On Friday, May 16, Moody’s, which assigns credit ratings to government debt securities, lowered the sovereign credit rating for the United States from its highest rating, Aaa, to its second-highest rating, Aa1. This signals that they believe U.S. Treasurys may be a riskier investment than they have been, historically. With this move, Moody’s joins the other two credit rating agencies in their assessments—Standard and Poor’s downgraded U.S. debt in 2011; Fitch did so in 2023. In a statement regarding the move, Moody’s cited both the increasing cost of the U.S.’s existing debt load, as well as the potential impact that extending the 2017 Tax Cuts and Jobs Act would have on the debt.1 Given the circumstances, this may have some investors concerned about the long-term health of the US economy.

"In my experience, many investors generally have some level of concern about the national debt," says Naveen Malwal, an institutional portfolio manager with Strategic Advisers, LLC. "What's different over the last decade or so, however, is the very high level of debt that the US has taken on. I can understand why people are concerned."

With the US national debt at historically high levels, is it reasonable to be concerned about the future full faith and credit of the US? To fully appreciate the potential impact that the high-and-rising US debt load could have on the health of the economy, it's important to put it in the appropriate context. “With a deeper understanding of our national debt situation, I hope that many investors will see that this doesn't appear to be a significant risk for investors," says Malwal. "Nevertheless, it's something worth paying attention to and for elected officials to address over the long term. Investors, however, would likely benefit from getting and staying invested in the markets. That's because growing their wealth over time may allow them to deal with any potential changes that might come about as a result of high levels of national debt."

How did we get here?

The US national debt represents the money borrowed by the federal government to pay for public services when the cost of those services exceeds what can be paid for by on-hand, available funds. There are many reasons why the government may not have the funds necessary to cover such costs—for example, decreases in tax rates that are not accompanied by proportional reductions in services will result in a deficit that must be covered by borrowing. New or expanded services that are implemented without accompanying offsets or tax increases will have the same effect. Additionally, when individuals and corporations earn less money, they will typically pay less in taxes, which can reduce the pool of funds available to the government.

How do we fix this?

How best to reduce the budget deficits that add to the national debt is a continual topic of debate in Washington DC.

"When debt levels are high, the government has a few tools at their disposal," says Malwal. "At a simple level, they can attempt to increase revenues by raising taxes or cut spending by cutting back on federal programs and services."

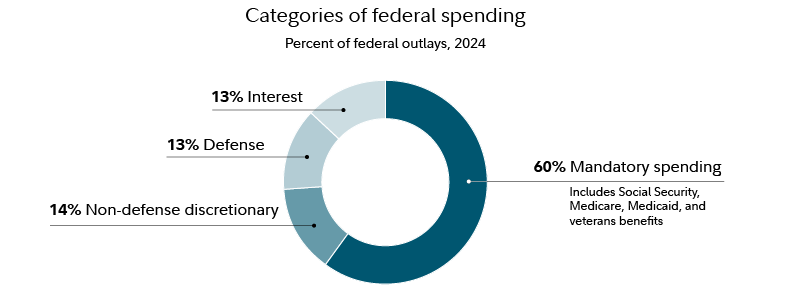

60% of government spending is considered mandatory. This category is largely dominated by social insurance programs such as Social Security, Medicare, and Medicaid. The rest is made up of discretionary spending, including spending on national defense (13%), and interest payments.

Another way to reduce the debt, according to Malwal, may be through increased economic growth. "If growth picks up and the economy becomes more productive, the resulting increase in tax receipts can be used to pay down the debt. As one example, it's possible that breakthroughs in technology such as artificial intelligence could potentially lead to a more productive economy. It goes to show that there may be several ways out of this situation."

Living within our means?

When the topic of the national debt comes up, it's common to hear it analogized to personal or household debt in an effort to make this complex, often confusing topic more accessible to lay audiences. While it may feel more comfortable, such an analogy can obscure some important differences between personal debt and government debt.

"One significant difference is that, for the government, the list of potential expenses is theoretically infinite," says Malwal. For most individuals and families, the universe of financial goals may be relatively small and, once reached, can be checked off the list: a new car, a new home, education, retirement, and passing on a legacy, for example. For the US government, however, the list will likely never end. "The government is always going to need or want to spend on roads and bridges, airports, the military, or health care," says Malwal. "There will often be other opportunities for the government to invest in, such as science or health care research."

Additionally, the time horizon of the US government is also far longer than that of an individual. "The government has the luxury of time when it comes to paying down its debt obligations," says Malwal. "Unlike an individual, the government can issue 30-year bonds to raise revenue and then, when those bonds reach maturity, issue another set of 30-year bonds to replace those. So overall, contrasting the government to an individual or a family may not be a perfect comparison."

A manageable situation?

If you're concerned about an imminent economic meltdown due to the rising national debt, Malwal suggests that such a thing is unlikely to come to pass. "The impact of a high debt-to-GDP ratio on the economy is likely a multiyear or even multidecade phenomenon," says Malwal. "If you look around the world, there are many countries with high debt-to-GDP ratios and their economies have not fallen apart. Many have managed to continue to thrive despite their debt load. Increasing debt is not a sign that economic growth is coming to an end; it may simply just point toward a more moderate rate of growth over time."

What does this mean for investors?

According to Malwal, the national debt situation is likely not an imminent risk for investors. “Looking at stocks that have generally risen over the last 5 years, manageable interest rates, and a healthy US dollar, it seems to me that most global investors are not overly worried about the US national debt. There certainly are questions about the pace of economic growth for the U.S., and that varies over time. But in my perspective, concerns about a near-term national debt crisis seem somewhat exaggerated."

What investors may see down the road as a result of the rising national debt is higher taxes, reductions in government services due to spending cuts, and higher interest rates. Each of these could potentially affect the markets and the economy, but gradually. “I see each of those things leading to potentially slower economic growth over time," says Malwal. "But the idea that the government would go bankrupt at some point is far-fetched to me. Just because something is possible in theory, doesn't mean it's bound to happen. Rather, if the national debt starts to become a more pressing issue for more voters, I believe they are likely to elect officials to address this situation over the coming years."

What should investors do?

"If an investor is still concerned about the effect that the debt might eventually have on their portfolio, diversification may offer them some protection," says Malwal. He suggests taking a broader view of what a successful investment portfolio might include, by looking beyond the US, to international stocks and commodities.

"The investment team at Strategic Advisers LLC is focused on helping our clients grow their wealth over the long run," says Malwal. "Within well-diversified client accounts, we go beyond just U.S. investments. We also include exposures to international stocks and bonds, commodities, alternatives, and other investments. This diversification may help investors through periods of volatility for the U.S. economy."

He specifically warns against reallocating to a large short-term investment position because of concerns around the national debt. The impact of inflation and the loss of potential growth that comes with being out of the market may lead to a more modest standard of living in the future.

"I believe the national debt is an important issue that bears watching and addressing," says Malwal. “At the same time, I do not believe investors need to be overly worried about the market impacts of this situation. In fact, getting and staying invested in a diversified portfolio may give investors a chance to afford the lifestyle that they desire later in life. This may be especially important if taxes and interest rates wind up higher in time, or if there are adjustments to popular government programs for retirees. Having more wealth in the future may help individuals and families better adapt to any changes that may take place over the coming decades."