Looking to better understand the key terms and concepts related to how options prices are determined? Here's a quick overview of how changes in price, time, and implied volatility affect options prices.

![]()

What is options pricing?

The price of an option is referred to as the premium. Options premiums represent the current market prices at which buyers and sellers can trade. These premiums are a combination of intrinsic and extrinsic value. Options prices or premiums are quoted as a bid and ask price. Let's break down bid, ask, and options pricing a bit further.

Options buyers focus on the ask price as it represents the cost and risk of purchasing an option. Sellers focus on the bid price, which is the premium received for taking on the contract's risk.

Example: An option has a bid of $7.90 and an ask of $8.00. For a trade using this bid-ask, an option seller could expect to receive a total premium of $790 ($7.90 premium x 100 shares) and an option buyer could expect to pay a total premium of $800 ($8.00 premium x 100 shares). Notice there is a difference between the current bid and the ask price. When talking about options pricing, this is referred to as the "bid/ask spread."

Bid/ask spread explained

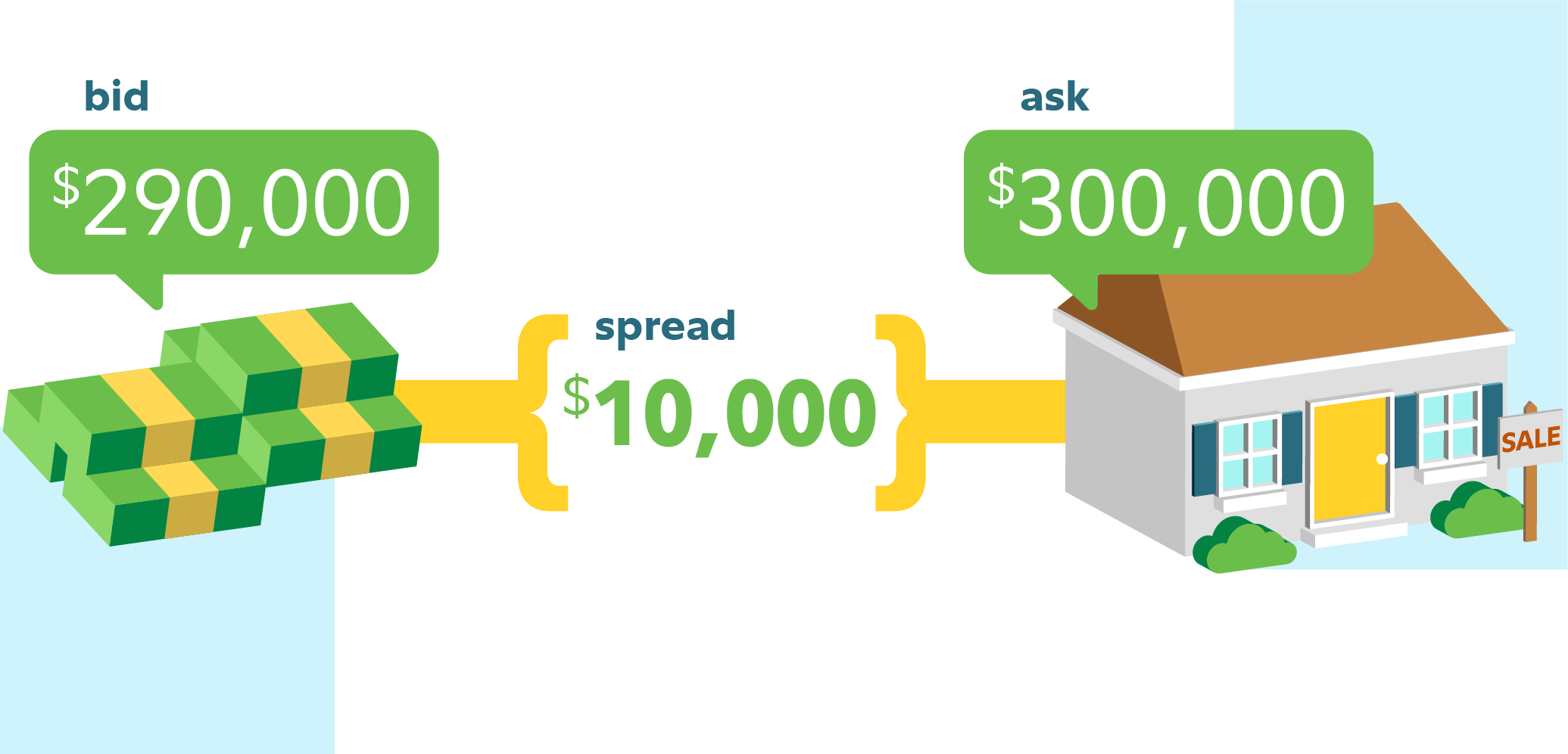

To understand bid and ask prices, think of a real estate transaction. Buyers are willing to spend $290,000 (bid), while sellers list homes for $300,000 (ask). The $10,000 difference is the spread. If a buyer raises their bid or a seller lowers their ask, agreeing on price, a transaction can occur. Similarly, in options trading, buyers and sellers continuously adjust their bid and ask prices to find a match in a market with multiple participants.

How are options priced?

While there are many factors that affect an option's prices, the underlying asset's price, time until expiration, and implied volatility are the 3 most impactful. Understanding these elements helps in making informed trading decisions. Let's talk more about each one.

How can underlying price changes affect options pricing?

The first factor affecting options premiums is the underlying security's price. As the underlying stock, ETF, or index price rises and falls, the option's bid and ask prices will fluctuate. The underlying price determines whether the option has any intrinsic value. An option only has intrinsic value if it is "in the money." Let's break down what in the money and intrinsic value mean using call and put options.

