At the heart of bitcoin and cryptocurrencies lies an innovative technology called blockchain. But blockchain powers more than just crypto. Let's explore how it works and why its adoption could potentially reshape industries.

What is blockchain?

At its most basic level, blockchain is an online database, like a spreadsheet you might use at work or home. However, this database (or "ledger," in blockchain terms) is decentralized and distributed: Instead of the data being stored in one place on a computer or on a server maintained by one person or company, a network of unrelated computers known as "nodes" each maintain their own copy of the ledger. The fact that copies are not centralized helps protect the reliability of the data; someone would have to corrupt multiple copies of a ledger to deceive the network.

How does blockchain work?

To help you understand how blockchain works, let's break down its name: In this context, a block is a way of storing data, such as transaction data. Blocks typically contain multiple data points (think more than one transaction). Once a block is filled with all the data it can hold, it's added to a chain of all the blocks of data that came before it.

Blocks are designed to become unalterable once locked into place in the chain. This allows anyone running the blockchain software to trace the history of a piece of data's journey from the blockchain's launch to the present.

Not just anyone can add data to a blockchain. This ability is limited to individuals and companies running blockchain software on computer nodes. They most often update the blockchain by expending computing and electricity resources to solve mathematical problems (in a system called "proof of work") or by putting forward a small amount of cryptocurrency that they will forfeit if they approve fake transactions (in a system called "proof of stake"). These are called "consensus mechanisms," processes by which the participants in the blockchain network form an agreement on whether transactions are valid.

Once a node has approved a transaction, that information is distributed to all other nodes so they can collectively accept the addition and update their own copies of the blockchain ledger.

In theory, blockchain systems are kept secure because a hacker would have to put forth more computing power than the majority of the network (something that would be very difficult to do), risk losing some of their crypto holdings if they approve fake transactions, or control at least 51% of the nodes to force all nodes to update the overall blockchain with the faked data.1

While it would be very unlikely for a well-established blockchain system with many nodes to be hacked in one of those ways, newer systems with fewer nodes can be more vulnerable to attacks. But blockchain's infrastructure makes it much more difficult—and potentially costly.

How is blockchain used?

Blockchain may provide a framework to create a new wave of technology, whether it's cryptocurrencies or it's recordkeeping platforms that could change how companies handle their supply chains or how individuals manage their identity online during sensitive transactions.

Cryptocurrencies are the best-known use of blockchain technology. In fact, most major cryptocurrencies, including bitcoin and Ethereum, run on blockchain systems.

Crypto blockchain ledgers record transactions made with a particular cryptocurrency as well as provide mechanisms to help prevent fraudulent charges, such as double spending. That's when someone sends the same cryptocurrency to more than one place in an effort to spend it multiple times. Because the blockchain is constantly updated and shared with other nodes to update their ledgers, it would be difficult to trick a node into allowing you to use a coin once it's out of your possession.

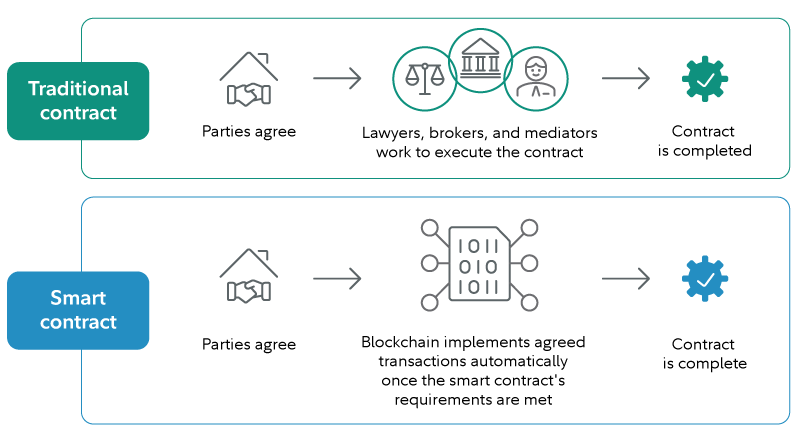

A smart contract is a computer program that uses blockchain to execute what would be real-world agreements or contracts. It gets the "smart" in its name because it's able to automatically enact a transaction once certain terms and conditions are met and logged in a block.

