A conditional order allows you to set order triggers for stocks based on the price movement of underlying security or index. There are 4 types: contingent, one-triggers-the-other (OTO), one-cancels-the-other (OCO), and one-triggers-a-one-cancels-the-other (OTOCO).

Contingent orders

A contingent order triggers an equity order based on any one of 8 trigger values for the stock, or up to 40 selected indexes.

- Trigger values: last trade, bid, ask, volume, change % up, change % down, 52-week high, and 52-week low.

- Market, limit, stop loss, and trailing stop loss are available order types once the contingent criterion is met.

- Security type: Stocks and ETFs.

- Time-in-force: For the contingent criteria and for the triggered order, it can be for the day, or good 'til canceled (GTC). The time-in-force for the contingent criteria does not need to be the same as the time-in-force for the triggered order.

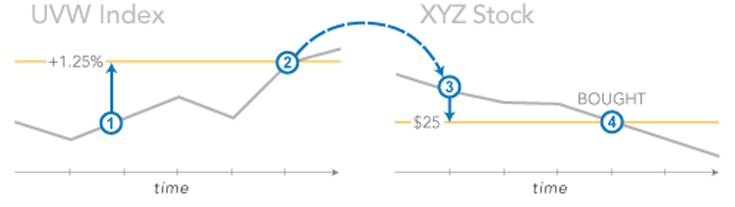

Example of a contingent order

1. You place a Contingent order to buy XYZ stock at a limit of $25 if the UVW index moves up more than 1.25%. 2. A rally occurs that pushes the index up 1.30% on the day... 3. ...which triggers a limit order to buy XYZ at $25. 4. XYZ hits your limit of $25 so shares are bought.

One-triggers-the-other (OTO)

A one-triggers-the-other order actually creates both a primary and a secondary order. If the primary order executes, the secondary order automatically triggers. This type of order can help you save time: place a buy order as your primary order and a corresponding sell limit, sell stop, or sell trailing stop at the same time. Trailing stop orders are available for either or both legs of the OTO.

- Security type: Stocks and ETFs.

- Time-in-force: Can be different for each order.

- For OTO orders that are good ’til canceled (GTC), the whole order is good for 180 days (e.g., if the primary order executes on day 30, the secondary order is live for 150 days).

- If the primary order is canceled, the secondary order is also canceled.

- If the secondary order is canceled, the primary order remains open as a separate order.

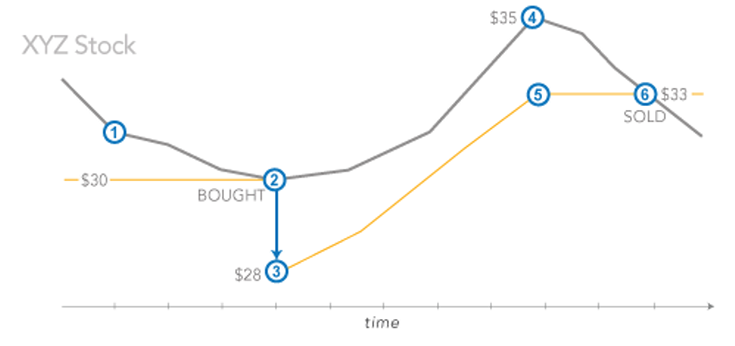

Example of a one-triggers-the-other order

1. You place an OTO to buy XYZ at $30 and sell at a $2 trailing stop loss. 2. The stock drops to $30, which triggers a buy order of XYZ stock that executes and... 3. ...a sell trailing stop loss order with a $2 trail is placed with an initial trigger price of $28. 4. XYZ moves up to $35... 5. ...so the new trigger price for the trailing stop order is $33. 6. XYZ trades down to $33, which triggers the trailing stop order and shares are sold at the market.

One-cancels-the-other (OCO)

With a one-cancels-the-other order (OCO), 2 orders are live so that if either executes, the other is automatically triggered to cancel.

OCO orders are perfect for creating an exit plan when you own a security. They give you the ability to place both a protective stop loss order to minimize your losses and a limit order to maximize your gains. If one of the two orders executes, the other is automatically cancelled.

- Security type: Stocks and ETFs.

- Time-in-force: Must be the same for both orders.

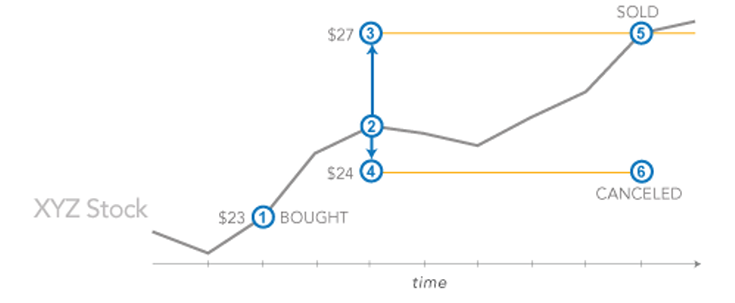

Example of a one-cancels-the-other order

1. You buy XYZ stock at $23. 2. XYZ stock rises to $25. 3. You place an OCO with a sell order of $27 and... 4. ...a sell stop at $24. 5. XYZ stock hits $27, so your sell order executes and... 6. ...your sell stop order is canceled.

One-triggers-a-one-cancels-the-other (OTOCO)

In a one-triggers-a-one-cancels-the-other order, you place a primary order which, if executed, triggers 2 secondary orders.

If either of these secondary orders executes, the other is automatically canceled.

- Security type: Stocks and ETFs.

- Time-in-force: Primary can be different than both secondary orders. However, both secondary orders must have the same time-in-force.

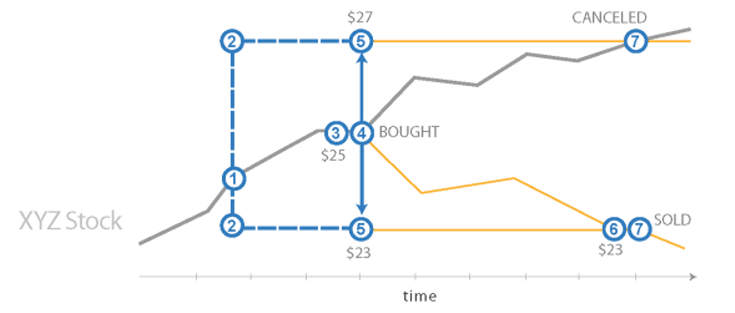

Example of a one-triggers-a-one-cancels-the-other order

1. You place an order to buy XYZ at $25. 2. At the same time, you place 2 sell orders, one at stop loss for $23 and one at a limit of $27. 3. XYZ trades at $25. 4. Your buy order executes. 5. Simultaneously, your 2 sell orders are triggered. 6. XYZ drops to $23. 7. Your stop loss order executes and your limit order is automatically canceled.