- Call options are in the money (ITM) when the underlying asset price is trading above the strike price. For example, if a stock trades at $160 and the call option's strike price is $155, the intrinsic value is $5 ($160 market price − $155 strike price).

- Call options are out of the money (OTM) when the underlying price is trading below the strike price. For example, if a stock trades at $150 and the call option's strike price is $155, there is no intrinsic value because the stock can be purchased cheaper in the market than exercising the option.

- Put options are in the money (ITM) when the underlying asset price is trading below the strike price. For example, if a stock trades at $140 and the put option's strike price is $145, the intrinsic value is $5 ($145 strike price − $140 market price).

- Put options are out of the money (OTM) when the underlying price is trading above the strike price. For example, if a stock trades at $150 and the put option's strike price is $145, there is no intrinsic value because the stock can be sold at a higher price in the market than exercising the option.

Both call and put options are considered at the money (ATM) when the stock and the strike price are equal. Let's see how underlying price changes affect options with a hypothetical example:

How price movements affect options

Suppose a trader buys a long call option for Company XYZ with a $50 strike price, paying a $1.00 premium, while the current stock price is $45. This option is out of the money. After a positive earnings report, the price rises to $55, making the option in the money, with an intrinsic value of $5.00. The option must be worth at least $5.00, plus any additional extrinsic value due to the time left until expiration.

The trader now has 3 choices to manage their open options position:

- Sell the call option and lock in a theoretical profit of $400 ($5 sale − $1 purchase = $4 profit x 100 shares = $400.)

- Exercise the call to buy the stock at $50. Then, hold the stock or sell the shares immediately at the higher market price of $55, realizing a profit.

- Continue holding and monitoring the option if there is time until expiration and their price outlook stays the same.

How do time and expiration affect options pricing?

Options traders consider the time until the defined expiration date and factor that into the option's price. This is often referred to as extrinsic or time value. Generally, options with further expiration dates cost more than an equivalent option with a shorter expiration date.

