With US stocks hitting record highs over the past year, it’s been easy to lose sight of the fact that stocks can go down as well as up. But as the dog days of August began, stocks delivered a vivid reminder of that fundamental truth of investing. In just 3 days, the S&P 500 dropped 6%, including a nearly 3% decline in a single day on August 5. Thankfully, the market bounced back in short order but there is no guarantee that the next market drawdown will heal itself so quickly.

Younger people who have decades before they need money from their stock portfolios for retirement can take comfort from the fact that historically stock prices have risen over the long term, despite unpleasant and inevitable volatility.

Investors who are closer to the time when they need to rely on their portfolios rather than on jobs for income may find that long-term trend less helpful. That’s because the time that stocks have taken to recover after downturns has historically varied widely. Some recoveries such as the one last month have been short and sharp. At other times, though, the market has taken years to return to its previous high. Those steep drops and slow recoveries have historically happened when economic growth is slowing.

Fortunately, though, there are things you can do besides putting all of your retirement portfolio’s eggs into a basket of volatile stocks. Strategies that combine larger allocations to high-yielding bonds with smaller allocations to stocks may provide an alternative to relying primarily on stocks to achieve your goal of earning income while also protecting the spending power of your portfolio from inflation as you approach, enter, and live in retirement.

A high-yielding alternative

Mark Notkin and Brian Chang manage the Fidelity® Capital & Income Fund (

Like many things that came of age in the 1980s, high-yield bonds have long been misunderstood. Back then when the market for bonds issued by companies with credit ratings below investment grade matured, the media took to calling them “junk” bonds. The name caught on and made these bonds sound like something you wouldn’t want in your portfolio.

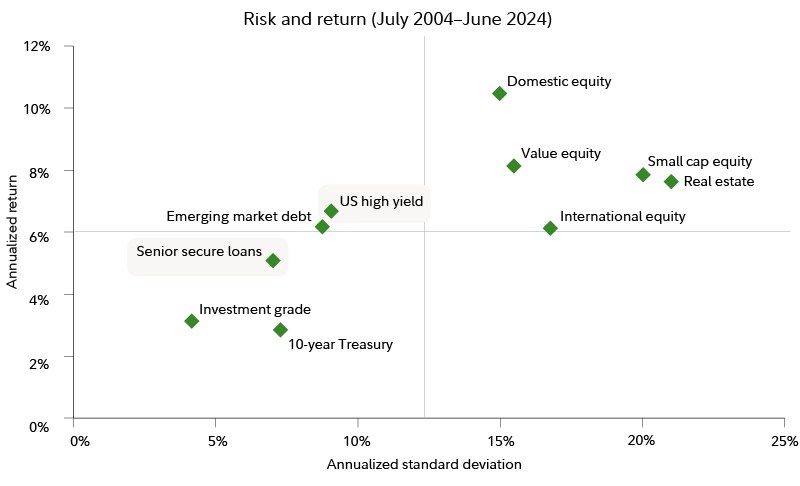

Forty years later, history shows that what are now known as high-yield bonds are anything but junk. Notkin points to the ICE Bank of America US High-yield Index to show just how un-junky high-yield bonds have proven to be. “Since its debut in 1986, it’s become a benchmark for this bond market, much as the S&P is for stocks, and as the chart shows, high-yield has been consistently in the top left quadrant. That means historically it's given you very good return per unit of risk over the medium-to-long term,” he says.

How high-yield bonds deliver return

The level of return that high-yield bonds offer reflects what traders in the market believe about how much more risk of default these bonds possess than US Treasury bonds. Most investors consider US Treasurys to be risk-free investments, despite the federal government’s sharply rising debt. High-yield bonds typically pay more than Treasurys in order to persuade investors to accept their higher levels of default risk. High-yield bonds have returned an average of nearly 500 basis points more than Treasurys over the same historical time period as of September 3, 2024. Says Notkin, “That 500 basis points of return has compensated investors pretty well for the risk they’ve taken.” That higher yield is known as the risk premium and the difference between it and the yields on Treasury bonds is called the spread. The higher the return on high-yield bonds, the wider the spread. Fidelity now offers new tools that make it easy to track fixed income spreads and yields with up-to-the-minute data.

How not to worry about interest rates

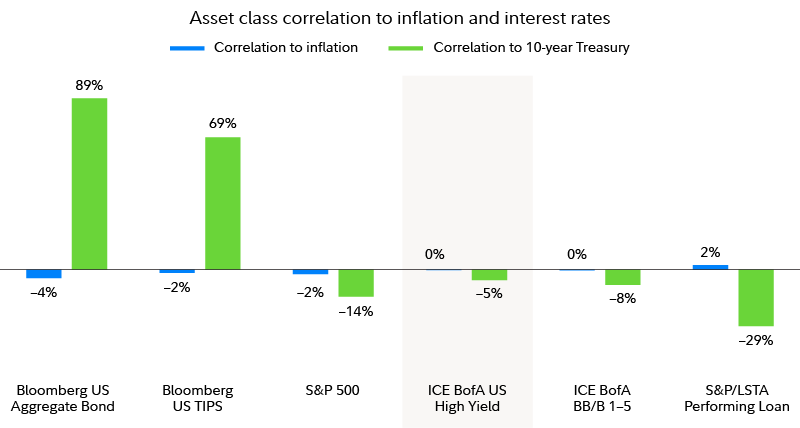

To be sure, high-yield bonds aren’t the only fixed income investments that can offer attractive yields and reliable income. However, high-yield bonds also offer a unique advantage that other bonds don’t. Their returns are not strongly affected by changes in interest rates. “Over the long term, the correlation between the high-yield market and interest rates is close to zero,” says Notkin. "We think that’s really attractive."

