When markets are roiled by uncertainty, it isn't always easy to stay focused amid the turmoil. Given that you can't anticipate whether markets will rise or fall in the future, your best bet is to develop a plan that’s designed to reach your long-term goals and, perhaps most importantly, gives you the confidence to stick with it. "Diversification is important, especially in an environment like this where there are lots of potential outcomes," says Scott McAdam, institutional portfolio manager with Strategic Advisers, LLC. "In the face of uncertainty, all we can do is try our best to be prepared."

Resisting the common bear market myths

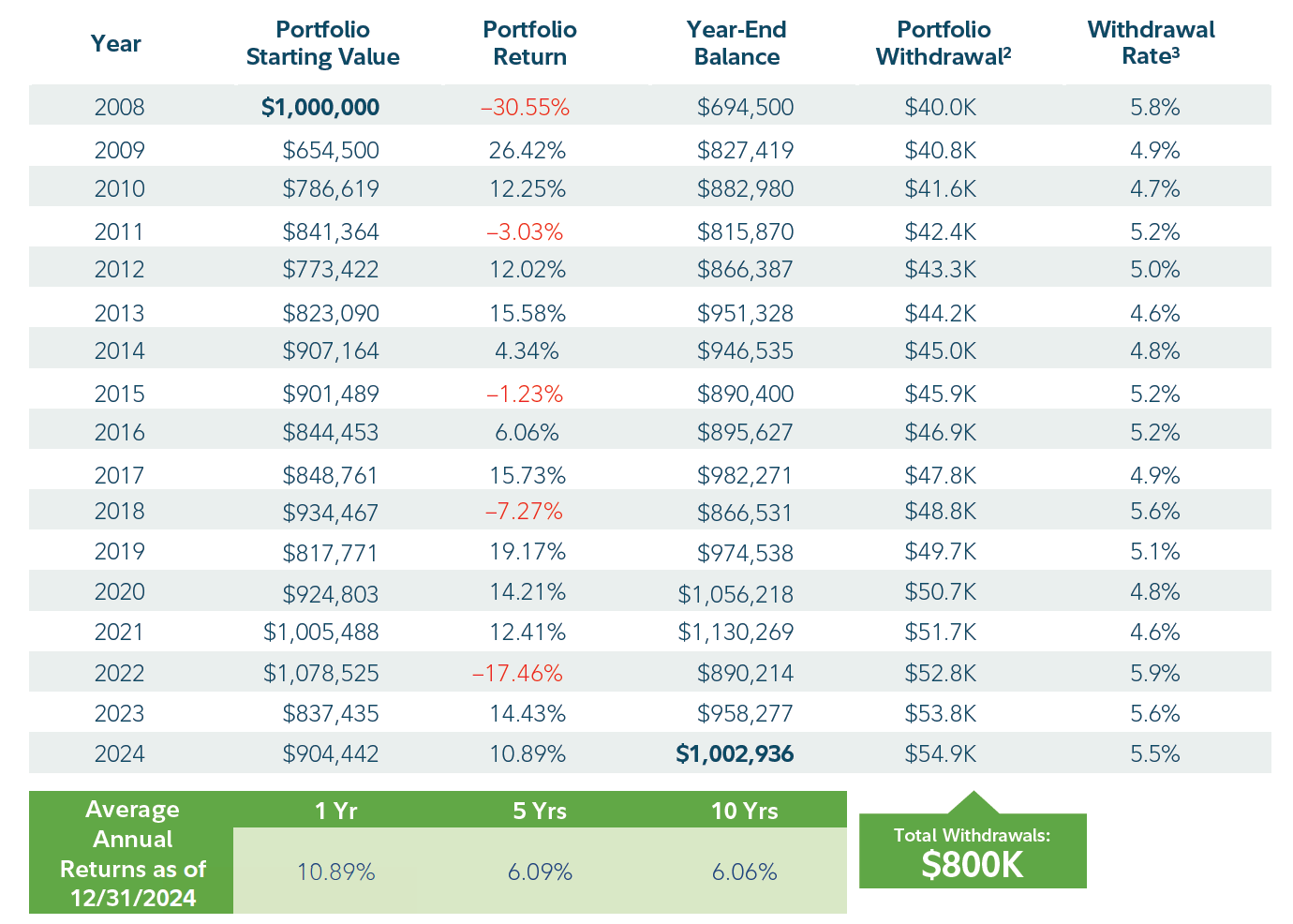

Let’s consider an educational example that follows a theoretical retired couple who started taking withdrawals from their portfolio in 2008, when the financial markets experienced a steep drawdown, and charts their journey through to the present day. Although past performance doesn’t guarantee future results, it can be helpful to see how such a scenario might have played out.

It’s 2007 and Jordan and Shawna are planning to enter retirement in 2008. In preparation, they meet with their advisor to consider their options. First and foremost, they are seeking income that could help them achieve the lifestyle they desire in their golden years. But they also want to maintain a healthy, long-term base of assets that has the potential to grow over time and could help them address any unforeseen expenses or emergencies that might arise during their retirement.

After talking it over with their advisor, Jordan and Shawna decided to invest $1 million in a diversified, professionally managed account. "When devising a plan for a client, we start by evaluating their needs," says McAdam. "We want to know what their goal is and what it is they’re saving for, so we can better understand their tolerance for risk. When we can determine how much money they might need to achieve that goal, that helps us design a portfolio that’s equipped to help them reach it." Based on Jordan and Shawna’s expected needs, the couple determined that they would need to withdraw $40,000 in the first year of retirement to fund their lifestyle and planned to increase their withdrawal amount by 2% each year, to account for inflation.

