You and your partner likely have a lot of shared dreams, but do you have a shared financial plan? Because whether you’re newlyweds or approaching milestone anniversaries, some decisions—like those involving your money—are too important not to make together.

Love and money—why the two go hand-in-hand

There are countless advantages of having open and honest discussions about finances with your partner. Some believe couples who manage their finances together may strengthen not only their financial relationship but also their emotional one.

According to Fidelity’s 2024 Couples & Money study, only 55% of couples say they make decisions about retirement and other investment plans together.1 It was also found that, of those that communicate well with their partner:

- 78% discuss finances together at least monthly.

- 65% expect to live a comfortable lifestyle in retirement.

- 57% rate their household’s financial health as excellent or very good.

However, if you find financial conversations with your partner challenging or feel like you’re left in the dark at times, you’re not alone. Nearly 1 in 4 couples still feel money is their greatest challenge and admit to being frustrated by their partner’s money habits or resent being left out of financial decisions. So, what can you do about it?

Consider enlisting professional help

Aligning your financial goals can sometimes feel overwhelming, especially if one person has been dedicated to “handling the finances.” Trying to catch your partner up or loop them in may feel like extra work, especially when you have other commitments and priorities, like taking care of children or aging parents and/or a career, but that’s where enlisting professional help may be beneficial.

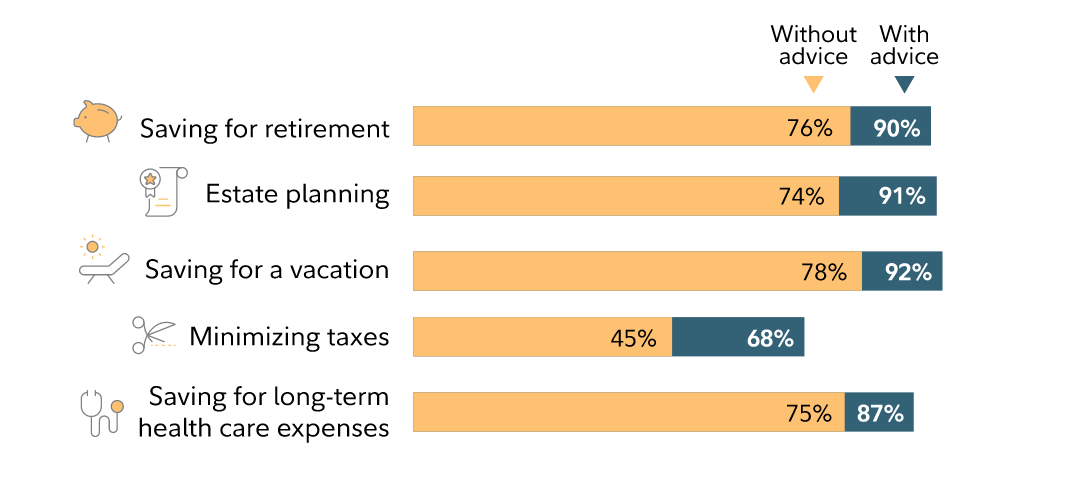

From robo advisors with access to coaching, to a team of advisors, to dedicated 1-1 support, there are many different ways to get help. Working with a financial professional in any capacity can offer a range of benefits—especially for couples. Not only can they help outline your current financial picture, they can help you align on short-term and long-term goals and identify opportunities to potentially reduce fees and enhance returns. Take a look at the percentage of investors who say they feel confident about reaching their goal with and without financial advice.2

Financial advice is more than just numbers and investment strategies. It’s about helping you, your partner, and your family pursue your financial goals while feeling more comfortable and confident along the way. Think of a financial advisor as a valuable third party who can help take the emotion and uncertainty out of your finances—and that's where we can help. Fidelity financial professionals are committed to helping their clients, just like Fidelity has been helping investors for over 75 years. See ways we can work together.

How to prepare for your planning call

Once you’ve scheduled your couples planning call, we want you to know what to expect, so you can feel as prepared as possible. We’ve created a checklist that outlines what you and your partner can start discussing in advance.

But don’t worry if you don’t get through all of it—or any of it. A financial professional can walk you through everything below and more during your planning call.

FOR THE PRESENT

The first step in any financial plan is to create a picture of your current finances. You may have heard this referred to as “doing inventory” or “getting in financial sync.” Here are some questions and steps you can take together.

1. Gather all your accounts. This includes your spending accounts, savings accounts, investment accounts, debts, loans, and more—think anything coming in and anything going out. Fidelity Full View® is a tool created for this purpose. It automatically displays your existing Fidelity accounts and allows you to add your non-Fidelity account(s) information as well, so you get the full view of your finances.

2. Questions to ask yourself:

- Do you have a budget? If so, are you sticking to it or how can you adjust?

- Do you have an emergency fund?

- Are your savings, investments, and payments automated?

- Are you able to pay at least the minimums on your debts?

- What are the interest rates on your debts?

FOR THE FUTURE

Communication is key. Did you know 48% of couples disagree on the age they plan to retire and 53% disagree on how much to save for retirement?1 So, to ensure you’re on the same page—even if retirement seems far away—here are some things to consider.

1. Be open and honest. You may have different goals than your partner, and that’s OK. It’s important for each partner to feel heard and supported. Here are some communication tips to help improve your money talks.

2. Questions to ask yourself:

- What are your goals? What are you saving for?

- How often do you check in on your finances?

- When do you plan to retire and what kind of lifestyle do you envision?

- Are you maximizing resources offered by your employer, like an HSA, employer match, student loan repayment assistance, or fitness reimbursements?

- Are you able to increase automated savings or payments by 1%?

FOR THE UNEXPECTED

Planning for the unexpected is just as important as the anticipated. Think about if something happened to you, your partner, or both of you—are you confident about where and how your assets would be distributed? Having a plan in place can help give you peace of mind, and here are some things you can do to prepare.

1. Make sure your important documents are secure and accessible. Having all your information in one place can help your family know what to do and who to call in case of an emergency.

2. Questions to ask yourself:

- Do you have beneficiaries designated for all your accounts?

- Do you have a will and health care proxy in place?

- Do you have the proper insurance(s) to cover your family, your home, and any other important assets?

- Do you have a plan for sick parents or family members?

- Do you have an estate plan?

The bottom line

Couples enlisting professional help are more likely to agree on their retirement vision, find it easier to have money conversations, and feel overall more confident about their financial health.3 Financial professionals can help facilitate financial conversations and get you on the same page. They can help you explore opportunities to potentially grow and protect your assets and help you decide what may be right for you, your partner, and your unique financial situation. And they can help you monitor your progress over the years and make any adjustments along the way—together.

Call 800–343–3548, say “COUPLES PLANNING,” and schedule your planning call today! Or select the “Let's work together" to see ways we can help you and your partner reach your goals.