In times of uncertainty, it can be difficult to willingly expose yourself to risk. But when it comes to investing, an overabundance of caution can be riskier than you may realize.

If you're holding a lot of your assets in cash because you feel it's safer than investing in stocks or bonds at the moment, or because you're concerned about what the near future might hold for the economy, you may be putting your prospects for long-term growth in danger.

"Some investors may feel that they're getting a return on their short-term investments which could potentially offer different risk and return profiles compared to the stock or bond market. The extra performance potential that may exist in those markets may not seem worth the extra volatility," says Naveen Malwal, an institutional portfolio manager with Strategic Advisers, LLC.

But staying out of the market may have its own risks when it comes to achieving financial goals. In fact, putting cash to work sooner rather than later may potentially offer benefits for investors. Here are 6 reasons why you may not want to wait any longer.

1. History shows that there's no "wrong" time to get in the market

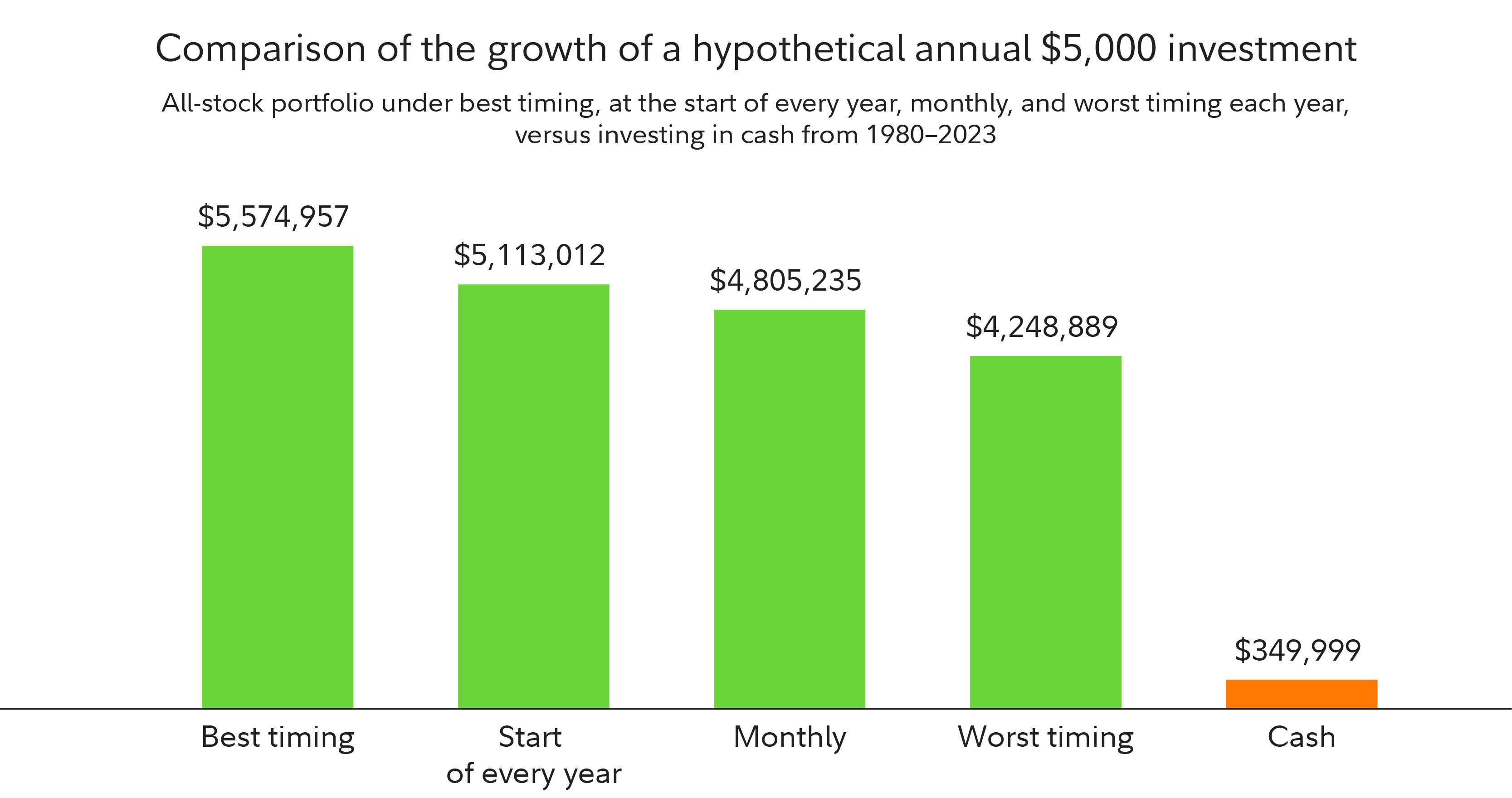

If you're holding a large cash allocation because you're worried about investing your money at the wrong time, you may be doing yourself a disservice. We looked at how a hypothetical, annual $5,000 investment would perform in various scenarios. What we found is that even if that money was invested at the "worst" possible time each year—that is, when the market was at its peak—it would still significantly outperform a cash allocation over time.

Since it's difficult, if not impossible, to identify when markets are at their peak or have reached their bottom, most investors would be best served by simply investing their money on a regular basis without regard for timing.

"Historically, market timing has been practically impossible to do consistently. And those who've attempted it often fell behind investors who simply put their money to work on a consistent basis," says Malwal.

As the chart above shows, investing our hypothetical $5,000 at the start of every year or on a monthly basis would still have provided ample growth, and, in the case of the former, only slightly less than if our hypothetical investor had the ability to perfectly predict when the market had reached its bottom.

