets Donation CalculatorOpens in a new window.

The calculator allows you to enter the size of your proposed contribution, its cost basis, and your capital gains and marginal tax rates to arrive at a savings figure that includes both the capital gains tax savings and the tax reduction from the higher itemized charitable deduction.

You may want to work with a financial professional to evaluate specific securities to consider for donation and balance those recommendations against an appraisal of the fundamental attractiveness of keeping those assets in your portfolio for the longer term.

Rebalance your portfolio

Many savvy investors typically perform an annual or semiannual review of their existing portfolio to determine whether rebalancing is necessary to keep their investment mix in line with their risk tolerance, investment horizon, and financial situation.

Disciplined portfolio rebalancing supports the practice of selling investments that have done well and buying those that may be undervalued—the "buy low, sell high" adage of successful investing. One downside of rebalancing is that it often generates capital gains taxes. But aligning your portfolio rebalancing with your charitable giving can help make that less of an issue.

Instead of selling an appreciated security and using the cash proceeds to purchase new investments, you could use that appreciated security to make your annual charitable contribution. Then, you could take the cash you would have normally given to charity and invest it in securities that rebalance your portfolio. Or, because the wash sale rule does not apply to securities donated to charity, you could use that cash to repurchase the same security you donated and own it with a higher cost basis. Either way, the result is the same: 2 goals accomplished and a potentially lower tax bill, to boot.

Simplify your giving

For those charitably inclined, donating long-term appreciated securities is a smart tax strategy, but if you want to support many different charities with this type of donation, it may become time-consuming. You can simplify the process by using a single contribution of long-term securities to create a giving plan and support multiple charities with a donor-advised fund (DAF), which is a program at a public charity. You make a tax-deductible charitable contribution to the charity that sponsors the DAF. Then you can recommend grants from your DAF to qualified public charities which are, generally speaking, IRS-qualified 501(c)(3) public charities. You can also invest your charitable dollars for potential tax-free growth and generate even more money to support the charitable causes you care about.

Using our hypothetical example above, if you don't want to give your entire $50,000 worth of stock to one charity, you could simply contribute it to the sponsoring organization of your DAF and recommend grants to multiple charities, and some of these grants might come years in the future. The tax-savings benefit for you remains the same, but the process is simpler for you—and the charity.

Break the check habit

With all the potential benefits of contributing long-term appreciated securities, why don't more people take advantage of the strategy?

"It comes down to habits that are hard to break," O'Yang notes. "Many people who contribute to charity on a regular basis have traditionally written checks, so that seems to them to be the easiest way to go. But the fact is that contributing long-term appreciated securities doesn't require much additional effort, especially if you do it with a donor-advised fund, and the tax savings can be really significant for you as well as beneficial to the charities you care most about."