If this year’s market volatility has got you second-guessing your investing strategy, you're not alone.

It’s hard to feel certain about your investments when the economy feels so uncertain and when the market’s drop of almost 20% earlier this year is still fresh on investors’ minds. With no shortage of worrying news headlines, many investors may be wondering if they ought to change up their portfolios or even sell out of stocks in an attempt to head off any further volatility.

But history shows that getting or staying out of the market has often led to weaker returns for investors. In fact, some investors may be so worried about what they can't control—like whether the market will go up or down in the next year—that they overlook the things they can control, like managing taxes on their investments and avoiding emotional decision-making.

Read on for 7 top mistakes that investors are making now, and how to avoid them yourself.

1. Avoiding investment decisions due to uncertainty

Where will tariff rates finally settle? Is the economy slowing? Could high inflation come back?

There’s no shortage of questions to keep investors up at night right now—and keep them second-guessing whether it’s the right time to invest. Naveen Malwal, institutional portfolio manager with Strategic Advisers, LLC, the investment manager for many of Fidelity’s managed accounts, says he sees many investors staying out of the market in the hopes that the landscape will look less uncertain at some future time.

“In most environments there are a few factors that may give investors pause,” says Malwal. “Last year it was the election, and this year it might be tariffs or the latest job numbers.”

The trouble with waiting for greater certainty is that it can leave investors waiting a long time—sitting on the sidelines while the market is potentially still rising. “Some investors want to see a lot of positive news headlines and flashing green lights before they jump into the market, and in my experience, it is exceedingly rare to find that,” says Malwal. Markets have historically tended to rise over the long term, usually amid continued uncertainty.

2. Always expecting the “next shoe to drop”

In a similar vein, some investors may be sitting out of the market due to fear that a major market decline or economic recession may be right around the corner.

“Distressing headlines can lead investors to assume the worst,” says Malwal. Headlines do occasionally spark short-term market volatility. But often the bigger risk is that by over-focusing on the negatives, investors end up missing out on opportunities and long-term growth. “Those investors may find themselves falling behind, because worries kept them out of a relatively good environment,” he says.

“Relatively good” might be an apt description for the current economic environment. US companies generally experienced better-than-expected earnings growth in the second quarter, and analysts expect S&P 500 companies to earn 10% more in 2025 than they did last year.1 Even after recent revisions to job numbers, the job market has been continuing to grow. And unemployment has remained low and relatively stable. “With rising earnings and a steady job market, recession doesn't feel imminent to me,” says Malwal.

Even if the US does eventually encounter a recession, it’s typically no reason to abandon a well-thought-out investment plan. Over long periods the market has historically recovered from recessions and even a depression—often beginning to rally before the economic downturn is even over.

3. Waiting for cheaper valuations

US stocks have experienced generally strong returns for the better part of the past 3 years—even after the market's big dip earlier this year. The S&P 500 delivered a cumulative total return of more than 60% over the 3 years through August 7.

Yet after such a strong run, some investors may worry that the market is now overvalued and that they should either “get out at the top” or wait for lower valuations before investing more.

“It’s true that US stock valuations such as forward price-earnings ratios are above their long-term average,” says Malwal. (Forward price-earnings ratio means current stock price divided by consensus earnings estimates for the next 12 months). “And yet, that may not be a reason to avoid the market.”

Malwal says that historically, valuations like PE ratios have not been reliable signals for telling investors when to get in or out of the market. “Performance has been stronger following periods when valuations are low, but you don’t necessarily get negative returns following high valuations,” he says. Instead, markets have historically delivered more modest positive returns after periods of high valuations—but still better returns than are typically available in bonds or short-term investments.

In other words, high valuations on their own shouldn't be a reason for selling out of stocks or avoiding investing. Instead, they’re often simply a reflection of investors’ expectations of strong earnings growth.

That said, Malwal notes that high average valuations in the US could be an additional reason for investors to make sure they are well diversified. Stocks in both developed and emerging international markets have lower average valuations than US stocks. Valuation-sensitive investors can also find opportunities in the US by looking beyond some of the largest and most well-known stocks.

4. Holding too much in CDs and other short-term investments

Short-term CDs and Treasurys came into favor among many investors in the past few years as rates rose. Many investors feel comfortable in these investments due to the potential protection they can provide in a down market, their low risk of default, and their predictable cash flows.

