The US has suspended some previously-announced tariffs on imports from many of the world’s countries, while further raising them on imports from China. The US had previously announced so-called reciprocal tariffs that would have particularly impacted countries that are big exporters to the US and which place tariffs on imports from the US. Instead, the US will impose a uniform 10% tariff on most countries for the next 90 days. Meanwhile China, Canada, and Europe have raised tariffs on US imports.

Many details about countries' longer-term tariff policies are still unclear so it’s uncertain how all this will impact economic globalization which has been one of the drivers of the strong performance of US stocks over the past several decades. It has also helped keep inflation low even as the US economy has continued to grow.

Lars Schuster, institutional portfolio manager with Fidelity’s Strategic Advisers, says there are also other key questions in the short term: “How will companies respond? How much will they pass on to higher costs? Will they cut jobs to offset potentially higher input costs? And how will consumers respond? Will they cut spending, increase savings, substitute domestic products for imports?"

Schuster says the market is also watching to see how foreign governments may respond. “We'll be closely following all developments by tapping into our deep network of research. We will adjust portfolios as needed, including rebalancing,” he says.

Tariffs and the economy

Though there is now more clarity about what tariffs will be implemented, unanswered questions remain about what comes next. “This poses important questions given the ongoing lack of clarity around who pays for the tariffs and how long they might last,” says Mike Scarsciotti of Fidelity’s Capital Markets Strategy Group.

The wide-ranging nature of the tariffs means they could cause higher inflation. "A transitory period of inflation due to tariffs could be drawn out, especially if they are rolled out gradually. If companies and consumers delay spending in this environment, there could be a deeper impact on growth,” he says.

Tariffs and markets

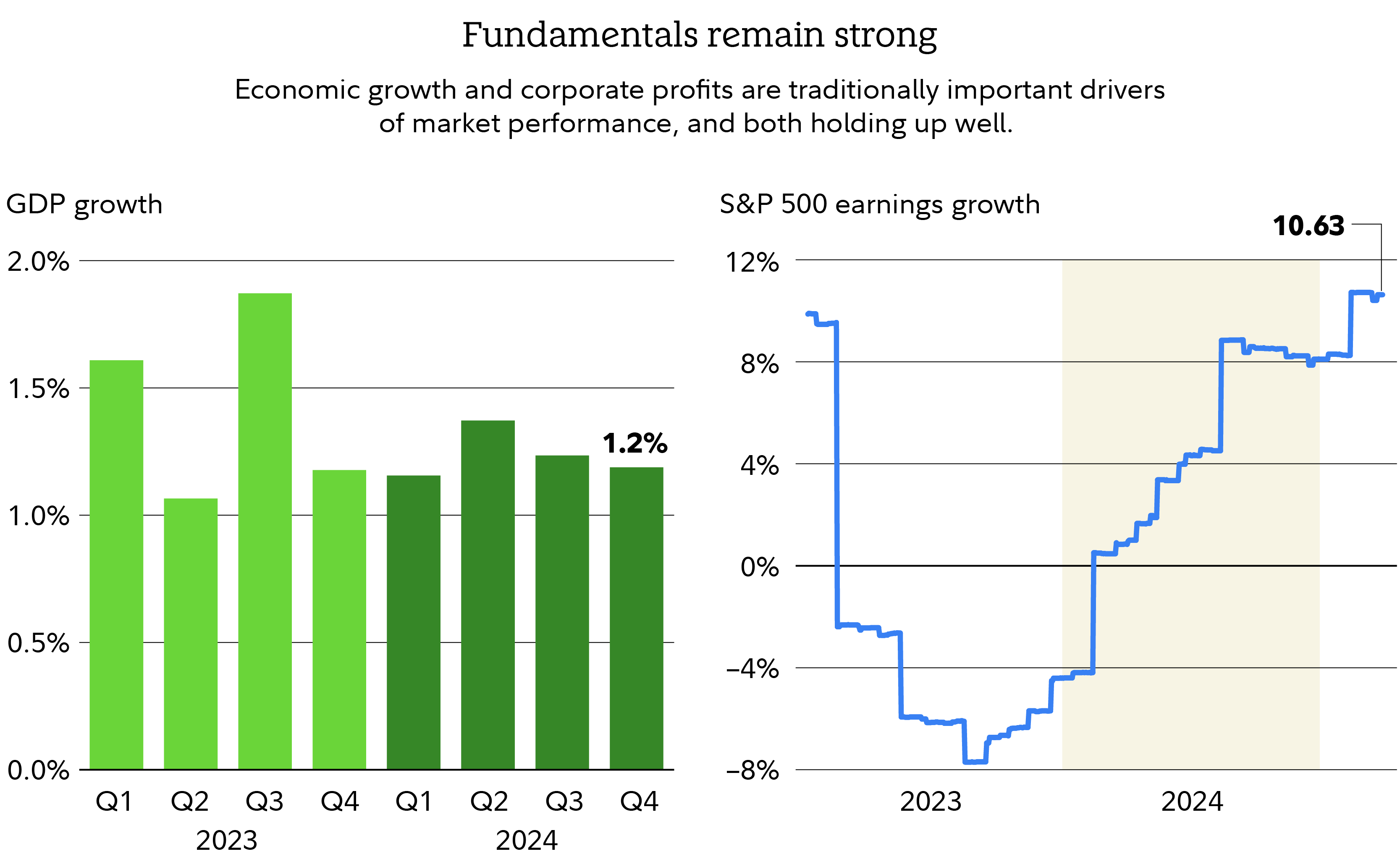

It's important to remember that economic growth and corporate profits have historically been far more important for financial market performance than shifts in government policy and these have remained positive despite anxiety-producing rhetoric and headlines.

Though market volatility may remain in the short term, Scarsciotti believes stocks and bonds have the potential to deliver positive returns over the long term thanks to continued economic and earnings growth. “Our outlook for US stocks remains positive and we believe intermediate-term bonds can offer yield as well as diversification,” says Scarsciotti. Schuster agrees, saying he sees “bonds playing their traditional role by acting as portfolio shock absorbers.”

What investors can do

Of course it's only natural to be concerned when the market experiences fluctuation. It's important to take a long-term view of your investments and review them regularly to make sure they line up with your time frame for investing, risk tolerance, and financial situation. Ideally, your investment mix is one that offers the potential to meet your goals while also letting you rest easy at night.

We suggest you—on your own or with your financial professional—define your goals and time frame, take stock of your tolerance for risk, and choose a diversified mix of stocks, bonds, and short-term investments that you consider appropriate for your investing goals.

Schuster says the Strategic Advisers investment team relies on broad diversification across a wide range of asset classes to help manage potential risks including international stocks and inflation hedges.

Scarsciotti notes that diversification within and between asset classes can help manage risk and protect against inflation. “Within your stock portfolio, you could consider a balance between value-oriented dividend-yielding stocks as well as growth, and international stocks as well as US-listed ones. Also, evaluate how much you're holding in cash and consider locking in higher yields on intermediate-term bonds if it makes sense for your plan,” he says.

“Staying invested is hard at times like these,” says Schuster. “But remember, the market often comes back fast and unexpectedly. The biggest mistake investors often make is trying to time the market and then not being there for the recovery.”