What are the benefits of working with a financial professional?

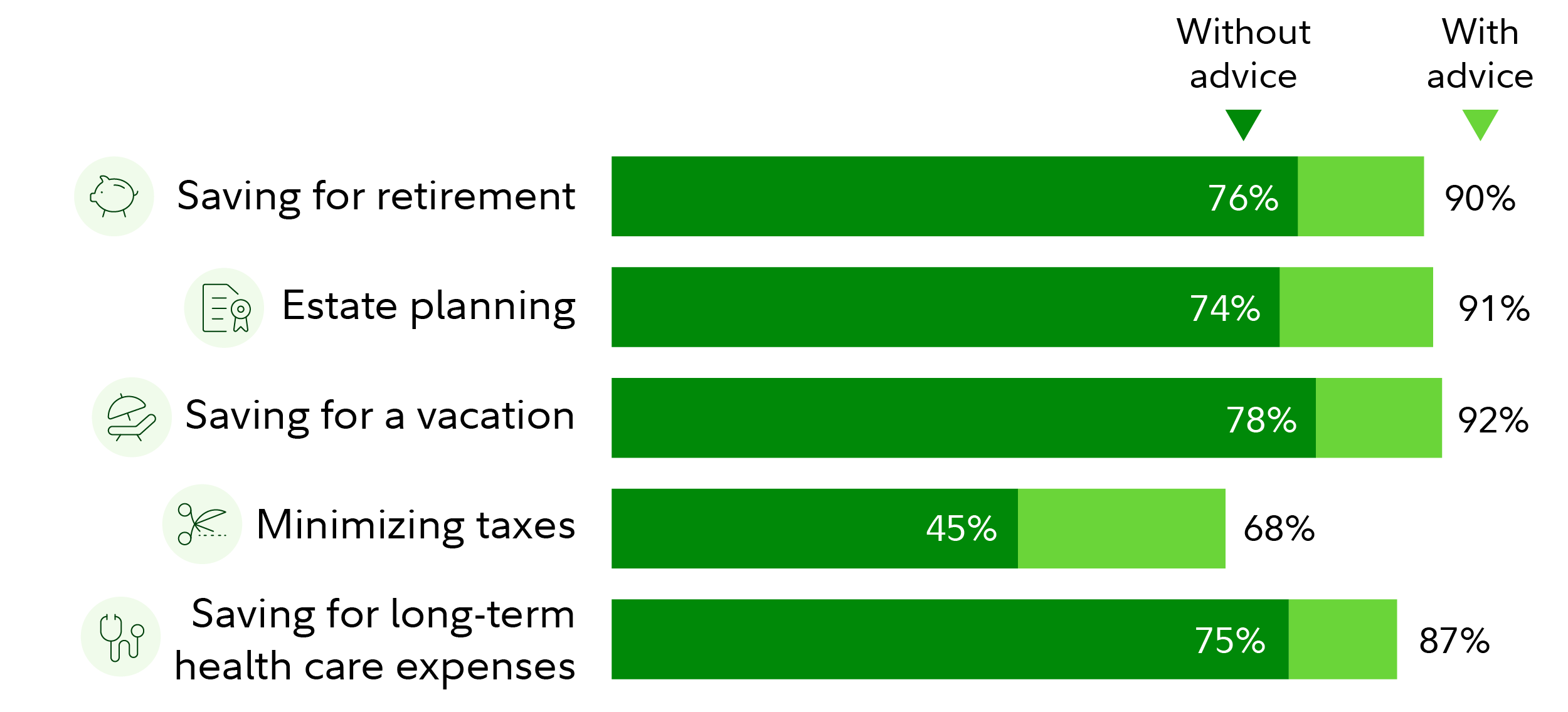

Everyone can benefit from working with a financial professional. And we mean everyone—no matter your situation. Those who work with a financial professional are generally more confident about their goals and about their overall financial situation.1 Additionally, industry studies estimate that professional financial advice and investment management can add up to 5.1% to portfolio returns over the long term (depending on the time period and how returns are calculated).2 Here’s a quick look at the percentage of investors who say they feel confident about reaching their goal with and without financial advice.

Working with a financial professional can also help set you and your family up for success in case something happens unexpectedly, like losing a job, taking a leave of absence to take care of family or have children, experiencing a health issue, or retiring early. It can be easier to adjust your plan if there is already a plan in place, and planning ahead of time may help you stay objective instead of reacting out of emotion. Plus, if something were to ever happen to you or your spouse, having an established relationship with a financial professional can potentially give you and the rest of your family peace of mind to know there’s someone else that knows your financial situation and can jump in to help.

