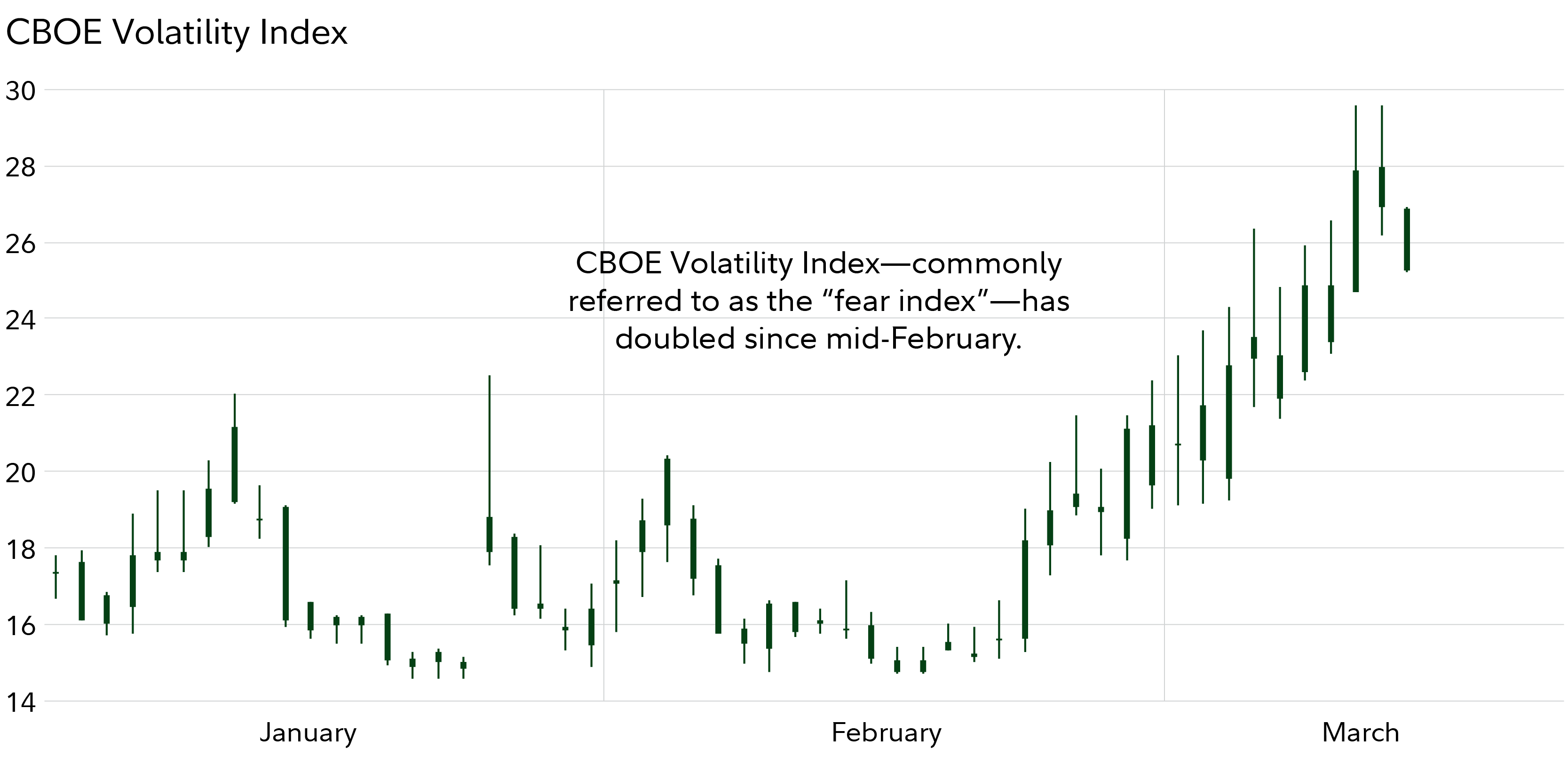

Investor enthusiasm has dissipated to some extent over the past month or so. The S&P 500 is down roughly 10% since hitting an all-time high on February 19, while the CBOE Volatility Index—commonly referred to as the “fear index”—has nearly doubled.

Here are some of the factors that helped cause market volatility, plus ways to help navigate those risks.

Tariffs propel uncertainty

The impact of tariff wars has shown up in several data points, including weakening consumer and business sentiment surveys. Most notably, consumer sentiment fell in February by the largest amount month-over-month since August 2021. When there is uncertainty, consumers may pull back on consumption and companies can retrench by holding off on investments in their businesses.

With that said, it’s important to remember that, generally speaking, the consumer is still doing relatively well—based on record-high net worth and wage growth that’s broadly outpaced inflation. And while tariffs may be inserting some volatility into the market now, it’s possible that deals may be struck to stabilize markets over the longer term.

