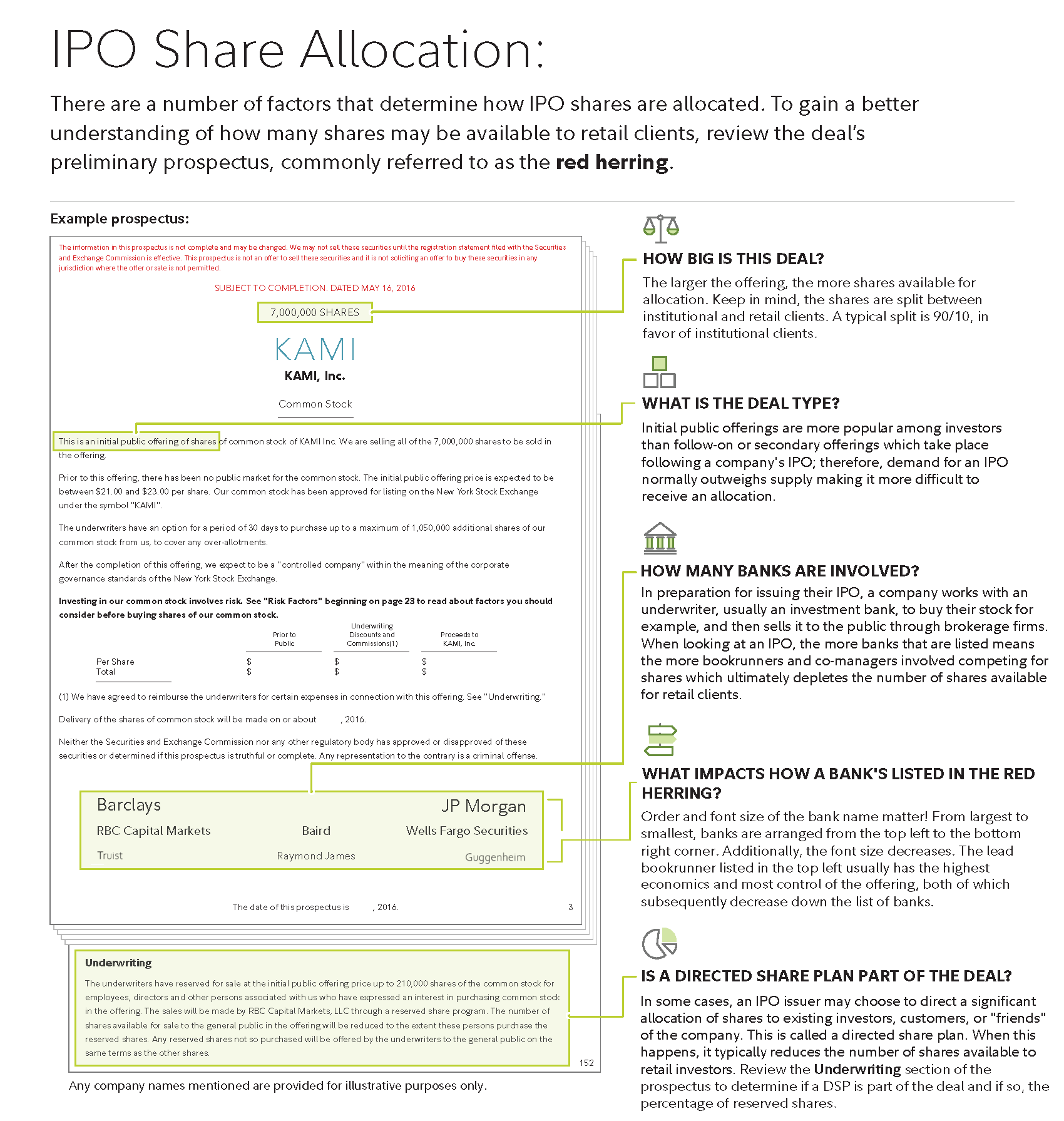

There are a number of factors that determine how IPO shares are allocated. To gain a better understanding of how many shares may be available to retail clients, review the deal's preliminary prospectus, commonly referred to as the red herring. Download infographic (PDF)