Unlike stocks, exchange-traded funds (ETFs), or mutual funds, options have finite lives—ranging from a week (Weeklys1) to as long as several years (LEAPs). The farther out the expiration date, the more time you have for the trade to be profitable, but the more expensive the option will be. Thus, figuring out the balance between price and time until the contract expires is a key to success when buying or selling options.

Let’s say that on January 1, you bought one April XYZ 50 call for a $3 premium (the cost of an option is known as the premium). This option would give you the right to buy 100 shares of XYZ stock (one contract typically covers 100 shares) at a strike price of $50 at any time before the expiration date in April—regardless of the current market price.

Suppose the underlying stock rose to $60 on March 1 and you decided to exercise your option, which was “in the money” because the strike price was less than the price of the underlying security. Your profit, before taxes and transaction costs, would be $700 ($60 stock price minus the $50 option strike price, less the $3 premium, times 100).

But was the April expiration date the best choice for your strategy? Let’s say that in January, you could also have bought a March XYZ 50 call option for a premium of $2, or a May XYZ 50 call option for a premium of $4. Here are the breakeven prices (the price the underlying stock must hit for the option to become profitable) for these 3 different hypothetical options:

- March XYZ 50 call with a $2 premium: $52 breakeven

- April XYZ 50 call with a $3 premium: $53 breakeven

- May XYZ 50 call with a $4 premium: $54 breakeven

The trade-off for the longer time until expiration is a higher cost and, consequently, a higher breakeven price.

How do you decide which expiration date is right for your strategy? Just as you need to make a price forecast for an underlying stock before picking an option's strike price, so to do you need to make a forecast of how long it will likely take for your trade to become profitable before picking an option's expiration date. As always, start with your outlook. Then, determine which specific option would be the most appropriate.

When do options expire?

3 tools

Here are 3 tools, among others, that can help you choose the right expiration date for your strategy:

1. Volatility

Your assessment of volatility is one of the most important factors when selecting both your options strategy and the expiration date. Many options traders rely on implied volatility (IV) and historical volatility (HV)3 options statistics to help them pick an expiration date.

Implied volatility, in particular, can be the X factor in options pricing. It can give you an idea of how expensive or inexpensive an option may be, relative to other expiration dates. Typically, the higher the IV, the more expensive the option.

For instance, let's say the March XYZ 50 call has a 30-day IV of 20, the April XYZ 50 call an IV of 40, and the May XYZ 50 call an IV of 90. If XYZ was scheduled to report earnings in May, it might explain why that month’s IV is so much higher than the IV in previous months.

If you think the company is going to report very strong earnings that exceed the market’s expectations, and the stock is going to make a strong move higher as a result, it might be worth your while to purchase the more expensive May contract. By assessing each contract’s IV, you can weigh how much you are willing to pay for the length of the contract.

Furthermore, implied volatility tells you how cheap or expensive the premium is relative to past IV levels. A higher IV indicates a higher options premium. This may sound like a benefit to an option seller. However, you need to consider the trade-off, which is perhaps that a higher-than-normal IV may be due to an upcoming announcement or earnings release that is causing the market to expect a large price move. Thus, you need to weigh the cost against your expectation for the stock to move.

Volatility options statistics are available on Fidelity.com and Fidelity Trader+™ Desktop.

2. Greeks

Greeks are mathematical calculations designed to measure the impact of various factors—such as volatility and the time to expiration—on the price behavior of options. There are 2 Greeks in particular that can help you pick an optimal expiration date.

Delta, which ranges from –1 to +1, measures an option’s sensitivity to the underlying stock price. If the delta is 0.70 for a specific options contract, for instance, each $1 move by the underlying stock is anticipated to result in a $0.70 move in the option’s price. A delta of 0.70 also implies a 70% probability that the option will be in the money at expiration. Generally, the greater the probability that the option will be profitable at expiration, the more expensive the option will be. Alternatively, the lower the probability suggested by delta, the less expensive the option will likely be.

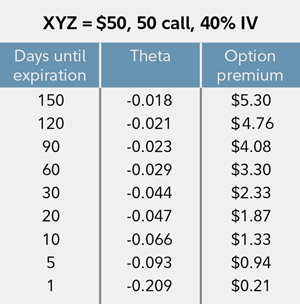

Theta quantifies how much value is lost on the option due to the passing of time, known as time decay. Theta is typically negative for purchased calls and puts, and positive for sold calls and puts. If XYZ were trading at $50, and a 50 strike call with 150 days until expiration had a premium of $5.30 and a theta of .018, you might anticipate that the option might lose about $0.018 per day until expiration, all else being equal.

The accompanying table reflects how theta tends to behave over time and its relationship to an option’s premium.

To find the delta or theta for an options contract, look at the options chain for a particular stock.

A hypothetical call option’s days until expiration, theta, and option price.

3. Probability calculator

If you want a more precise calculation of the probability that a particular expiration date will be in the money at various strike prices, you can use Fidelity’s Probability Calculator. Go to the options research page on Fidelity.com, select the Quotes and Tools tab, and then enter a ticker symbol or log in to Fidelity Trader+™ Desktop.

The Probability Calculator enables you to adjust the stock price target, expiration date, and volatility parameters to determine the odds of the underlying stock or index reaching a certain price. The calculator also allows you to enter different expiration dates to determine the probability of a successful trade.

For example, you can see the probabilities of an underlying stock hitting different breakeven prices (e.g., $52, $53, $54) by March, April, and May. Using this information, you can assess how much you want to pay for the varying expiration dates.

Of course, there are other considerations when making an options trade. These include selecting the underlying stock to which the option corresponds, the liquidity of the option contract, the particular strategy you are considering, and the strike price, among others. And it’s critically important to understand all the risks and complexities involved with trading options.

The expiration date choice, in addition to these other decisions, can help you potentially improve the odds that your trade will end up in the money. When choosing the expiration date, it’s about balancing time and cost.