Previously, a middleman, such as a lawyer, broker, or mediator, would have been needed to ensure that such transactions happened. Now, instead of having to pay escrow fees or hire an attorney, for instance, a smart contract can ensure that funds are moved from one party to another after an agreed-on term is completed. Because of their self-executing nature, smart contracts could eliminate many costly processing fees, which could be beneficial to many different industries.

But smart contracts aren't a perfect alternative to traditional contracts. Depending on how they're written, they can be incredibly hard to alter once set and are vulnerable to hacks or bugs.2

Because it creates an unalterable list of transactions, blockchain can also be used to track and verify ownership of items, such as real estate and art. These days, it's best known for enabling newer intangible assets called "non-fungible tokens" (NFTs).

An NFT is a unique digital asset that is not interchangeable, meaning it cannot be directly exchanged for another thing. One dollar, for example, can readily be traded for another dollar because their values are identical. But for unique assets, such as many types of artwork, for instance, one piece's value is not directly equal to and exchangeable with another's, even if they were made by the same person. NFTs usually represent objects like music, artwork, or videos. They're built using blockchain technology, most often Ethereum. This allows purchasers to instantly certify an NFTs' authenticity as well as trace its ownership history.

Unlike standard digital files, which can be copied endlessly, NFTs cannot be reproduced. This creates scarcity and may allow NFTs' values to rise, assuming they remain in demand. In addition, thanks to smart-contract technology, NFTs are able to pay their creators royalties based on future sales. Normally, artists would not receive percentages of any secondary sales.

Manufacturers can adopt blockchain technology to track their products on the journey from producer to consumer (a.k.a. the supply chain). For instance, in the food industry, farmers, distributers, food producers, and vendors can use blockchain technology to create complete transparency in the supply chain from the farm to the grocery story. In supply chains where blockchain is implemented, anyone can see the full history of a food product. This can help verify claims such as "organic" or "fair trade" and give customers greater insight into the food they're buying.3

Advantages of blockchain

Decentralization

Because its ledgers are decentralized and distributed across many nodes in different locations, blockchain is theoretically harder to tamper with than similar records held by a centralized source. It would be easier for a hacker to alter financial information held in one bank's centralized database, for example, than it would be for them to hack into the majority of a decentralized and distributed blockchain's nodes to bring about the same forgery in a block.

It's important to note here that simply having something distributed, meaning in more than one location, isn't the same as it being truly decentralized. It becomes decentralized only when all participants have equal rights within the rules of the system and there are no centralized authorities or administrators. In other words, a system would be decentralized when you as an individual have the same rights to update a log of transactions as a bank or company does. This helps ensure that blockchain systems are able to continue running even after the people, organizations, and companies that made them are long gone.

Increased transparency

Blockchains have built-in transparency for those people with access to the network, allowing anyone in the system to inspect the ledger of transactions and monitor for potential cheating or fraud.

That's right—while many people think that cryptocurrencies allow anonymous transactions, there's actually a log of every movement that its native digital coin has taken on its blockchain. So theoretically, in certain instances, it could be easier for authorities to track money laundering if they can pair a publicly visible crypto wallet address with a money launderer.4

Disadvantages of blockchain

Concerns over energy usage

Because they rely on computer networks and some require extensive computing resources, certain blockchain systems can require a lot of energy. This can be harmful to the environment if it comes from unsustainable sources, such as fossil fuels. Blockchain supporters believe that eventually most of this energy will be derived from renewable sources, but it remains to be seen if this vision can be realized.

As blockchain technologies continue to grow and develop, people, companies, and governments must determine whether the value and benefits of energy-intensive blockchains outweigh the potential energy consumption.

Changing regulations

Because blockchain and cryptocurrencies are relatively new, governments around the world are still learning and figuring out how to treat them. Depending on where you live in the US, for instance, you may not be able to invest using the same crypto exchange platforms or even access the same cryptocurrencies as people in other states.

On a larger scale, this uncertainty presents risks for those looking to buy or invest in blockchain technology or cryptocurrencies. Certain blockchain applications may be outlawed by governments, or they may be taxed in ways that impede their long-term growth. Moreover, crypto is highly volatile, and may be more susceptible to market manipulation than securities. Crypto holders do not benefit from the same regulatory protections applicable to registered securities, and the future regulatory environment for crypto is currently uncertain. Crypto is also not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation, meaning you should only buy crypto with an amount you're willing to lose.