As 2024 nears its end, the stock market is high—and so is the economic uncertainty that has been with us for so long. But despite potential risks, Fidelity’s investment pros have found plenty of smart moves for investors to consider for 2025.

Here are 5 of their top investing ideas for the coming year. And be sure to check out our full 2025 investing outlook for more ideas from our pros.

1. Small- and mid-cap stocks

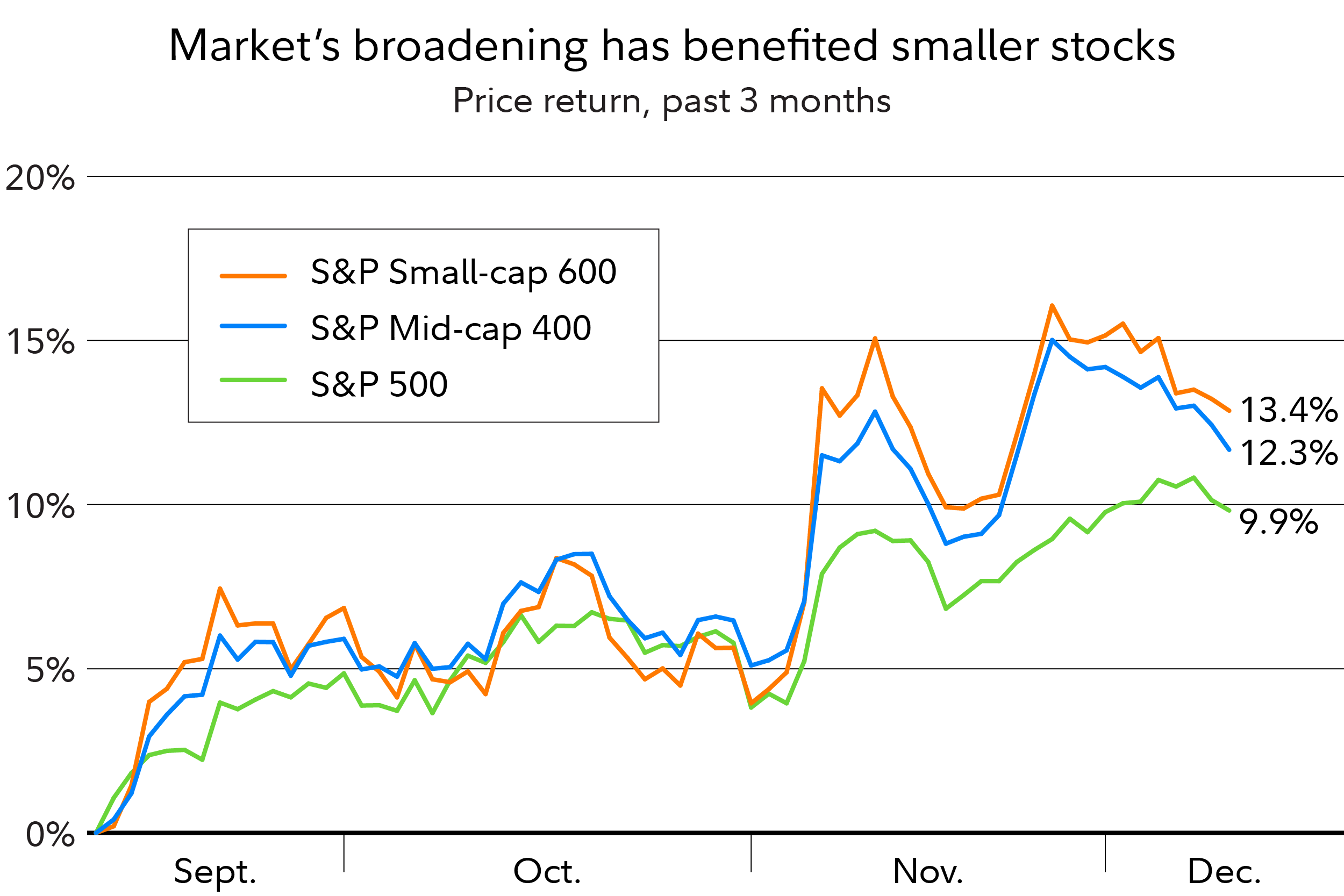

One of the big stories in 2024 was the market broadening. For nearly 2 years, market leadership had been dominated by the so-called “Magnificent 7,” a group of mega-cap growth stocks. But in the second half of 2024, the market finally started rewarding other types of stocks, including small- and mid-caps, which had lagged significantly in recent years.

