No one opens and contributes to a workplace savings account like a 401(k) or a 403(b) expecting to need their hard-earned savings before retirement. But if you find you need money, and no other sources are available, your 401(k) could be an option. The key is to keep your eye on the long-term even as you deal with short-term needs, so you can retire when and how you want.

Loans and withdrawals from workplace savings plans (such as 401(k)s or 403(b)s) are different ways to take money out of your plan.

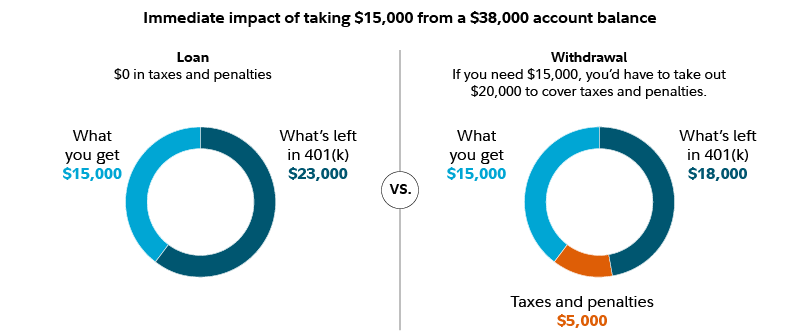

- A loan lets you borrow money from your retirement savings and pay it back to yourself over time, with interest—the loan payments and interest go back into your account.

- A withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties.

Let's look at the pros and cons of different types of 401(k) loans and withdrawals—as well as alternative paths.

401(k) withdrawals

Depending on your situation, you might qualify for a traditional withdrawal, such as a hardship withdrawal. The IRS considers immediate and heavy financial need for hardship withdrawal: medical expenses, the prevention of foreclosure or eviction, tuition payments, funeral expenses, costs (excluding mortgage payments) related to purchase and repair of primary residence, and expenses and losses resulting from a federal declaration of disaster, subject to certain conditions. Also, some plans allow a non-hardship withdrawal, but all plans are different, so check with your employer for details.

Pros: You're not required to pay back withdrawals of the 401(k) assets.

Cons: Hardship withdrawals from 401(k) accounts are generally taxed as ordinary income. Also, a 10% early withdrawal penalty applies on withdrawals before age 59½, unless you meet one of the IRS exceptions.

401(k) loans

With a 401(k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of your vested account balance or $50,000, whichever is less. An exception to this limit is if 50% of the vested account balance is less than $10,000: in such a case, the participant may borrow up to $10,000.

Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases. Your plan's rules will also set a maximum number of loans you may have outstanding from your plan. You may also need consent from your spouse/domestic partner to take a loan.

Pros: Unlike 401(k) withdrawals, you don't have to pay taxes and penalties when you take a 401(k) loan. Plus, the interest you pay on the loan goes back into your retirement plan account. Another benefit: If you miss a payment or default on your loan from a 401(k), it won't impact your credit score because defaulted loans are not reported to credit bureaus.

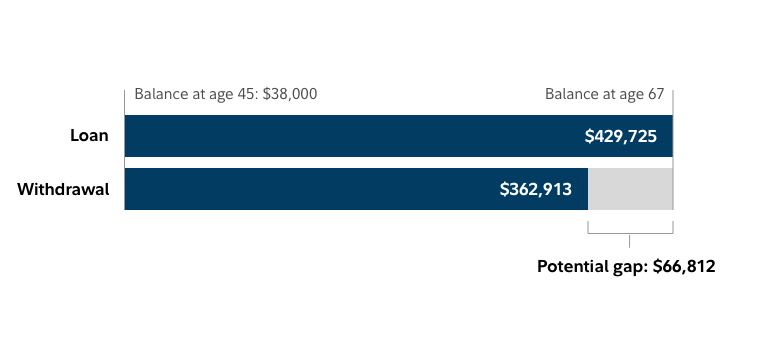

Cons: If you leave your current job, you might have to repay your loan in full in a very short time frame. But if you can't repay the loan for any reason, it's considered defaulted, and you'll owe both taxes and a 10% penalty on the outstanding balance of the loan if you're under 59½. You'll also lose out on investing the money you borrow in a tax-advantaged account, so you'd miss out on potential growth that could amount to more than the interest you'd repay yourself.

Immediate impact of taking $15,000 from a $38,000 account balance

Is it a good idea to borrow from your 401(k)?

Using a 401(k) loan for elective expenses like entertainment or gifts isn't a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what's been discussed so far, borrowing from your 401(k) might be beneficial long-term—and could even help your overall finances. For example, using a 401(k) loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What's more, 401(k) loans don't require a credit check, and they don't show up as debt on your credit report.

Another potentially positive way to use a 401(k) loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401(k) loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you're paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

What are alternatives?

Because withdrawing or borrowing from your 401(k) has drawbacks, it's a good idea to look at other options and only use your retirement savings as a last resort.

A few possible alternatives to consider include:

- Using HSA savings, if it's a qualified medical expense

- Tapping into emergency savings

- Transferring higher interest credit card balances to a new lower (or zero) interest credit card

- Using other non-retirement savings, such as checking, savings, and brokerage accounts

- Using a home equity line of credit or a personal loan1

- Withdrawing from a Roth IRA—contributions can be withdrawn any time, tax- and penalty-free

Note that you will pay taxes and penalties on any earnings withdrawn.

How do you take a withdrawal or loan from your Fidelity 401(k)?

If you've explored all the alternatives and decided that taking money from your retirement savings is the best option, you'll need to submit a request for a 401(k) loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.