Are you an experienced investor looking to protect your investments or profit from market trends without owning individual stocks, funds, or indexes? Learn the basics of derivatives and how they could serve as an additional component to your investing strategy.

What are derivatives?

Derivatives are financial contracts whose value comes from another asset, like a stock, ETF, or index. It's a contract between 2 or more parties that defines the underlying asset and the time frame for any future exchanges. Derivatives can be used to increase investment power through leverage, manage investment risk, or trade in anticipation of market changes.

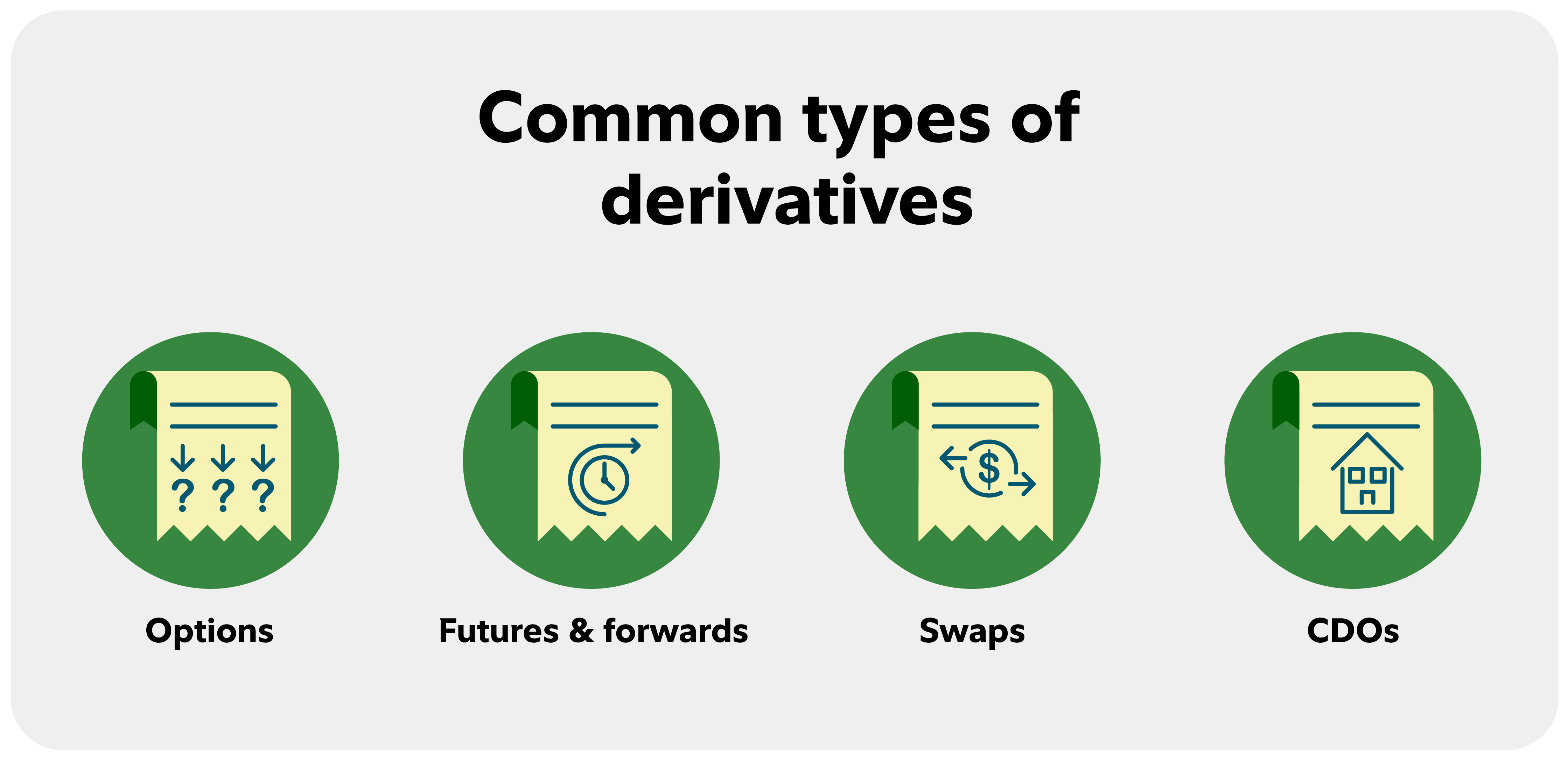

Types of derivatives

There are several common types of derivatives that include options, futures and forwards, swaps, and collateralized debt obligations (CDOs). Let's take a closer look at each one:

Options

Options are contracts that give buyers the right to buy or sell an asset, like a stock, at a specific price up to certain date. There are 2 types of options: calls and puts. Call buyers can buy an asset at a set price, while put buyers can sell an asset at a set price, both without obligation. Options are traded on exchanges like the Chicago Board Options Exchange (CBOE). Options can be used to profit from changes in an asset’s price without owning the actual asset. Additionally, they can be used to benefit from the passage of time and changes in implied volatility.

