Choose from 2 competitive options for your cash

Fidelity® Government Money Market Fund

Inflation can slowly eat your dollars. You may want to consider this option if you want to maximize your potential earnings. Your cash is automatically held in a money market fund (SPAXX).

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate, so investors may have a gain or loss when shares are sold. Current performance may be higher or lower than what is quoted. Click or tap the security for most recent month-end performance.

FDIC-Insured Deposit Sweep Program

You may want to consider this option if you want additional protection. Your cash (up to $4 million) is insured by the Federal Deposit Insurance Corporation (FDIC). We automatically place your cash in an account at one or more program banks.2

Award-winning account with features to help your goals

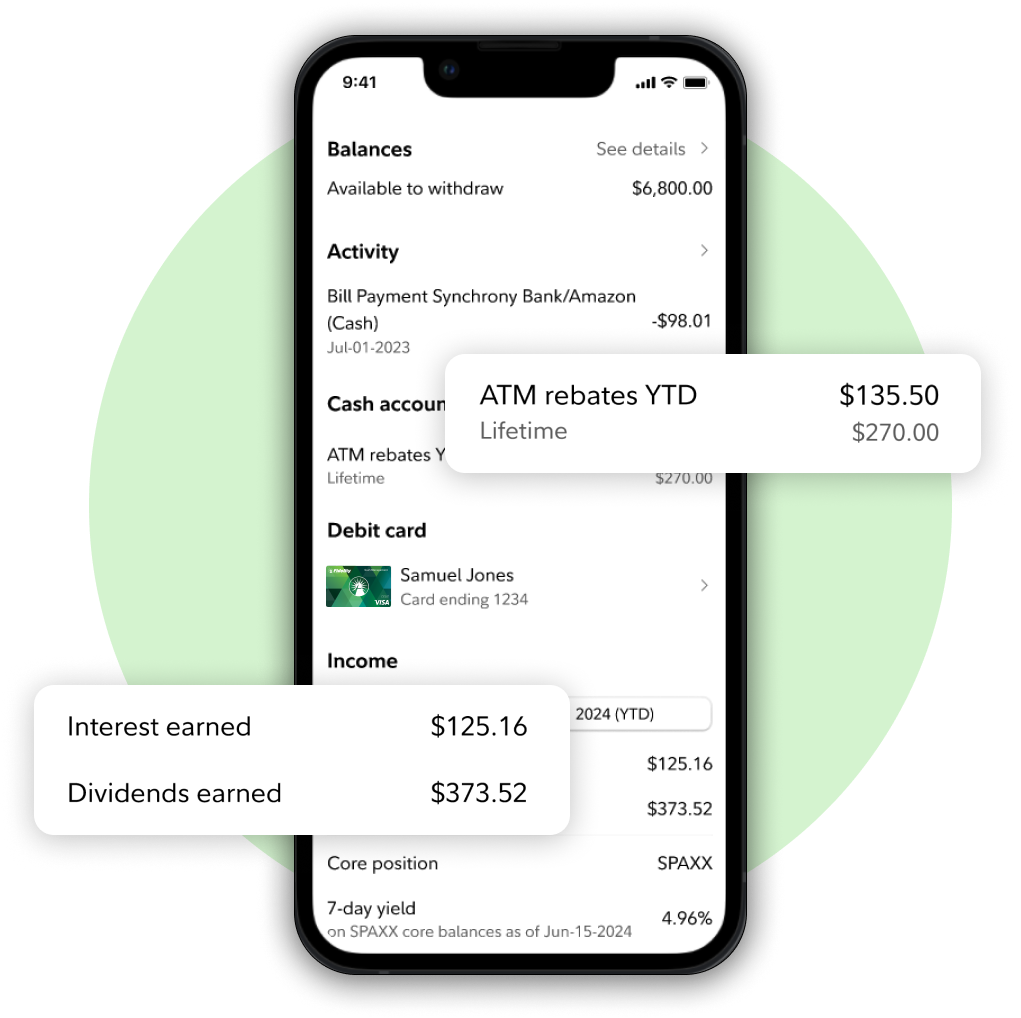

ATM fee reimbursement3

Unlimited global reimbursement on ATM withdrawals.4

Competitive rates

Earn well above the national average5 for a traditional checking account.

No fees

No account fees or minimums to open an account.