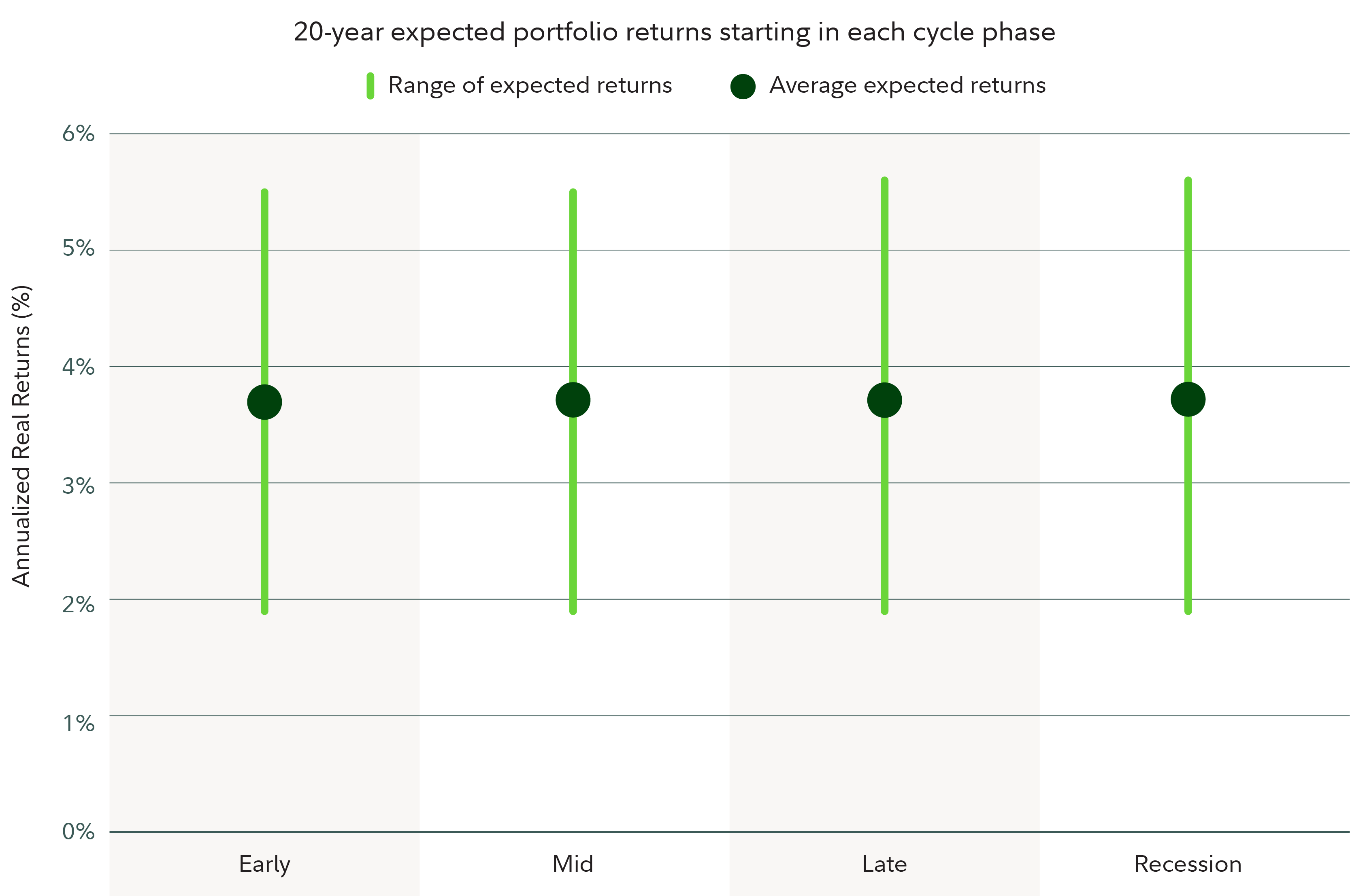

Our research also shows which stage of the business cycle you choose to put your money in the market may have very little effect on the average, long-term performance of your portfolio.

This means that making investment decisions based on where you think the US economy is in its business cycle or where it may be headed isn't likely to have a dramatic effect on long-term outcomes. Even investing during a recession has historically provided an average expected return in line with other, less volatile parts of the business cycle.

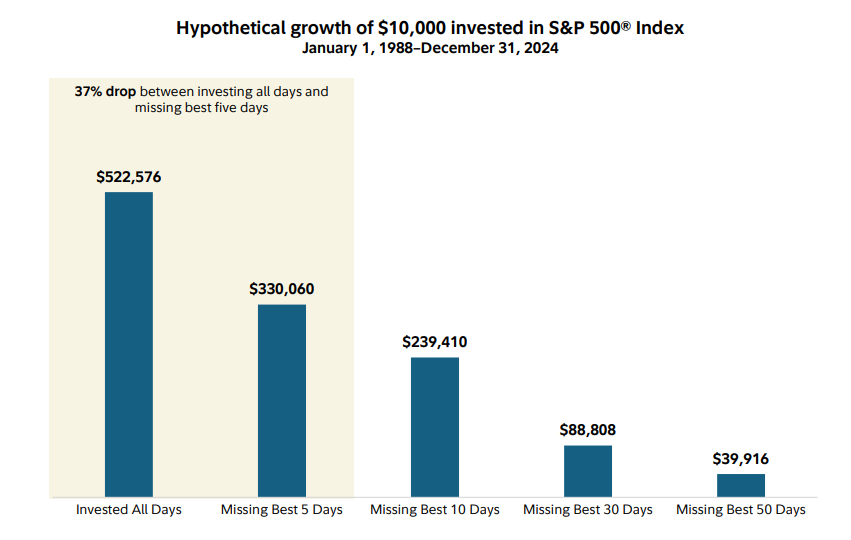

2. Being out of the market for even a short time can significantly reduce growth

When you get into the market isn't likely to make a big difference in your long-term growth potential—but being out of the market, even for a short period, certainly can. As the chart below shows, a hypothetical investor who missed just the best 5 days in the market since 1988 could have reduced their long-term gains by 37%.

