When ordering ice cream at an ice cream shop, you probably spend a good amount of time mulling over the choice of flavor options—vanilla, chocolate, rainbow, pistachio, and so on—and very little time deciding between a cone or cup to hold the treat.

Most of us approach investing in a similar way, paying a lot of attention to our investment choices and asset allocation—whether and how much to invest in stocks, bonds, actively managed mutual funds, ETFs, maybe alternative investments—and not considering whether those assets are held in a taxable brokerage account, IRA, or other tax-advantaged account.

Having an appropriate asset allocation for your goal based on your time horizon and tolerance for risk is the critical building block of a solid investing plan. But with that in place, it can pay to be selective, when possible, about the type of accounts you select for those assets, a strategy known as asset location. That's because different accounts can be treated differently for tax purposes, and some types of assets can be more tax-efficient than others. "We can't control taxes, but we can be smart about where we put our stocks and bonds in order to grow those assets with as little resistance as possible," explains Mitch Pomerance, CFP®, CFA, vice president and financial consultant with Fidelity Investments.

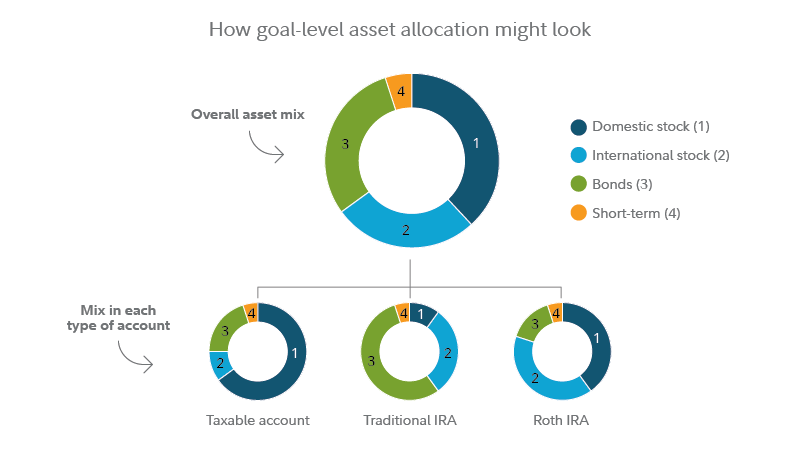

Asset location shouldn't change the level of investment risk across your household, emphasizes Matt Bullard, a regional vice president for managed solutions at Fidelity. Rather, the goal is to put assets in the right place to help optimize your after-tax returns. "I like to compare asset location to using building blocks to build a tower," Bullard says. "If the same set of blocks is arranged in a more efficient way, you can often build the tower higher."

Why location matters

To understand how asset location works, it's important to know how different accounts are treated for tax purposes. There are 3 main types of accounts: Taxable, which includes traditional brokerage accounts that can own almost any type of security or ETF; tax-deferred, which includes traditional 401(k)s, 403(b)s, and IRAs; and accounts that may be tax-exempt and subject to certain rules, which include health savings accounts (HSAs), Roth IRAs, and Roth 401(k)s.

Also consider which types of assets are likely to produce taxable income. On the lowest end of the scale are municipal bonds and muni bond funds, which are often tax-exempt. Stocks held for over a year are also relatively tax-friendly, since they are generally taxed at the lower long-term capital gains rate. In addition, many stock index funds and stock mutual funds that have a goal of tax management tend to hold assets for longer periods and generate fewer short-term capital gains. Conversely, stock mutual funds with high turnover tend to be less tax-friendly, since they often produce short-term gains. Other less tax-advantaged assets include those that generate interest income, which includes some dividend-producing stocks, bonds, and bonds funds.

Matching assets to accounts

Broadly speaking, an asset location strategy places or locates assets that are relatively tax-efficient in accounts that are taxed at a higher rate—and conversely, places less tax-efficient assets in tax-advantaged accounts. It's also important to consider potential for short- and long-term growth, notes Bullard. "For example, the equity exposure in my Roth IRA is mostly domestic small and midcap, as well as emerging markets. That's because these assets have the potential to create significant capital gains," he explains. You may also want to hold investments that are sensitive to interest rates or certain parts of the business cycle, such as high-yield debt, commodities, or other alternative investments, within accounts such as IRAs where they can be traded without tax consequences.

Consider a hypothetical couple who owns a taxable account, a traditional IRA, and Roth IRA. Using the principals of asset location, they might, if possible, have a higher weighting of growth-oriented assets in the Roth, to potentially benefit from tax-free growth, and locate lower-growth assets that generate income, such as bonds, in the traditional IRA. For the taxable account, they can focus on efficient assets like index funds, ETFs, and separately managed accounts (SMAs), along with muni bonds.

Looking at the big picture

Employing an asset location strategy can be difficult to do on your own, and even more so across a household, cautions Bullard. A couple might each have tax-advantaged workplace accounts like a 401(k), as well as multiple tax-deferred IRAs and Roths and non-joint or jointly held taxable brokerage accounts. The strategy also needs to be complementary to any workplace accounts that might have restricted access to some types of assets. "It's important that we look at the full picture so we can suggest an asset location strategy that takes all of a client's holdings into account, no matter where the assets are held," Bullard explains.

Another challenge is maintaining an asset allocation strategy as markets shift. "Let's say there's been market volatility and as a result, I need to sell stocks and buy more bonds to maintain my asset allocation. Where do I sell the stocks and buy the bonds to optimize tax efficiency?" says Bullard. You may also need to revisit your asset location if you or your spouse change jobs, since you might opt to move the assets in a 401(k) to a rollover IRA, or gain or lose access to different types of investments in your workplace account.

Next steps

Given the complexities of asset location, you may want to consider working with a financial professional who can review your household portfolio holistically and suggest both an asset allocation and asset location strategy to help you reach your financial goals. "When asset location is done effectively, there are 2 things that might happen," says Bullard. "You can get to your goals sooner, or you get to your goals with more money in your pocket."