With the Federal Reserve holding interest rates steady, yields on high-quality bonds with longer maturities remain attractive. That means an opportunity may still exist for those investors who have cash in money markets or maturing CDs to lock in those yields for the longer term.

If that sounds like you, you should know that buying bonds is not like buying other investments.

Investors who trade individual stocks probably know how much commission they pay their broker for each trade. Same for most mutual funds or options. But for investors who choose to buy individual bonds, figuring out the commission may be more difficult.

Bond dealers collect commissions on bonds they sell, but these commissions, commonly called "mark-ups," are bundled into the price that's quoted to investors. Typically, most brokers do not reveal mark-ups to customers prior to purchase, so some investors may not even realize they are paying a commission to the broker in addition to the price of the bond.

Regulations require brokers to publish their mark-ups on certain types of bonds—but only after a transaction.

It's important to know that these commissions exist and how much they cost because those costs impact how much you earn on your investment. Spending less on bond trades can help improve your returns over the long run. Here's how bonds are priced, and how you can comparison shop.

A fragmented, opaque market

Only a tiny portion of the 1.2 million bonds currently available are sold over public exchanges like the New York Stock Exchange, where investors can easily browse available securities and receive up-to-the-minute pricing information.

Instead, most bonds are traded "over the counter" between brokerage firms and their customers, or from one dealer to another. The brokerage firm that buys a bond on your behalf typically won’t show you all the relevant pricing data, such as the price it paid to acquire the security. Instead, the firm will simply quote you the bond's yield and the price you will pay, without saying how large a mark-up is included in that price.

Mark-ups are akin to the difference between the wholesale price for an item and the retail price in a store. In theory, a mark-up helps brokers cover expenses related to acquiring and selling the bond on behalf of clients, as well as ongoing costs related to custody and recordkeeping, and making a profit.

The challenge for investors is that they often don't know how much they’re paying. And mark-ups on the same bond can vary between firms—sometimes dramatically. And there is no easy way to compare mark-ups.

The true cost of mark-ups

The cost of bond mark-ups can have a big impact on the yield of your bond portfolio. The higher the price you pay, the lower the yield you'll receive on your investment; the less you pay, the higher the yield.

If you were to buy a single $1,000 bond with a 3% yield and a 5-year maturity, a $15 per bond mark-up drops your yield when the bond matures to 2.83%. If the mark-up were $1, your yield would be 2.99%. That difference can add up. If you bought 22 bonds, the average size purchase at Fidelity, paying a mark-up of $1 per bond rather than $15 would save you more than $300 in expenses.

Fidelity commissioned research firm Corporate Insight to compare prices of the same bonds offered online by several broker-dealers. The July 2024 study found average online prices for corporate and municipal bonds at certain competitors to be $12.95 more per bond than Fidelity's prices, including our $1 per bond mark-up. Fidelity’s prices were found to be lower than those of other brokers more than 97% of the time, on average. Competitors also charged higher average mark-ups on longer maturity bonds than on shorter maturity bonds.

How much do bond prices vary?

| Bond type | Percentage of matching bonds that were cheaper at Fidelity |

|---|---|

| Corporates | 98.9% |

| Municipals | 95.3% |

| Average | 97.1% |

How to learn what you’re paying

So how do you know what your broker is charging? Start by asking. Most brokers should be able to answer honestly and directly. If your broker seems evasive, you have every reason to be suspicious. It’s also a bad sign if they claim there is no mark-up, because "no mark-up" is almost never the case.

You can also comparison shop. Comparing bond prices at different brokers is trickier than comparing the price of a refrigerator at 2 different stores, but it can be done. If you have accounts with different brokerage firms, you can log on and check whether they offer the same bond, then compare the prices, which include the mark-up. This won't always work, however, because not all brokers offer the same bonds.

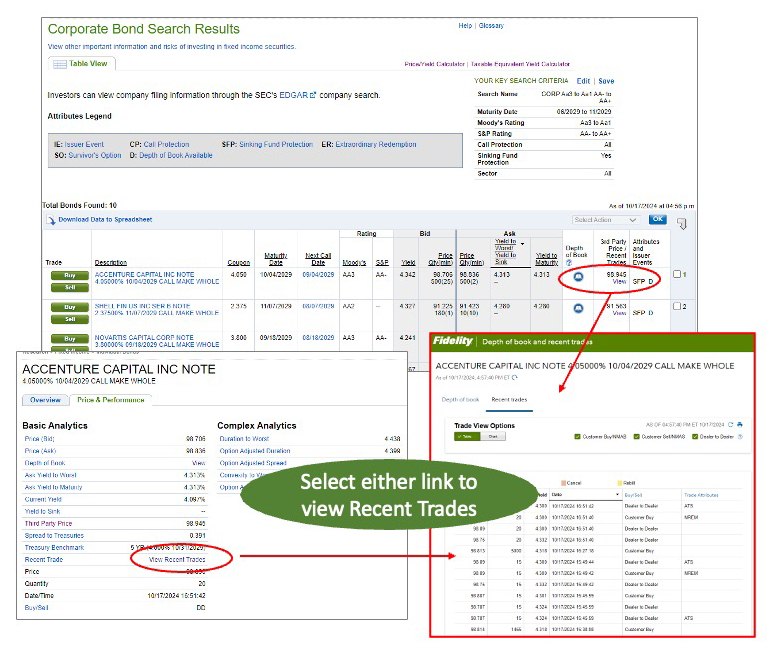

Another option is to review trade reporting data provided by the Municipal Securities Rulemaking Board (MSRB) and Trade Reporting and Compliance Engine (TRACE).

How Fidelity can help

MSRB and TRACE data

Prices and yields change from day to day. By using the historical trade data from MSRB and TRACE, you can see where prices and levels have been trading in the recent past and compare them to the current live offer or bid prices. In addition, by comparing customer prices with dealer-to-dealer prices for trades executed for the same quantities at the same time, MSRB and TRACE data provides increased transparency into the mark-ups that bond brokers are charging their clients.

"Fair" pricing is a personal decision

What makes a mark-up fair and acceptable? It depends partly on personal opinion. Investors who have a strong relationship with a broker and value the service they provide might feel more comfortable paying slightly higher mark-ups. However, many investors likely will find lower mark-ups more attractive—especially considering the impact mark-ups have on yields.

Use your knowledge about how bond mark-ups work to compare the service and prices offered by different brokerage firms or bond dealers. Besides comparing actual prices, consider how transparent different dealers are about revealing those numbers and what goes into setting them. Greater transparency may give you greater peace of mind. The bond market may once have been a murky place, but regulation and technology are steadily improving transparency. You don't have to stay in the dark about the cost of your bond investments anymore.