It's easy to find people with investing ideas—talking heads on TV, or a "tip" from your neighbor. But these ideas aren't a replacement for a real investment strategy that can help you achieve your goals no matter what surprises the market serves up.

We believe that you should have a diversified mix of stocks, bonds, and other investments, and should diversify your portfolio within those different types of investment. Setting and maintaining your strategic asset allocation are among the most important ingredients in your long-term investment success.

Then give your portfolio a regular checkup. At the very least, you should check your asset allocation once a year or any time your financial circumstances change significantly—for instance, if you lose your job or get a big bonus. Your checkup is a good time to determine if you need to rebalance your asset mix or reconsider some of your specific investments.

Why diversify?

The goal of diversification is not necessarily to boost performance—it won't ensure gains or guarantee against losses. Diversification does, however, have the potential to improve returns for whatever level of risk you choose to target.

To build a diversified portfolio, you should look for investments—stocks, bonds, cash, or others—whose returns haven't historically moved in the same direction and to the same degree. This way, even if a portion of your portfolio is declining, the rest of your portfolio is more likely to be growing, or at least not declining as much.

Another important aspect of building a well-diversified portfolio is trying to stay diversified within each type of investment.

Within your individual stock holdings, beware of overconcentration in a single investment. For example, you may not want one stock to make up more than 5% of your stock portfolio. Fidelity also believes it’s smart to diversify across stocks by market capitalization (small, mid, and large caps), sectors, and geography. Again, not all caps, sectors, and regions have prospered at the same time, or to the same degree, so you may be able to reduce portfolio risk by spreading your assets across different parts of the stock market. You may want to consider a mix of styles too, such as growth and value.

When it comes to your bond investments, consider varying maturities, credit qualities, and durations, which measure sensitivity to interest-rate changes.

Diversification has proven its long-term value

During the 2008–2009 bear market, many different types of investments lost value at the same time, but diversification still helped contain overall portfolio losses.

Consider the performance of 3 hypothetical portfolios: a diversified portfolio of 70% stocks, 25% bonds, and 5% short-term investments; an all-stock portfolio; and an all-cash portfolio. As you can see in the table below,1 a diversified portfolio lost less than an all-stock portfolio in the downturn, and while it trailed in the subsequent recovery, it easily outpaced cash and captured much of the market's gains. A diversified approach helped to manage risk, while maintaining exposure to market growth.

Diversification helped limit losses and capture gains through the financial crisis and recovery

Why is it so important to have a risk level you can live with? The value of a diversified portfolio usually manifests itself over time. Unfortunately, many investors struggle to fully realize the benefits of their investment strategy because in buoyant markets, people tend to chase performance and purchase higher-risk investments; and in a market downturn, they tend to flock to lower-risk investment options; behaviors which can lead to missed opportunities. The degree of underperformance by individual investors has often been the worst during bear markets.

"Being disciplined as an investor isn't always easy, but over time it has demonstrated the ability to generate wealth, while market timing has proven to be a costly exercise for many investors," observes Ann Dowd, CFP®, vice president at Fidelity Investments. "Having a plan that includes appropriate asset allocation and regular rebalancing can help investors overcome this challenge."

