After setting new all-time highs earlier this year, in recent days the S&P 500® Index of large-cap US stocks has fallen by more than 10% from its peak. While not an official definition, a drop of at least 10% from market highs is generally considered a correction.

The volatility seems to be driven by concerns around global economic growth and uncertainty around the impact of recent changes in US trade policy. Recent weeks have also seen declines in consumer confidence and estimated first-quarter economic growth.

“After 2 strong years of stock market returns, this recent bout of market volatility may feel particularly jarring for investors,” says Naveen Malwal, institutional portfolio manager with Strategic Advisers, LLC, the investment manager for many of Fidelity’s managed accounts. “And given some of the fast-moving news headlines over the last few weeks, I can appreciate why some investors may feel anxious.”

With a correction at hand, it may be time to brush up on what corrections have typically looked like, and what you may want to consider.

How unusual is a decline of this magnitude?

While corrections can be unnerving, they have historically been a normal part of investing.

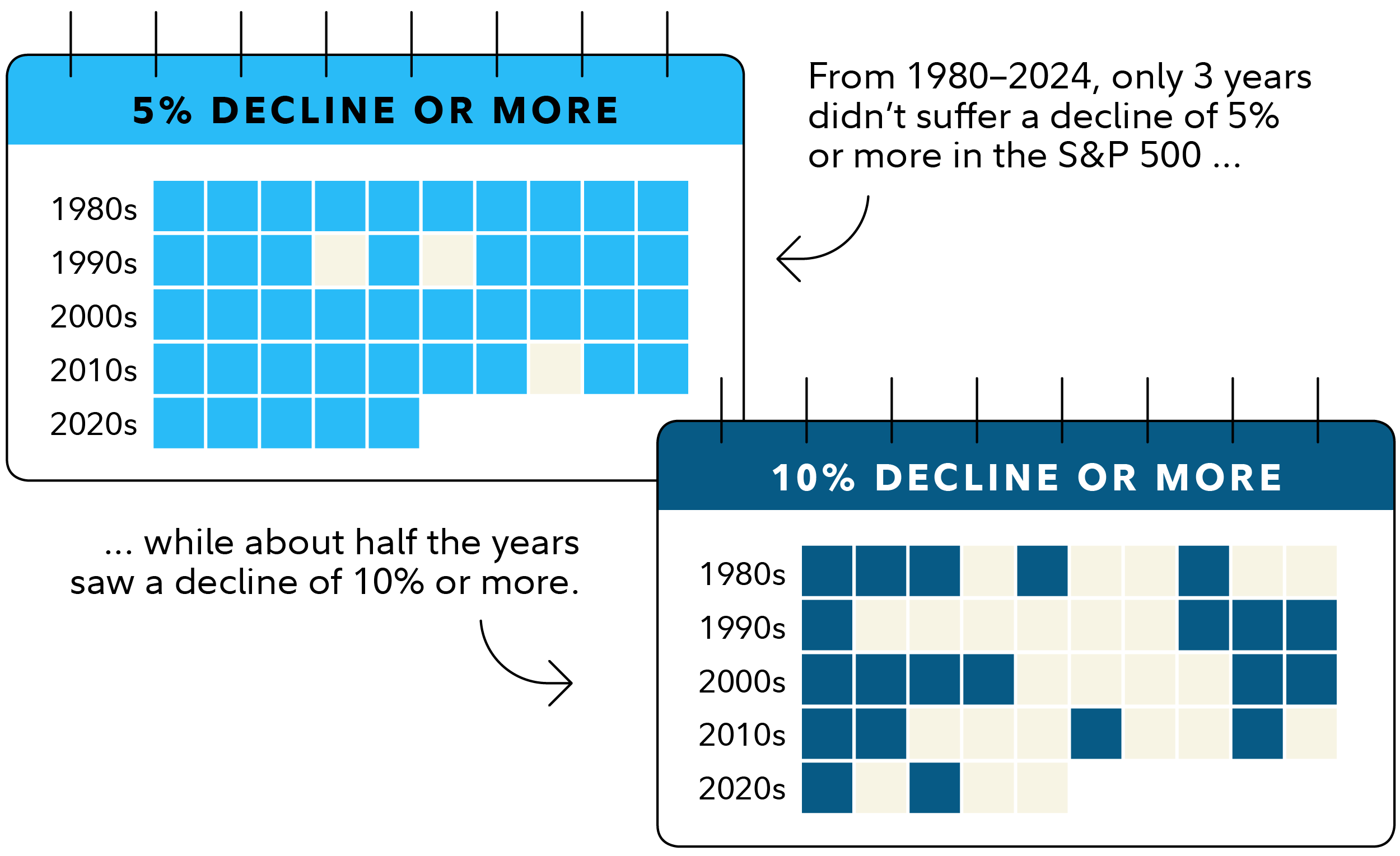

Since 1980, the S&P 500 has experienced a drop of 5% or more in 93% of calendar years, and has experienced a drop of 10% or more in 47% of calendar years.

