When markets become volatile and recessions loom, one of the biggest threats to your portfolio performance may not be the falling value of your investments—it might be how you react to it.

Over the last 30 years, studies have shown that when investors give up on their long-term strategies and begin reacting to short-term market developments—selling investments as prices fall, for example—portfolio performance suffers.1 While your gut may compel you to sell in order to stanch the bleeding and preserve what's left of your investment, getting out of the market can be potentially devastating to a portfolio, even if it's just for a short time. For example, a hypothetical investor who missed out on just the five best days over the past 35 years (between January 1, 1988 and December 31, 2024) would have reduced their portfolio’s value by 37%.2

Staying invested in the face of market turmoil is easier said than done, however. "We've seen lots of evidence that when people experience significant volatility in the markets, they may become emotional and abandon their financial plan," says Scott McAdam, an institutional portfolio manager with Strategic Advisers, LLC, the investment manager for many of our clients who have a managed account. While there are personal habits you can develop to prepare yourself for the emotional distress of watching your portfolio value drop, it may make sense to configure your portfolio in a way that can help mitigate the impact of volatility. By investing defensively, you may be able to implement an approach that could result in shallower dips in your portfolio when the broader market is in decline. And shallower dips may help you fight the urge to overreact and save you from possibly abandoning your plan.

Looking for stability in an uncertain environment

While diversification is a good first step in crafting a portfolio designed to weather sudden changes in the market, defensive investing takes things a step further by tilting allocations to more conservative areas and incorporating specific asset classes that have historically tended to better absorb volatility. This may help temper losses in down markets while still providing enough risk exposure to allow a portfolio to potentially benefit from gains when the market is in better shape.

Such a portfolio may include:

- Conservative US and international stocks. According to McAdam, companies with strong balance sheets, steady earnings growth, and historically lower volatility may help temper volatility within a portfolio's stock allocation.

- High-quality US Treasury bonds. When stocks fall sharply, Treasurys have often risen and may help offset declines in a portfolio. "When markets run into bouts of volatility, US Treasury bonds may act as a safe haven," says McAdam. "They have typically benefitted in such periods, which can sometimes temper what's going on in the market."

- Treasury Inflation-Protected Securities (TIPS). These are bonds whose principal and interest payments are designed to rise when inflation does.

- Nontraditional asset classes. Alternative investments, such as hedge funds and derivatives, tend to be less correlated to traditional asset classes, which may provide enhanced diversification opportunities.