Options pricing breakdown

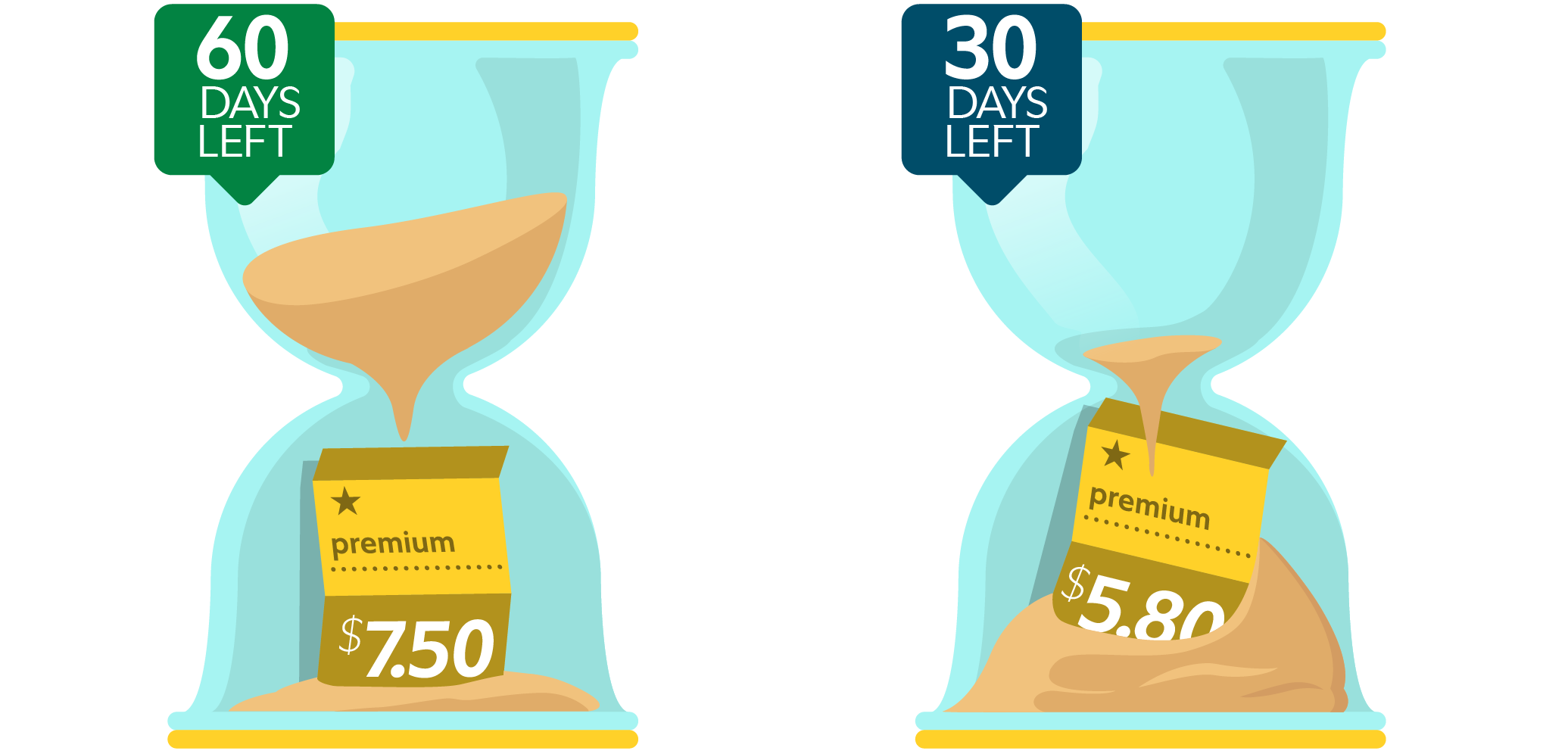

Suppose there's an in the money call option with 60 days until expiration, a $45 strike price, and a trading price of $7.50. The underlying stock is trading at $50, giving the option $5 of intrinsic value ($50 market price − $45 strike price). With 60 days until expiration, the option is worth more than its intrinsic value. The extra $2.50 is the extrinsic value, reflecting the remaining time and implied volatility expectations ($7.50 premium − $5 intrinsic value = $2.50 extrinsic value).

How time affects options

Now, let's look at another scenario, with the only difference being the option has 30 days until expiration. This shorter-dated option is hypothetically trading for $5.80. This option is worth $1.70 less ($7.50 premium − $5.80 premium) than its longer-dated counterpart. With all things being equal, the passage of time will reduce the option value. This is known as time decay. This is why it's crucial to have a clear trading plan that determines how long you are willing to hold onto a trade.

How does implied volatility affect options pricing?

Implied volatility , also known as IV, accounts for the supply and demand for options. Thinking back to Economics 101, if there is a major increase in demand for something, prices are assumed to go up. When there are many options traders who are buying up call and put options, generating strong demand, those options will generally increase in price.

