Many people are familiar with buying CDs directly from a bank, but may be less familiar with brokered CDs.

Brokered CDs are still issued by banks, but they’re purchased through a broker. While that might sound like a small difference, it can actually bring some surprisingly big potential benefits—like simplifying how you shop around for the best rates and manage your CD holdings.

Read on for more about how brokered CDs work, and pros and cons to consider.

What is a brokered CD?

Just like traditional bank CDs, a brokered CD is issued by a bank, comes with a set interest rate, and is FDIC-insured, up to certain limits. (Learn more about CDs.)

The key difference is in how you buy them and where you hold them.

Banks issue brokered CDs for the customers of brokerage firms. Banks usually issue brokered CDs in large amounts and the brokerage firm divides them into smaller amounts for resale to its customers. Because the deposits are obligations of the issuing bank, and not the brokerage firm, FDIC insurance applies.

How do brokered CDs work?

A brokered CD works just like a traditional bank CD, except you buy it through a brokerage firm, hold it with the brokerage firm, and receive both interest payments and the repayment of principal when the CD matures, in your account with the brokerage firm.

For example, suppose you are a customer of Fidelity looking to buy a 12-month CD in your brokerage account. You visit the CDs & Ladders research page, and find a 12-month CD with an attractive interest rate issued by (hypothetically) ABC Bank. You decide to deposit $5,000 in the CD.

Your brokerage account will then show the CD from ABC Bank in your portfolio. You’ll earn interest in your brokerage account, according to the CD’s terms, and at maturity you’ll get the principal back in your brokerage account. In the unlikely event that ABC Bank were to fail during your CD’s term, your CD would be protected by FDIC insurance—just as it would if you’d bought it directly with ABC Bank.

What are brokered CD rates and how do they work?

Brokered CD rates work just like rates on traditional bank CDs. Each CD has a set coupon rate, which determines how much interest it pays. (Learn more about how CDs work.) Depending on the terms of the CD, it may pay all of its interest at maturity, or it might make periodic payments, like monthly or twice a year.

That said, with brokered CDs, it’s important to understand the difference between new issue CDs and secondary CDs.

A new issue CD is one that a bank is offering for the first time. When you buy a new issue CD, you’re in the first group of buyers. If you invest $1,000, you receive $1,000 of principal value and you receive interest on that $1,000 principal. If you hold to maturity, you get that $1,000 principal back.

A secondary CD is one that you’re buying from another investor (such as someone who bought a new issue CD, but then needed their money back before the maturity date). Secondary CDs may be priced at, above, or below par value (i.e., you may need to pay more or less than $1,000 in order to buy $1,000 of principal value). Because of this, your overall return may be higher or lower than the stated interest rate of the CD.

That’s why for secondary CDs, it’s particularly important to compare yields, in addition to comparing the coupon rate of each CD. Yield, and the related measures of yield to maturity and yield to worst, can help give a more complete picture of what the total return might be on a secondary CD. (Learn more about how CD prices, rates, and yields work.)

Also consider transaction costs when buying or selling CDs in the secondary market.

Brokered CDs vs. bank CDs

While brokered CDs are similar to bank CDs in many ways, there are a few key distinctions:

Ability to sell before maturity

If you need your money back before maturity, you may be able to sell your brokered CD to another investor. (This is called the “secondary market” for CDs.) That said, there can be drawbacks to selling a CD in the secondary market—scroll down to the “Disadvantages of brokered CDs” section for more. With a bank CD, if you need your money back early, you must generally pay an early withdrawal penalty.

Portability

A brokered CD can be transferred from one brokerage firm to another, allowing the owner to consolidate assets at one firm. This is not possible with bank CDs (an investor would need to withdraw from the CD in order to move their money to a different institution).

