Dollar-cost averaging

So you've learned the fundamentals of crypto, are aware of its risks and volatility, understand how crypto cybersecurity works, and are ready to invest. One question remains: Which strategy could be right for you? Below, we'll explore one of the most popular strategies for long-term investors.

What is dollar-cost averaging?

Dollar-cost averaging is a strategy where you invest your money in equal portions, at regular intervals, regardless of which direction the market or a particular investment is going. In other words, your investments are based on a schedule, which means you buy whether the market is going up or down.

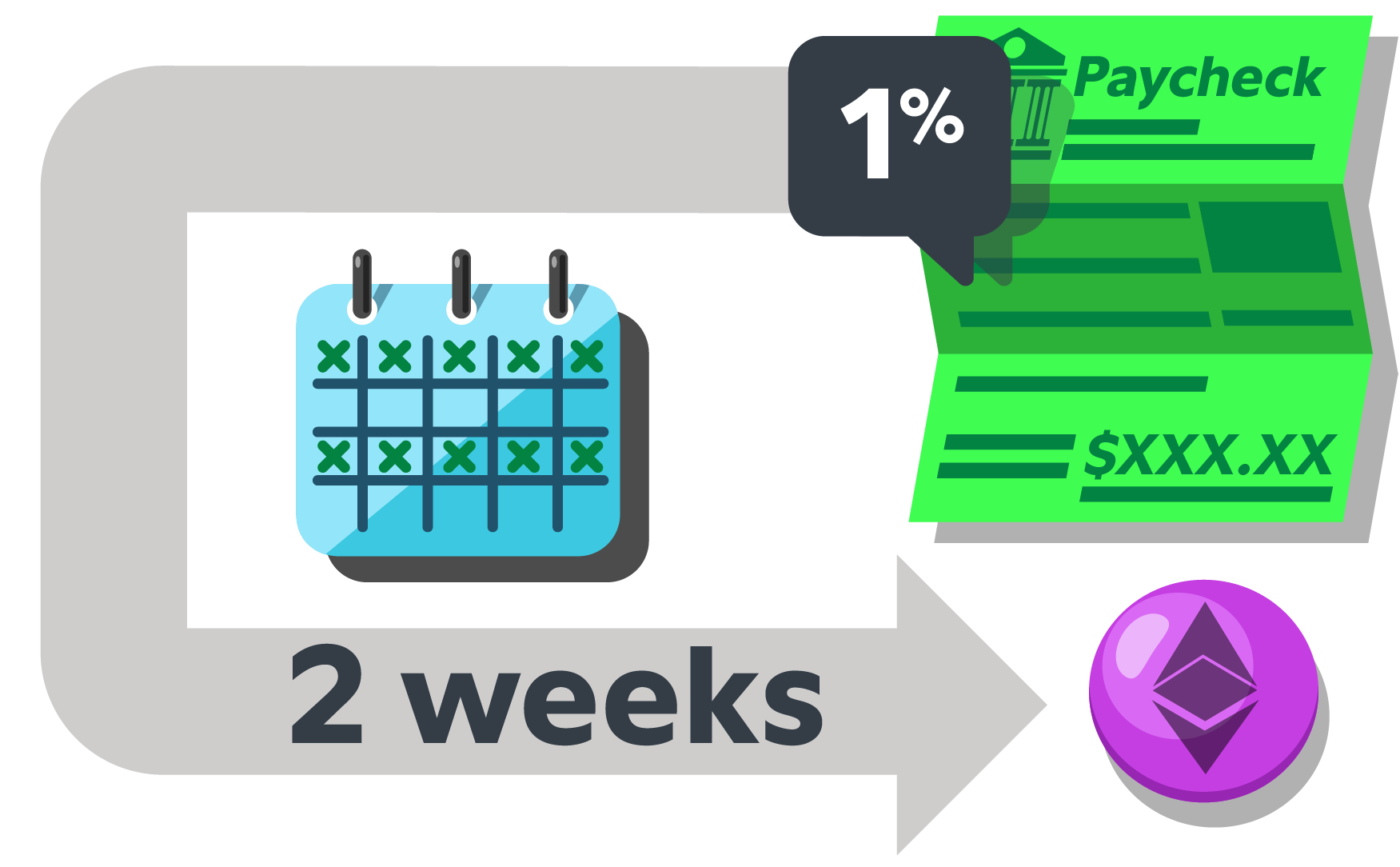

2 hypothetical examples might include:

Buying $100 worth of $BTC on the first day of every month.

Buying $ETH every 2 weeks with 1% of your biweekly paycheck.

What's the goal?

If you believe crypto will go up in the long run, dollar-cost averaging makes it so that you don’t have to time the market. Sometimes you'll buy when the market is going up, and sometimes when it's going down.

Overall the goal is to vary the prices at which you buy, which can potentially help reduce the impact of market volatility on your overall purchase.

Note that this strategy does not assure a profit or protect against loss in declining markets. It also involves continuous investment in cryptocurrencies, so you should consider your financial ability to continue your purchases through periods of low price levels.