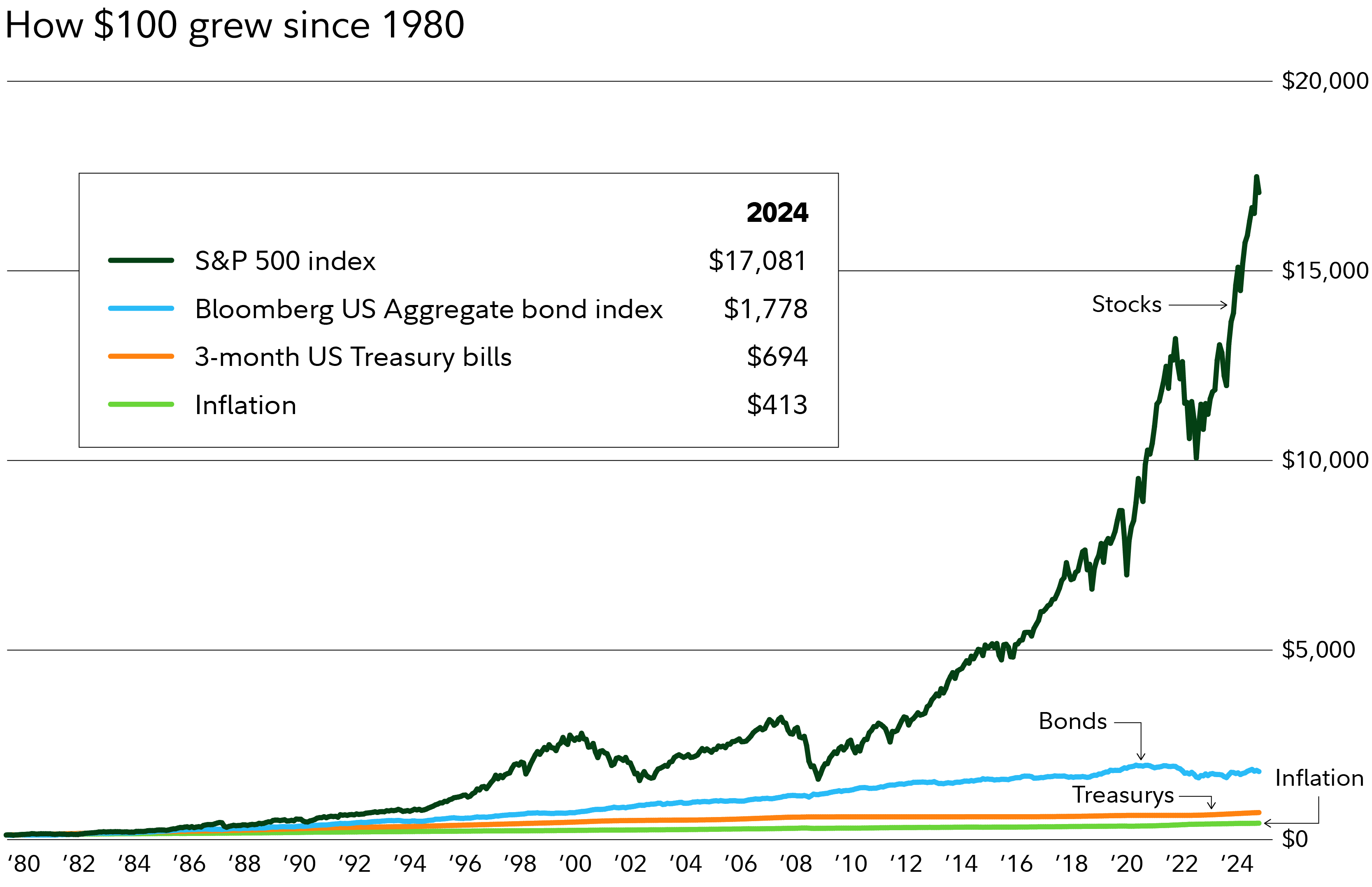

“There are many wonderful features of short-term investments,” says Malwal. “But history shows investors with a long-term outlook have often been better off including stocks in their portfolios.”

The key challenge with short-term investments is a lack of stronger growth potential. “While it’s true that stocks may be more volatile than short-term investments or bonds in the near term, over the long run stocks have provided much higher returns,” says Malwal. Although rates on these investments may appear attractive, they may not be providing much growth after accounting for inflation.

Says Malwal, “Investors who have time on their side can typically benefit from having a broader exposure to stocks and bonds, or a combination of the 2, as opposed to staying in short-term investments for a long time.”

5. Trying to predict the future

If you browse financial news headlines, it's easy to find points of view making confident predictions about the future of the market, an asset class, or a given stock. Some investors may also enjoy the process of developing their own predictions, feeling that they are putting together a challenging puzzle, to better see the big picture.

While these predictions may feel compelling, remember that the wisest investors don't simply follow the most persuasive voice in the room. Instead, they typically follow a disciplined investing plan. The future seldom unfolds exactly as anyone predicts. And even when it does, the market has often already priced in any good or bad news.

“Rather than trying to predict what’s going to be the next major market development, what I have found helps investors more over the long run is to develop a sensible and well-rounded investing plan, which includes diversifying across a whole host of investments," says Malwal.

6. Not factoring taxes into investing decisions

Investors often think of their brokerage accounts as accounts they should use for trading stocks or pursuing their latest ideas. But because brokerage accounts are not tax-deferred, Malwal says this can lead to one of the top mistakes he sees: generating a bigger tax bill than necessary.

Actions like trading a lot and holding tax-inefficient investments can increase investors’ tax bills. “Generally speaking, in taxable accounts, investing tax-efficiently and making gradual changes may help investors keep more of what they earn before taxes,” he says.

Simple actions like choosing a mutual fund that trades less or keeping in mind the potential benefits of lower long-term capital gains tax rates may help investors keep more of what they potentially earn. Some investors could also benefit from tax-loss harvesting in their taxable accounts, which can help reduces taxes by offsetting gains or income. (If you’re already working with Fidelity, try our Tax-Loss Harvesting Tool for step-by-step guidance to see if you can save on taxes while staying invested.)

7. Letting the perfect be the enemy of the good

Analysis paralysis can be a problem for any investor.

Even if you’ve come up with a solid investing plan, it can be easy to get hung up on “what if” questions. What if I’m missing out on an even better investment option? What if the market crashes tomorrow? What if my plan just doesn’t work out?

The reality is that investing is inherently uncertain. Even the most experienced investors can only work off estimates, not certainties. While investors might worry about the “right” answer to any given investing question—like what investment to buy or when to get into the market—the fact is there may be a range of reasonable solutions.

One thing has been true time and again historically: Over long periods, investors have done better by being in the market than being out of the market. If you’ve got a well-rounded, suitable plan that’s sensitive to your financial needs, then don’t let hang-ups about the perfect investment or the perfect time derail you from your goals. And if you need help developing a plan, learn more about how we can work together.