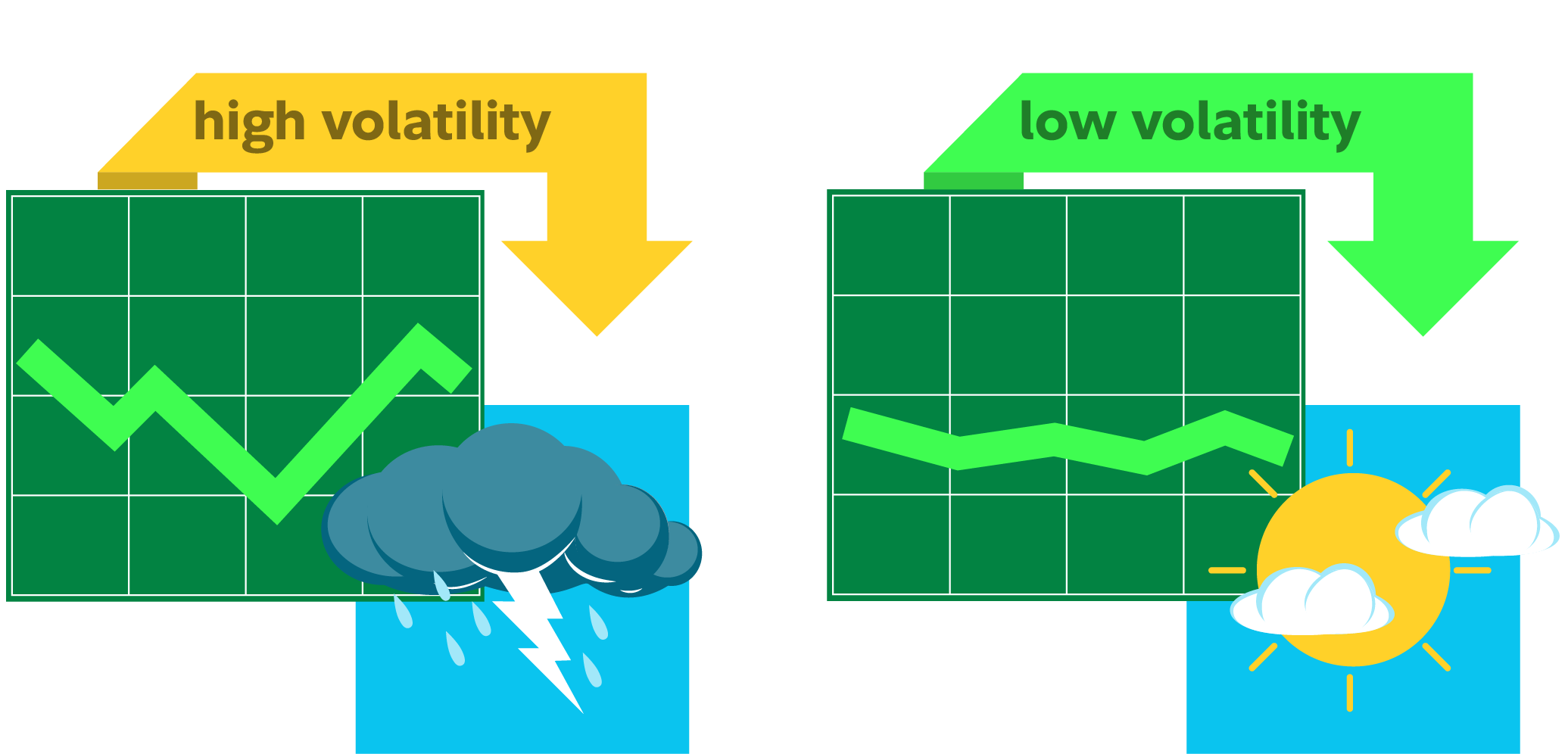

Implied volatility is a measure of what the market expects volatility to be in the future for a given stock, ETF, or index. Think of it like weather forecasts: High implied volatility anticipates big changes (a storm), and low implied volatility anticipates small changes (calm weather). Since implied volatility is standardized, you can compare it relatively across different stocks or ETFs to see which ones are expected to be more or less volatile.

During earnings season or major news announcements, implied volatility can spike, driving up options premiums as traders anticipate significant price movements. It's important to remember that the demand for options is dynamic.

Weathering the storm: Implied Volatility

Putting it all together: Options pricing

Understanding the trading fundamentals and key factors that influence options premiums—underlying price, time until expiration, and implied volatility—can help you make informed trading decisions. While other factors, like dividends and interest rates, also play a role, focusing on these primary elements will give you a solid foundation in options trading.

If you're interested in trading options, make sure you apply for options trading. If approved, your account will be enabled to trade the appropriate tier of options. As a friendly reminder, remember to manage risk responsibly and avoid making common yet unnecessary trading mistakes. By grasping these concepts, you'll be better equipped to navigate options with a well-defined trading plan to help make strategic investment decisions.