Read more on how an advisor can help make a difference.

When should someone consider working with a financial professional?

When to work with a financial professional is entirely up to you. Maybe you have specific questions you want answered or maybe you want guidance on what to do next or where to start or maybe you’re just looking for validation that what you’re currently doing is on the right track. Everyone’s situation is unique and a good question to ask yourself is “what kind of help do I need?”

This can depend on several factors, like how complex your situation is, how much you want to be involved, how much time you have to dedicate to your finances, and the extent of your knowledge and comfort level. These 5 questions can help you make the most of a meeting with a financial advisor—whether it's your first time or for a regular check-in.

Why is it important for women especially to consider working with a financial professional?

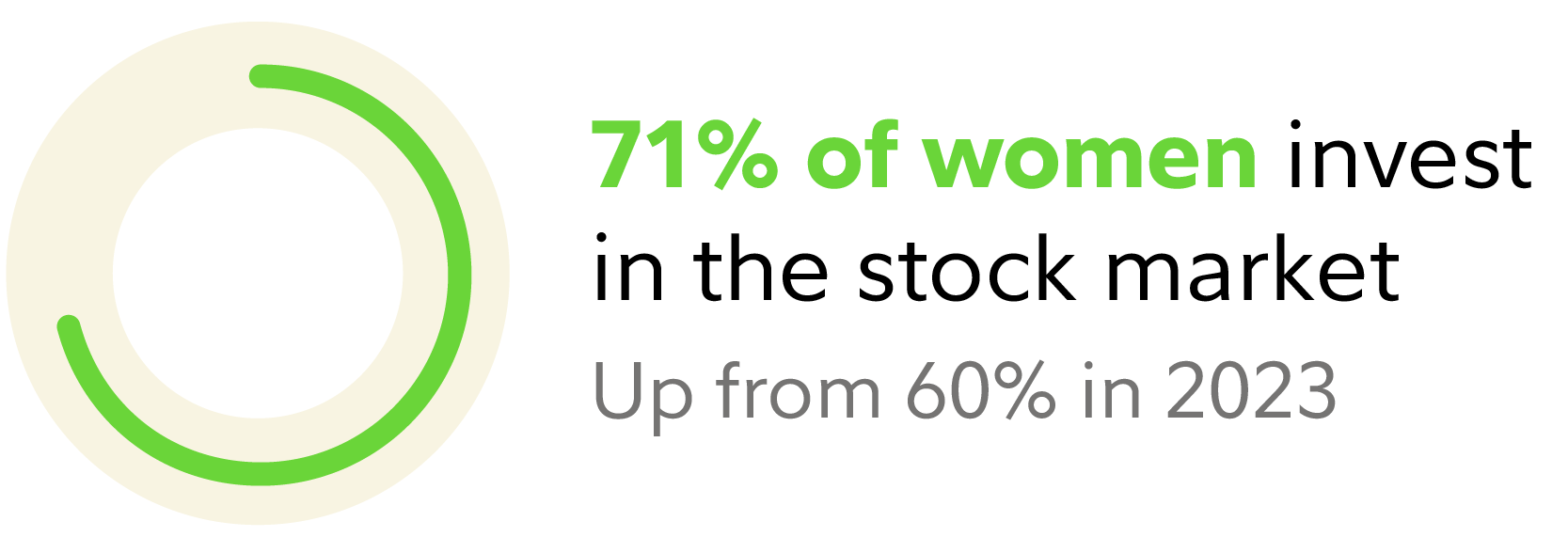

Women face different financial realities. On average, women tend to live 6 years longer than men,3 which means your savings might need to last a little bit longer and you may need to plan differently for care. However, the gender pay gap can impact your ability to save and invest for the future. In fact, women tend to have 30% less saved for retirement.4 But according to Fidelity’s 2024 Women & Investing Study, more women are investing in the stock market than ever before.

That said, there are still many women that hold back or are hesitant for a variety of reasons. According to that same study, roughly 55% of women are overwhelmed when it comes to their finances and 48% of women are embarrassed they don't know more about investing.5 But working with a financial professional may help alleviate those feelings of intimidation toward investing and managing your finances overall.

What is the difference between investment management and financial planning?

Every institution has a different process or way of handling both offerings. Some firms combine them, while other firms, like Fidelity, sometimes separate the two. Knowing the difference between these two offerings can help you determine what kind of help you need.