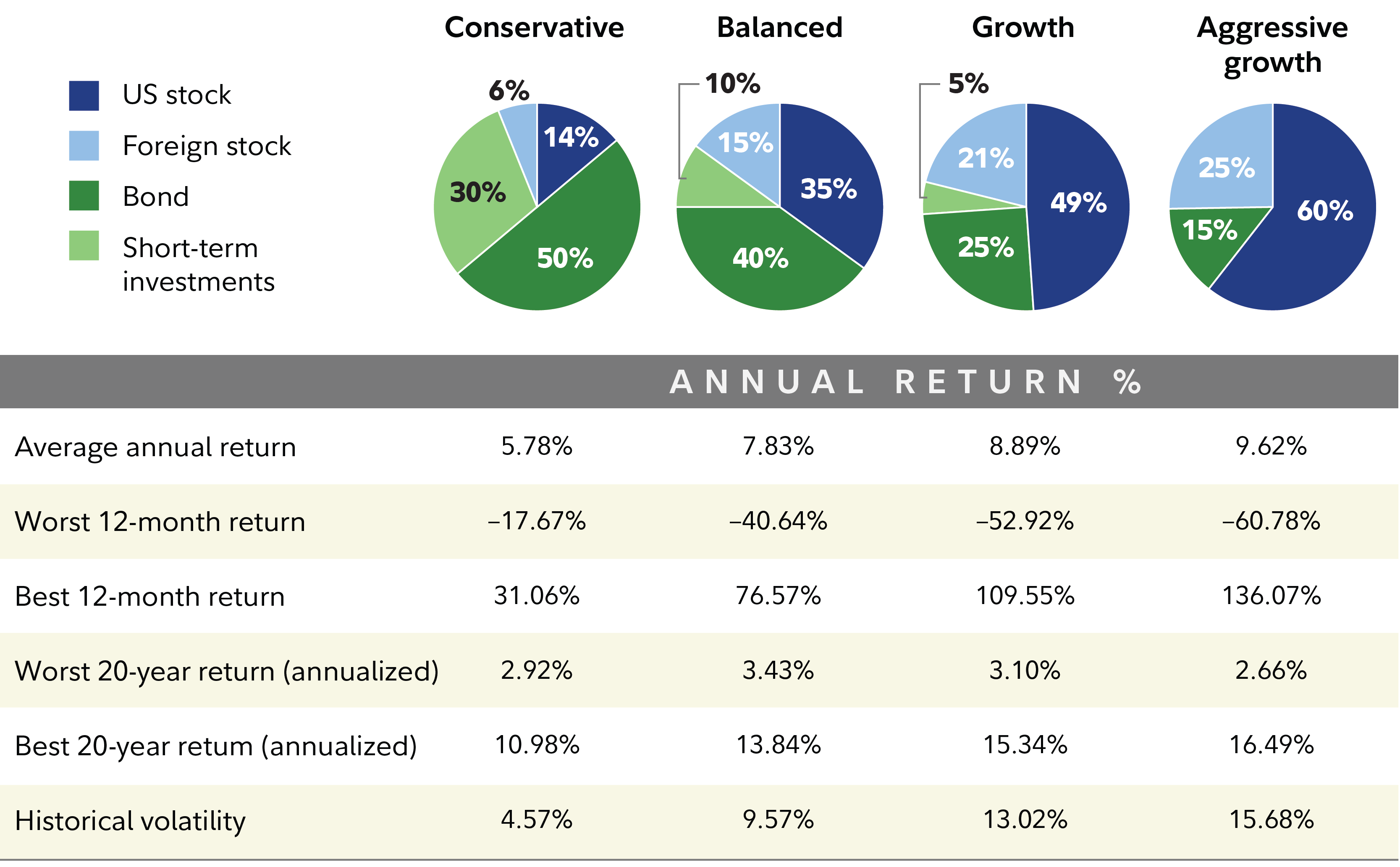

Building a diversified portfolio

To start, you need to make sure your asset mix (e.g., stocks, bonds, and short-term investments) is aligned to your investment time frame, financial needs, and comfort with volatility. The sample asset mixes below combine various amounts of stock, bond, and short-term investments to illustrate different levels of risk and return potential.

Choose the amount of risk you are comfortable with

Diversification is not a one-time task

Once you have a target mix, you need to keep it on track with periodic checkups and rebalancing. If you don't rebalance, a good run in stocks could leave your portfolio with a risk level that is inconsistent with your goal and strategy.

What if you don't rebalance? The hypothetical portfolio shows what would have happened if you didn’t rebalance a portfolio from 2000 to 2020: The stock allocation would have grown significantly.

How an investment mix can change over time

The resulting increased weight in stocks meant the portfolio had more potential risk at the end of 2020. Why? Because while past performance does not guarantee future results, stocks have historically had larger price swings than bonds or cash. This means that when a portfolio skews toward stocks, it has the potential for bigger ups and downs.2

Rebalancing is not just a volatility-reducing exercise. The goal is to reset your asset mix to bring it back to an appropriate risk level for you. Sometimes that means reducing risk by increasing the portion of a portfolio in more conservative options, but other times it means adding more risk to get back to your target mix.

A 3-step approach

Investing is an ongoing process that requires regular attention and adjustment. Here are 3 steps you can take to keep your investments working for you:

1. Create a tailored investment plan

If you haven't already done so, define your goals and time frame, and take stock of your capacity and tolerance for risk.

2. Invest at an appropriate level of risk

Choose a mix of stocks, bonds, and short-term investments that you consider appropriate for your investing goals and don’t forget to consider stock awards you may have through your employer. (Fidelity's Planning & Guidance Center can help.)

Stocks have historically had higher potential for growth, but more volatility. So if you have time to ride out the ups and downs of the market, you may want to consider investing a larger proportion of your portfolio in equities.

On the other hand, if you'll need the money in just a few years—or if the prospect of losing money makes you too nervous—consider a higher allocation to generally less volatile investments such as bonds and short-term investments. By doing this, of course, you'd be trading the potential of higher returns for the potential of lower volatility.

Once you have chosen an asset mix, research and select appropriate investments.

3. Manage your plan

We suggest you—on your own or in partnership with your financial professional—do regular maintenance for your portfolio. That means:

- Monitor – Evaluate your investments periodically for changes in strategy, relative performance, and risk.

- Rebalance – Revisit your investment mix to maintain the risk level you are comfortable with and correct drift that may happen as a result of market performance. There are many different ways to rebalance; for example, you may want to consider rebalancing if any part of your asset mix moves away from your target by more than 10 percentage points.

- Refresh – At least once a year, or whenever your financial circumstances or goals change, revisit your plan to make sure it still makes sense.

The bottom line

Achieving your long-term goals requires balancing risk and reward. Choosing the right mix of investments and then periodically rebalancing and monitoring your choices can make a big difference in your outcome.