Rebalancing is a key part of maintaining your investments over time.

If getting invested is like buying a car—you have to put in some time and research and make a few major decisions up front—then rebalancing is like taking your car in for occasional maintenance. It’s a bit of a lift, but the effort is worth it to make sure that everything is running as expected and that you can get where you need to go.

What is rebalancing?

Rebalancing is the process of buying and selling investments to help keep your portfolio in line with your investment strategy.

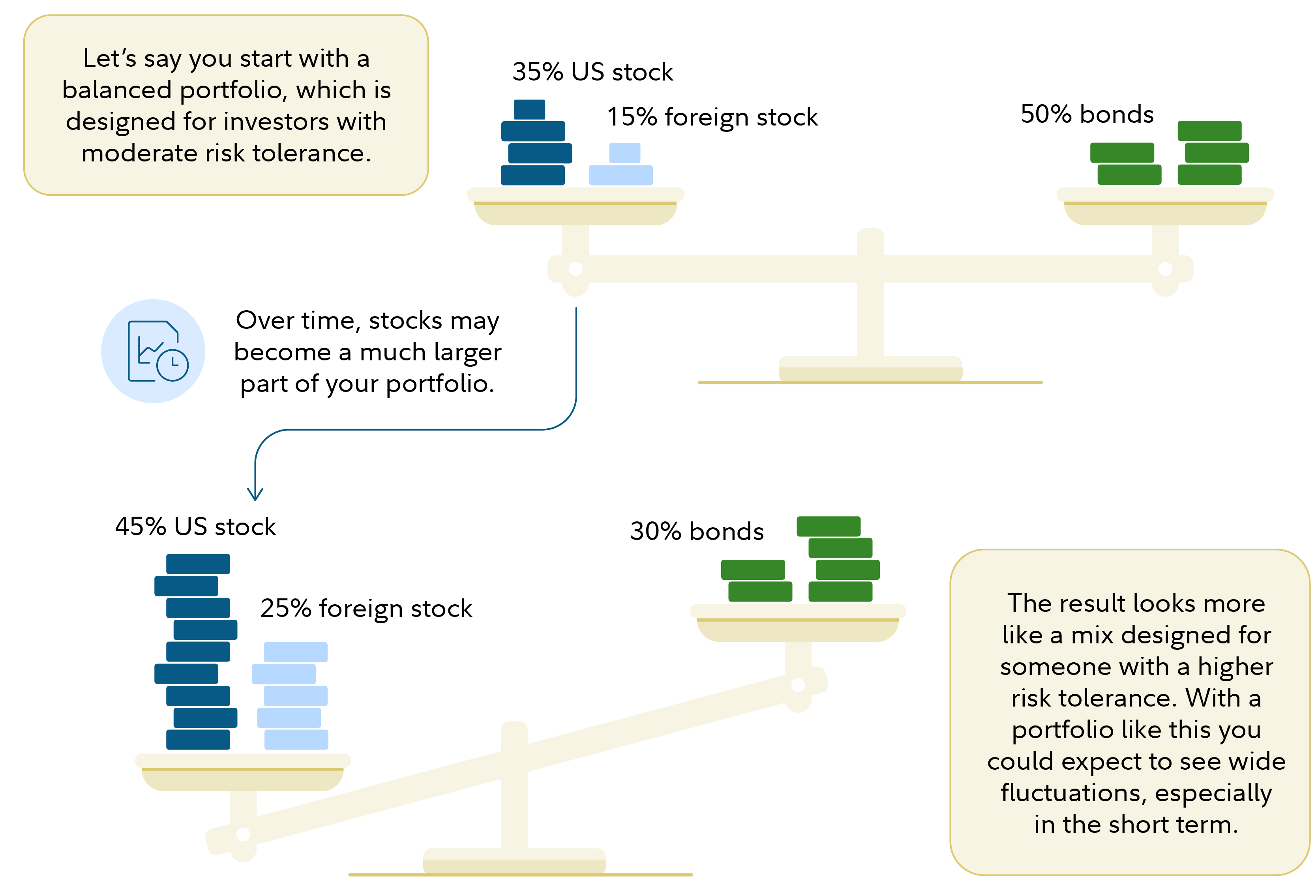

When you first started investing, you probably came up with a targeted asset allocation. For example, maybe that asset allocation included a 50% allocation to stocks. Over time, as your investments change in price and deliver different rates of return, your actual allocation will tend to drift away from your original target.