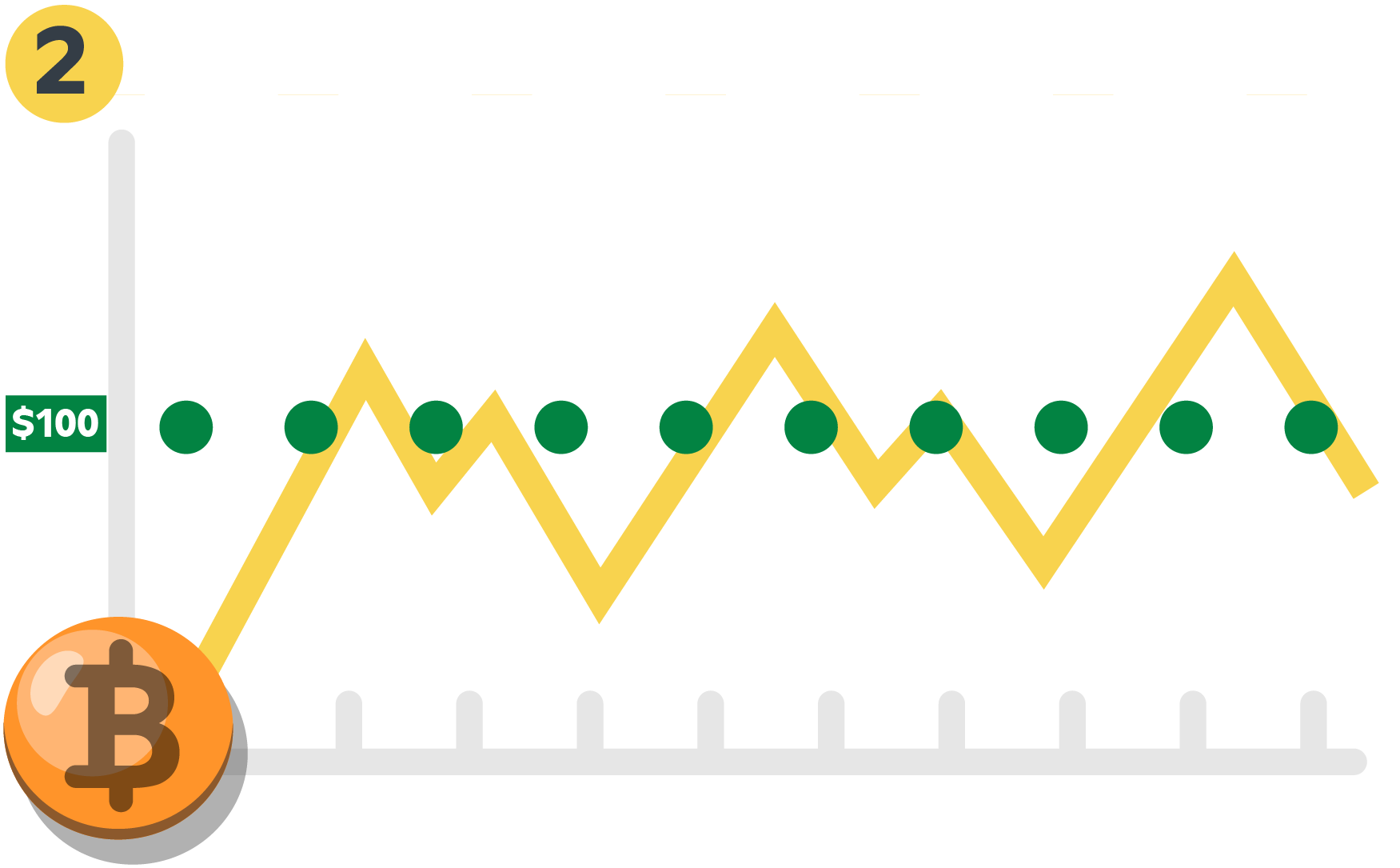

Let's look at an example of how dollar-cost averaging works.

1. Say you had $1,000 to invest at the start of 2018.

2. You decided to dollar-cost average your investments by buying $100 worth of $BTC at the beginning of every month for the next 10 months.

3. During these 10 months, you would've sometimes bought when $BTC's price was down, and sometimes when it was up. And by the end of 2018, your $1,000 portfolio would've dropped in value, as bitcoin was in a bear market.

4. By mid-2021, however, bitcoin had recovered and was hitting new all-time highs, meaning your portfolio would've been worth considerably more than what you started with.

Potential pros and cons of dollar-cost averaging

Pros of dollar-cost averaging

- Allows you to invest according to a schedule regardless of whether price is up or down

- Helps take some of the guesswork and emotions out of entering the market

- One of the easiest investing strategies if the market goes up in the long run

Cons of dollar-cost averaging

- May generate lower returns compared to buying all at once if price goes up over time (for example, if you had the foresight to put all $1,000 in the market when price bottomed in late 2018 from the scenario above)

- Requires you to hold funds in cash for periods of time, which could generate low rates of return if the interest rates you're earning on your cash are low. Note: This doesn't apply if you are investing a portion of each paycheck

- May require sitting through long periods where your investments are in the red

- Dollar cost averaging does not assure a profit or protect against loss in declining markets. For the strategy to be effective, you must continue to purchase shares in both market ups and downs.

Key considerations

Dollar-cost averaging with crypto may only make sense if you are confident the asset you're investing in will go up in the long run. Historically, some larger cryptocurrencies like $BTC and $ETH have made new highs in each market cycle, though past performance is no guarantee of future results. Note that these currencies have also experienced large losses and price swings in the process of arriving at these new highs.

In contrast, many smaller cryptocurrencies have not managed to make new highs in each market cycle. It's common for altcoins to drop to $0 and disappear from existence.

In general, remember that crypto is highly volatile, and may be more susceptible to market manipulation than securities. Crypto holders don't benefit from the same regulatory protections applicable to registered securities, and the future regulatory environment for crypto is currently uncertain. Crypto is also not insured by the Federal Deposit Insurance Corporation (FDIC) or the Securities Investor Protection Corporation (SIPC), meaning you should only buy crypto with an amount you're willing to lose.

Dollar-cost averaging

Dollar-cost averaging