Alternative investments can complement traditional investments by offering additional opportunities for you to choose from. And there’s a wide variety of alternative assets. If you are curious about alternatives, it can help to explore them by being familiar with the different types of alternatives and their unique features—including differences in liquidity.

What are alternatives?

You may see alternative investments referred to as “alternatives” or “alts.” These are investments that do not fall into traditional investment categories (e.g., stocks, bonds, and cash). Alternative investments can include private equity, private credit, real assets, digital assets, and liquid alternatives.

According to the Chartered Alternative Investment Analyst Association (CAIA), alternative investments total $22 trillion in assets under management, which is roughly 15% of global assets under management, as of September 2024.

Liquidity and alternatives

Alternatives may help diversify your investment mix, potentially enhance returns, generate income, and/or help manage risk. These potential benefits are driven by each alternative investment's strategy and understanding their liquidity is an important consideration.

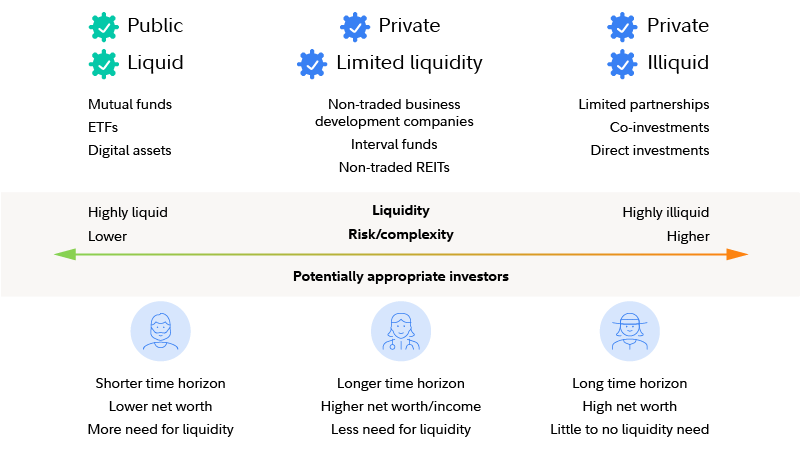

Liquidity refers to how easy it is to buy and sell something. With alternatives, liquidity is of particular importance to understand, as different types may offer varying levels of liquidity. These levels can be viewed on a spectrum—liquid, intermittently liquid (or semi-liquid), and illiquid.

Understanding some of the potential pros and cons to each level of liquidity is important as you get started with alternative investing. The chart below illustrates a high-level spectrum of some different alternative investments and how much liquidity they provide to investors.

Highly liquid investments, such as a stock or ETF, tends to trade frequently. Essentially, that means it’s generally easy to sell to turn into cash. Mutual funds are also highly liquid as investors can buy or redeem shares daily.

Semi-liquid and illiquid investments require investors to be comfortable with less, or no, liquidity to access their initial investment over some period of time. But investors may benefit from the ability to invest in private markets (where investor money may not need to be returned on demand and strategies can be pursued that can help enhance returns or income).

Of course, liquid, semi-liquid, and illiquid alternative investments come with risks. For example, the use of derivatives and complex trading strategies in liquid alternatives, such as short selling, may increase the risk of loss or volatility. Illiquid or semi-liquid private market alternatives may have investor restrictions on liquidity, employ leverage, and have unique risks associated with each investment strategy. Semi-liquid and illiquid alternatives also carry opportunity risk because they cannot easily be liquidated to take advantage of other opportunities that may arise. However, this risk may be accompanied by the potential for higher returns.

Let’s further explore the liquidity spectrum so that you can gain a stronger understanding of why it’s so important when considering alternative investments.

Liquid alternatives

Liquid alternatives invest in securities that primarily trade in public markets. What puts the “alternative” in liquid alternatives? Unlike traditional "buy and hold" strategies, liquid alternatives usually have the flexibility to take both long and short positions (short positions seek to benefit from declining asset values). You can find liquid alternative investments across different strategies. Liquid alternatives can generally be bought or sold relatively easily and you can more readily see their price and other relevant information.

Examples of liquid alternative investments include digital assets and liquid alternative funds. Liquid alternative fund strategies include hedged equity, relative value, event driven, global macro, market neutral, and convertible arbitrage.

For liquid alternative funds, their liquidity is driven by the liquidity at the fund level (i.e., the ability to buy or sell the fund) as well as the liquidity of assets held by the fund. They are typically structured like mutual funds or ETFs, and in most cases, they can be bought and sold like these types of funds.

Intermittent liquidity alternatives

For those who may not need daily access to an alternative investment, semi-liquid (or intermittently liquid) alternatives exist. Intermittent liquidity alternatives may offer limited opportunities to access part of your investment at certain times and can help deliver the ability to access both public and private markets (such as private credit or private real estate), while still seeking to provide investors with regular liquidity.

How do they work? Intermittent liquidity alternatives may allow you to redeem a portion of your investment, often known as “tender windows” or “repurchase offers.” Investors can typically sell their shares back to the fund periodically, on a specified redemption schedule and at specified intervals. Examples of commonly known intermittent liquidity alternatives are interval funds, tender offer funds, and unlisted business development companies (BDCs).

Intermittent liquidity alternatives can help investors access private markets, while still offering more frequent liquidity compared with illiquid alternatives (albeit not daily).

Illiquid alternatives

On the other end of the liquidity spectrum, illiquid alts generally do not offer frequent pricing and public transparency.

While liquid alternative funds may use alternative strategies to invest in public investments (e.g., stocks and bonds), illiquid alternatives typically invest in assets solely through private markets. Private equity and private credit are 2 strategies frequently offered via illiquid alternatives.

Why would investors consider illiquid alternatives if they limit their ability to access their investment? Historically, illiquid alts have produced superior returns or income compared with traditional investments (see chart below).

Illiquidity can allow for more time to execute on an investing strategy, pursue investment opportunities, influence a company's management and operations, and to exit an investment on more favorable terms.

However, as you might expect, past performance is no guarantee of future results, and higher returns may be accompanied by higher risk. Moreover, illiquid alternatives are generally not able to be converted to cash quickly if the need arises or may require a significant fee to do so. This is often referred to as a “lock-up period,” during which time the investment cannot be sold, often for a period of many years. In many cases, illiquid funds can only distribute returns to investors if and when the fund successfully sells one or more of its underlying investments.

It is important to note that some of these investments may only be available to investors who meet certain net worth, asset, and/or income minimums.

Are alternatives right for you?

It is important for you to consider an alternative's liquidity and risks before investing. Liquid, intermittently liquid, and illiquid alternatives feature different potential benefits and risks. If you are thinking about investing in alts, you should carefully weigh the differences. The degree of liquidity may help you make an investment decision.

And to be sure, there is much more to understand about alternatives than liquidity. Moreover, the decision whether to include alts in your mix of investments should come down to your goals, comfort with risk, time horizon, tax situation, and liquidity needs, among any other factors specific to your situation. While investing involves risk, including the risk of loss, and past performance is no guarantee of future results, new developments in the world of alts are making it more possible than ever before to achieve your investing goals using non-traditional investments.