Individual investors looking for new ways to potentially enhance their portfolio's returns, manage risk, and improve diversification may want to take a cue from large, institutional investors, such as pension funds, endowments, and foundations. According to a Fidelity survey of these institutions, 86% of respondents said that they invest in alternative strategies.1

For many years, alternative investment strategies were largely available only to these institutional investors. Additionally, alternatives are generally less liquid (that is, not as easy to buy or sell) than traditional investments, which has made access to them more complicated. This lack of access to alternatives has been one of the major roadblocks to their widespread adoption. But asset managers have accelerated their efforts to develop and offer innovative investment vehicle structures that can grant a broader spectrum of investors access to alternatives—some in the form of mutual funds and exchange-traded funds (ETFs).

Because of their exclusivity, some investors have felt that alternatives were too complex or too cumbersome for their portfolios or were not convinced that the historical returns and risk attributes of these investments made it worth their while. But with a more comprehensive understanding of the range of alternative investments and their key attributes, investors may be better equipped to determine which, if any, may be appropriate for their portfolios. With that in mind, it's important to note that there can be more risks associated with these relatively complex investment types and that they are not suitable for all investors.

What is an "alternative" investment?

As the name implies, alternative investments (alternatives), are those that do not fall into one of the conventional investment categories of stocks, bonds, and cash. Generally, there are 5 main categories of alternative investments. While not an exhaustive list, what follows is an overview of the alternative investment landscape:

- Liquid alternatives and hedge funds strategies often invest in public equities and bonds, but may also hold privately held assets or derivatives (financial instruments based on agreements or contracts and whose value is tied to an underlying asset, instrument, or index), with the goal of generating returns that are uncorrelated to traditional asset markets.

- Private equity is, in general, the investment in companies that are not traded in public markets. Investors can make direct investments in a private company or invest in a private equity fund. Unlike traditional public equity, private equity investors typically need to hold an investment for multiple years to gain value before exiting positions.

- Private credit, like private equity, generally refers to investments that are originated or negotiated privately, are not traded on public markets, and are often composed of higher-yielding securities. This can include direct lending, whereby investors lend money directly to private companies. The borrowers are typically small and mid-sized private companies while the lenders may be institutions or asset management firms.

- Real assets encompass a diverse range of assets including private real estate, fine art, collectibles, commodities, and investments in infrastructure, such as bridges, highways, pipelines, airports, and data centers.

- Digital assets, or cryptocurrencies, such as bitcoin, are designed to work as mediums of exchange that are stored on a decentralized ledger known as a blockchain.

There are also numerous subcategories that represent different approaches to each strategy.

| Liquid Alternatives and Hedge Funds | Private Equity | Private Credit | Real Assets | Digital Assets |

|---|---|---|---|---|

|

|

|

|

|

Investors may gain access to illiquid alternatives through direct investments or in a private vehicle structure, such as a limited partnership. These vehicles may be available only to investors that meet certain net worth, asset, and/or income minimums and can be highly illiquid, with lockup periods that limit investors' access to their capital.

Because the investment vehicles for alternative strategies are typically not traded on public markets like their traditional counterparts (e.g., a mutual fund or ETF), they often cannot be readily converted to cash. However, there are "liquid alternatives," which are alternative investment strategies that are structured as mutual funds, ETFs, and collective investment trusts (CITs) that offer daily pricing and liquidity. Many of these are hedge-fund-like strategies that are uncorrelated with public markets and seek to provide investors with sources of diversification beyond traditional asset classes.

Investors should consider whether liquidity may come at a cost. If illiquid assets are offered in liquid vehicle structures, there may be trade-offs over time between greater liquidity and the underlying exposures investors are seeking when allocating to alternatives.

Why own alternatives?

To explore the roles that individual categories of alternatives can play in multi-asset-class portfolios, we analyzed the historical risk, return, and correlation statistics of 18 traditional and alternative investment categories, representing alternatives with the following: Liquid alternatives, private equity, private credit, and real assets from 2005 through 2023.2 We found that within multi-asset class portfolios, individual categories of alternatives have historically offered enhanced returns, lesser downside among poor public equity performance, or diversification, among other potential benefits.3

That said, it's important to note that alternative investment strategies generally have a much shorter historical track record than their more traditional counterparts, and thus much less data than we typically evaluate when approaching strategic asset allocation decisions. The track records for bitcoin and other digital assets, in particular, are so short that we have excluded them from our quantitative analysis.