Rebalancing means bringing your portfolio back in line with your targeted allocation, by reducing positions that have grown larger than intended and adding to positions that have become smaller.

Why is rebalancing important?

Rebalancing is important to help keep you on track for your investing goals. In a well-rounded portfolio, every investment serves a particular role. Maintaining your targeted balance among your different investments may help your portfolio continue potentially performing as you need it to.

More specifically, rebalancing can help to:

Manage risk

There may be times when your higher-risk investments perform better than your lower-risk investments. However, if these higher-risk investments grow as a percentage of your portfolio, then your portfolio’s overall risk level also increases. Rebalancing can help bring your overall risk exposure back on track.

Maintain returns potential

There may be other times when your lower-risk investments perform better, such as during a down market, leading them to grow as a percentage of your portfolio. While it can feel reassuring to hold low-risk investments, over longer periods they have typically offered lower returns. Rebalancing at such times—by trimming lower-risk investments and adding to higher-risk ones—can help bring your future potential returns back up to your targeted level.

Stay diversified

As your asset allocation drifts off course over time, certain specific portfolio positions might become disproportionately large. Rebalancing helps restore your portfolio’s diversification, so that your risks and returns potential are spread widely among investments.

How to rebalance?

Here are the essential steps to rebalancing.

Step 1: Identify your portfolio’s current asset allocation

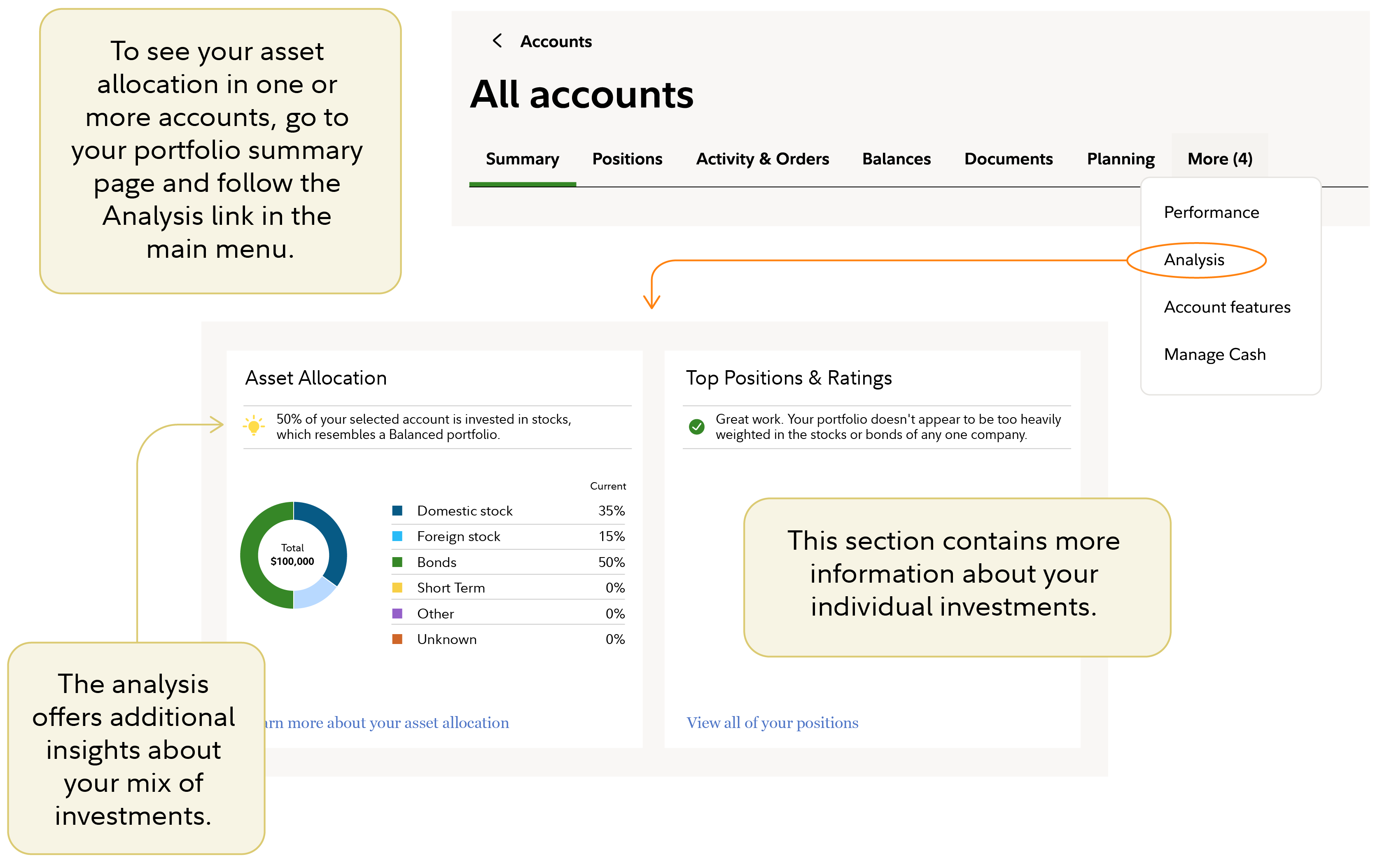

This means figuring out what percentage of your portfolio is currently made up of different major asset classes, such as US stocks, international stocks, bonds, and short-term cash-like investments. Some investors may also prefer to look at more granular categories, like further drilling into their allocations to large companies versus small companies.

Fidelity investors can see their asset allocation across all accounts, and also by individual account, by navigating to the analysis section of their portfolio summary .

Step 2: Compare with your targeted asset allocation

Line your actual asset allocation against your targeted asset allocation and look for categories that are now over target or under target.

If you’ve never come up with a targeted asset allocation, then consider this your invitation to finally do so. You can start by learning more about investing basics, reviewing model portfolios targeted to various risk tolerance levels, or checking out sample asset allocations from the Fidelity Go® robo advisor. Or, if you’re feeling intimidated by these decisions, consider getting help.

