What is a trading halt?

A trading halt is an intentional temporary pause in trading activity. Trading halts are implemented by stock exchanges, where buying and selling of stocks and other investments occur. Trading halts can be implemented by exchanges due to factors such as volatility, large changes in investment prices, and/or order imbalances that may be the result of major news announcements or other market factors.

For example, a trading halt can occur when a company is set to release information about a merger. Exchanges, such as the New York Stock Exchange (NYSE), may also pause trading due to technical glitches.

There are 2 different sets of volatility-based trading halts: market-wide circuit breakers and single-security circuit breakers.

What are market-wide circuit breakers?

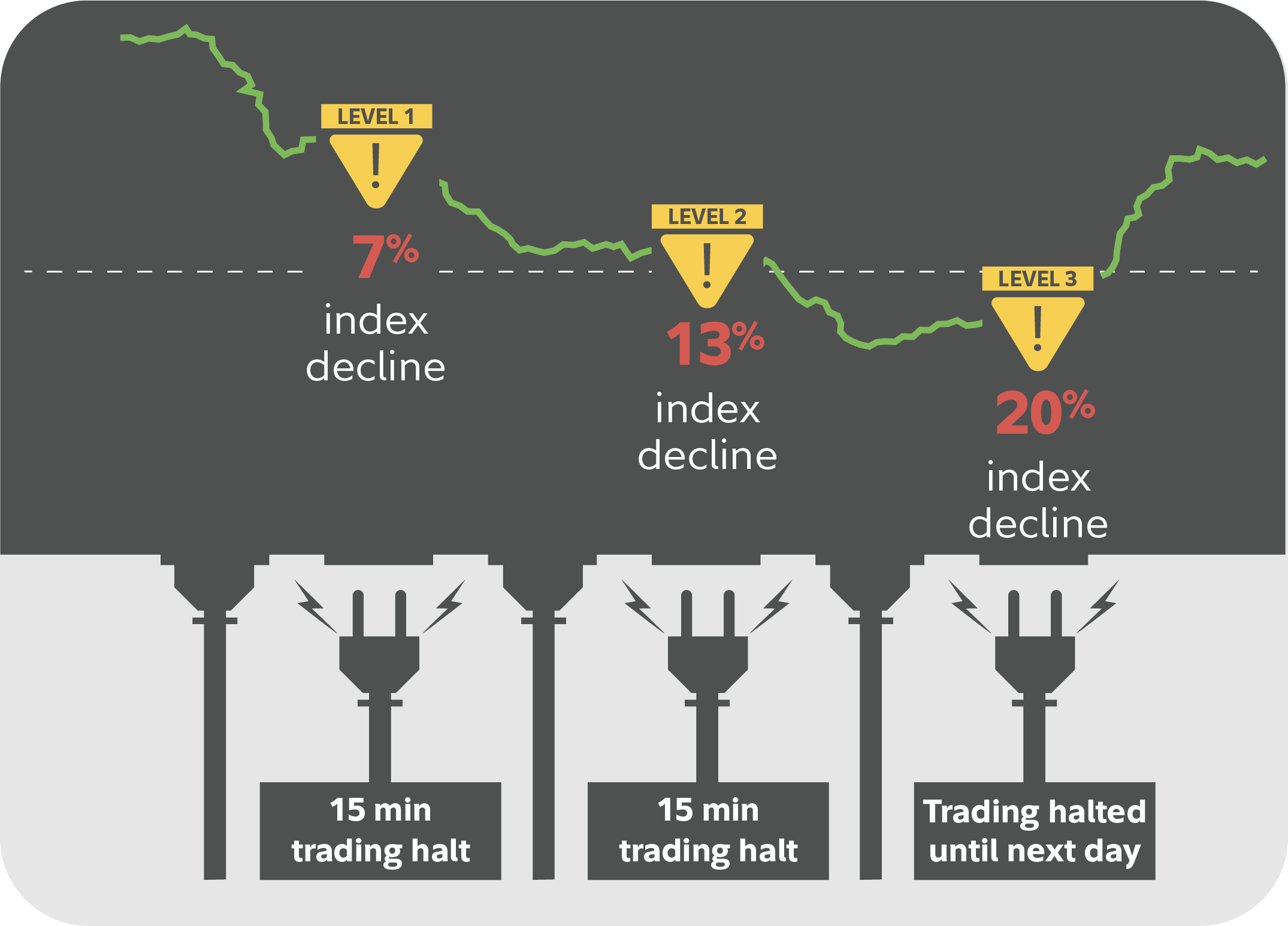

Market-wide circuit breakers are based on a set of rules created by the US Securities and Exchange Commission (SEC), and implemented by exchanges. They are designed to temporarily halt trading activity across the entire market during significant market declines in the S&P 500 Index (

