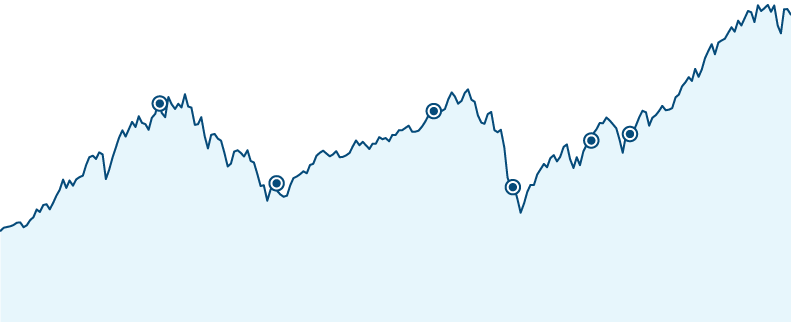

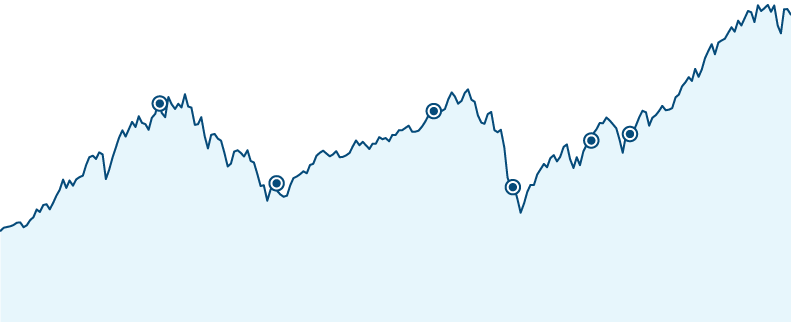

The stock market often recovers from intra-year declines.

Move your cursor over the dates to see what happened in the stock market during some particularly volatile years.

2200

2000

1800

1600

1400

1200

1000

800

600

400

200

0

Dec-96

Dec-98

Dec-00

Dec-02

Dec-04

Dec-06

Dec-08

Dec-10

Dec-12

Dec-14

1999 market volatility

What happened:

The stock market finished the year at an all-time high, despite two market corrections. It

capped a decade of unprecedented growth and the longest-running stock rally in history.

2002 market volatility

What happened:

Indexes slid steadily starting in March, with dramatic declines in July and September. The dollar

declined against the euro, reaching a valuation not seen since the euro’s introduction.

2006 market volatility

What happened:

The Dow also passed 12,000 for the first time. Major indexes had the strongest gains since

2003. Interest rates were forecasted to drop.

2008 market volatility

What happened:

The stock market crashed, Lehman Brothers declared bankruptcy, and AIG was bailed out by the

Federal Reserve. The Dow also ended the year down 34%.

2010 market volatility

What happened:

A 'flash crash" on May 6 caused the Dow to drop 1,000 points in one hour. Concerns over

Greece and Europe pulled the market down too, but the Dow ended the year up 11%.

2011 market volatility

What happened:

Oil prices were volatile, and there was continued stress in eurozone banks. The S&P 500®

ended the year down 0.04 points—the smallest change in history.

S&P 500

® Index market volatility

S&P 500

® Index annual total return

S&P 500

® Index max intra-year decline

Past performance is no guarantee of future results. It is not possible to invest directly in an index. Returns are based on index price appreciation and dividends. Max intra-year declines refer to the largest index drop from a peak

to a trough during the calendar year. Not intended to represent the performance of any Fidelity fund or strategy. For illustrative purposes only. Data from 12/31/1994 to 12/31/2015. Source: Standard & Poor’s, Haver Analytics,

Bloomberg, L.P.