Aiming for lower highs, higher lows

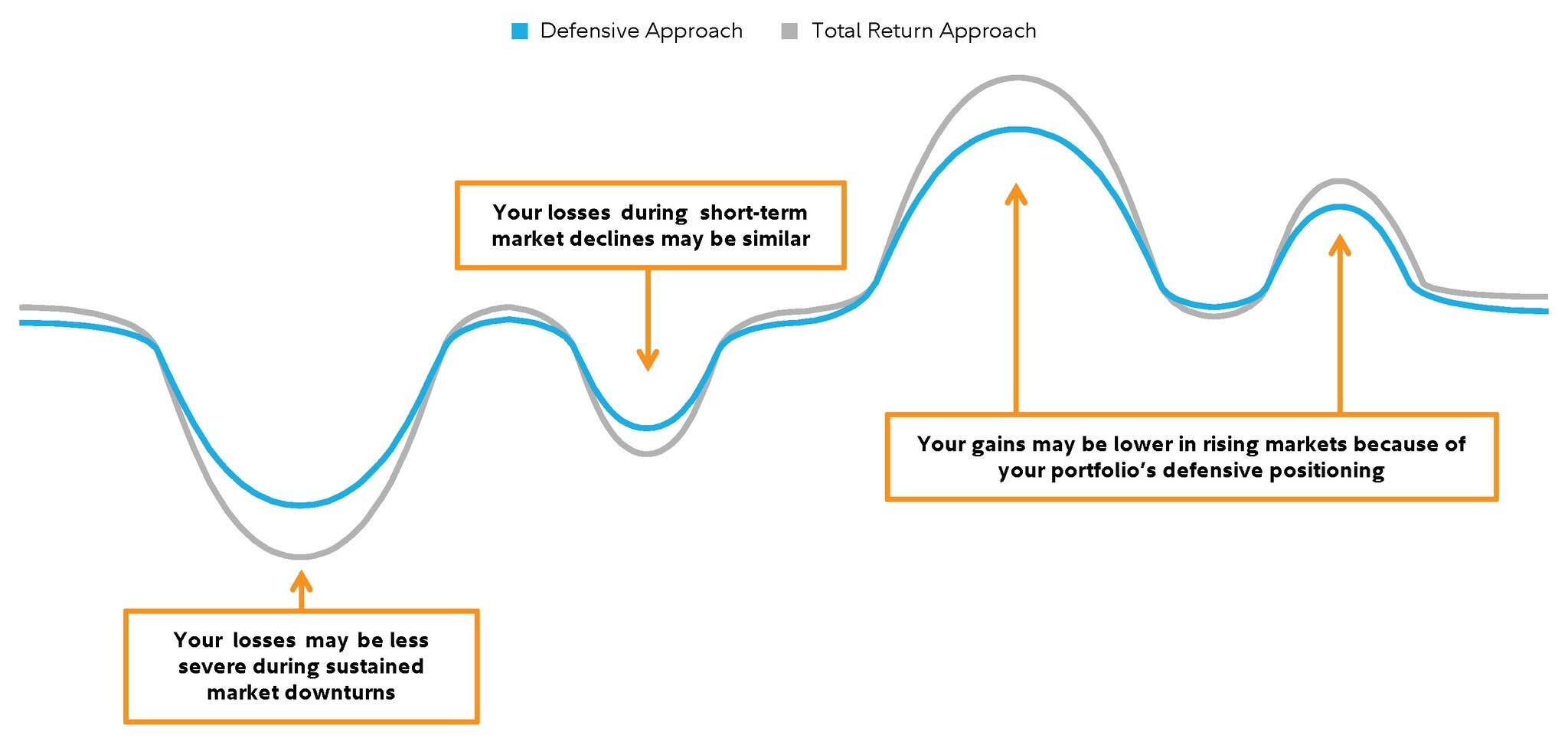

The aim of this defensive preparation is a portfolio that offers a narrower range of potential outcomes—less likely to reach the highs of a portfolio focused solely on maximizing return, but also less likely to experience significant volatility.

The Personalized Portfolios defensive approach managed by Strategic Advisers, LLC, seeks to outperform the Personalized Portfolios total return approach during down markets. (See how these strategies have historically performed in various market conditions.)

Seeking lower highs, higher lows, and similar performance over a market cycle

"A total return strategy," says McAdam, "is going to take on more volatility for a chance at higher returns, whereas a defensive portfolio may give up some amount of returns in exchange for potentially lower volatility." McAdam says that in addition to temperamentally risk-averse investors who are simply looking for some reassurance in a difficult market environment, those who are near or in retirement may also find this strategy appealing given their shorter time horizon.

The power of professional advice

Self-directed investors who lack the time or skill may find it difficult to construct a defensive portfolio themselves, let alone monitor and rebalance it over time, as necessary. Working with a professional who can devote more time and attention to this effort may be worth it.

Strategic Advisers monitors the business cycle and conducts deep research into the various asset classes to identify securities that they believe are well suited for a defensive investment strategy. Additionally, they employ a disciplined process to reallocate funds between asset classes as markets move, in order to help maintain a client's desired asset allocation and to help ensure that the portfolio remains on track. This is especially critical, as the longer an investor goes without rebalancing, the more their risk may inadvertently increase or decrease.

Whatever approach you take, it's important to remember that periods of volatility, and even recessions, have historically tended to be relatively shallow and short lived when compared to the longer, expansionary periods they interrupt. For prudent investors who maintain a long-term perspective, there very well may be a light at the end of the tunnel.