With continued uncertainty about what’s next for interest rates, many investors might think so too. If you want to add fixed income to your portfolio, you probably want to do so in a way that can benefit from the interest-rate environment you expect will exist in the future. For example, a falling-rate environment may be a better time to own shares of a bond ETF or fund than to build a ladder of individual bonds. That’s because a fund can benefit from rising bond prices as rates fall.

High-yield bonds may help reduce this challenge of determining how best to add fixed income to your portfolio to diversify away some stock risk. That’s because they are influenced less by interest-rate moves than other types of bonds are and more by the health of the overall economy and its movement through the phases of the business cycle from growth to recession and back. “What Treasurys and investment-grade bonds offer are their coupon yields, which are closely tied to interest rates. In contrast, spreads matter far more for high-yield bonds and they widen and narrow throughout the business cycle,” says Notkin.

Managing the risks of high-yield bonds

Of course as savvy investors know, no investment comes without some risk and high-yield bonds are no exception. The risk premiums on these bonds reflect the concern that these bonds’ issuers are more likely to default than issuers of government, agency, or investment-grade corporate bonds. That risk of default can also rise when the economy weakens and companies' earnings may decline. However, that rising risk may be accompanied by rising risk premiums and widening spreads between high-yield and Treasurys. That means that while the risk of an issuer defaulting may rise, the wider spread may compensate investors for that increased risk.

Chang points out that the risk of default may be somewhat lower today than it has been historically. “Over the last 10 years, roughly 50% of all newly issued high-yield bonds have been BB rated. This has led to a shift in the overall credit mix of the index relative to history. The percentage of BB-rated bonds within the index has increased from 45% in 2014 to 53% in 2024. Given the higher credit quality, investors could see a more benign default environment than they have historically,” he says.

Notkin manages default risk through careful research that seeks to avoid the riskiest issuers. “It's not simply avoiding bonds with triple-C credit ratings and buying anything with a single-B rating,” he says. “It’s digging into the issuers’ circumstances and being able to price risk. Pricing risk in high-yield is more art than science. I don't mean that it's creative, but that it’s hard. The trick is to avoid the losers. I ask ‘Is this company stable?’ We want companies with good management and good return on capital. They are not typically the best of best but they’re not bad businesses. In some cases, there are really great businesses. Tesla and Netflix both got their starts in the high-yield market, and they’ve been incredible companies. We look for companies that are able to comfortably pay their coupons and where we’re comfortable with the capital structure. We've not gotten it perfect all the time, but we’ve picked companies that were able to pay their coupons and we've outperformed very nicely over time.”

Besides having higher risk of default than investment-grade bonds, high-yield bonds also differ from higher-rated bonds in that they tend to move more in tandem with stocks than with investment-grade bonds. Historically, that has meant that high yield has tended to underperform when the economy heads into recession and stocks fall. For that reason, most investors may also want to allocate a portion of their portfolio to investment-grade bonds, which historically have outperformed stocks and high-yield bonds during recessions.

A pinch of stock

An investment strategy that allocates part of your portfolio to high-yield bonds can provide attractive income through the business cycle and help cushion the impact of changing interest rates. What it does less well is to protect you from inflation, which has slowed over the past year but is by no means vanquished. For that, Notkin suggests considering a relatively small allocation to stocks along with the bigger one to high-yield bonds. Unlike most high-yield funds, Fidelity® Capital & Income Fund seeks capital appreciation as well as income, so it can own stocks as well as bonds.

A relatively small allocation to stocks may help protect a high-yield bond portfolio from inflation because they can benefit from something that high-yield bonds can’t: rising corporate earnings. While companies face higher costs due to inflation, many can pass those costs on to their customers by raising prices and continue to keep their earnings growing and their stock prices rising. Indeed, despite periods of inflation, earnings for the S&P 500 have grown very steadily at 7% over very long periods of time. This has provided what Notkin calls the “constant tailwind of earnings growth” for these stocks. “That's one reason to have some stocks along with your high-yield bonds,” he says.

Of course, as we saw at the start of August, even the most constant tailwind can be offset at times by other short-term factors and events that can push stock prices down without warning. “That’s why you need to have a demonstrated track record of knowing when to own more stocks alongside your high-yield bonds and when to own fewer stocks,” says Notkin. “We look at the earnings yield of the S&P to help determine when we should own more stocks and when to own more high-yield bonds. The earnings yield of the S&P is the inverse of the price/earnings (P/E) ratio, so for example, a P/E of 20 equals a 5% earnings yield. We compare that earnings yield to the yield available in the high-yield market, represented by the ICE Bank of America US High-yield Index to see when high-yield bonds or stocks can offer more opportunity.”

Finding ideas

If you want to diversify your portfolio with high-yield bonds, consider a mutual fund or exchange-traded fund. If you believe you have the time, skill, and will to build and manage a portfolio of high-yield bonds, Fidelity offers research tools that can help you do it yourself.