The potential for enhanced returns

Our research indicated that private equity (represented by equity-generalist, buyout, and venture capital) outperformed all other traditional and alternative asset categories over the period studied.

Based on our analysis beginning in 2005, the returns of private equity (as represented by equity-generalist, buyout, and venture capital), were superior to all other traditional and alternative investment categories over the period studied. Importantly, private equity outperformed US small and large cap equities, illustrating the return premiums that investors expect when they sacrifice liquidity by owning private versus public equities.

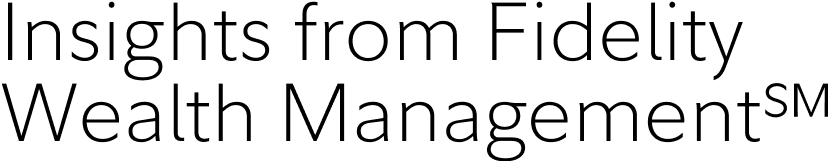

An opportunity to manage risk

To explore the potential risk management benefits of alternative asset classes, we examined performance in years when public equity returns were poor. We found that during these years of poor U.S. equity returns, all of the traditional asset classes experienced negative returns. Among the alternatives categories, we found that managed futures experienced the best returns overall, at 6.9%. Private real estate, direct lending, and macro also generated positive returns.

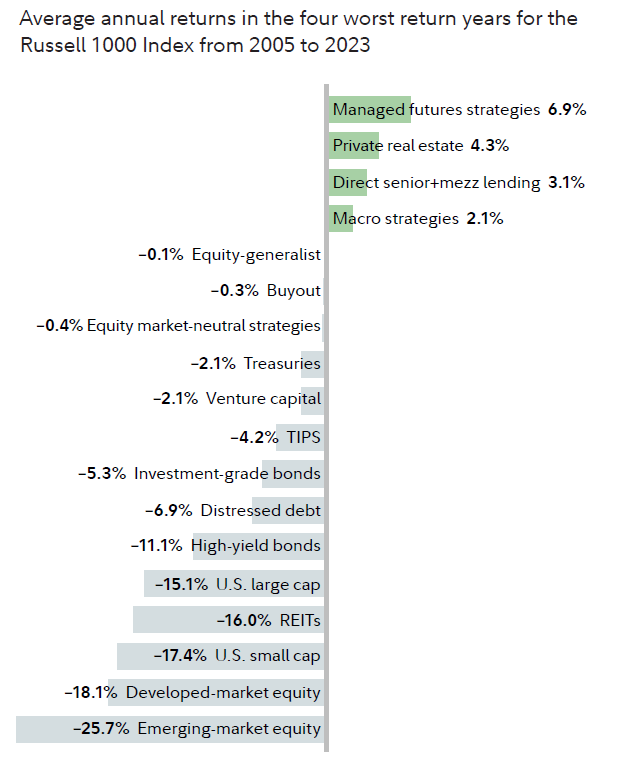

A means of improving diversification

To understand the diversification benefits of alternatives within a portfolio context, we analyzed the average historical correlations of each category with the other 17 asset classes from 2005 through 2023. Among the alternatives we studied, managed futures exhibited negative correlation with other asset categories, while macro, private real estate, and venture capital also exhibited diversifying characteristics in a multi-asset class portfolio context.

Consider your needs as an investor

Based on the potential risk, return, and diversification benefits of the alternative asset categories we've outlined, investors may improve investment outcomes by incorporating them into multi-asset class portfolios. The types of alternative investment strategies and vehicle structures an investor might consider will depend on their investment objective, time horizon, and risk tolerance. Furthermore, some categories of alternatives have a wide dispersion of returns among managers and strategies, so the performance an investor experiences in a single strategy may differ from the data shown in the examples shown here. The broad range of investment outcomes of some alternative strategies suggests that investors who choose to allocate to alternative investments may want to consider diversified exposure to alternatives, such as a fund of funds, multi-strategy solution, or in the case of real estate, a real estate investment trust (REIT).

How Fidelity Private Wealth Management® clients can qualify for our alternative investments program

Because alternative investments come with unique sets of risks, the requirements governing who can participate in this program are different than those of traditional investments. While your Fidelity advisor can help you better understand these requirements, which often vary from offering to offering, participation in the program is generally only available to qualified purchasers enrolled in Fidelity Private Wealth Management.