Consequently, while there may be short-term disruptions to specific industries and markets, not all tariffs being proposed may be implemented, and those that are may be unlikely to change the fundamentals of most businesses. If you are comfortable with your long-term plan, consider sticking to it.

For more on tariffs, read Viewpoints: What to know about tariffs

Tech weakness led markets lower

Even before tariff talk began to sap some of the momentum that markets had heading into the year, tech stocks—which represent the largest weighting in the S&P 500 among all 11 sectors—were starting to give back some of their historic gains from the prior 2 years. More broadly, US stock prices and valuations have run higher than other parts of the world. Valuations for the tech sector, and the Magnificent 7 in particular, have stretched the most in recent years.

The sector-specific flashpoint for the latest US tech weakness may be pinpointed to the arrival of China-based DeepSeek's artificial intelligence model. That, in addition to investors generally shying away from riskier, growth-oriented sectors, has led to tech being the second-worst performing sector year to date (trailing the consumer discretionary sector—which has been hit hard by aforementioned tariff worries and weakening consumer sentiment).

It’s important to put these price moves in context. While stocks are down year to date, this follows 2 consecutive years of greater than 20% gains—which has been more than double the historical yearly average for stocks. And many of the same tech stocks that have been responsible for much of the gains in recent years have run up even higher than the broad market. Moreover, despite the tech weakness, corporate earnings have remained strong—including many companies in the tech sector.

With that said, if your investment mix has become overallocated to tech stocks (which may have occurred with this sector having rallied so high so fast in recent years), diversification across sectors may help mitigate some of that concentration risk.

Recession fears resurface

Looking at the US economy, recession worries have bubbled back up, and concerns about economic growth with it. In particular, there have been 2 recent warning signals that’ve flashed.

