We live in a world of feedback. We have instant access to vital signs for health, warning systems for safety, and directional tools for navigation. In each case, we are receiving leading indicators of long-term outcomes: information available now that can help us know where we are headed in the future.

Unfortunately, there aren’t technology feedback systems that help families know how the way they engage now will impact their relationships in the future. So it can be difficult to assess whether our current practices are pointing us toward enduring family harmony, which is a state of closeness and connection where people have a voice in decisions that impact them.

Nowhere is this more true than in a family’s all-of-life engagement around money, wealth, and estate planning, a developmental arena where families learn to make choices and decisions together.

Families learn and grow together whenever they encounter the “never been here before” financial topics that come up through time. Just consider the learning opportunities around topics like choosing a career, getting married, having children, buying a home, giving an allowance, deciding who can or will pay for college, making charitable gifts, saving for short-term needs, investing for retirement, planning for long-term care, and envisioning the financial impact you hope to have on future generations.

To support families in their growth and change, the Fidelity Center for Family Engagement (FCFE) identified 5 leading indicators of enduring family harmony to help us all navigate these important developmental topics.

The descriptions and reflective prompts that follow provide indicators of future harmony in your family. You can use them to guide individual and collective reflections on your family’s current practices around money, wealth, and estate planning. And those insights can help you identify areas where intentional conversations and skill building may be beneficial.

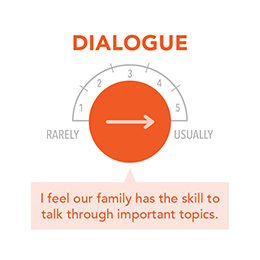

1. Dialogue: Creating shared meaning

What it is: Dialogue is not just talking. The word’s Greek roots mean “talking through.” Talking through money, wealth, and estate planning topics means engaging and understanding each other's perspectives, exploring the impact of decisions, and aligning around interests and outcomes. In dialogue, individuals avoid problematic modes of communication, such as debating opinions, telling versus asking, or leveraging emotions to get their own way.

Why it matters: If your family can really discuss topics such as money, wealth, and estate planning topics—like wishes, fears, lifestyle, values, decision-making, impact, and fulfillment—you can create shared meaning, enrich your relationships through time, and avoid unintended outcomes.

What you can do: Dialogue is a skill-based sport. An inexperienced skier wouldn’t head down a black diamond trail, but we often jump into black diamond conversations—those that are complex, emotional, and loaded with family history—without the skills to navigate them. Instead, to “dialogue,” you must identify the skills you need, practice “bunny slope” topics first, and then work your way up to the harder ones, just like you would in any arena of excellence.

DIALOGUE: Indicator reflections

Do your family members:

- Naturally engage around money, wealth, and estate planning topics? Ask about and honor the feelings and views of other family members?

- Hold strong opinions in a way that makes family members feel it is safe to engage?

- Talk in a way that creates deeper understanding and generates new insights?

2. Story: Creating shared understanding

What it is: Families are defined and described by their story. In psychology, the family narrative is said to be the emotional and psychological story of our lives. But there is never just one story. Your family’s story is composed of many individual stories and collective experiences. How your family thinks and talks about money, wealth, and estate planning through time becomes an important part of your story. It is a touchstone for multiple generations.

Why it matters: Developing a shared understanding of your family story helps build intimacy. In money, wealth, and estate planning, talking through your stories around buying things, saving, investing, helping and gifting, planning for the future, and passing money on shape your current and future family story.

What you can do: Ask your family members about their version of the family story. Just listen. Don’t interpret or judge their story. Hear the successes and failures, pain and healing, the good and the bad. Integrated family stories honor multiple viewpoints. Focus on the emotional, meaningful parts of a story, not just the facts. Find one keyword and ask a follow-up question using that word: “What did that failure feel like?” or “What made that important to you?”

STORY: Indicator reflections

Do your family members:

- Engage in the emotional and meaningful parts of the family story?

- Tell the good and the bad parts of the family story?

- Allow everyone’s version of the family story to be told and heard?

- Step into—not over—other family members’ lives and embrace their stories?

3. Collective: Creating shared identity

What it is: There is always a “me” and an “us” in a family experience. As an individual, you have your own thoughts, feelings, and wishes. You are also part of a larger group that has its own collective beliefs, expectations, and loyalties. And those different perspectives are not always aligned. Emotional development and health come from being able to hold the “me” and the “us” in tension, not living too much on one side or the other, including with money, wealth, and estate planning.