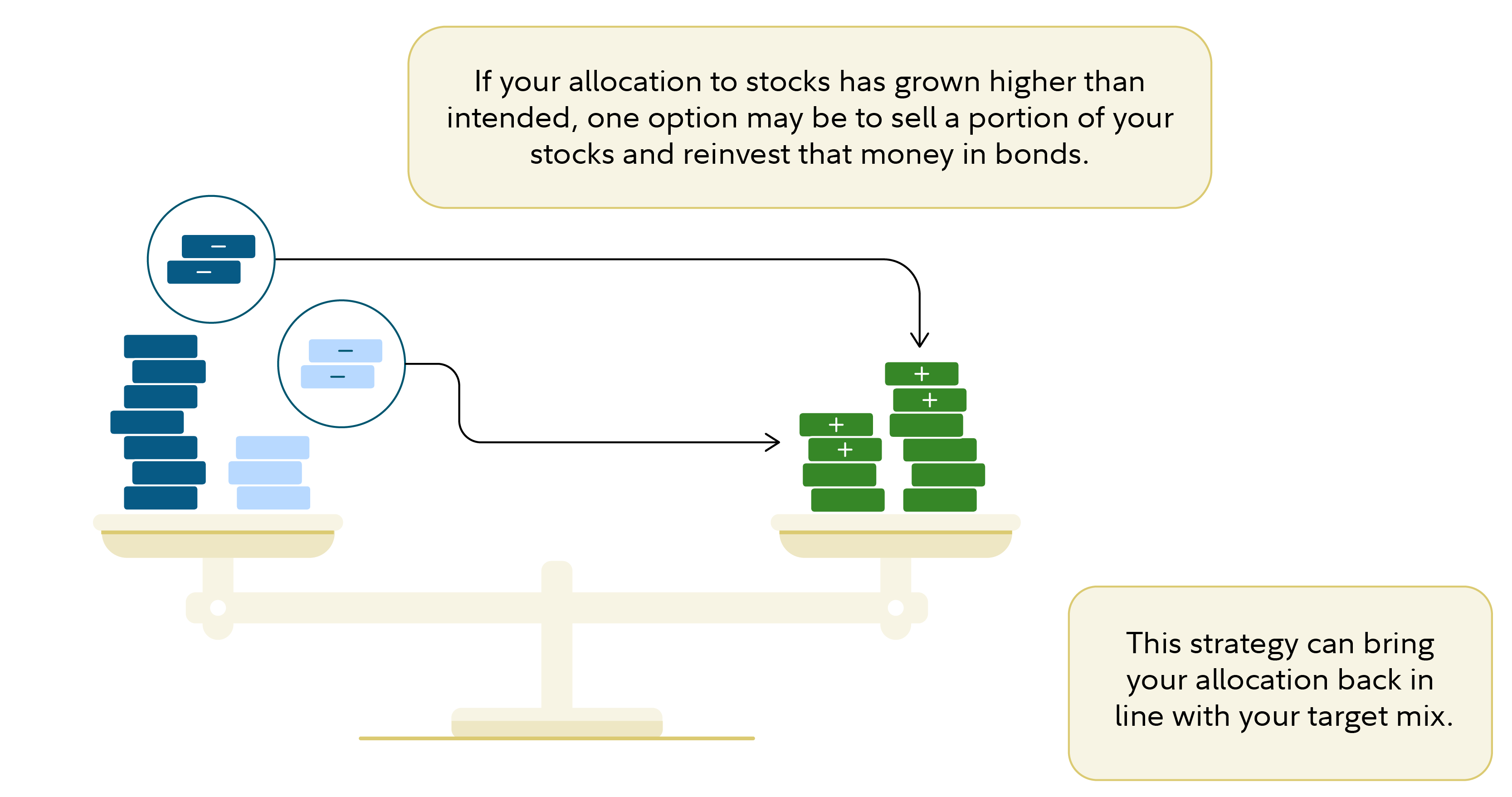

Step 3: Figure out how much you need to buy or sell of each position

Generally speaking, this will mean selling a portion of any investments that have grown too large as a percentage of your portfolio and buying more of any investments that have become too small.

