4 options for an old 401(k) or workplace savings

1. Roll over to a Fidelity IRA

With a rollover IRA, you have the opportunity to consolidate the workplace savings you've left behind into a single Fidelity account, while maintaining the potential for tax-deferred growth1 through a wide range of investment options.

2. Roll over to a new workplace plan

If allowed by your new employer, consolidate your old workplace savings accounts, like a 401(k) or 403(b), into one account with the new employer, continuing your tax-deferred growth potential. Investment options vary by plan.2

3. Stay in your old workplace plan

If allowed by your former employer, keep your money where it is. You'll continue your tax-deferred growth potential ... but won't be able to contribute anymore. Investment options vary by plan.

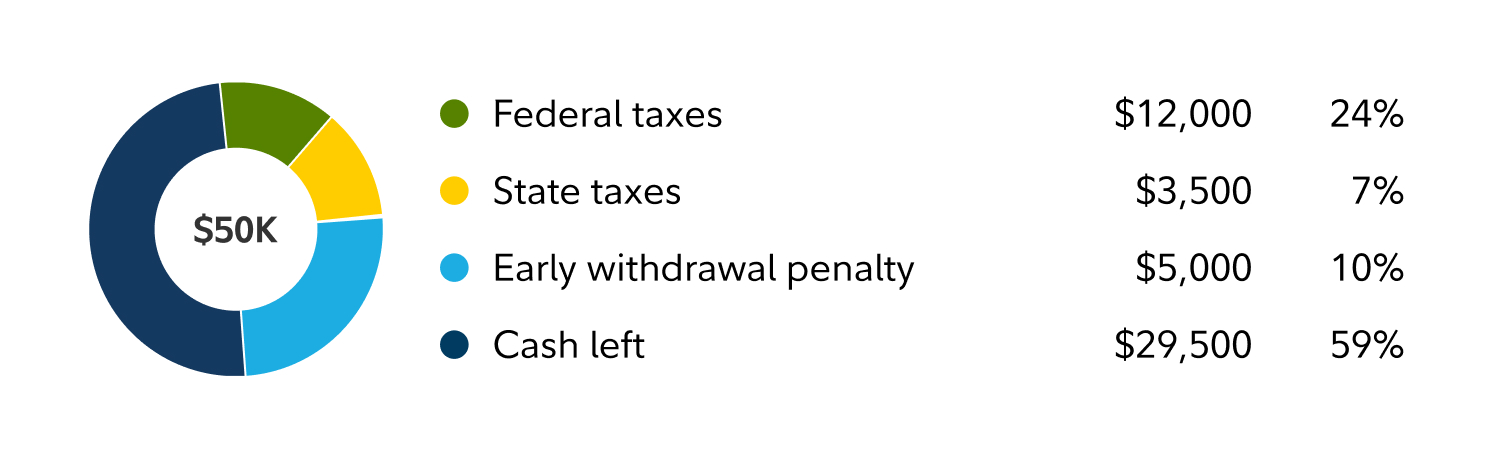

4. Cash out (and pay taxes)

Any cash you withdraw will be subject to state and federal taxes and, before age 59½, a 10% withdrawal penalty may apply.3 Also, your money won't have the potential to continue to grow tax-deferred. Here's a breakdown of what you'll get from a hypothetical cash-out of $50,000 before age 59½:

A hypothetical 24% federal marginal income tax rate, a hypothetical 7% state income tax, and a standard 10% penalty for early withdrawal. The penalty is not withheld from the distribution, but rather paid when the employee files their income taxes. This example is for illustrative purposes only. Please note that the 10% early withdrawal penalty does not apply to distributions made to an employee after separation from service after age 55. The withdrawal will still be subject to income taxes.

Questions?

A Fidelity representative can help you understand your options and guide you through each step of the rollover process.