These rules were created to prevent a repeat of the staggering 1987 market crash, when the Dow (

Market-wide circuit breakers have been triggered a number of times since being implemented, including during the 2020 COVID-19 sell-off. During that March, the S&P 500 Index triggered 4 separate market-wide circuit breakers in an attempt to limit global panic selling.

After a market-wide circuit breaker is lifted, trading resumes as normal. However, when trading is paused and then resumes, the price of an investment might be up or down significantly compared to its last price before the pause. This sudden change in price, without trading activity between prices, is called a "price gap."

| Circuit breaker level | S&P 500 Index decline percentage | Market impact |

| 1 | 7% | 15-minute trading halt* |

| 2 | 13% | 15-minute trading halt* |

| 3 | 20% | Trading halted for all securities until the next trading day |

*Note: Level 1 and 2 circuit breakers do not halt trading after 3:25 p.m. ET.

Fidelity routes your orders to various market centers/exchanges even while a market-wide circuit breaker is in effect; however, the orders will not be eligible to execute until the circuit breaker is lifted. Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. However, due to market/security volatility, the status of your order may be delayed.

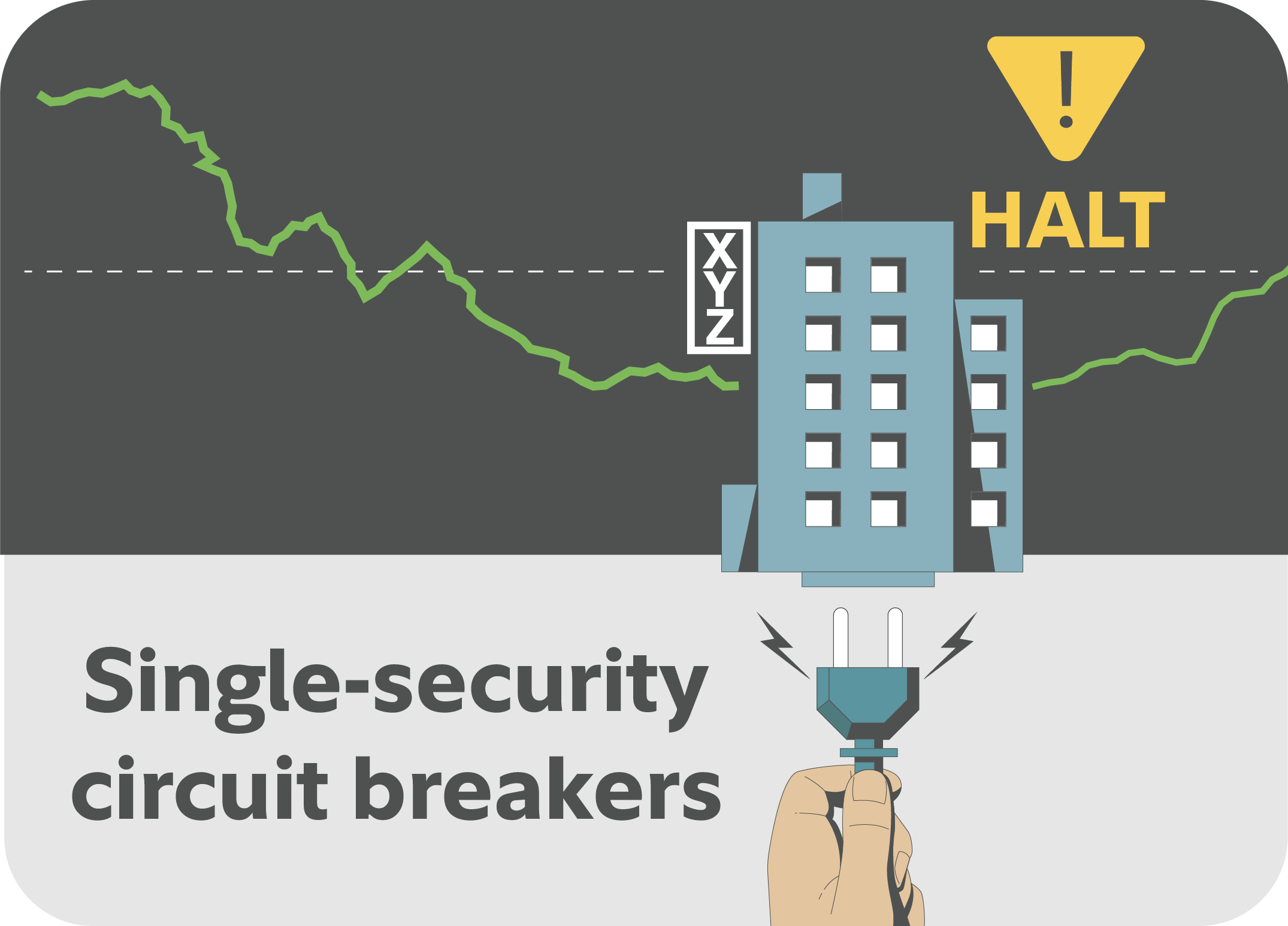

What are single-security circuit breakers?

Single-security circuit breakers, also known as Limit Up-Limit Down (LULD) rules, are temporary trading halts for individual stocks or ETFs. The goal of single-security circuit breakers is to temporarily halt trading in an individual investment and not across the market.

Single-security circuit breakers pause trading if an individual security, like a stock or ETF, moves outside a certain price range within a trading day. Halts are based on price bands, which are calculated high and low price ranges. If the price hits one of those upper or lower bands, a trading pause can be triggered. That means individual security circuit breakers apply to both large upward and downward movements.

Imagine XYZ Corp's stock is trading at $50 per share when news about a product recall causes a rapid drop in the stock price. If the downward move exceeds the lower band for 15 seconds, trading will pause for 5 minutes. Since December 8, 2013, exchanges have implemented the following price band approach:

| Securities included | Trading hours | Previous day’s closing price | Price band percentage | Price band percentage during market close* |