Since hindsight is 20/20, you’ve probably already guessed what happens next. Jordan and Shawna’s million-dollar investment runs headfirst into the 2008 financial crisis. In the very first year of their retirement, Jordan and Shawna watched their portfolio—their hard-earned savings—lose more than 30% of its value. And after withdrawing the $40,000 to pay their day-to-day expenses, they were left with about $650,000 and a feeling of unease about what the future might hold for them and their portfolio.

In a situation like this, it’s easy to fall prey to your fears and end up making an emotional decision about your money. There are at least 3 common responses to this kind of difficult financial environment that, while entirely understandable, are in fact myths that could lead you to make a serious, potentially life-changing error.

"When you see a big drop in your savings on your account statement, it’s likely that you’re going to have a visceral reaction," says McAdam. "But that’s when you need to buckle down and try to stay focused on long-term goals rather than short-term volatility."

Myth #1: It’s time to get out

Watching more than 30% of your savings evaporate into thin air isn’t easy and given how shaky financial markets seemed back during the 2008 crisis, you couldn’t blame Jordan and Shawna for thinking that maybe they’d be better off pulling their money out of the market and waiting for things to settle down.

But again, with the benefit of hindsight, we can see what a mistake that would have been. Down markets can present an opportunity for investors who can ride out short-term volatility and uncertainty. In the following year, 2009, markets rebounded; in this educational example, Jordan and Shawna’s portfolio would have seen a gain of more than 26%, nearly erasing the previous year’s loss. Had they gotten skittish and left the market when things were down, they might have missed out on the subsequent rally.

Personalized Portfolios Account—Total Return Blended Growth with Income1

Past performance is no guarantee of future results. Diversification and asset allocation do not ensure a profit or guarantee against loss. For informational purposes only. Returns for individual clients will vary.

Based on the performance of a composite of Fidelity Wealth Services accounts managed using the Growth with Income asset allocation, the total return investment approach, and blended investment universe. Please be aware that the return information differs, perhaps significantly, for an account that is not managed using the same configuration of strategy characteristics as the composite shown above. The Growth with Income asset allocation, total return investment approach, and blended investment universe were chosen because they are the most commonly used asset allocation, investment approach, and investment universe in the program. Please speak to your Fidelity representative for information about the performance of other strategy characteristics available through the program. Performance shown is pre-tax, and the assessment of taxes will reduce returns. Please see disclosures for additional important information regarding performance returns.

Myth #2: It’s time to try something different

Even when you’re able to resist exiting the market, it’s hard not to consider switching things up and changing your plan, perhaps by retreating to a more conservative portfolio allocation. In the educational example featuring Jordan and Shawna, they had initially selected a well-diversified "growth with income" portfolio because, at the time, they believed it was the best fit for their long-term goals. But while the 2008 financial crisis was certainly disruptive, Jordan and Shawna’s goals wouldn’t likely have changed. The shock of the drawdown in their portfolio may have just made them fear that they were less likely to reach their goals. Were Jordan and Shawna to remain focused on that long-term vision, they might be less likely to change the plan described in this educational example.

"Stocks are the growth engine in your portfolio," says McAdam. "It’s important to have a growth element in your retirement account to help sustain your standard of living and spending power. But stocks can be very volatile, so we offset that volatility with diversifiers, like bonds, to try and smooth out that volatility over time. This can help investors withstand the emotional ups and downs that the market can present."

Taking the long view, an analysis of the performance of an account like Jordan and Shawna’s between 2008 and 2024 demonstrates that their initial plan was prepared to handle the occasional bump in the road. Over that period, Jordan and Shawna would have seen only 5 years in which their portfolio return was in the red, and their 10-year average annual rate of return would have been 6.06%. While this is no guarantee that something similar might occur in the future, it can be helpful to see how such an approach might have performed under the circumstances.

Myth #3: It’s time to cut back

So let’s say you stay in the market and stick to your plan. Surely, with the principal value of your account diminished so significantly, you’ll have to cut back on your withdrawals and, by extension, your spending. Again, it’s natural to react to a dip in your portfolio with some belt tightening. It just seems prudent. But it may not actually be necessary. Obviously, your circumstances may vary, but with a well-diversified portfolio, you may be able to weather less-than-stellar years in the market without having to significantly curtail your withdrawals or adjust your lifestyle.

For our fictional couple, this meant that over the period between 2008 and 2024, they would have been able to stick to their withdrawal strategy and get the funds they needed to live the lifestyle they wanted even when markets were down. In fact, by the end of that period, they would have withdrawn a total of $800,000 and still ended up with a portfolio value just over $1 million.

Staying disciplined

So how do you stay disciplined when you’re staring down a bear market?

- Begin by recognizing and acknowledging your emotions and how they influence your decisions. There are tactics you can use to keep your cool in difficult times.

- McAdam suggests that investors may want to explore setting up a more solid financial foundation that can help them feel more at ease. Setting up emergency savings or establishing a more predictable stream of income, such as from annuities, to address near-term needs may help you resist the urge to act when markets fluctuate.

- Think about working with investment professionals who can help tailor a diversified portfolio in accordance with your goals and risk tolerance. Knowing you have a professional watching over your portfolio can help to remove emotional or reactive decision-making from the equation.