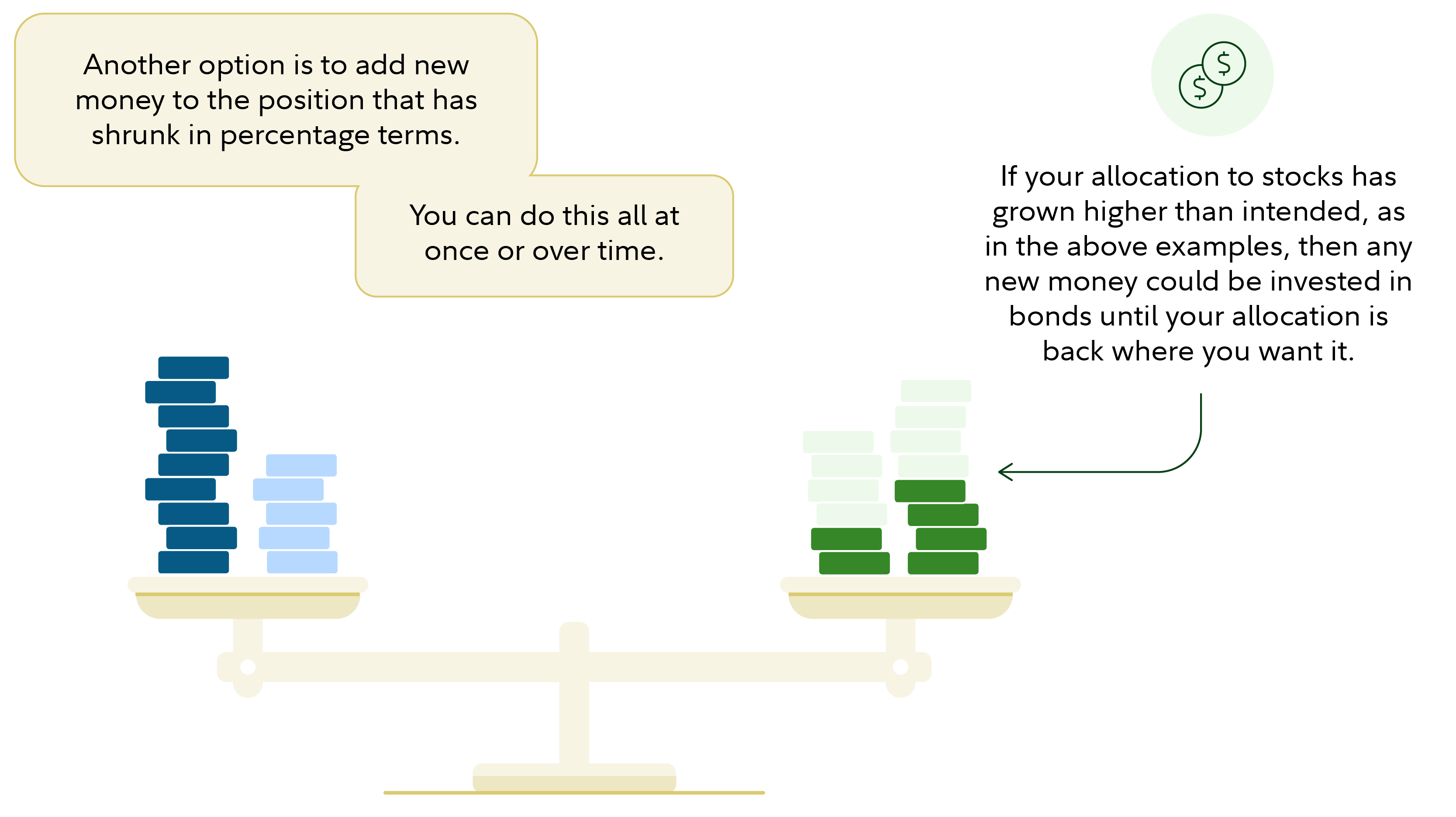

If you’re planning to contribute more to your investments soon, another option is to use those new contributions to rebalance. This might allow you to restore your targeted allocations without selling any positions—and instead by buying more of positions that have shrunk in percentage terms.

Step 4: Make the necessary trades to rebalance

The final step is to place the trades needed to bring your portfolio’s actual asset allocation back into line with your targeted allocation.

Keep in mind that—depending on how much cash is already in your portfolio—you might need to execute your “sell” trades first, in order to generate the cash needed to place your “buy” trades.

Can rebalancing trigger a tax bill?

Whether rebalancing triggers tax consequences depends on what type of account you’re trading in.

Rebalancing within a tax-advantaged account does not generate tax consequences. These types of accounts include 401(k)s, Roth and traditional IRAs, health savings accounts (HSAs), and 529 accounts.

Rebalancing within a brokerage account, however, can trigger tax consequences if you are selling part of a position. If you sell an investment at a profit—meaning you’re selling it at a higher price than you paid for it—then the sale will create a capital gain, which is generally taxable. If you sell a position at a loss, then the sale will create a capital loss, which you can potentially use to offset a certain amount of capital gains or income—essentially reducing your taxes.

As mentioned above, rebalancing with new contributions might allow you to bring your portfolio back on track without having to sell any positions, and so can help avoid triggering taxes when rebalancing in a brokerage account.

How often should you rebalance?

There are 3 main approaches to deciding when to rebalance:

- Calendar approach. Rebalance on a set periodic schedule, like once a year.

- Threshold approach. Rebalance when your asset allocation strays off course by a certain amount, like anytime a position deviates by 5 percentage points or more from your target.

- Hybrid approach. Evaluate your portfolio for rebalancing on a set schedule, like once a quarter, but only rebalance if your asset allocation has strayed off course by a certain amount.

Although it’s important to maintain your portfolio, you also don’t want to tinker with it excessively. Monitoring investments too closely can tempt investors to trade too much or to make reactive trading decisions. Rebalancing too frequently can also subject you to unnecessary costs if you’re trading in a taxable account, or if you pay transaction fees on trades (like a commission on stock trades or a sales load on mutual fund transactions).

Try to find a balanced approach to rebalancing, that keeps your allocations reasonably on course, while also being mindful of taxes, transaction fees, and your mental bandwidth.

Get help with rebalancing

Rebalancing is simple enough in concept, but it can become complex if you’re investing in a taxable account. On top of that, some investors find it very stressful to execute trades—due to fears that they might make a mistake or lack of confidence in their investing decisions.

The good news is that there are investing options that can take the burden of rebalancing off your shoulders. These can include all-in-one mutual funds, such as target date funds, or professional money management, like with a robo advisor or dedicated financial professional.

If you think you need more help but you’re not sure about your next step, consider how we can work together, or take a quiz to see what type of managed account might fit your needs and goals.