Even Will Danoff, manager of the Fidelity® Contrafund® (

These companies may have valuation and earnings tailwinds, to boot. Denise Chisholm, Fidelity’s director of quantitative market strategy, notes that mid-cap stocks in particular have looked cheap on several measures, which has historically been a strong indicator of subsequent outperformance, and have also seen earnings accelerating.

2. Financial stocks

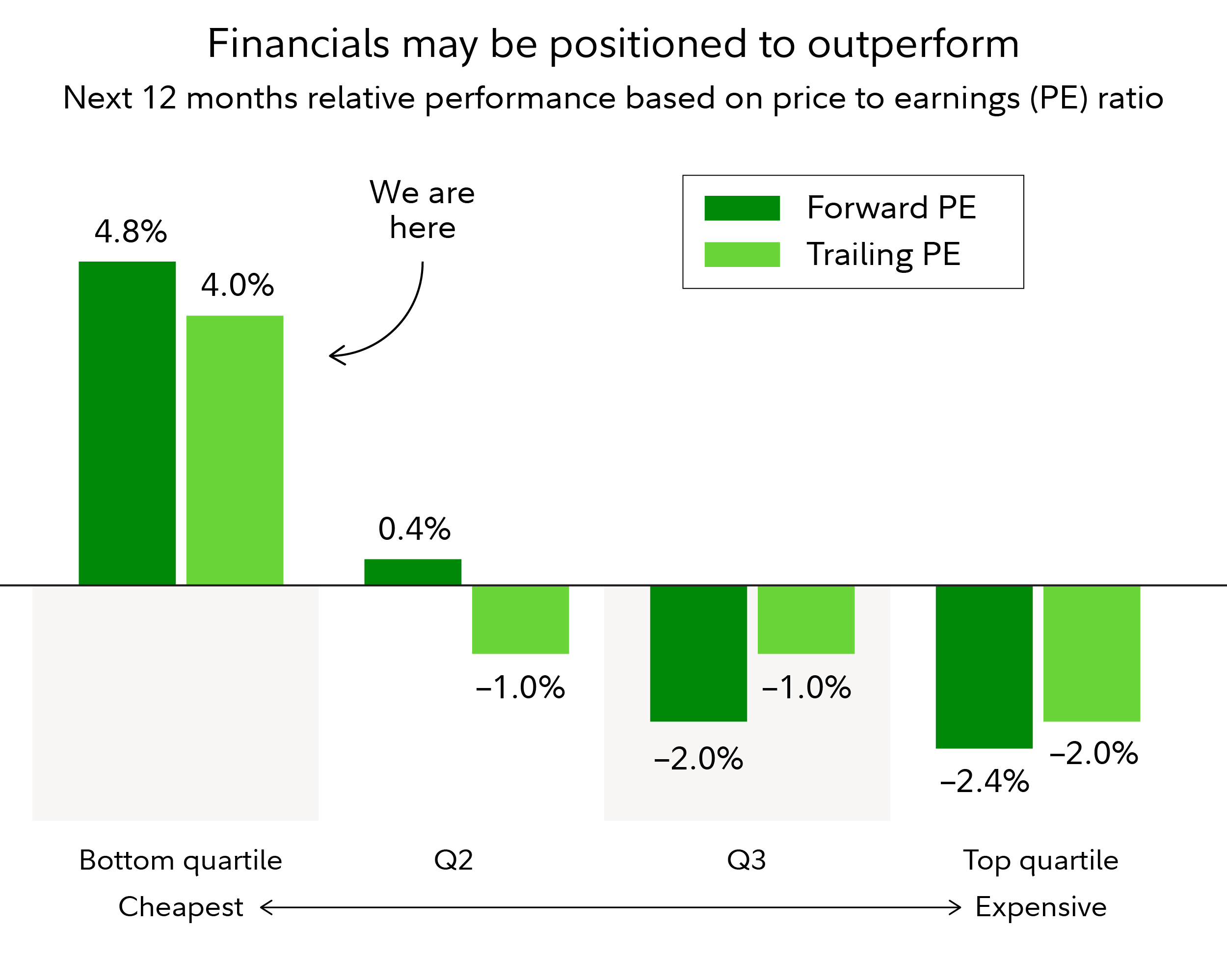

The often-sleepy financial sector suddenly burst to life in a post-election surge, positioning financials to be one of the top-performing sectors for 2024. Chisholm says that despite that surge the sector still looks undervalued—one of the main reasons it’s one of her top picks for the new year. “The sector’s valuations have remained in the bottom quartile of its historical range,” says Chisholm, a dynamic that historically has preceded outperformance.