- Financial planning creates an overview of your finances and helps you organize all your accounts and create a plan. Think of this as a roadmap to help you reach your goals and make sure you’re comfortable and confident with where your money is going. There is no cost for financial planning at Fidelity (unless combined with investment management or other advisory services).

- Investment management is the act of managing investments and making investment decisions. There are several ways to do this, including on your own, hiring a dedicated advisor or team of advisors, a digital robo advisor, or a combination of both. There are generally fees associated with this type of help, which vary based on account type.

What are the costs associated with working with a financial professional and how much money does someone need to have to work with one?

At Fidelity, there is no cost to get help with financial planning. Depending on your specific investment management needs that’s where fees may apply, but Fidelity will be transparent about the costs involved. Explore ways to work with us and the associated costs and requirements of each option.

“I say this all the time on the Women Talk Money webinars and to my clients directly, but there are no assets too big or too small for Fidelity. There’s a common misconception that you need to have a certain amount to work with a financial professional—that’s not true. There’s a financial professional for every kind of investor at every stage. We work with clients that start with just $10! But that’s the most important part … just start. And if you don’t know how to start, that’s what we’re here for; that’s why we do what we do,” said Ryan Viktorin, Vice President and Financial Consultant at Fidelity Investments.

How do you find a financial professional?

Here are some tips to help you find a financial professional that fits your needs and can be a trusted partner as you take your next step.

- Call us at 800–343–3548. You’ll be asked by an automated recording to describe what you’re looking for, and you can say “financial planning” or “financial advisor” or something along those lines. From there, you’ll be directed to a Fidelity representative who can help you find an advisor in your area if you want to meet someone in person or schedule a phone call or virtual meeting.

- Use our online branch locator tool. Simply select “Find an advisor near you” and answer 1–2 questions to see a list of qualified individuals that may fit your needs and budget.

- Ask your family and friends if they can recommend anyone! Whether it’s with Fidelity or somewhere else, we all work hard for our money, and it’s time to help it work harder for you as well.

- If you prefer to explore other options outside Fidelity, you can DIY your search at such resources as the CFP [Certified Financial Planner] Board, Fidelity, the Financial Planning Association, and the National Association of Personal Financial Advisors.

What are some questions to ask when you’re trying to find a financial professional to work with? And what credentials may be important to look for?

It may take a few appointments and introductory conversations until you find the right person. You want to find someone you feel comfortable with—comfortable asking questions or asking for clarification, comfortable with their background and expertise, and comfortable trusting them with your information. Here are a few questions you can start off with.

- What are your credentials?

- How are you compensated?

- What’s your process?

- How long have you been doing this?

As you search for a financial professional to work with, you’re likely to encounter a lot of acronyms. Here are the main ones to be aware of during your search.

- CFP® — A certified financial planner has passed a comprehensive exam on financial planning topics, has met a threshold of performing a minimum amount of financial planning, and is held to a standard that requires them to act like a fiduciary.

- ChFC — A Chartered Financial Consultant is a lot like a CFP. Both have financial planning expertise, but their educational requirements are a little different. CFPs, for instance, must pass a cumulative final exam whereas ChFCs generally take slightly more courses than CFPs but only have exams at the end of each individual class related to financial planning.

- RIA — A Registered Investment Adviser may be a person or company that manages investment portfolios and that may offer some financial planning services. As the name implies, they must register with the US Securities and Exchange Commission (SEC) or state agencies, and they have a fiduciary duty to their clients.

- CFA® — A Chartered Financial Analyst has passed extensive exams related to financial analysis and has built an expertise in investment analysis. You're most likely to find CFAs® working for companies, though some may offer financial planning to consumers.

- CPA — A Certified Public Accountant generally specializes in the ins and outs of tax code. You likely won't get all your financial planning done by one unless they also have other certifications, but a financial advisor or planner may consult with a CPA when trying to determine the best tax strategy for finances. (Note: Fidelity advisors do not consult with CPAs.)

What if you don’t like the financial professional you work with now? What options does someone have to find a new one?

It’s important to work with someone you feel comfortable with, and changing who you work with is doable for any reason. If you’re thinking about switching your financial professional, ask yourself these questions to see if the relationship is working.

“We know it’s nothing personal if you want to switch financial professionals. And you shouldn’t feel awkward or have any hesitations asking to switch. This is an ongoing relationship you’re building with someone, and just like other relationships in your life, they all don’t work out—and that’s OK!” said Gina Gillespie, Vice President and Financial Consultant at Fidelity Investments.

If you work with a financial professional at Fidelity, simply call the branch they are associated with and ask to speak to the manager. They can help you understand your other options and help you schedule your next appointment with a different financial professional.