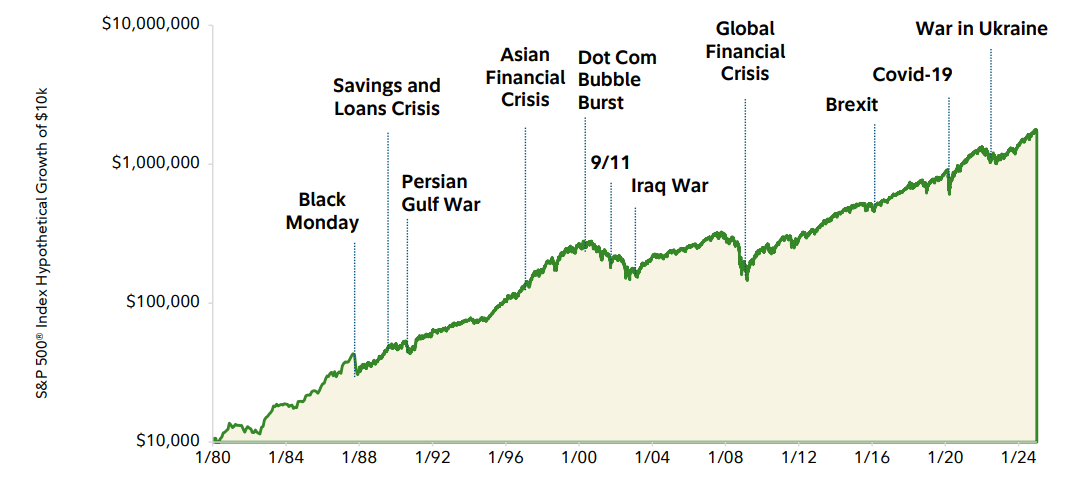

3. Stocks have tended to rise even amid upheaval and uncertainty

If you're concerned about the effect that so-called "black swan" events might have on your portfolio, it may be helpful to consider how markets have reacted to challenging periods in the past. While past performance does not guarantee future returns, historically, markets have persevered through times of strife and uncertainty. Be it war, recession, or even the COVID-19 pandemic, stocks have historically shown resilience during short-term volatility, which could potentially lead to long-term gains for investors.

Moreover, stocks have the potential to recover from these disruptions. For example, stocks have, on average, historically recovered just 11 months after a recession began, often surpassing their pre-recession highs. Getting or staying out of the market when times seem tough could result in missing out on potential recovery periods.

"Back in 2020, for instance, there was a lot of concern about the global economy and people feared that we might be seeing a repeat of the 2008 financial crisis. Back then, the markets fell considerably and took a long time to recover," says Malwal. "But what we actually saw in 2020 was that the market, despite suffering an extreme pullback through March of that year, went on to rally the rest of the year. By the end of the year, the stock market was up almost 20%, even though we had a global pandemic and a severe recession that year. If you knew that the pandemic was coming and sat in cash thinking it was less risky, you likely would've fallen behind."