3. Consumer discretionary stocks

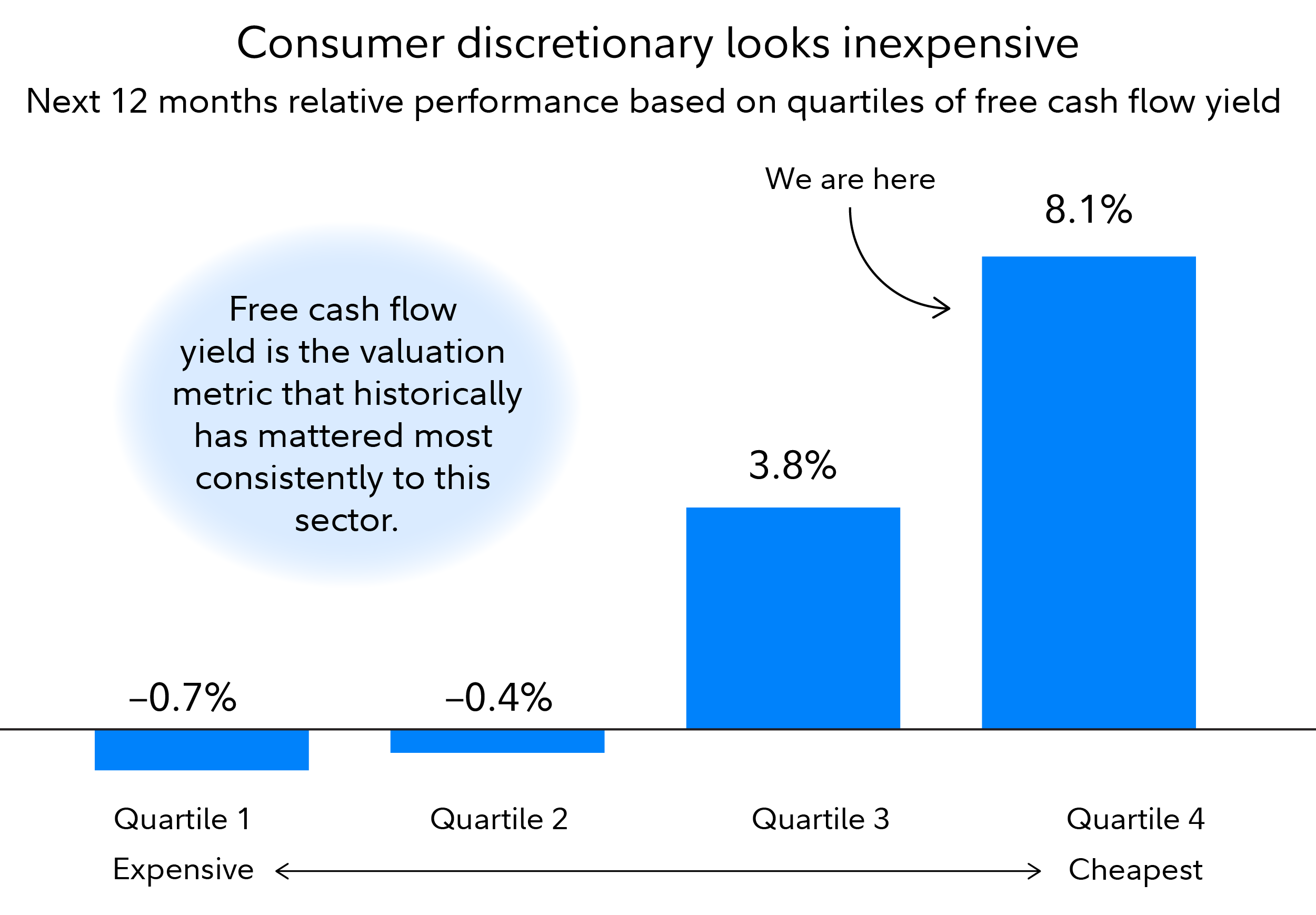

Chisholm’s other top sector pick for the year ahead is consumer discretionary. This sector consists of companies that mainly do well when the American consumer is doing well: Think new cars, online shopping, hotels, and luxury goods. She notes that in the last year, the sector’s valuations relative to the market declined significantly (based on price to free cash flow). Chisholm also notes that in the same period, the sector’s earnings grew faster than the market. In isolation, each of those dynamics might be a bullish indicator, but in combination they could be an even stronger signal.

