ETFs can be incredibly valuable and useful tools in investors' toolbelts. Whether you're looking for low costs, a simple way to diversify, or an investing choice to help improve tax efficiency, ETFs have a range of attractive attributes that can help them fill a variety of roles in investors' portfolios. (Before you decide to invest in ETFs, make sure you understand the risks. Learn more about the basics of ETFs.)

These days there are so many ETFs to choose from—and their potential benefits are so widely understood—that many investors choose to build full portfolios out of ETFs.

Of course, building a well-rounded portfolio can feel like a tall order even to experienced investors. That's why we've sought to help simplify the process and break it into manageable steps, so you stay focused on your goal of getting invested.

Here are 5 steps to help you build an ETF portfolio.

Want to make it even simpler?

1. Figure out how much risk to take on

Taking on risk sounds like a bad thing—but it's important to remember that in investing, risk and return potential are joined at the hip. A low-risk portfolio won't have the potential to return as much as a higher-risk portfolio over the long run.

Rather than gravitating to the extremes of no risk or excessive risk, many people find it makes sense to choose a risk level (and potential returns level) that's somewhere in the middle. Here are some of the main factors that typically inform this decision:

- Time until you'll use this money (aka time horizon). All else equal, the longer this money will stay invested, the more risk you may be able to take on. That's why a 20-something investing for retirement and who is comfortable with the ups and downs associated with a riskier portfolio can typically invest in an aggressive, stock-heavy portfolio. But someone saving up to buy a house in a year probably should not take on much risk with their down-payment money.

- How you feel about market swings (aka risk tolerance). An aggressive portfolio might return more over the long run but could go through more severe declines over shorter-term periods. Risk tolerance is a measure of how much stock market up-and-down you're willing to put up with in exchange for potential longer-term growth.

- Overall strength of your finances (aka risk capacity). If you're on strong financial ground—i.e., you have solid emergency savings, you don't have too much debt or any high-interest debt, you have enough insurance coverage and a stable job—you may be able to take on more risk than you would if your foundation was shakier.

Learn more about how these 3 key factors work together to inform your investing strategy.

2. Translate that risk level into an overall investment mix

Once you understand how much risk you can take on, you can start to zero in on a targeted investment mix. Your investment mix is also known as your asset allocation, and it means what percent of this portfolio you're holding in different major types of investments.

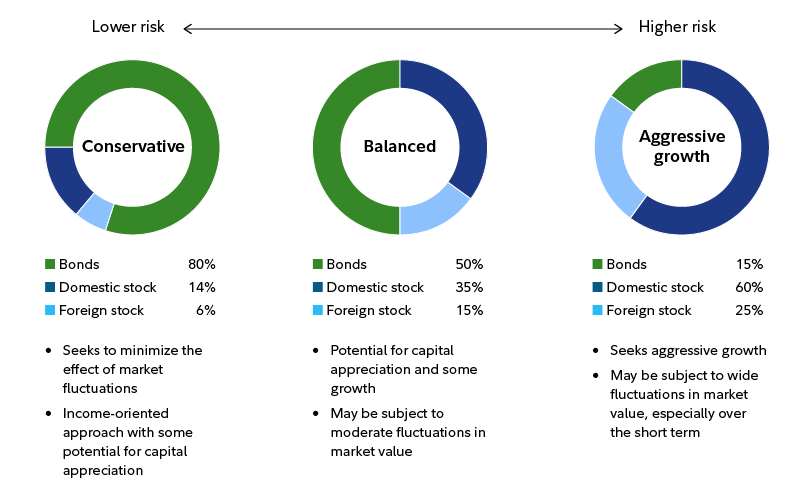

At a high level, people often think about this in terms of their overall mix between stocks and bonds. Stocks generally have higher-risk and higher-return potential than bonds. So a portfolio with 90% stocks and 10% bonds would be more aggressive than a portfolio with 50% stocks and 50% bonds. To get more granular with your portfolio, you might also consider the mix between US stocks and foreign stocks.

Here are some examples of potential investment mixes an investor might target at this stage—covering a wide range of risk levels.

Just remember there's no single "best" investment mix—just tradeoffs to weigh in relation to your situation and preferences. Planning tools may be able to help you work through this step.

3. Fill in the buckets of that investment mix with specific ETFs

Now that you have the outline of your portfolio sketched out, it's time to shade in the details with specific ETFs.