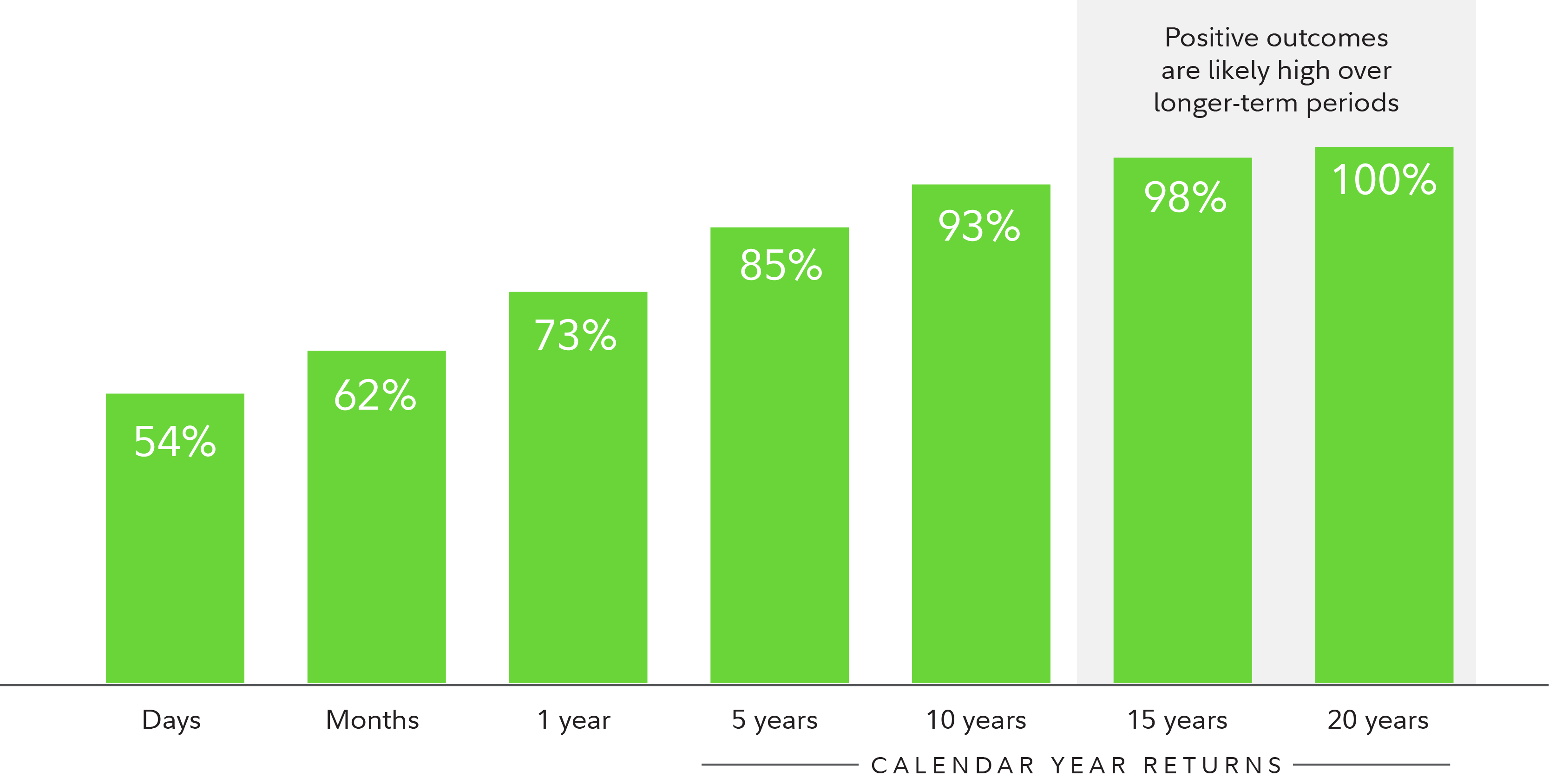

4. Investing in the market for a longer period may potentially increase your chances of experiencing positive outcomes

When you're looking at short-term stock market performance, whether or not you'll see a good day can seem as random as a coin flip. And that's largely true—since 1928, stocks have tended to have a positive outcome on just over half the days. Zoom out a little, however, and you'll begin to see a different story.

"In the short term, the stock market can feel volatile, but the odds of seeing a positive outcome potentially improve the longer you stay invested," says Malwal. "For example, if you're in the market for a year, there's been an almost 3 out of 4 chances that you've seen a positive return in the past. And the further out you go, the odds may change. Now, of course, past performance can't guarantee the future, but it seems like the odds are overwhelmingly in the favor of an investor who stays in the market over one who does not."

"Another way to think about it is to take the inverse," says Malwal. "A cash investor may only have a 1 in 4 chance of seeing a positive outcome over a single year, or a 2% chance over 15 years. Knowing that, it seems intuitive to be drawn toward the stock market even though there are risks involved."