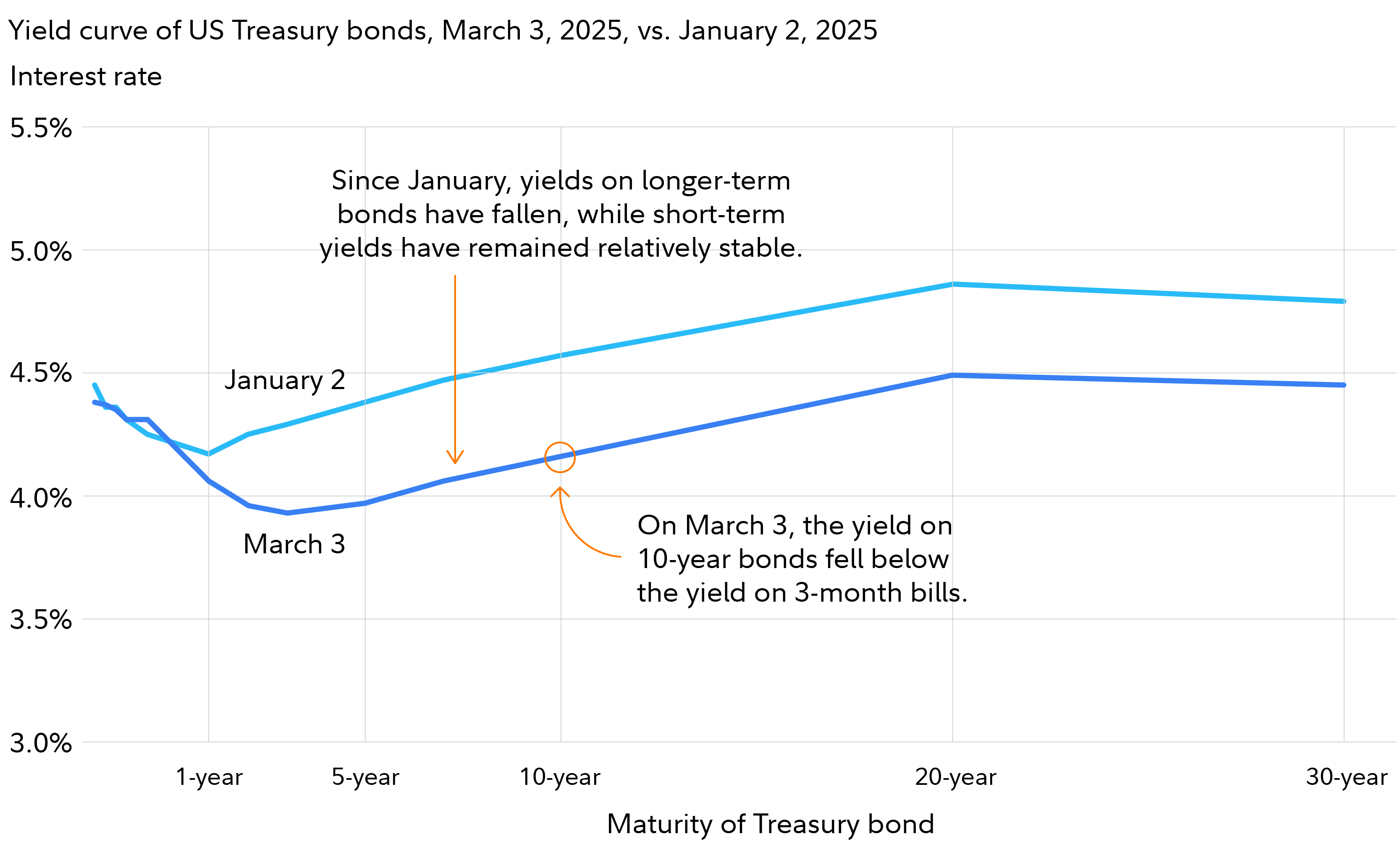

The Federal Reserve's preferred recession indicator cast a warning sign when the yield curve inverted (the 10-year Treasury yield fell below the 3-month Treasury yield). This indicator has had relatively accurate predictive power foreshadowing economic downturns in the following 12 to 18 months.

Additionally, the Atlanta Fed's GDPNow (a running estimate of real GDP growth based on available economic data for the current measured quarter) suggests the US economy might contract by 2.8%, which would be the first negative quarter for GDP growth since Q1 2022.

But Dirk Hofschire, managing director of Fidelity’s Asset Allocation Research Team, thinks there isn’t enough evidence to suggest the US economy is dipping into a recession. “To me, the fundamentals of the economy haven’t changed dramatically and near-term recession risks remain relatively low.”

If you are concerned about the near-term prospects for the US, now could be a good time to consider if you have enough international diversification. That could help reduce overexposure risk to the US—especially if the US is at risk of stagflation (where economic growth slows yet prices remain stubbornly high).

Markets in Europe, for example, have been boosted by renewed defense spending in several major Euro block nations. And with the US representing roughly 70% of the world’s market cap, it can be particularly important to consider international diversification when domestic valuations get stretched. Moreover, in many instances, both emerging markets and developing markets remain attractively priced based on many valuation measures. Of course, international investing entails unique risks that should be understood before making such an investment.

For more on international markets, read Viewpoints: 2025 global investing outlook

Inflation still causing choppy waters

Speaking of inflation, it remains a significant part of the reason why consumer sentiment has weakened recently. While progress has been made to slow the pace of inflation growth since the 2022 price spike, prices have generally not come down, and in some recent data price growth has actually begun to reaccelerate.

The January US Consumer Price Index (CPI) report, which tracks the prices of a wide range of goods and services, showed the largest month-over-month increase in nearly a year and a half. Notably, there was a record increase in the cost of prescription medication and motor vehicle insurance. The most recent CPI revealed that prices increased by 0.2% in February, putting the annual inflation rate at 2.8%.

Not only has inflation flowed into consumer sentiment, it can have ripple effects elsewhere. If inflation remains relatively high, the US central bank may be more hesitant to bring rates down further—and higher rates can serve to slow economic activity.

If you remain concerned about inflation, Treasury Inflation-Protected Securities (TIPS) are an investment that you might consider.1 These are bonds whose principal and interest rate payments rise along with inflation.

For more on inflation and what you can do about it, read Viewpoints: Inflation: Latest news and analysis

Interest rates, government spending

While higher inflation would be a factor that could slow the Federal Reserve from lowering short-term rates, longer-term rates (which are driven primarily by market expectations of future inflation) have ticked down a bit recently as investors have become more concerned about economic growth.

But many investors had been hoping for rates to come down faster than they have. Rates remaining relatively high has been a major factor that’s loomed over the market, and the Federal Reserve has telegraphed it wants to see more progress made on inflation before moving more aggressively to lower rates.

In addition to concerns that the US central bank may not lower rates faster, the new US administration’s efforts to pare back federal spending has also captured headlines. Some fears have emerged that reduced federal spending will hinder growth, increase unemployment, and limit the capacity of the US government to backstop the economy if it does start to slow. And amid all this, reoccurring budget talks have contributed to investor uncertainty.

Yet Hofschire notes there is little evidence that the US has dramatically reduced overall federal spending. “With that said, we are monitoring growth and inflation trends in an environment of very high policy uncertainty," according to Hofschire. "These factors do point to some increased risks relative to the very bullish picture markets were anticipating heading into this year.”

For the latest on Fed moves, read Viewpoints’ latest Fed analysis.