| Tier 1 securities: Stocks in the S&P 500 Index, Russell 1000 Index and certain ETPs | 9:30 a.m. ET – 4:00 p.m. ET | > $3.00 | 5% | 10% |

| Tier 2 securities: All stocks, excluding rights and warrants | 9:30 a.m. ET – 4:00 p.m. ET | > $3.00 | 10% | 20% |

| $0.75 up to and including $3.00 | 20% | 40% | ||

| Less than $0.75 | Lesser of $0.15 or 75% | $0.30 or 150% (upper band only) |

* Price band percentages will generally be doubled at the market close (3:35 p.m. ET – 4:00 p.m. ET).

Trades for individual exchange-listed or National Market System (NMS) stocks will be prohibited from occurring outside these set percentage bands during relevant time frames.

Do trading halts impact options trading?

Yes, market-wide or single-security circuit breakers can cause options trading to be halted because the underlying stocks or ETFs aren't trading. Current stock prices are a crucial factor in stock-based options pricing, so it’s difficult to estimate options pricing during a halt.

During a halt, you can still exercise options and cancel open orders. Options trading resumes once the market for the underlying security shows a quote and trades at or within the quote. While broader markets and individual securities have circuit breaker rules, options contracts do not. Keep in mind that certain assets are not subject to trading halts, such as cryptocurrencies.

What can you do when trading is halted?

During a trading halt, there are several steps you can take to manage and monitor your portfolio:

Assess market news

Stay updated on market-wide circuit breakers or a single stock up-down limit trading halt by using Fidelity’s tools. You can get real-time news alerts on our Active Trader Pro® and Trading Dashboard. And use streaming charts to help you visualize the market volatility and identify any price gaps when trading has resumed.

Review your portfolio

Consider using the temporary pause in market activity to reassess your investments. If you own an investment that is impacted by a trading halt, you might ask yourself if the factors behind the big price move are a reason to reevaluate your position.

Prepare for resumption of trading

Trading halts do not last forever. Review your trading balances and any open orders you may have. Having a clear plan and knowing where you stand will empower you to act when the time is right.

Trading halts may pause the market, but they shouldn’t pause your financial discipline. Stay informed, be patient, and use these opportunities to review investments.