Why it matters: Families that can grow to honor and talk about the “me” and “us” similarities and differences find more enduring health and harmony. This is particularly important for your family journey from parent-child relationships to adult peership, which are relationships based on mutual love, respect, feedback, and dialogue regardless of varying ages, roles, genders, or decision rights. Peership is the developmental goal of families.

What you can do: When raising money, wealth, and estate planning topics for discussion with your family, be intentional about giving a peership voice to family members and clarifying who has a vote or decision depending on the topic and life stage. This practice will help your family hold the “me” and “us” in tension when having important or hard conversations in the future.

COLLECTIVE: Indicator reflections

Do your family members:

- Allow others to share their views on topics that are important to them?

- Give others a full range of choices without recrimination for their decisions?

- Create an atmosphere where people own their responsibilities, rather than blaming others?

- Cultivate positive views that give others the benefit of the doubt?

4. Life events: Creating shared experiences

What it is: Life events, such as birthdays, graduations, weddings, and holidays, hold significance and meaning for us all as individuals and families. How you engage verbally, emotionally, and functionally around life events is a key driver of intimacy and connection through time. Life events also have important money, wealth, and estate planning topics attached to them, which makes them a gateway into developmental conversations.

Why it matters: It is easy to step over the significance of life events and allow functional planning and execution to become the emphasis rather than focus on the intimacy of the event. When life events intersect with money, wealth, and estate planning, they can become complex and emotionally loaded. Teasing out the complexity from the significance of the event allows your family to foster connection and intimacy.

What you can do: Anticipate the significance of upcoming life events. Think about what opportunities and emotions they represent. And consider how your family history influences patterns of behavior today, such as who calls whom when important life events occur or how you talk about money, gifts, and appreciation. Aim for transparency and be willing to be vulnerable whenever your family marks a major life event.

LIFE EVENTS: Indicator reflections

Do your family members:

- Think ahead about the individual and family significance of life events?

- Discuss and define what it means to be together as they move through life stages?

- Practice openness about the financial and life decisions that impact their lives?

- Allow others to evolve in their roles and views through time?

5. Family alignment: Creating shared purpose

What it is: The objective of alignment is to elevate conversations above debate or a drive to agree on specific outcomes. Alignment has 4 separate parts you can practice. First, establish a shared vision by hearing family members’ wishes. Then, co-create principles to guide the conversation and decision-making. Then, intentionally share your vulnerabilities—feelings, concerns, and hopes—about the process or outcomes. Finally, discuss what it means to trust the process, which includes understanding that there will be obstacles, challenges, and disappointments on the path toward achieving your shared vision.

Why it matters: Your family can better navigate the most important money, wealth, and estate planning matters, such as marriages and prenuptials, in-law relationships, planning, and end-of-life wishes, when you align around a shared purpose for the future.

What you can do: Be more intentional about your family’s conversational process. Don’t just jump into important life-changing topics. A colloquialism we often use is this: “Have the right people talking about the right things in the right way at the right time.” The practices of alignment—combined with the skills of dialogue—can ensure you do just that.

ALIGNMENT: Indicator reflections

Do your family members:

- Successfully hear wishes and envision the future together?

- Use clear guiding principles as touchstones for family decision-making?

- Understand the importance of vulnerability and bringing their whole selves to conversations?

- Trust the process and allow the future to unfold?

Working toward family harmony

Each of these 5 leading indicators can be a reflective guide in your family journey toward more intimate communication and connection around money, wealth, and estate planning. By working with your financial advisor, you can begin incorporating these leading indicators and practices into your family engagement to help you move closer to one of life’s most elusive and rewarding destinations: enduring family harmony.

About the author

Dr. Timothy Habbershon is a Managing Director at Fidelity Investments and is the founder and leader of the Fidelity Center for Family Engagement. For more than 25 years, Dr. Habbershon has been an advisor, consultant, and coach to ownership and management teams of large family-controlled firms and family offices worldwide, focusing on their family and organizational transitions. He is also Adjunct Professor of Entrepreneurship at Babson College and serves on the boards of a number of family-owned companies. Prior to joining Fidelity Investments, he founded 3 institutes for enterprising families at the Beacom School of Business at the University of South Dakota, the Wharton School of the University of Pennsylvania, and Babson College, where he also founded a global applied research initiative, the STEP Project. The opinions expressed are those of the author and do not necessarily reflect those of Fidelity Investments.