Futures and forwards

Futures are standardized contracts to buy or sell an asset at a set price on a future date. They are traded on futures exchanges like the Chicago Mercantile Exchange. Futures are often used for commodities, like crude oil or corn, currencies, interest rates, and stock market indexes. Forwards are like futures in many ways, with the most obvious difference being they are traded over the counter and are customizable between the 2 parties.

Swaps

Swaps are agreements where 2 parties exchange payments from assets over a set period. Swaps, which are among the most complex privately traded financial instruments, are typically used by businesses and financial institutions to manage movements in interest rates, currency exchanges, and commodity prices.

Collateralized debt obligations (CDOs)

Another highly complex financial instrument, CDOs bundle different types of debt, like mortgages or loans to sell to investors. These pooled types of debt are divided into parts or “tranches” with different levels of risk and return.

How to use derivatives

Among other strategies, derivatives are mainly used for 3 purposes: Trading directional market movements, increasing investment power, and managing risk.

.png)

Trading market movements

A common reason some experienced investors have utilized derivatives is to trade in anticipation of expected market-moving events. For example, those investors with a higher risk tolerance may focus on options during earnings. Options may experience increased demand around quarterly earnings and Federal Reserve interest rate announcements. Market expectations can be confirmed or denied, sometimes leading to reactions that opportunistic investors may be able to capitalize on.

If you want to trade directional market movements using advanced trading strategies, you can apply for options trading. If approved, you’ll be notified which of the 3 options tiers your account is enabled for. Before you enter your first options trade, do your research. You can create a derivatives risk management plan that aligns with your risk tolerance and clearly defines your exit strategy.

Increasing buying power (leverage)

Derivatives allow investors to profit from price changes without owning the underlying asset, using leverage to amplify their investment power. Leverage means you can acquire a larger investment with a smaller amount of money. A larger investment creates greater exposure and risk related to the underlying asset, magnifying potential gains and losses. A successful derivatives investing strategy is a balancing act between risk and potential rewards.

Here's an example to illustrate how leverage can impact trade outcomes:

Suppose stock ABC is trading for $100 per share. You buy a $105 strike price call option for $7 per contract. After 30 days, the stock price has risen to $120, and the option's value has increased to $21. The 20% increase in the stock’s price resulted in a 200% increase in the option’s value. This is why it's called leverage; a relatively smaller input can create a larger output.

Let’s consider some potential downsides of this investment strategy with another example. Suppose all details are the same except ABC's stock price, which remains unchanged at $100 per share until the options expiration. Since the stock’s price is below the strike price, the call option would expire worthless, resulting in loss of the entire $7 per contract investment. Even with 0% movement in the stock's price, there was still a 100% loss off the option's value. Acknowledging the amplified risks and potential rewards offered by derivatives is an important step when assessing market opportunities.

Managing your investments is essential to avoiding undesirable outcomes. It’s vitally important to monitor your positions as market conditions change to ensure that they align with your objectives and risk constraints. Use Fidelity’s Active Trader Pro® or Trading Dashboard platforms to monitor your portfolio in real time and stay informed with custom alerts.

Managing risk

Derivatives are commonly used by businesses, investment banks, and some retail traders to manage risk. For example, farmers have historically used futures contracts to lock in the price of their crops before harvest to avoid detrimental price fluctuations. Similarly, traders will often incorporate derivatives into their existing portfolio to manage the risk of certain investments.

Let's look at a hypothetical example of how you might use the protective put strategy to “hedge” or manage the risk of a stock you already own:

Suppose you hold 100 shares of XYZ stock at $40 per share. To reduce the total risk of this position, you spent $300 to purchase a $30 strike put option, providing you the right to sell 100 shares of stock XYZ at the strike price up to expiration. During the life of the put option, this effectively locks $30 per share as your minimum sale price, no matter how low the stock price goes.

This protection does not come free. In this case, you paid the price of $300 to buy the protective put. The price of an option is often referred to as the premium. Options premiums change constantly throughout the day and can be very volatile. It’s crucial to understand options pricing and how factors, such as market volatility, can significantly affect the total options premium paid.

Hedging is an advanced risk management strategy that involves buying or selling an investment to potentially help reduce the risk of loss of an existing position. Using derivatives to manage the risk of your existing portfolio requires an understanding of the strategy complexities, costs, effectiveness, and suitability.

Should you trade derivatives?

.png)

Creating an investment plan can help you make better decisions about investing. A common strategy for successful investors is to focus on diversification. Fidelity believes one key foundation of successful investing is diversification (owning a variety of stocks, bonds, and other assets), which can help control risk. Diversification cannot guarantee gains, or that you won’t experience a loss, but it does aim to provide a reasonable trade-off between risk and reward.

While derivatives could be a small part of a diversified portfolio, they are complex investment products that may not be ideal for most investors. They should be considered within the broader context of your portfolio, risk tolerance, and investment strategy.

If you develop a disciplined investment routine, continuously manage risk, and make informed investment decisions, you will have implemented some of the key skills that may lead to financial success.