Roth IRA Contribution and Income Limits

2025

| Filing status | Modified adjusted gross income (MAGI) | Contribution limit |

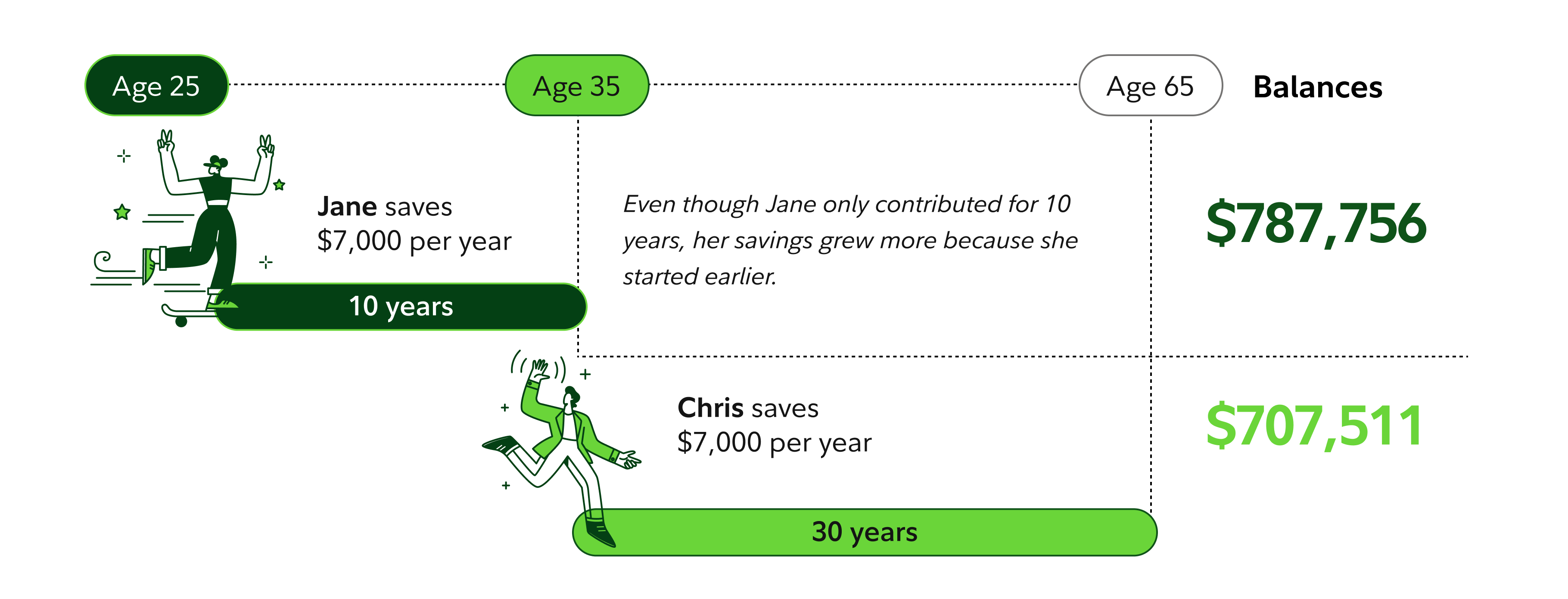

| Single individuals | < $150,000 | $7,000 |

| ≥ $150,000 but < $165,000 | Partial contribution (calculate) | |

| ≥ $165,000 | Not eligible | |

| Married (filing joint returns) | < $236,000 | $7,000 |

| ≥ $236,000 but < $246,000 | Partial contribution (calculate) | |

| ≥ $246,000 | Not eligible | |

| Married (filing separately) * | Not eligible | $7,000 |

| < $10,000 | Partial contribution (calculate) | |

| ≥ $10,000 | Not eligible |

2026

| Filing status | Modified adjusted gross income (MAGI) | Contribution limit |

| Single individuals | < $153,000 | $7,500 |

| ≥ $153,000 but < $168,000 | Partial contribution (calculate) | |

| ≥ $168,000 | Not eligible | |

| Married (filing joint returns) | < $242,000 | $7,500 |

| ≥ $242,000 but < $252,000 | Partial contribution (calculate) | |

| ≥ $252,000 | Not eligible | |

| Married (filing separately) * | Not eligible | $7,500 |

| < $10,000 | Partial contribution (calculate) | |

| ≥ $10,000 | Not eligible |

*Married (filing separately) can use the limits for single individuals if they have not lived with their spouse in the past year.