Ability to expand FDIC coverage

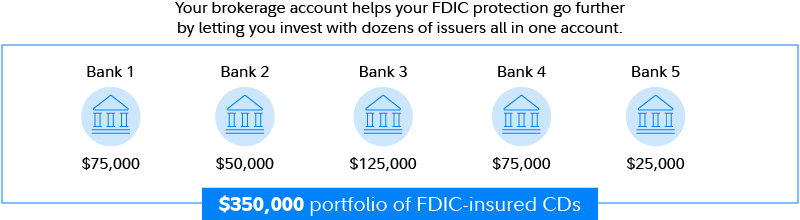

While banks themselves do not have the ability to exceed FDIC insurance limits, a broker such as Fidelity may offer many brokered CDs from hundreds of different banks, each of which provides for FDIC protection up to current FDIC limits. By combining a number of CDs issued by different banks in an account with a brokerage firm, an investor may be able to expand their coverage beyond the current FDIC limits.

Are brokered CDs FDIC-insured?

Brokered CDs offered by Fidelity are FDIC-insured up to $250,000 per account owner, per account type, per institution.

As long as a brokered CD is issued by an FDIC-insured bank, it will be insured up to those limits. As mentioned above, by combining a number of CDs issued by different banks in an account with a brokerage firm, you may be able to expand your FDIC coverage beyond the typical $250,000 per account owner.

Advantages of brokered CDs

The potential advantages of brokered CDs can include:

Expanded FDIC coverage

As mentioned above, combining CDs from different FDIC-insured banks may allow investors to expand their FDIC protection—all in one account.

Simplified rate shopping

Shopping for brokered CDs may let you research CDs from multiple banks at once, making it easier to compare rates. Fidelity investors typically will see around 100 new issue offerings and as many as 2,000 secondary offerings at any point in time.

Convenience

Purchasing brokered CDs requires none of the paperwork that is required when purchasing a bank CD. By consolidating a number of brokered CDs in a single brokerage account at a single financial institution, you can reduce paperwork, streamline the purchase process, and make it easier to track and manage your CD holdings in one place.

Liquidity

As mentioned above, if needed you may be able to sell a brokered CD prior to maturity in the secondary market—potentially making it easier to liquidate a position if you need to.

Flexibility

Brokered CDs come in a wide range of maturities—from as little as 1 month to as long as 20 years. They can also come with various coupon-payment frequencies, and a variety of other specific features such as call protection or a step-up coupon schedule. This can allow investors to tailor their brokered CD holdings to their particular needs and preferences.

Disadvantages of brokered CDs

The disadvantages of brokered CDs can include:

Risks if selling before maturity

The secondary market may be limited, resulting in a low bid for the brokered CD you are selling. The market value of a brokered CD in the secondary market may be influenced by a number of factors including interest rates, provisions such as call or step features, and the credit rating of the issuer. Brokered CDs sold with Fidelity prior to maturity are subject to a trading fee known as a "mark-down."

Requires 2 layers of research

When you buy a CD directly from a bank, you may want to verify that the bank is FDIC-insured and look into its reputation. When you buy a brokered CD, you should still look into the underlying bank—but also verify that the broker you’re purchasing it from is a legitimate financial institution that’s appropriately licensed and regulated.1

Same risks and tradeoffs as bank CDs

Brokered CDs also come with many of the same risks as traditional CDs, including lower yields compared with higher-risk investments, the risk of changing interest rates impacting the market value of a CD, the risk that an issuer may call its CD before maturity, and more.

Read more about the potential advantages and risks of brokered CDs.

How to buy a brokered CD

To buy a brokered CD, you need to have an account with a brokerage firm that offers them. (Learn more about the types of accounts Fidelity offers.) Then, you can search for new issue CDs and/or secondary CDs that meet your criteria. Some factors to consider as you search may be how much you want to invest, how long of a term you want, the CD’s coupon rate and yield, and whether it has call protection.

Fidelity investors can review available new issue CDs and secondary CDs, and easily compare features of the available brokered CDs.

Should you buy brokered CDs?

Brokered CDs might be appropriate if you want to invest in CDs but don’t want to open and manage accounts with the underlying issuing banks.

They can be useful in simplifying comparison shopping, since brokered CDs allow investors to compare rates from multiple banks in one place. They can also be particularly helpful for those who want to invest more than $250,000 in CDs, but who want the simplicity and convenience of managing their CD holdings with just one institution.