Description

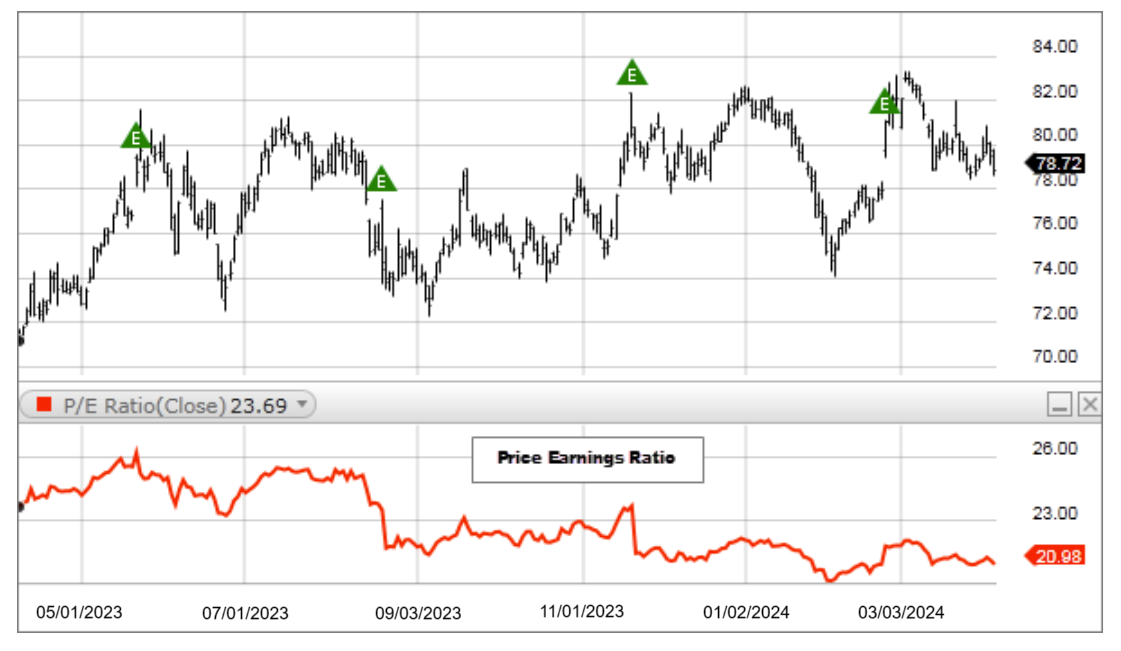

PE Ratio, or Price to Earnings Ratio, is a valuation ratio where a company's current share price is divided by its per-share earnings.

- PE Ratio is one of the most widely watched measures of valuation for both the stock market as a whole and for individual stocks. Many use it to determine whether the market (or a stock) is overvalued, fairly valued, or undervalued.

- In general, a high PE suggests that investors are expecting higher earnings growth in the future compared to companies with a lower PE.

- PE is sometimes referred to as the "multiple," because it shows how much investors are willing to pay per dollar of earnings. If a company is trading at a PE of 15, an investor would be paying $15 for $1 of earnings.

The PE Ratio is calculated as follows:

PE Ratio = (Market Value per Share) / (Earnings per Share (EPS))

Where: EPS is the summation of the last four quarters earnings.