“The combination of low valuations and market-beating earnings growth has been rare and powerful for the sector,” Chisholm says.

4. Bank bonds

Investment-grade bonds issued by large, globally important banks in the US and Europe may offer attractive opportunities in 2025. Fidelity® Corporate Bond Fund (

For specific fund information, including full holdings, please click on the fund trading symbol above.

5. Convertible bonds

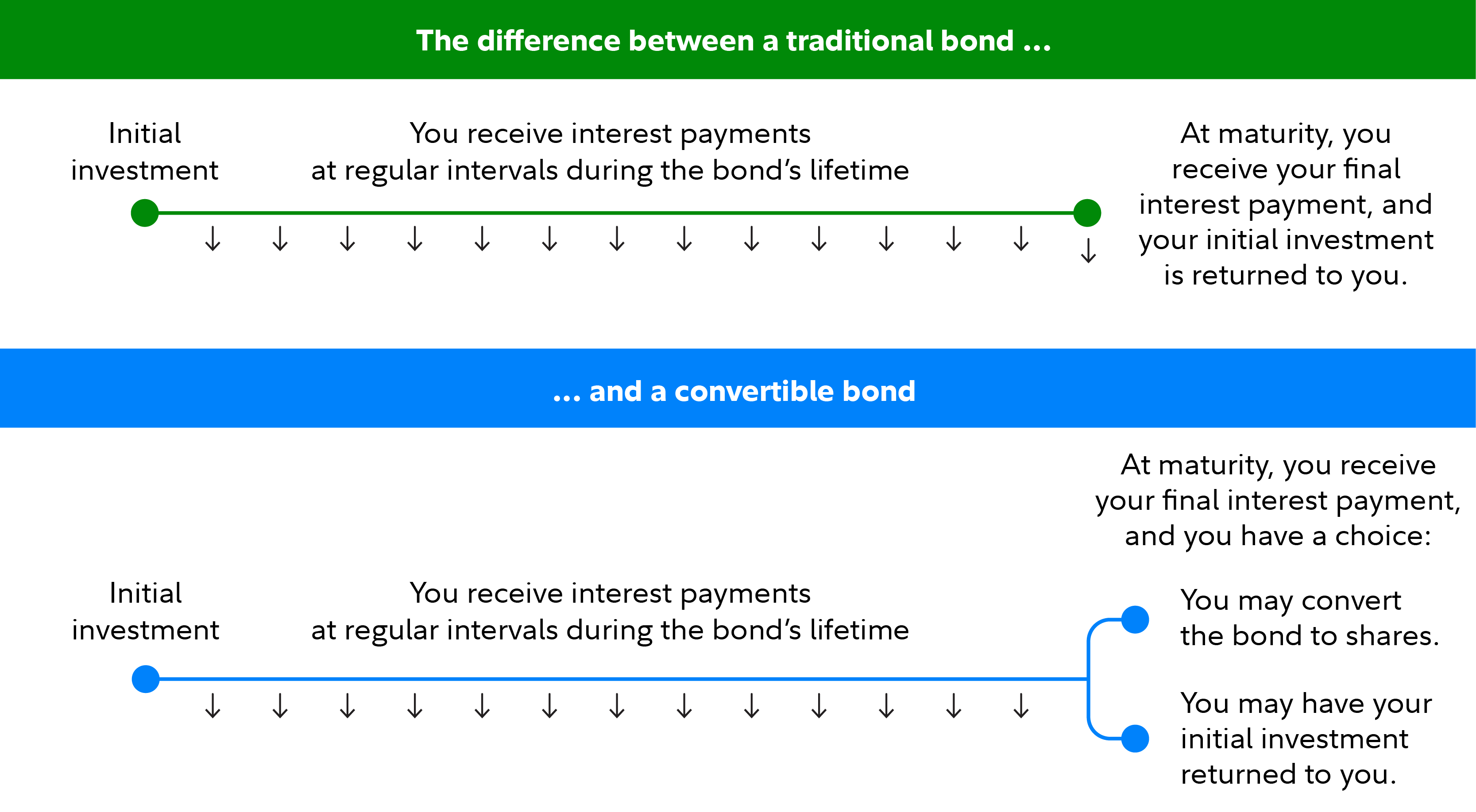

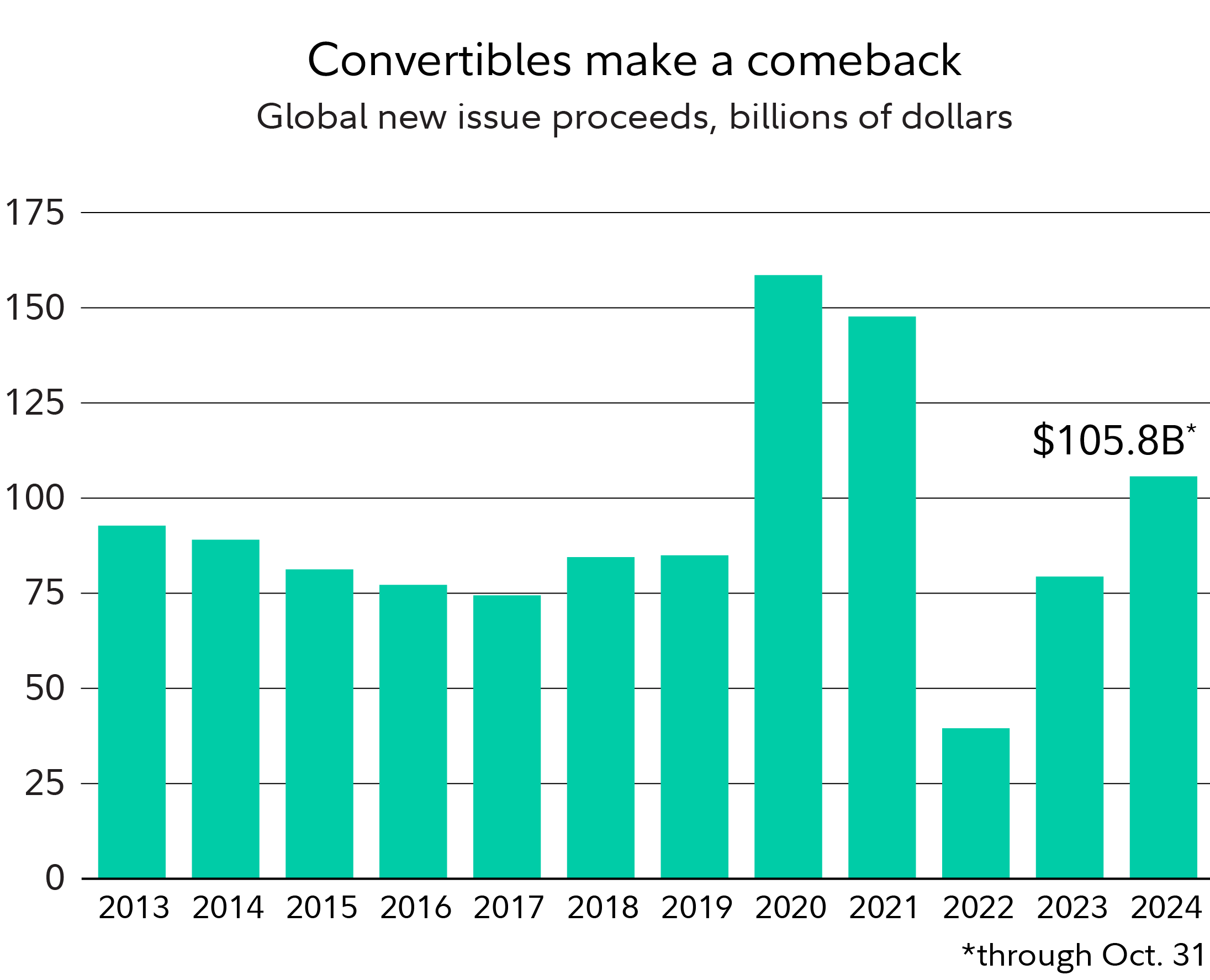

Convertible bonds are securities that pay interest like other bonds, but which also may be converted to shares of the issuing company’s stock. Adam Kramer manages Fidelity® Multi-Asset Income Fund (

Kramer believes that as 2025 approaches, convertibles not only offer attractive yields, but they also can enjoy future potential gains in the stock market that many investors are expecting in the next few years if deregulation and tax cuts help boost US stock prices.

Small though it may be now, the convertible market is also growing. “I wouldn't be surprised if convertible bonds are going to be a bigger part of the market in the next few years,” says Kramer. “I think now we're entering a golden age of convertible bonds. We're starting to see some really interesting deals come to the market.”