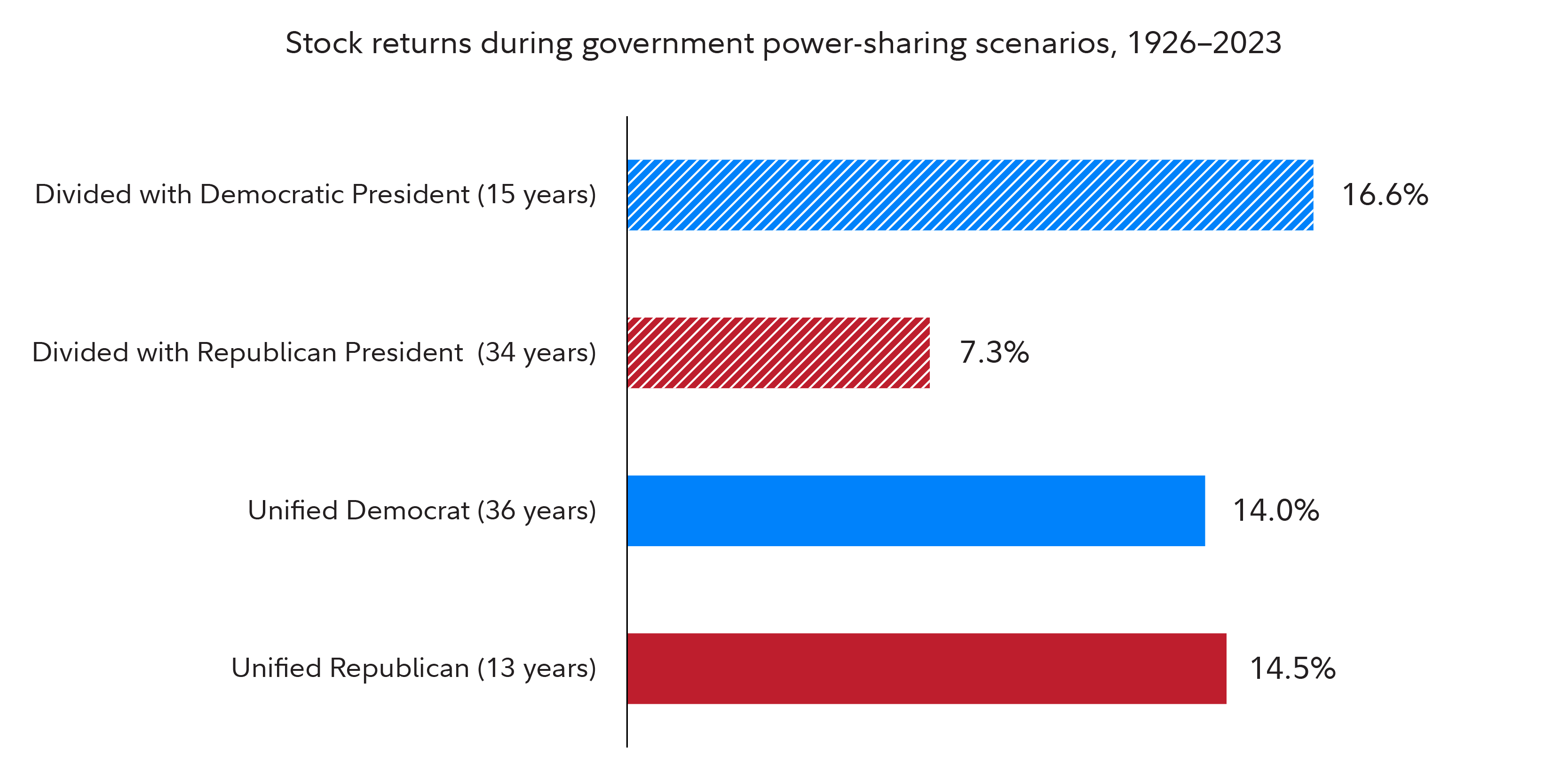

5. Which party controls Washington has historically tended to have little effect on stock returns

Although popular myths sometimes suggest that one party or the other is "better" for market returns, the historical data does not bear out these theories. The S&P 500 has historically averaged positive returns under nearly every partisan combination, as the chart below shows. "Historically," says Malwal, "there hasn't been a strong relationship between Election Day outcomes and how markets perform from there on out. As a result, the investment team that I'm a part of at Strategic Advisers doesn't adjust our positioning based solely on election outcomes."

Malwal warns against acting in response to promises made during the campaign. "There are dramatic differences between the proposals expressed on the campaign trail and the actual policy changes that take place once the candidate is in office," says Malwal. "It's exceedingly rare that a candidate will be able to deliver on exactly what they've proposed once they take office. If you're making investment decisions based on such proposals, it's important to consider the potential risks involved."

6. Rising deficits and persistent inflation may pose a risk to cash portfolios

The impact of inflation and the ever-rising national debt are 2 concerns that many investors are especially wary of, given recent history. While inflation has been ebbing recently and rising deficits are more of a longer-term issue, the effects of both could leave your cash allocation in a particularly vulnerable position.

"If you are concerned about these things, it's important to understand that all investments, including short-term ones, carry some level of risk," says Malwal. "If inflation stays at current levels or rises over time, or if the deficit continues to rise and leads to higher interest rates, it may make sense to invest in a diversified portfolio. Investing in a diversified portfolio may potentially help your wealth grow, and as it grows, you may have more flexibility to adapt to changes in interest rates or tax rates. If you're sitting in cash and your wealth isn't growing as much, you may find it more challenging to respond to those shifts."

Finding the right balance and sticking to it

Investing can potentially offer opportunities for growth. But that doesn't mean there's no place for cash in your portfolio. What's important is that you find an allocation that suits your particular needs, giving you the growth potential you need to reach your goals while providing you with the security necessary to ride out periods of volatility.

"We find that investors are typically more comfortable having a mix of stocks, bonds, and short-term investments in their portfolio," says Malwal. "And how that mix is determined comes down to a number of factors, including their time horizon, their risk tolerance, and what goal they're trying to achieve. Whether you're managing your portfolio on your own or working with a professional who can give you appropriate guidance, it can be helpful to think about your portfolio in terms of these factors rather than getting caught up in the concerns and fears you may be seeing in the news."