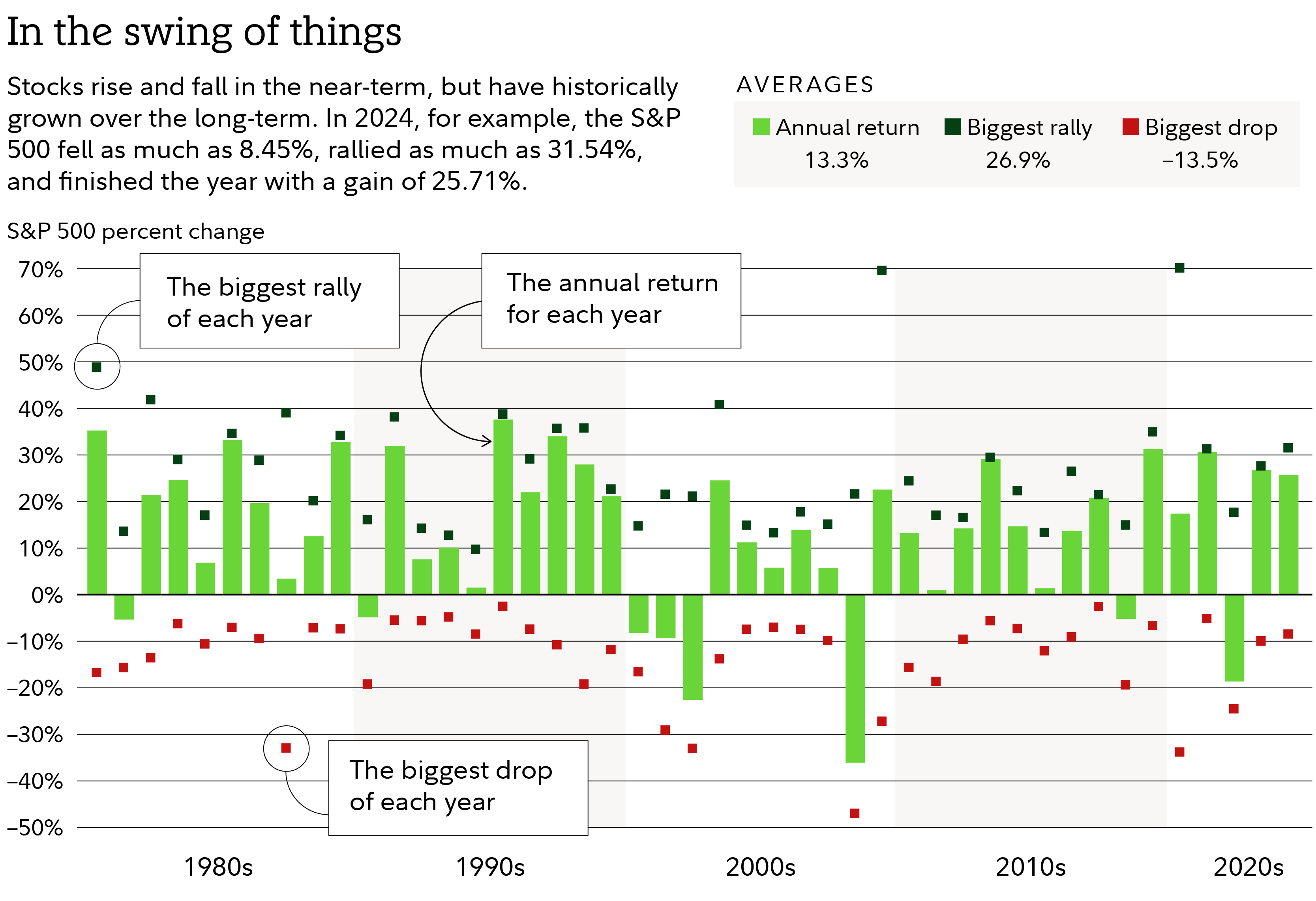

Despite those frequent declines, the market’s average calendar-year return over the same period has been 13.3%.

How long and deep will this correction be?

It’s impossible to say how long it may take for stocks to recover their previous highs and for volatility to subside, due to the complexity of the economic factors at work and the inherent unpredictability of future events.

But historically, the market has typically recovered quickly from corrections. The chart below shows the largest drop from a market high in each year (red dots). You can see that it’s not uncommon to experience significant market declines. But the market still has often recovered and produced positive results in most years (shown as the green bars).

“Since 1980, the S&P 500 index has experienced a decline of about −14% on average in any given calendar year,” says Malwal. “Yet stocks have normally recovered and finished with average gains of about 13% in any given calendar year, including dividends. So a market decline of −10% or −15% isn’t unusual, nor necessarily a sign that stocks will continue to decline. Market volatility can feel unsettling, but it is normal.”

Is this time different?

Some investors may nevertheless be worried that “this time is different.” In the midst of uncertainty, it’s natural to fear the worst. Yet investors should remember that historically the US economy and stock market have again and again surmounted steep obstacles—including pandemics, recessions, market bubbles, and even a depression—and eventually gone on to thrive.

“It may also help to remember that markets can react to news headlines and emotions in the short term,” says Malwal. “But over the long run, stocks have usually risen if corporate profits are growing. Corporate profits rose about 14% during the fourth quarter of last year and are expected to experience further growth in 2025, based on analysts’ estimates.”

What it means for investors