No fees to get in your way

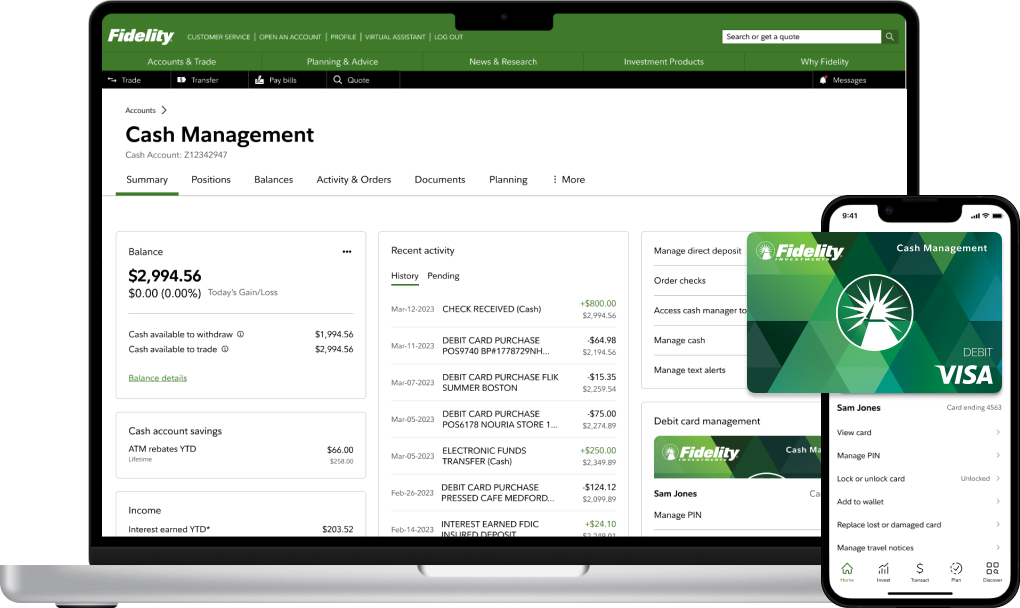

With no account fees7 and no account minimums to open, the Fidelity Cash Management Account can be a smarter digital alternative to traditional banks. Spend and withdraw with a debit card—without the fees to slow you down. Your cash balance can earn a competitive rate of return automatically every month, while your account is covered against unauthorized activity by our Customer Protection Guarantee.8

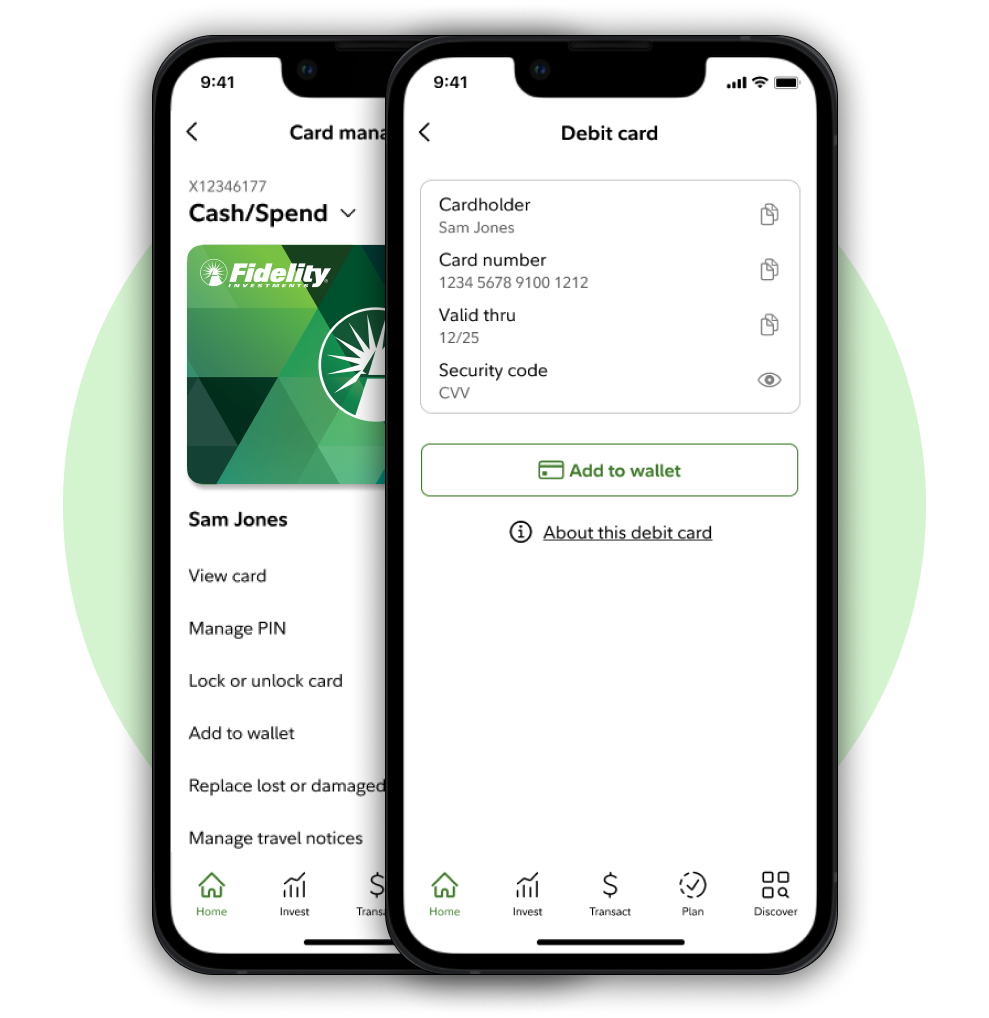

Real-time insights for right-time decisions

Know where your money is going with real-time spending views and alerts. Flexible options to pay and get paid make it easy to access your cash: Bill Pay, a digital wallet-compatible debit card, mobile check deposit, and payment apps integration.

Build routines to make saving a habit

Whether building emergency savings or for short-term goals, we’ll help make saving part of life. Easily set up direct deposit and create automatic transfers to invest your extra cash. Do it all in the palm of your hand—with the Fidelity mobile app.

Resources

Do you really need a bank?

The answer is not as clear-cut as it once was. Consider the alternatives.

Preparing for emergencies

Learn how to build a safety net to help protect yourself and your loved ones.

What to do with your cash

Learn about the ways you can manage the cash in your investment account.