For each of those buckets within your asset mix, you'll generally want to be broadly diversified among many different investment types (learn more about why diversification is so important and how to diversify). For example, in the US stock portion of your portfolio you might diversify by owning stocks from companies in a wide variety of industries and owning some smaller companies in addition to large companies. Fortunately, many ETFs are themselves so diversified that it can be possible to achieve these goals with just one or a few ETFs for each of those buckets.

Fidelity's ETF offerings and ETF research resources can help you filter through the ETF universe. Chances are, there will be many ETFs that could meet your needs and fulfill each of these specific roles in your portfolio. To narrow your search further (and avoid getting stuck on this step), here are some factors you might consider as you're comparing specific ETFs:

- Targeted investment universe. ETFs could fall into the same broad category, like international stocks or US bonds, but actually target very different parts of those investment universes. Checking each ETF's objective and benchmark (meaning what index it's measured against) can help you get clearer on this, to help you choose an appropriate ETF for each role in your portfolio.

- Active vs. passive. An active ETF is generally run by one or more professional managers, who evaluate investments and decide what to hold in the ETF. A passive ETF (aka index ETF) tracks the performance of an index, generally by holding the same investments the index tracks. Some investors feel strongly that active is always better or passive is always better, but many find that there are pros and cons to each approach and may use a mix of both. (Learn more about index investing and about actively managed ETFs.)

- Expense ratio. This is essentially the cost of being invested in a given ETF. Many investors choose ETFs for their relatively low cost structures. The main way to compare costs among ETFs is by looking at each ETF's expense ratio, which shows the annual cost of investing in the fund as a percent of assets managed. For example, for $1,000 invested in an ETF with an expense ratio of 0.25%, that would work out to $2.50 a year.

- Issuer. The issuer (aka sponsor) means the company that offers and manages the ETF. Particularly for the core parts of their portfolio, some investors prefer to invest with an established ETF provider with a strong reputation and long investing track record.

- Analyst ratings. Many ETFs receive ratings from firms that analyze ETFs. These ratings are not intended to predict how an ETF will perform, but rather to measure how well an ETF is managed in terms of its cost, efficiency, and other factors.

Of course, these are just some of the potential considerations. As you become more familiar with ETF investing you may grow comfortable with doing more deep-dive research.

4. Make the trades to buy your ETF portfolio

You've got your list of ETFs to invest in, and you know what percent of your portfolio you're going to invest in each. Now you just need to place some trades. For that you'll need to make sure you have each ETF's ticker symbol handy, and to make sure you've translated your targeted percentage allocations into dollar amounts.

If you're an experienced investor then this step might be a breeze. But if you're newer it can be nerve-wracking to hit that "Place Order" button. Investors with Fidelity can follow a step-by-step guide on How to trade stocks and ETFs to help walk you through the process from start to finish.

5. Monitor and adjust as needed

Once your trades are completed, you'll own an ETF portfolio. But it's important not to see this as the end of the process. You'll want to periodically check in on your ETF portfolio, consider whether it's still meeting your needs and goals, and potentially make adjustments.

Here are some of the issues you'll want to check in on from time to time:

- Have you saved more toward this goal? As you sock more cash away for this purpose, you may need to place additional trades to get that extra cash invested and keep your targeted investment mix on track. (If you're regularly saving additional amounts every month, you may be able to automate this process.)

- Do you need to rebalance? Over time, it's normal for a portfolio to start to drift away from its targeted investment mix. Periodically you may need to place a few trades to bring your portfolio back on track—such as trimming some top-performing positions if they've grown to be an outsized portion of your portfolio.

- Do you still have the right targeted investment mix? Sometimes, your goal for a particular pot of money changes, which means you need to reevaluate the right risk level for that portfolio. Even if your goal hasn't changed, it may be drawing nearer. Many investors find it makes sense to reduce risk as they near an investing goal—such as by holding more in bonds and less in stocks as they near retirement.

- Is each investment doing its job in the portfolio? Every ETF in your portfolio should be there for a reason. If you've bought an ETF because you want it to track the performance of US large-cap stocks, then you want it to perform in line with large-cap US stocks. If one of your investments isn't filling the role you expected it to, you may need to reevaluate.

For more on monitoring and maintaining your investments, learn about how to give your portfolio a checkup.

Ready to take the next step?

For a streamlined approach to building an ETF portfolio, Fidelity customers can try the ETF Portfolio Builder. For a more hands-on do-it-yourself approach, investors can use the ETF screener to find ETFs that meet their criteria. Or, if you need a bit more support in making progress on your investing journey, you can learn about how we can work together.