Do you evaluate the management and policies of companies that you are either invested in or are considering investing in?

While many people know of and have opinions on well-known executives at large companies, individual investors are oftentimes unaware of who runs the companies they invest in and, perhaps more importantly, the governance policies of those same companies. Here are some ways you can incorporate governance research into your analysis.

Consequences of bad management

Poor corporate governance systems can be catastrophic for investors. Think Enron, WorldCom, Wirecard AG, and numerous other companies whose scandals can be attributed, in some part, to poor governance policies. While it's critical to assess the underlying business metrics of a company (e.g., revenue, earnings, and cash flow growth), overlooking governance policies can be a mistake.

Governance quality is an important factor often considered by professional investors, but can be overlooked by individual investors. Assessments of governance quality are even more critical when investing in international companies, as emerging markets tend to be characterized by weaker regulatory environments.

Tips for evaluating management

So what makes up "good governance?" Obviously, management and board members should have the needed experience and qualifications to execute on the company's short- and long-term goals. Companies with good governance typically exhibit accountable and transparent governance policies, with diverse and independent boards, offer compensation incentives that align with shareholders, and have sound capital allocation policies. Strong corporate governance systems address potential conflicts of interest among stakeholders (e.g., managers implementing policies that benefit themselves, rather than shareholders).

Here are some other good governance guidelines and qualities you might look for:

- The board meets at least annually and without the presence of management.

- There is an annual review of the board, and directors are elected annually (i.e., not on a staggered schedule).

- The auditor does not have conflicts of interest with the firm.

- Performance of the company dictates compensation reviews for management, and not the compensation packages of comparable companies.

- The company's board members are not interlinked with other company board members. For example, a member of the board of Company A and a member of the board of Company B should not be on each other's boards.

- The board doesn't allow pro-forma earnings (essentially, earnings "before the bad stuff") for public use.

- The board uses independent counsel (i.e., not in-house counsel) when needed.

- Board actions generally do not limit shareholder rights, including proxy access and attendance at meetings.

- The company doesn't use anti-takeover provisions (like classified boards and supermajority vote requirements).

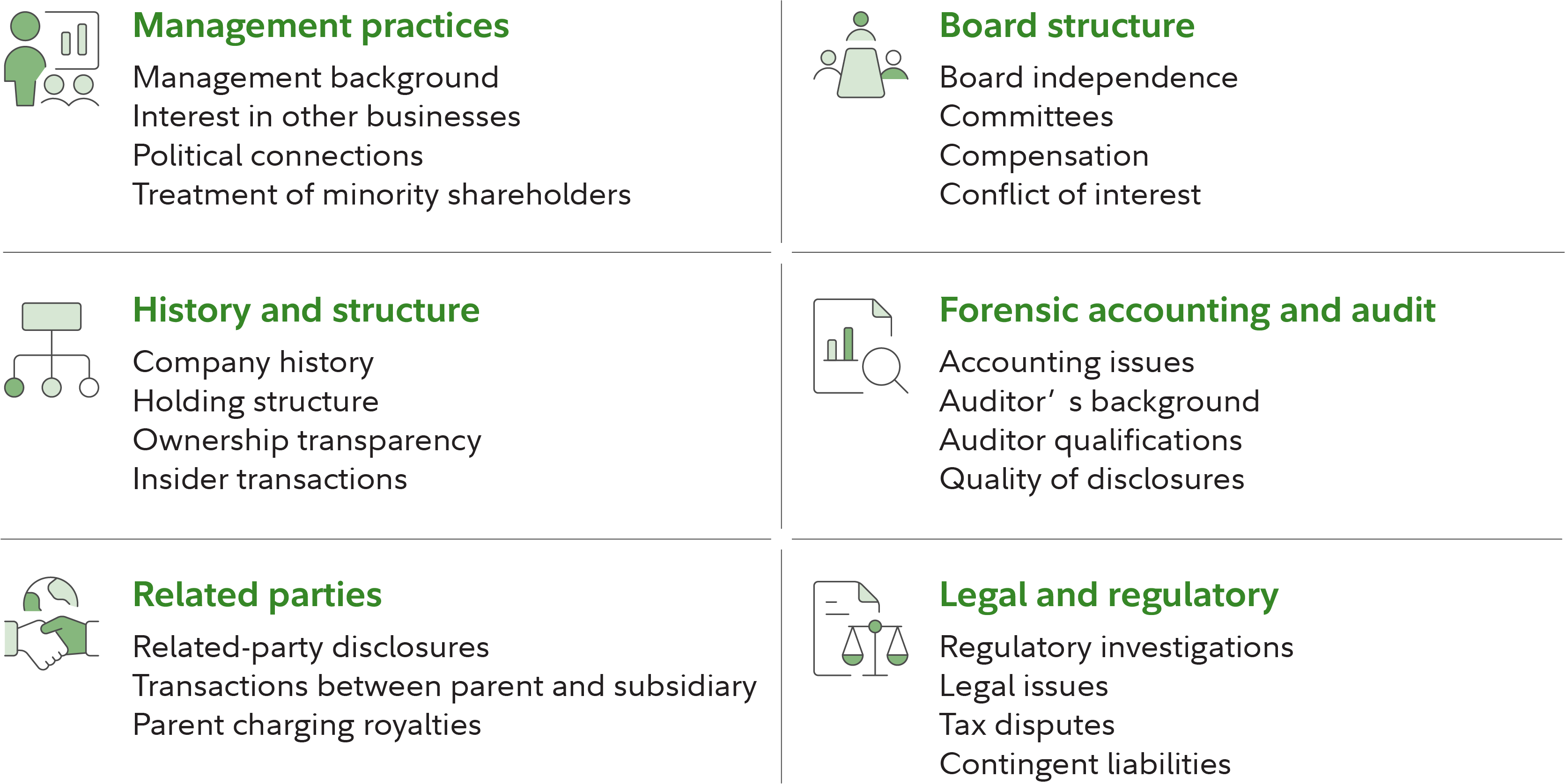

Of course, there are other factors that you could look at, and there are different frameworks that can be utilized. If you want to know what professional investors are looking for, the graphic below illustrates some of the key governance factors that Fidelity's Governance and Forensic Accounting team places a particular emphasis on to help avoid companies with significant corporate governance risks.

Corporate governance and forensic accounting framework