Tax-smart investing1

Tax-loss harvesting: one of the ways we manage your account for taxes

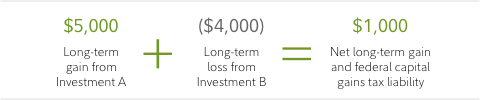

Fidelity® tax-managed accounts use a number of strategies designed to help you keep more of what you earn, evaluating your account each business day for tax-savings opportunities. One of those strategies is tax-loss harvesting.

This illustration is hypothetical and is not intended to represent the performance of any security in a specific tax-managed account. Investing in this manner involves risk, including the risk of loss, and will not ensure a profit.

This hypothetical illustration assumes the investor met the holding requirement for long-term capital gains tax rates (longer than one year), the gains were taxed at the current maximum federal rate of 23.8%, and the loss was not disallowed for tax purposes due to a wash sale, related party sale, or other reason. It does not take into account state or local taxes, fees, or expenses, or the net gain's potential impact on adjusted gross income, which could impact exemption and deduction phaseouts and eligibility for other tax benefits.

We work year-round seeking to help reduce or defer taxes in your account

While many investment management firms only use tax-loss harvesting at year end, the portfolio manager uses this and a number of other strategies throughout the year in an effort to reduce your tax liability and help you reach your goals as quickly as possible. Here are some of the strategies they may use:

- Defer realization of short-term gains in favor of seeking long-term capital gains, as appropriate

- Proactively look to harvest tax losses on an ongoing basis, analyzing accounts looking for opportunities.

Learn more

Call to learn more about the tax-smart investing techniques the portfolio manager uses on your behalf.

800-544-3455

Tax-smart (i.e., tax-sensitive) investing techniques (including tax-loss harvesting) are applied in managing certain taxable accounts on a limited basis, at the discretion of the portfolio manager primarily with respect to determining when assets in a client's account should be bought or sold. As the discretionary portfolio manager, Strategic Advisers LLC ("Strategic Advisers") may elect to sell assets in an account at any time. A client may have a gain or loss when assets are sold. There are no guarantees as to the effectiveness of the tax-smart investing techniques applied in serving to reduce or minimize a client's overall tax liabilities, or as to the tax results that may be generated by a given transaction. Strategic Advisers does not currently invest in tax-deferred products, such as variable insurance products, or in tax-managed funds, but may do so in the future if it deems such to be appropriate for a client. Strategic Advisers does not actively manage for alternative minimum taxes; state or local taxes; foreign taxes on non-U.S. investments; federal tax rules applicable to entities; or estate, gift, or generation-skipping transfer taxes. Strategic Advisers relies on information provided by clients in an effort to provide tax-sensitive investment management, and does not offer tax advice. Except where Fidelity Personal Trust Company (FPTC) is serving as trustee, clients are responsible for all tax liabilities arising from transactions in their accounts, for the adequacy and accuracy of any positions taken on tax returns, for the actual filing of tax returns, and for the remittance of tax payments to taxing authorities.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Effective March 31, 2025, Fidelity Personal and Workplace Advisors LLC (FPWA) will merge into Strategic Advisers LLC (Strategic Advisers). Any services provided or benefits received by FPWA as described above will, as of March 31, 2025, be provided and/or received by Strategic Advisers. FPWA and Strategic Advisers are Fidelity Investments companies.