While it can take nerves of steel not to react when stocks are falling, this has often been the best course of action. Investors who sell, in an attempt to head off further losses, risk locking in potential losses and often miss out on the market’s subsequent recovery. Here’s how to think about your potentially best course of action.

Long-term investors: Stick with your plan

If you are saving for retirement or another goal that is years away, the time to consider how much of a loss you can handle isn’t during a correction. Rather, you should consider the appropriate risk level for your portfolio when you are looking at your long-term goals, and thinking clearly about your financial situation and emotional reaction to risk.

If you haven’t created a plan, you should. If you have one, it may be worth checking in to see if your investments are still in line with that plan and if your plan continues to reflect your investment horizon, financial situation, and risk tolerance. If all that is so, you will likely be in a better position to manage the ups and downs of the market. If your mix of investments is off track, consider rebalancing back to a more neutral positioning.

Retirees: Manage your income

For retirees, who may be relying on their investment portfolio for a portion of their income, a market drop can present a different kind of challenge. If you have an income plan that is built to withstand different market conditions, you really don't need to react to a short-term market move. If not, it may be a good time to sit down with a financial professional to discuss your strategy.

Learn more about what to consider if you're recently retired or thinking of retiring soon.

The bottom line

While we don't know if any pullback will be short-lived or the beginning of a bigger downturn, history shows that the stock market recovers from downturns. Most sound investment strategies are built to withstand volatility, and even sharp pullbacks.

If you understand your capacity to take on risk and are comfortable with your plan, there is no need to take action. If you are concerned, work with your financial professional to build or test-drive your plan for whatever may lie ahead.