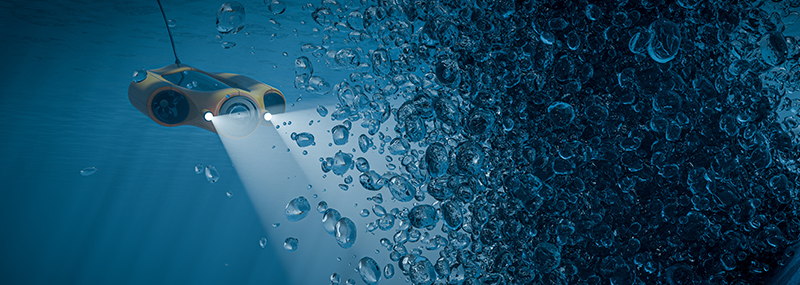

Underwater-drone technology is poised to revolutionize various military and civilian applications by offering a unique blend of innovation and practicality, opening up a sea of buoyant investment possibilities, according to Fidelity Portfolio Manager Marc Grow.

“Based on fairly new, rapidly expanding advances, these submersible marvels offer a cost-effective and scalable solution for data collection and other critical missions, all while minimizing risk to human life,” says Grow, who manages Fidelity® Small Cap Stock Fund (FSLCX). “I believe the shift toward smaller, more-versatile subaquatic technology is not just a trend, but the beginning of a strategic oceanic evolution.”

In helming the diversified domestic small-cap core strategy, Grow favors businesses with an honest and capable management team, superior return metrics, and strong free-cash-flow generation. His investment framework tends to be value-oriented and biased toward high-quality businesses.

As Grow sees it, the nascent industry for underwater drones could be on the verge of a major leap forward akin to the transformative impact of aerial drones in recent military conflicts where these low-cost tools have demonstrated meaningful capabilities.

“Cutting-edge improvement in underwater drones is at least a decade behind their aerial counterparts, meaning this lag makes the market ripe for growth,” Grow explains. “I believe the ability to deploy these devices at greater scale and a fraction of the cost of larger, manned vessels holds tremendous promise for Western navies over the coming decades.”

He goes on to consider the current state of underwater infrastructure: Pipelines and other submerged assets require constant monitoring and protection from both accidental and intentional damage.

“These are critical energy and communication infrastructure assets,” Grow points out. “Look no further than the recent incident in the Baltic Sea, when two subsea telecommunications cables – one connecting Finland and Germany, the other linking Sweden and Lithuania – were cut.”

These cables are vital to global internet connectivity, as they are responsible for the vast majority of intercontinental data traffic around the world.

Grow highlights that Western navies have traditionally focused on large-scale projects like nuclear submarines and aircraft carriers, which are both extraordinarily costly and time-intensive.

“In contrast, underwater drones offer a nimble and cost-effective alternative, capable of performing critical tasks without the need for human operators,” he notes. “They also play a crucial role in safeguarding armed forces.”

Grow cites Canada’s Kraken Robotics (KRKNF) as a firm that has positioned itself as a leader in this burgeoning industry. A fund holding as of December 31, the company offers a diverse range of products – including sonar systems and pressure-tolerant batteries – that are designed to operate at depths of up to 6,000 meters, he says. Kraken also manufactures a vehicle launch and recovery system for safely and efficiently bringing drone units in and out of the water.

“Unfortunately, many of these emerging defense technologies remain private investments, but I will continue to scour the depths of the market for additional investment opportunities that align to both this theme and my investment approach,” Grow concludes.

For specific fund information, including full holdings, please click on the fund trading symbol above.

Marc Grow is a research analyst in the Equity division at Fidelity Investments.

In this role, Mr. Grow is responsible for the coverage of U.S. small-cap industrials stocks. He also manages Fidelity Small Cap Stock Fund and Fidelity Small Cap Stock K6 Fund. Previously, Mr. Grow was on the equity research team covering small-cap consumer stocks and auto dealerships.

Prior to joining Fidelity, Mr. Grow was the chief financial officer of Lakeside Capital Group and was also an equity analyst at the value- focused hedge fund V. I. Capital Management. He has been in the financial industry since 2010.

Mr. Grow earned his bachelor of arts in accounting from Whitworth University and his master of business administration degree with a focus on value investing from Columbia University. He is also a CFA® charterholder.